41 1023 ez eligibility worksheet

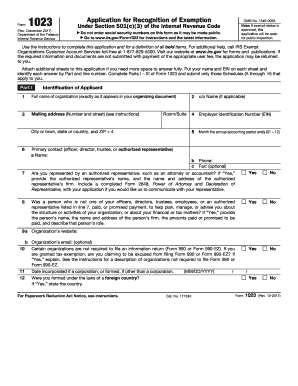

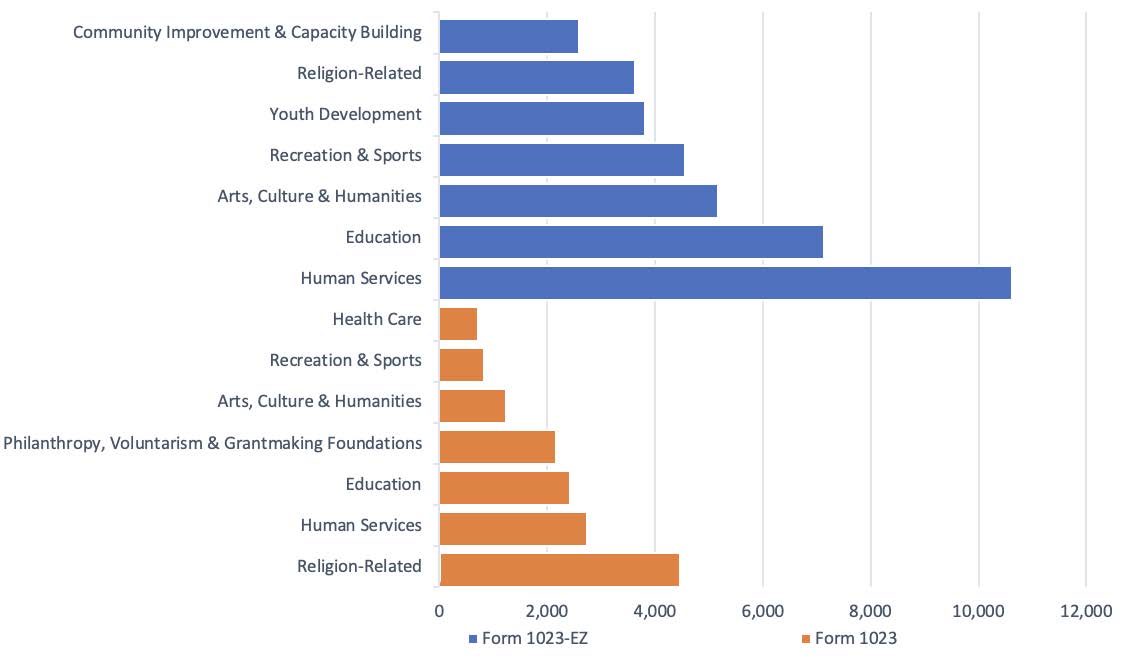

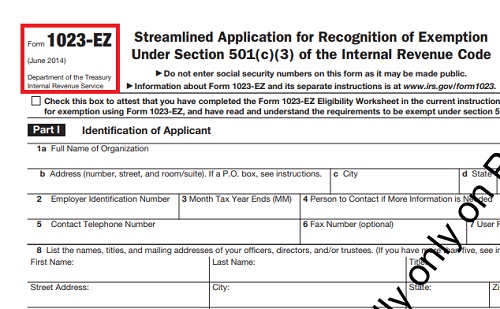

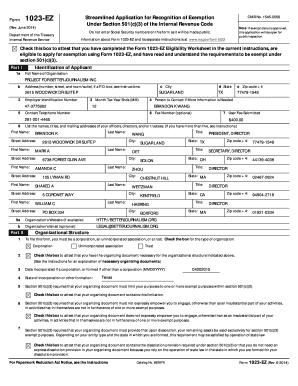

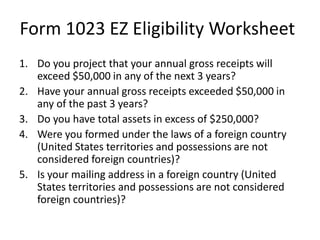

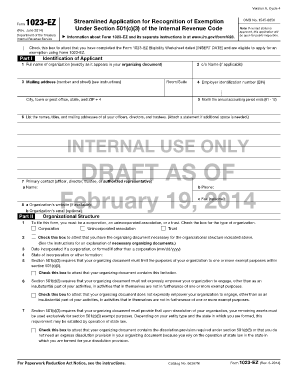

Filing the 1023 EZ Form for Your Nonprofit - Springly We will cover all of the form sections as well how to tell if your organization is eligible for the EZ format: 1023 vs 1023-EZ; Eligibility Worksheet; Part 1: ... About Form 1023-EZ, Streamlined Application for Recognition ... - IRS Aug 26, 2022 ... Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. · If eligible to file Form ...

Who Is Eligible to Use IRS Form 1023-EZ? - Nolo Basic Eligibility Requirements for the 1023-EZ · gross income under $50,000 in the past 3 years · estimated gross income less than $50,00 for the next 3 years ...

1023 ez eligibility worksheet

Instructions for Form 1023-EZ (Rev. January 2018) - IRS Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section. 1023 ez eligibility worksheet: Fill out & sign online - DocHub Edit, sign, and share 1023 ez eligibility worksheet online. No need to install software, just go to DocHub, and sign up instantly and for free. Form 1023-EZ Eligibility Worksheet (Must be completed prior to ... If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. 1. Do you project that your annual gross receipts will exceed $50,000 in ...

1023 ez eligibility worksheet. Application for Recognition of Exemption Under Section 501(c)(3) You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file that form. Streamlined Application for Recognition of Exemption Under Section ... If this occurs, you will need to complete the form again. We apologize for this inconvenience. Note: You must complete the Form 1023-EZ Eligibility Worksheet in ... What is IRS Form 1023-EZ? Filing Fees & Eligibility There are many other qualifications and any organization that wishes to file the Form 1023-EZ must complete the eligibility worksheet before submitting the form ... Form 1023-EZ (June 2014) - Washington Secretary of State Check this box to attest that you have completed the Form 1023-EZ Eligibility Worksheet in the current instructions, are eligible to apply for exemption ...

Form 1023-EZ Eligibility Worksheet (Must be completed prior to ... If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. 1. Do you project that your annual gross receipts will exceed $50,000 in ... 1023 ez eligibility worksheet: Fill out & sign online - DocHub Edit, sign, and share 1023 ez eligibility worksheet online. No need to install software, just go to DocHub, and sign up instantly and for free. Instructions for Form 1023-EZ (Rev. January 2018) - IRS Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section.

0 Response to "41 1023 ez eligibility worksheet"

Post a Comment