42 good faith estimate worksheet

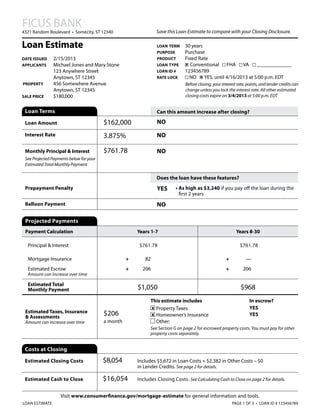

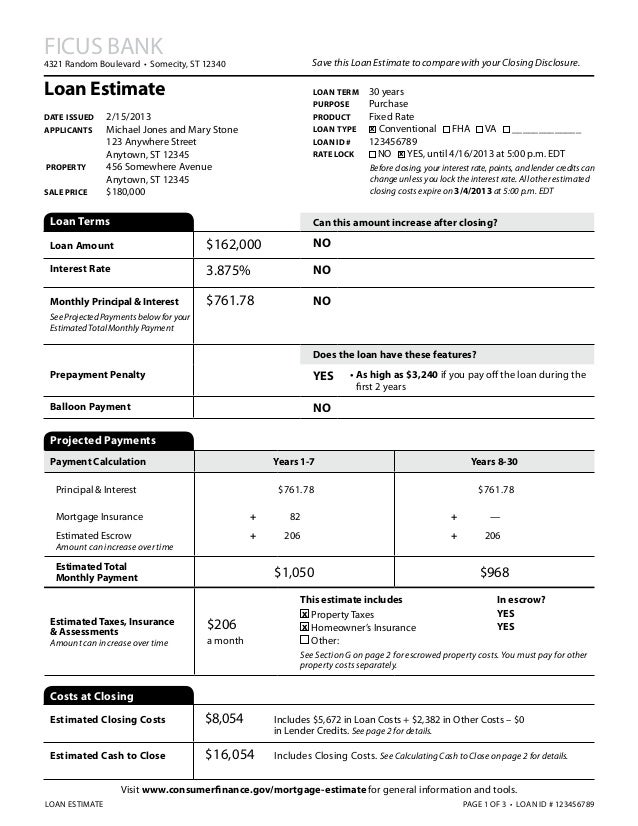

What is a Loan Estimate or "Good Faith Estimate"? A Loan Estimate (LE) is a standard document you'll receive when you apply for a mortgage with any lender. This document used to be called a "Good... A GFE, also referred to as a good faith estimate, is a document that includes the breakdown of approximate payments due upon the closing of a mortgage loan. A GFE helps borrowers shop and compare costs of loans with lenders. You are not obligated to accept the loan just because you received a GFE.

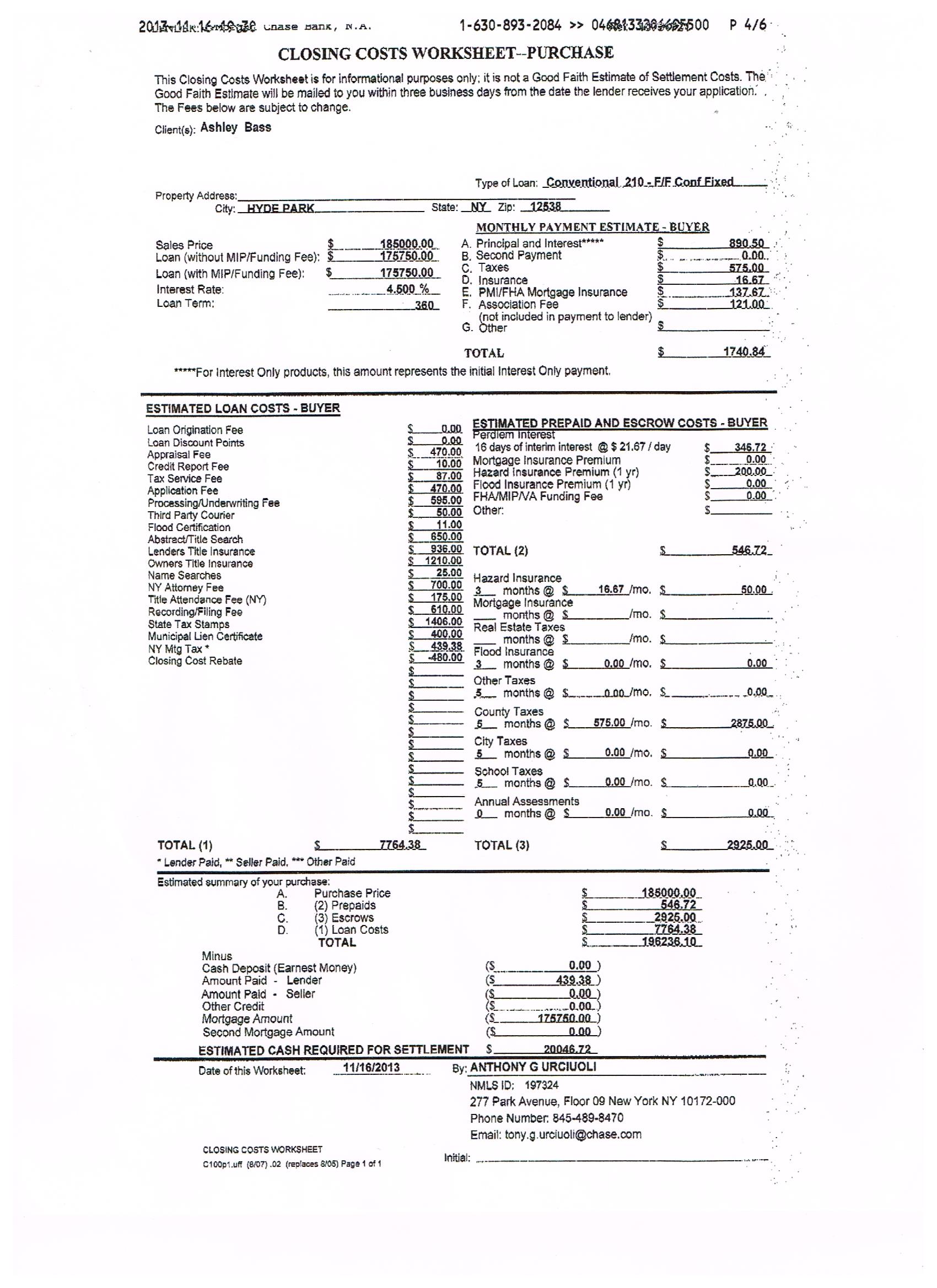

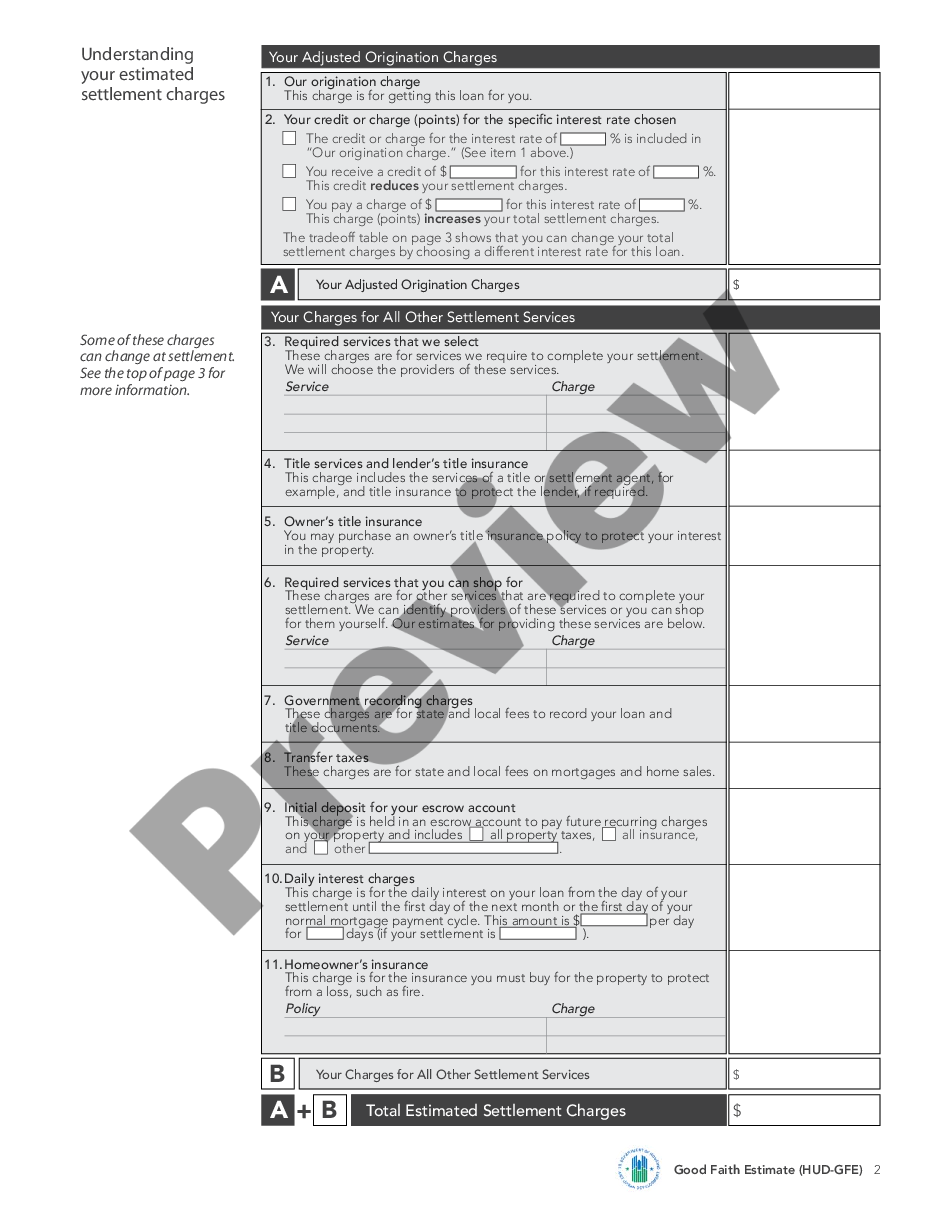

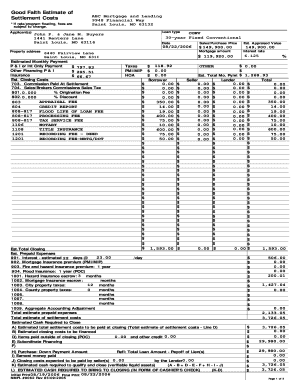

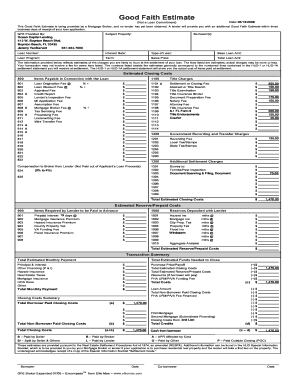

A "Good Faith Estimate" (hereinafter, named GFE) is exactly what the name says. It is an estimate and a breakdown of costs for your home purchase. It includes, but is not limited to, showing the purchase price and your down payment amount, origination fees, underwriting & processing fees, recording fees, title fees and your taxes and insurance ...

Good faith estimate worksheet

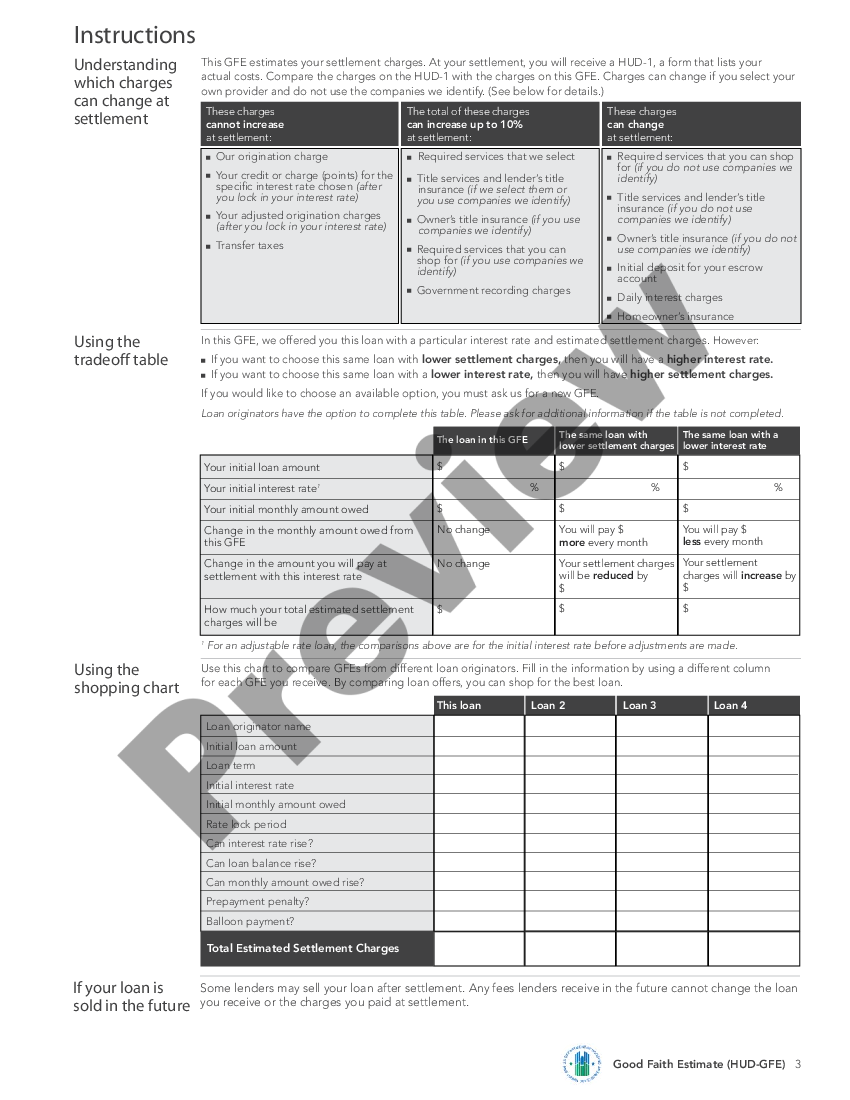

The government has come up with rules that lenders must follow when it comes time to reveal estimated closing costs to people who are shopping for a mortgage. The government-mandated closing costs form is called a Loan Estimate (formerly known as a Good Faith Estimate). When you look at a Loan Estimate, you'll see a break-down of closing costs. The good faith estimate shows the costs of items and services that your provider or facility expects to charge you for an item or service. The estimate should be based on information known at the time the estimate was created and does not include any unknown or unexpected costs that may arise during the course of treatment. Good Faith Estimate Excel Worksheet Template - This is an imaginative writing worksheet. When finding out an international language, it's essential to be able to express on your own in writing. Since it makes you stand out from the group, it's a good concept to have great handwriting.

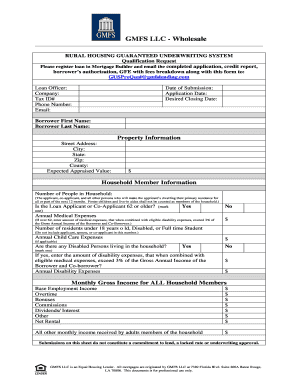

Good faith estimate worksheet. The good faith estimate must include expected charges for the items or services that are reasonably expected to be provided together with the primary item or service, including items or services that may be provided by other providers and facilities. For example, for a surgery, the good faith estimate might include the cost of the surgery, any ... Therefore, the signNow web application is a must-have for completing and signing good faith estimate example worksheet on the go. In a matter of seconds, receive an electronic document with a legally-binding eSignature. Get good faith estimate signed right from your smartphone using these six tips: Get Your Good Faith Estimate Before You Pay For Your Appraisal. July 8, 2014. ~ Carolyn Warren. ~ 4 Comments. True Story, June 2014. Mr. Borrower asks his lender for a Good Faith Estimate or a cost estimate for a purchase loan. He wants to borrow $320,000, has excellent credit, and 20% to put as a down payment. The Net Good Faith Baseline amount is reduced by the Baseline Adjustment amount. This amount is used as the new baseline amount for determining Fee Variance Violated Alerts in the category. For fees in the 10% category, the Legal Limit (Net Baseline + 10%) amount is recalculated based on the new Net Good Faith Baseline amount. Scenarios

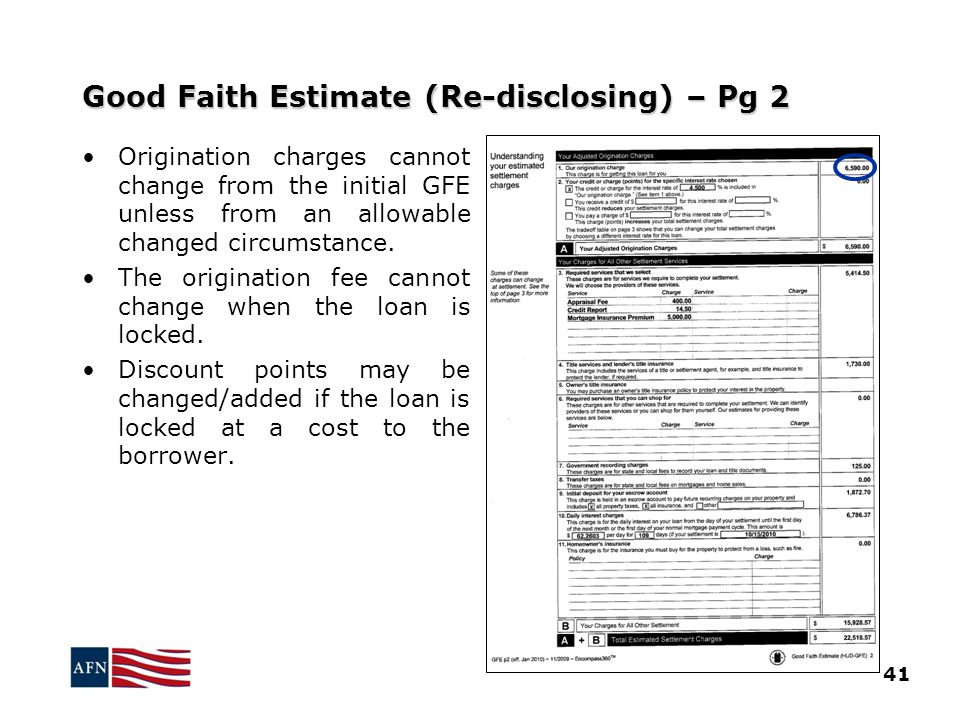

A township must provide a FOIA requester with a "good faith" estimate of any costs that will be charged, so you can also use the form as that estimate and send it to the requester. Note that if the "good faith" estimate of costs is over $50, the township may require that the requester pay a 50% good faith deposit up front—before the ... revised Good Faith Estimate to the borrower within 3 business days of receiving information sufficient to establish changed circumstances. The Redisclosure Worksheet is a tool for detecting Changed Circumstances and any changes to the Disclosed Fees. Quiz & Worksheet Goals Use this worksheet and quiz to: Determine what happens to a Good Faith Estimate if fees increase before closing Define the Good Faith Estimate Identify the law which requires... The regulations "do not require the good-faith estimate to include charges for unanticipated items or services that are not reasonably expected and that could occur due to unforeseen events." HHS also states that for 2022 it plans to exercise enforcement discretion in situations where the estimate leaves out charges from a co-provider.

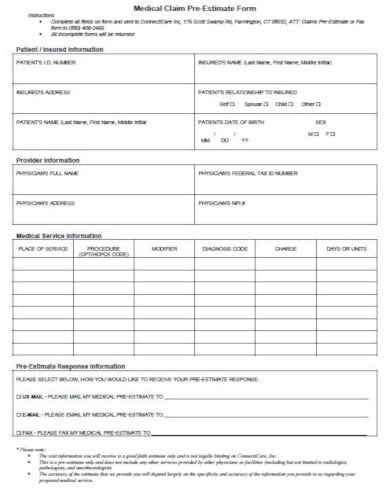

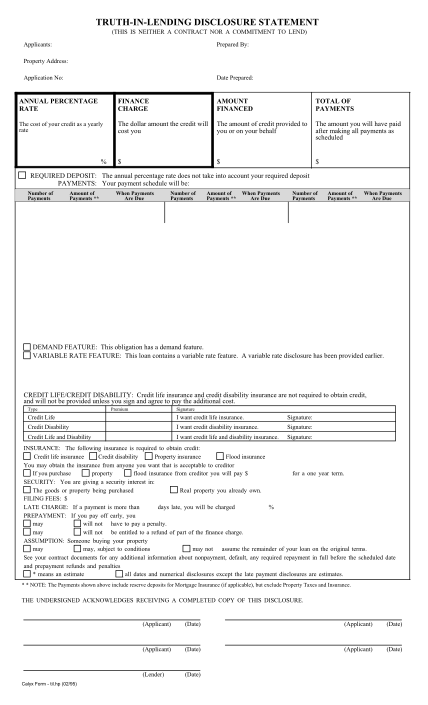

Good Faith Estimate years % includes A. Settlement Statement (HUD-1) D. Name & Address of Borrower: G. Property Location: Place of Settlement: C. Note: This form is furnished to give you a statement of actual settlement costs. Amounts paid to and by the settlement agent are shown. Items marked "(p.o.c.)" were paid outside the closing; they ... Good Faith Estimate (GFE) Your financial responsibilities as a homeowner In addition to your monthly amount owed for principal, interest, and mortgage insurance, you may need to pay other required annual charges to keep your property. We must provide an estimate for annual property taxes along with homeowner's, flood, and other required ... A good faith estimate (or a loan estimate) is a standard form intended to be used to compare different offers (or quotes) from different lenders or brokers. The estimate must include an itemized list of fees and costs associated with the loan and must be provided within 3 business days of applying for a loan. This Good Faith Estimate shows the costs of items and services that are reasonably expected for your health care needs for an item or service. The estimate is based on information known at the time the estimate was created. The Good Faith Estimate does not include any unknown or unexpected costs that may arise during treatment.

The good faith effect on revised disclosures, and it's not just limited to loan estimates, because you can see in our January 31st column, closing disclosures are also affected by this. Hey, most systems are still struggling to deal with this okay! Keep working at it, take notes along the way, write your story. Want to Learn more about TRID 2.0

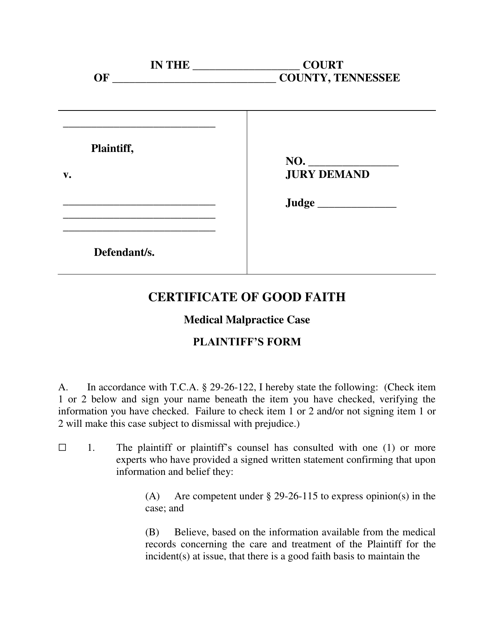

Good Faith Estimate (GFE) versus Initial Fees Worksheet. As of the first of the year HUD issued new rules regarding Good Faith Estimates (also know as GFE's). These newly adopted rules called for stricter guidelines for the preparation of GFE's by lenders, mortgage bankers and mortgage brokers.

What Is A Good Faith Estimate And A Loan Estimate? When you apply for a mortgage, your lender is required to give you a Loan Estimate: a standardized form that gives you important details about the mortgage you're applying for. The Loan Estimate includes your estimated interest rate, monthly payment, closing costs and more.

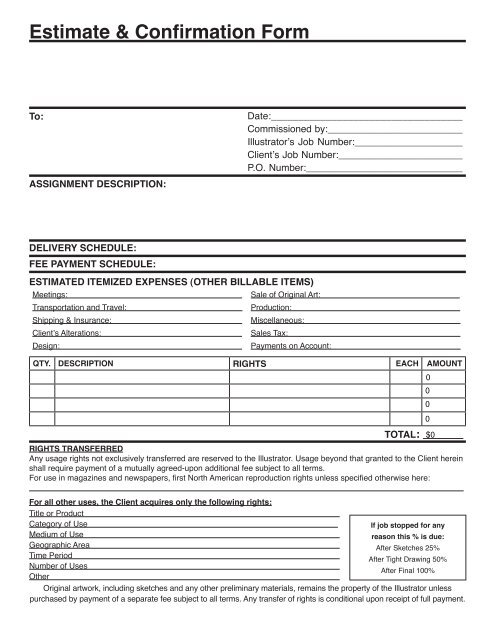

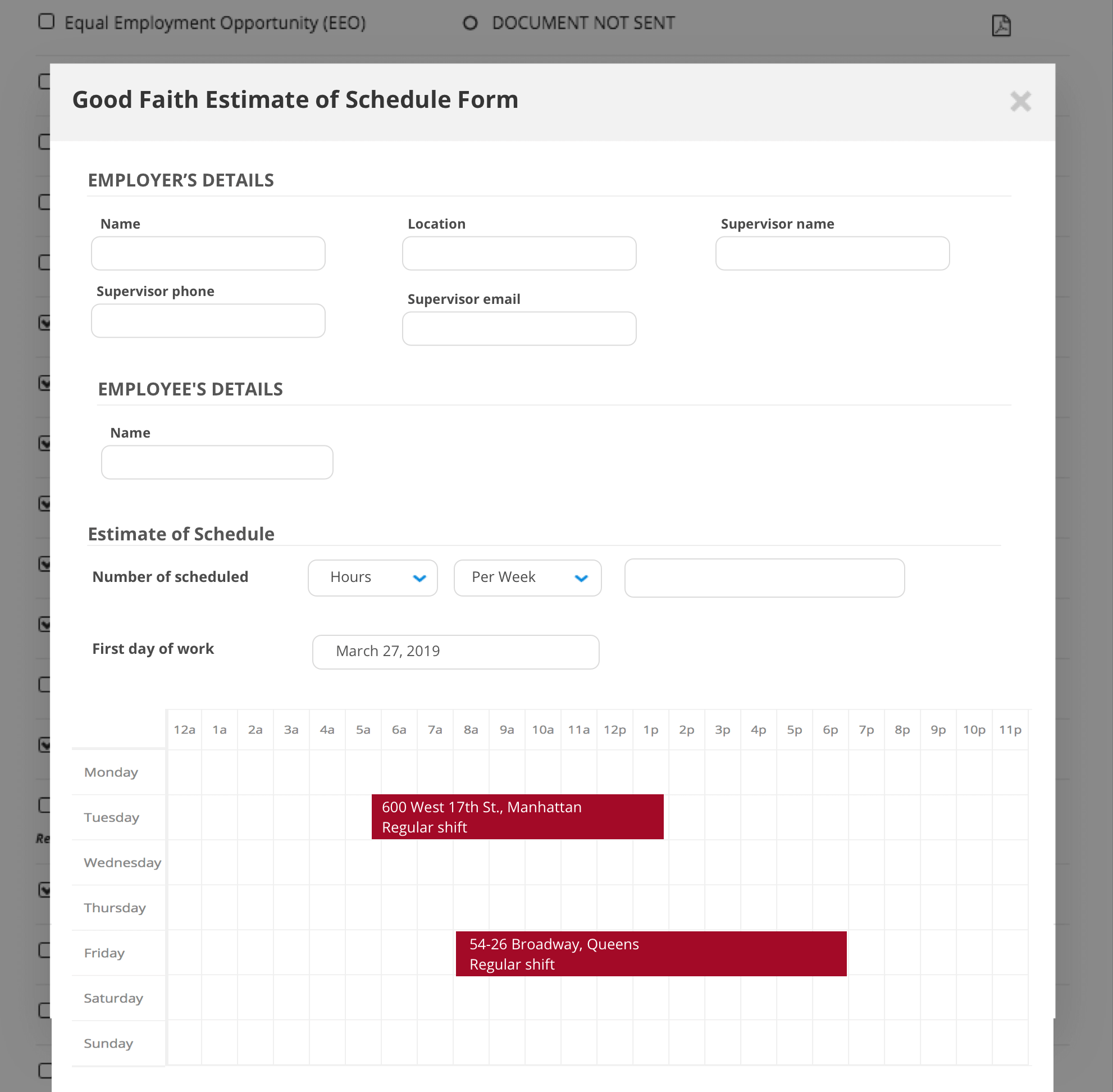

This "good faith estimate," as the Act calls it, must be given upon request or at the time of scheduling. Included in the documents released by CMS is a template for providers and healthcare facilities to use to deliver good faith estimates under the No Surprises Act. CMS says one of the documents (CMS-10791 - 11. 2.

A Good Faith Estimate is an estimate of all closing fees including pre-paid and escrow items as well as lender charges. The GFE must be given to the borrower within three days after submission of a loan application. With GFE's in the past, your quote may have been low-balled (underestimated on purpose) by hundreds and maybe even thousands of ...

The Los Angeles Times and other media outlets are claiming that lenders' use of loan cost worksheets and estimates are a "sidestep" of the new RESPA mandated Good Faith Estimate which went into effect on January 1. HUD officials say they plan to conduct a review of the growing use of "worksheets" and "fee estimate" forms by mortgage lenders providing quotes to home buyers and ...

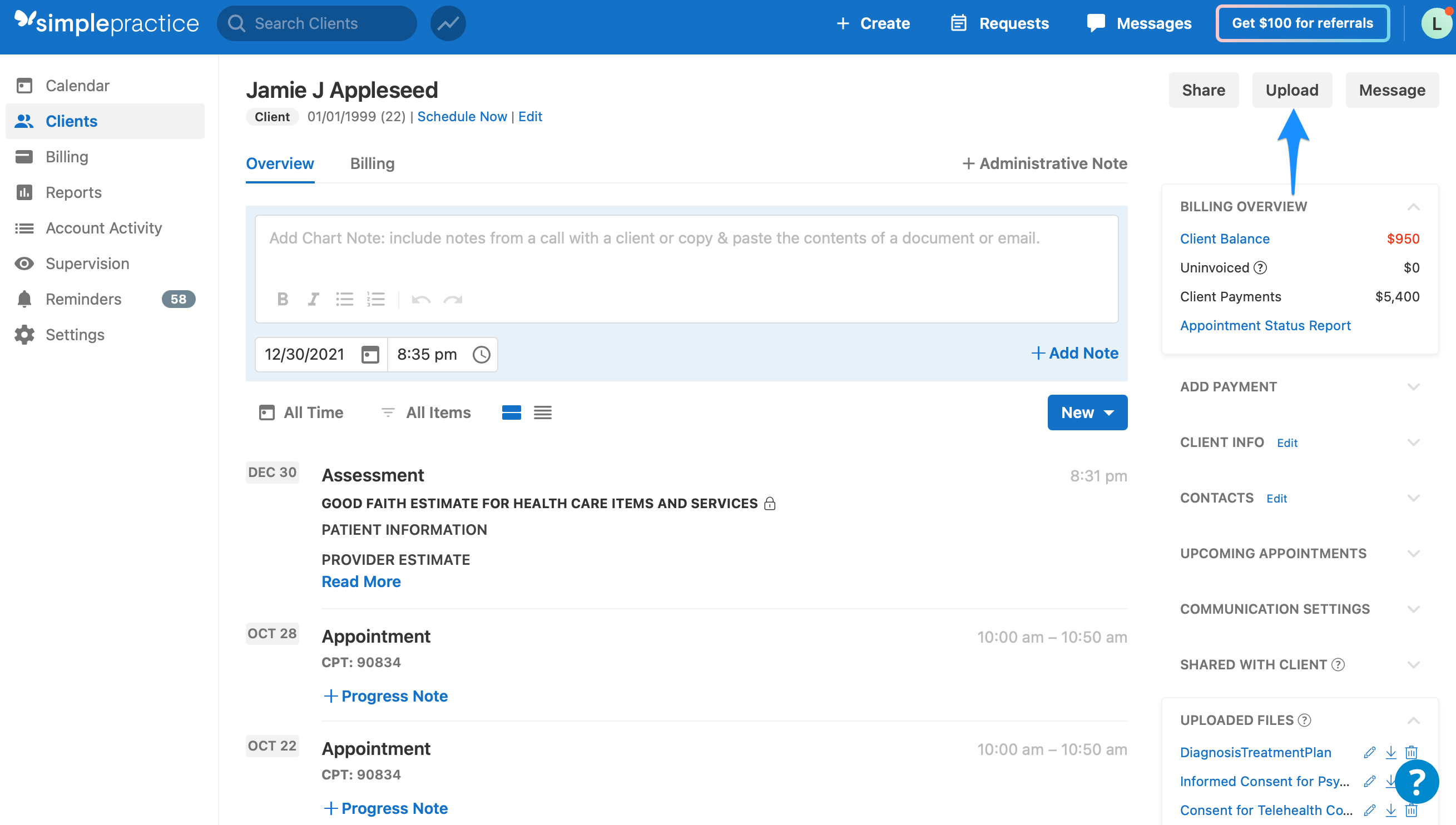

Good Faith Estimate — Counseling Recovery, Michelle Farris, LMFT. (408) 800-5736.

This estimator has been completed by the consumer and is for informational purposes only. Please contact a loan officer for a more detailed worksheet. Once you apply for a loan, you will receive a Good Faith Estimate of Closing Costs (GFE). All figures listed on this worksheet are approximations.

Before 2015, lenders were required to provide a "good faith estimate," or GFE, and a truth-in-lending statement. Since 2015, these documents were consolidated into the Loan Estimate. Borrowers will receive a loan estimate from the lender when applying for a mortgage. There is a difference between an informal worksheet estimate and the Loan ...

This Good Faith Estimate is being provided by [broker name], a mortgage broker, and no lender has yet been obtained. The information provided below reflects estimates of the charges which you are likely to incur at the settlement of your loan. The fees listed are estimates -- the actual charges may be mor or less.

Good Faith Estimates You can prepare a Good Faith Estimate for yourself, or, if you are a Real Estate Agent for your clients, by downloading Barnes Walker's complimentary electronic worksheet for Microsoft Excel or Lotus 1-2-3. To download the worksheet, just double click on the icon below. Download Good Faith Estimate

Good Faith Estimate Excel Worksheet Template - This is an imaginative writing worksheet. When finding out an international language, it's essential to be able to express on your own in writing. Since it makes you stand out from the group, it's a good concept to have great handwriting.

The good faith estimate shows the costs of items and services that your provider or facility expects to charge you for an item or service. The estimate should be based on information known at the time the estimate was created and does not include any unknown or unexpected costs that may arise during the course of treatment.

The government has come up with rules that lenders must follow when it comes time to reveal estimated closing costs to people who are shopping for a mortgage. The government-mandated closing costs form is called a Loan Estimate (formerly known as a Good Faith Estimate). When you look at a Loan Estimate, you'll see a break-down of closing costs.

0 Response to "42 good faith estimate worksheet"

Post a Comment