39 sec 1031 exchange worksheet

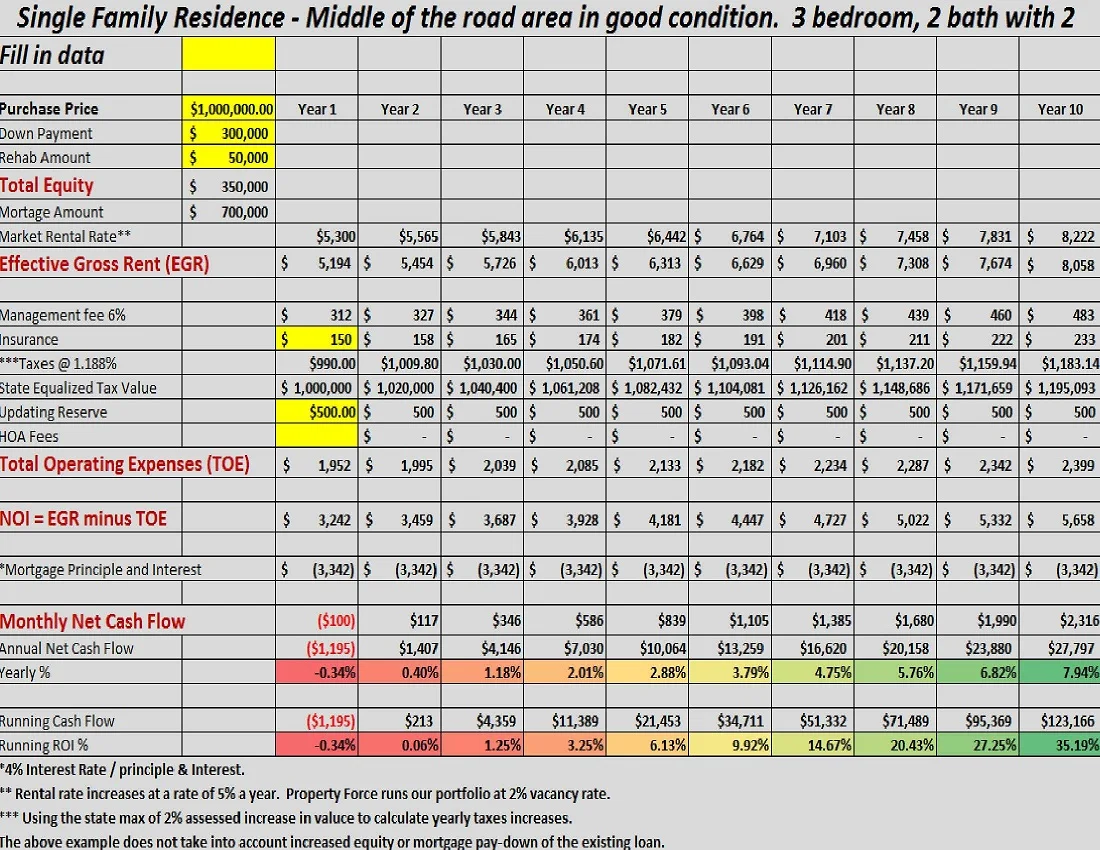

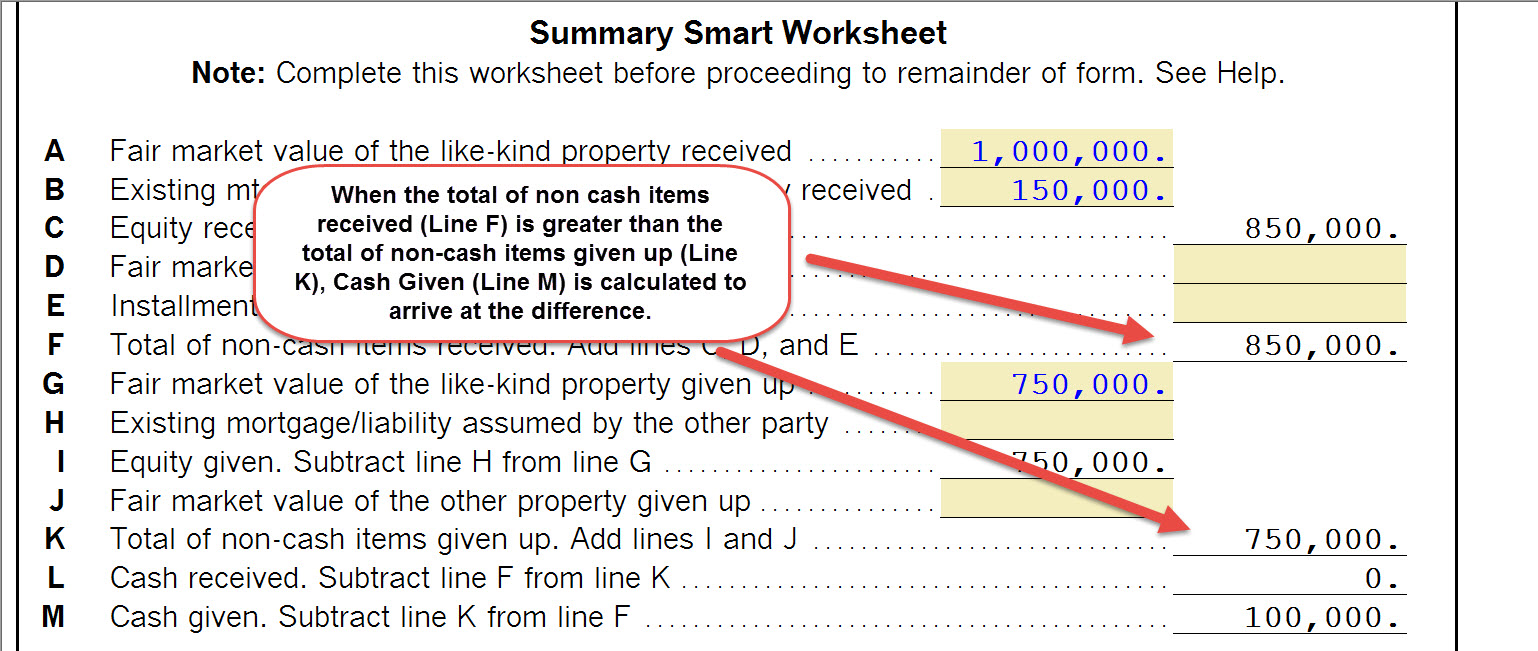

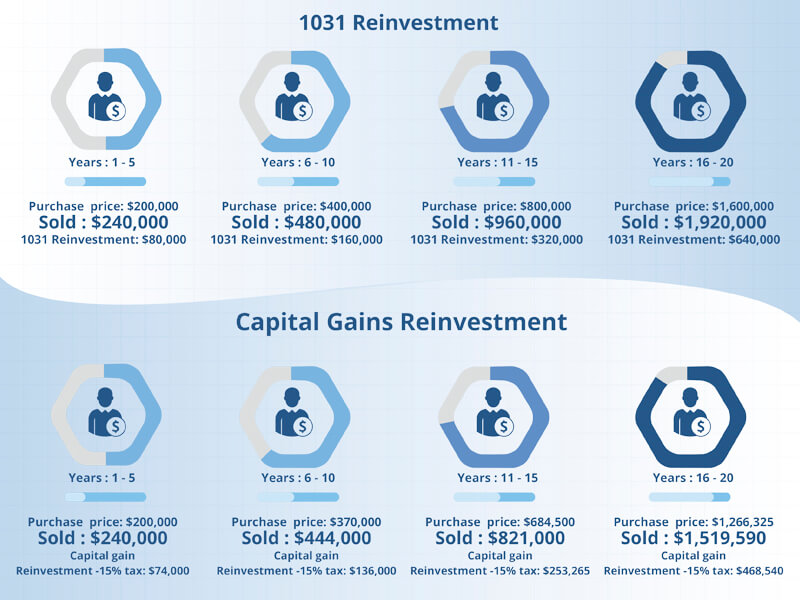

Excel 1031 Property Exchange - Business Spreadsheets 1031 Property Exchange for Excel is designed for investors, real estate brokers and facilitators allowing to: Balance equities. Evaluate boot given and received. Estimate the realized and recognized gains to calculate the transfer basis. Automatically create sample worksheets of IRS Form 8824. Perform "What if" analysis by changing the input ... IRC 1031 Like-Kind Exchange Calculator Under Section 1031, taxpayers can postpone paying this tax if they reinvest the profit in similar property. Doing so is known as a like-kind exchange, which allows taxpayers to grow their investment on a tax-deferred basis. Considering that long-term capital gains taxes are either 15 or 20 percent, and short-term capital gains rates range from ...

Instructions for Form 8824 (2021) | Internal Revenue Service Beginning after December 31, 2017, section 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or for investment, other than real property held primarily for sale. See Definition of real property, later, for more details.

Sec 1031 exchange worksheet

1031 Exchange: How To Calculate the Basis of Your New ... The basic idea is that a 1031 exchange lets an investor sell one property and reinvest the proceeds into another property. They then defer paying capital gains tax. Since you're deferring the tax liability from one property to another, this affects the cost basis (for tax purposes) of the new property you acquire. PDF 2019 Exchange Reporting Guide - 1031 CORP The "Tax Cuts and Jobs Act," effective January 1, 2018, repealed Section 1031 exchanges of tangible and intangible personal property assets. Reporting State Capital Gain/ Income Tax 1033 Exchanges - Deferring Gain on Property Lost Due to ... These are some of the basic rules, but if you are contemplating a 1033 exchange, you should investigate the details further with your tax advisor. First American Exchange is always available to answer your questions and to help you set up a tax deferred exchange, based on Internal Revenue Code Section 1031.

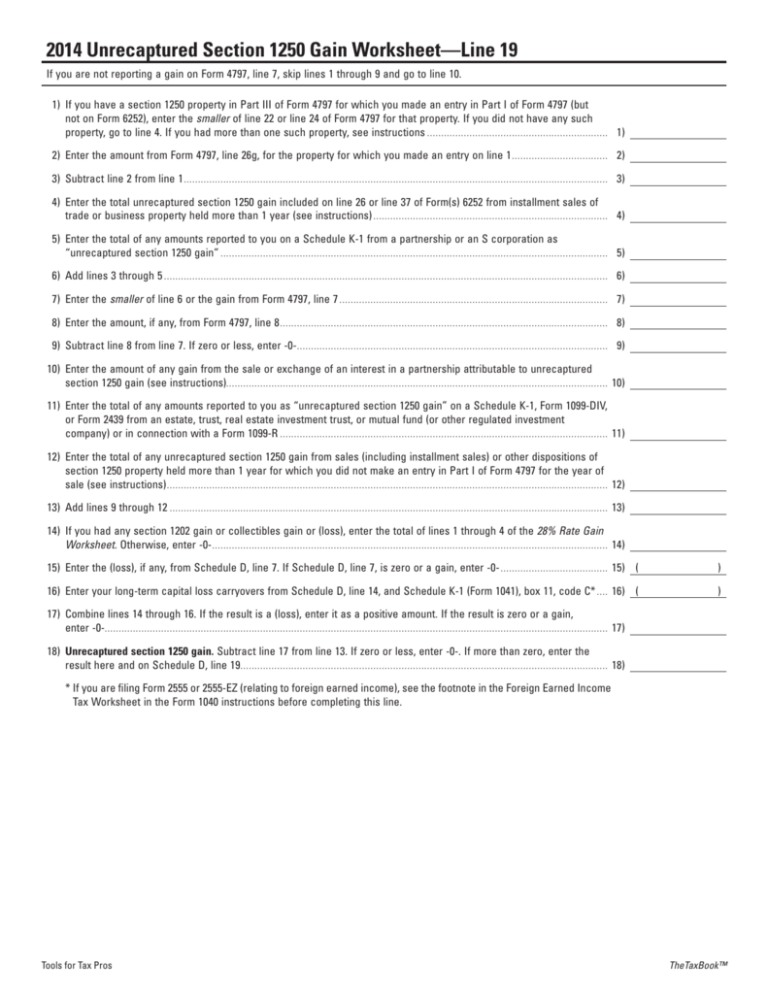

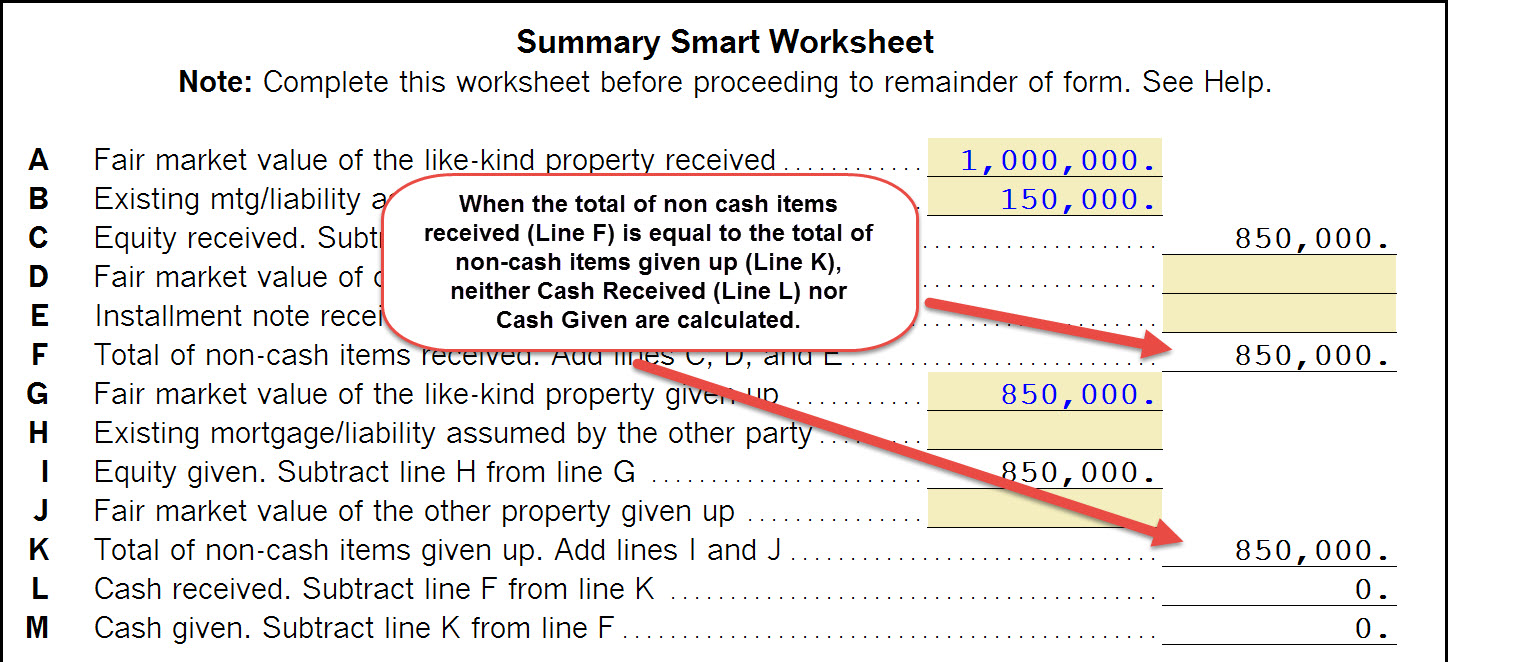

Sec 1031 exchange worksheet. PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 – Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from WorkSheet #7 (Line J) $_____ PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges ... FORM 8824 WORKSHEET Worksheet 2 Tax Deferred Exchanges Under IRC § 1031 ANALYSIS OF CASH BOOT RECEIVED OR PAID Sale of Exchange Property Sale price, Exchange Property $ 13 Less debt relief (Line 25 below) ( ) 14 Less exchange expenses paid (worksheet 3) ( ) 15 Total cash received (line 13 minus lines 14 & 15) 16 Purchase of Replacement Property PDF §1031 BASIS ALLOCATION WORKSHEET - firsttuesday received in exchange for the property sold.....$ _____ 4. Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost ... §1031 BASIS ALLOCATION WORKSHEET Replacement Property Depreciation Analysis (Supplement to §1031 Recapitulation Worksheet Form 354) Form 8824: Do it correctly | Michael Lantrip Wrote The Book FORM 8824. IRS Form 8824, the Like Kind Exchange form, is where you report your Section 1031 Exchange - Delayed, Reverse, or Construction. The Form 8824 is due at the end of the tax year in which you began the transaction, as per the Form 8824 Instructions. Even if you did not close on your Replacement Property until the following year, Form ...

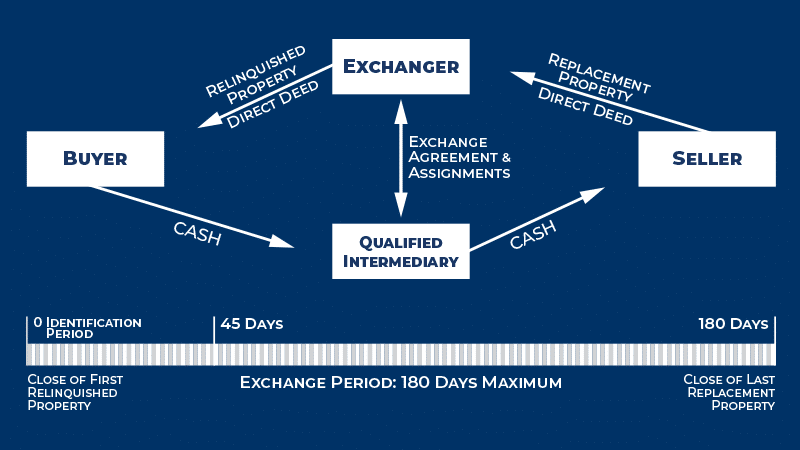

1031 Exchanges | FirstBank Setup a 1031 Exchange today by calling us at 888-367-1031 or visit us at efirstbank1031.com. If you are selling investment property and intend to reinvest the proceeds in similar, or like-kind, investment property, you should never have to pay income taxes on the sale of property. A 1031 Exchange can help you defer the taxes on the transaction. Solved: 1031 exchange - Intuit Accountants Community A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. 1031 Exchange Calculator - The 1031 ... - The 1031 Investor This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received). XLS 1031 Corporation Exchange Professionals - Qualified ... 1031 Corporation Exchange Professionals - Qualified ...

1033 Exchange / Eminent Domain Reinvestment Similar to a 1031 exchange, 1033 guidelines require an investor to reinvest proceeds from a forced conversion into a like-kind real estate exchange to qualify for full tax- deferment benefits. However, the tax deferral provisions and timelines of a 1033 exchange are typically much more relaxed and generous to the taxpayer than the 1031 rules ... PDF Like-Kind Exchanges Under IRC Section 1031 type of Section 1031 exchange is a simultaneous swap of one property for another. Deferred exchanges are more complex but allow flexibility. They allow you to dispose of property and subsequently acquire one or more other like-kind replacement properties. To qualify as a Section 1031 exchange, a deferred exchange must be distinguished from the case PDF Reporting the Like-Kind Exchange of Real Estate ... - 1031 REPORTING THE EXCHANGE Section 13303 of the Tax Cut and Jobs Act (TCJA) (PL No 115-97) passed in December 2017 amended in IRC Section 1031. The main change, effective January 1, 2018, was the deletion of Personal and Intangible property exchanges. THE EXCHANGE OF REAL PROPERTY (real estate) WAS RETAINED. PDF §1031 Basis Allocation Worksheet - Irex received in exchange for the property sold ... Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost ... (Supplement to §1031 Recapitulation Worksheet Form 354)

Like-Kind Exchange Worksheet - CS Professional Suite This tax worksheet examines the disposal of an asset and the acquisition of a replacement “like-kind” asset while postponing or deferring the gain from the ...

1031 Tax Exchange Rules: What You Need to Know What Is Section 1031? Broadly stated, a 1031 exchange (also called a like-kind exchange or a Starker) is a swap of one investment property for another. Most swaps are taxable as sales, although if...

IRS 1031 Exchange Worksheet And Section 1031 Exchange ... Apr 17, 2018 · Worksheet April 17, 2018. We tried to get some great references about IRS 1031 Exchange Worksheet And Section 1031 Exchange Calculation Worksheet for you. Here it is. It was coming from reputable online resource and that we enjoy it. We hope you can find what you need here.

1031 Exchange Examples | 2022 Like Kind Exchange Example 37.3%. $606,625. (1) Federal Capital Gains equal to Realized Gain less depreciation taken multiplied by the applicable rate. (2) Based on amount of depreciation taken during ownership of the property. In this example,the amount is based on $400,000 of depreciation taken. (3) Rate varies by state.

Concise Overview of Combining 1031 Exchange and 121 ... Section 1031 of the Internal Revenue Code ("1031 exchange") provides that property held as rental or investment property or property used in your business ("relinquished property") can be exchanged for "like-kind" property also held as rental or investment property or property used in your business ("replacement property") allowing you to defer ...

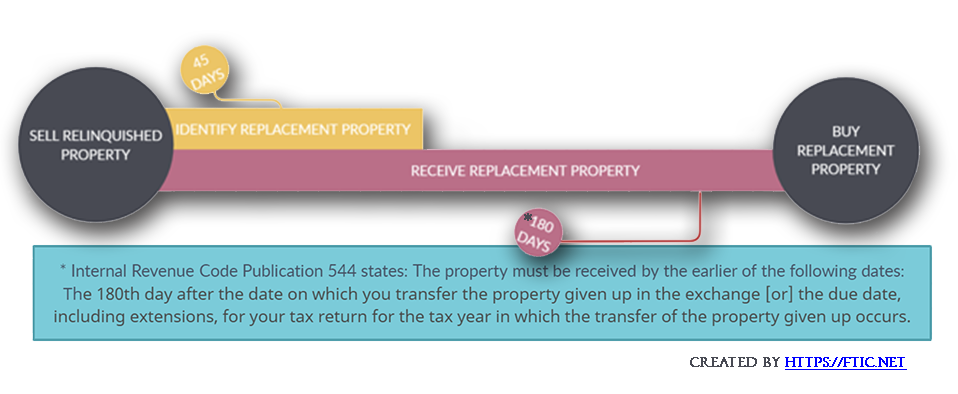

1031worksheet - Learn more about 1031 Worksheet 1031worksheet - Learn more about 1031 Worksheet 1031 Exchange Rules In all cases of a 1031 exchange, the owner must close on the identified replacement property (s) within 180 days from the sale date of the original property. The "three-property" 1031 exchange rule: the owner may identify up to three properties, regardless of their value.

Real Estate Investment Software Product Page - RealData Real Estate Investment Analysis - Professional. Income-property investment analysis software for existing residential and commercial properties. Optional add-ons for Portfolio Analysis and Property Comparison Analysis. Learn More.

1031 Exchange Calculator | Calculate Your Capital Gains Since our founding in 1990, Realty Exchange Corporation's sole mission is to provide qualified intermediary service to real property investors and their advisors for 1031 exchanges. William Horan is a Certified Exchange Specialist® (CES), the qualified intermediary industry's prestigious designation.

Exchanges Under Code Section 1031 - American Bar Association Exchanges Under Code Section 1031 What is a 1031 Exchange? An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or business and uses the funds to acquire replacement property. A 1031 exchange is governed by Code Section 1031 as well as various IRS Regulations and Rulings.

1031 Like Kind Exchange Calculator - Excel Worksheet That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Calculate the taxes you can defer when selling a property. Includes state taxes and depreciation recapture.

IRC Section 1031 Like-Kind Exchange Calculator: IRS Home ... A Section 1031 Like-Kind Exchange must be reported to the IRS on a Form 8824 and filed with the tax return for the year the exchange was performed. The form asks the purchaser to describe the properties exchange, identify when properties were identified and transferred, the relationship between the parties who exchanged property, values of both ...

2021 Instructions for Form 8824 - Internal Revenue Service Beginning after December 31, 2017, section. 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or ...

1031 Exchange Worksheet 2019 - Fill Online, Printable ... Fill 1031 Exchange Worksheet 2019, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✓ Instantly. Try Now!

1031 Exchange Calculation Worksheet And Sec 1031 Exchange ... We always effort to show a picture with high resolution or with perfect images. 1031 Exchange Calculation Worksheet And Sec 1031 Exchange Worksheet can be beneficial inspiration for those who seek a picture according specific topic, you can find it in this website. Finally all pictures we've been displayed in this website will inspire you all.

1033 Exchanges - Deferring Gain on Property Lost Due to ... These are some of the basic rules, but if you are contemplating a 1033 exchange, you should investigate the details further with your tax advisor. First American Exchange is always available to answer your questions and to help you set up a tax deferred exchange, based on Internal Revenue Code Section 1031.

PDF 2019 Exchange Reporting Guide - 1031 CORP The "Tax Cuts and Jobs Act," effective January 1, 2018, repealed Section 1031 exchanges of tangible and intangible personal property assets. Reporting State Capital Gain/ Income Tax

1031 Exchange: How To Calculate the Basis of Your New ... The basic idea is that a 1031 exchange lets an investor sell one property and reinvest the proceeds into another property. They then defer paying capital gains tax. Since you're deferring the tax liability from one property to another, this affects the cost basis (for tax purposes) of the new property you acquire.

![What is the 1031 Exchange Timeline for 2021? [+ infographic]](https://resources.hemlane.com/content/images/2021/04/What-is-the-1031-Exchange-Timeline-for-2021----infographic-.jpg)

![What is the 1031 Exchange Timeline for 2021? [+ infographic]](https://resources.hemlane.com/content/images/2021/04/1031-exchange-timeline-for-real-estate-investors---Hemlane.com.png)

0 Response to "39 sec 1031 exchange worksheet"

Post a Comment