40 nc 4 allowance worksheet

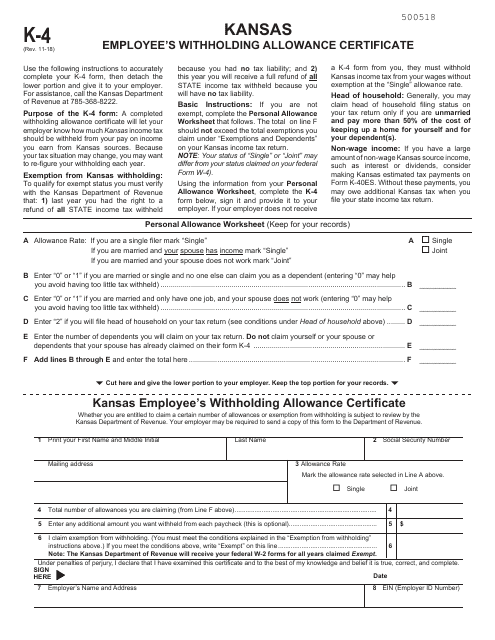

PDF NC-4 Employee's Withholding - ComplyRight NC-4 Allowance Worksheet. Your withholding will usually be most accurate and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet). NONWAGE INCOME - If you have a large amount of nonwage income, PDF NC-4 Employee's Withholding 11-15 Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

NC-4 Employee’s Withholding 9-16 Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

Nc 4 allowance worksheet

c; sides of paper. NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4). 39 nc-4 allowance worksheet - Worksheet Resource Nc 4 Allowance Worksheet - Addition Worksheets Pictures 2020 Allowance worksheet part i. It may send you back with a number to enter on line 1 or send you to complete part ii of the allowance worksheet. Instructions on completing new nc 4. Franchise tax corporate income tax and insurance premium tax rules and bulletins reflecting changes made ... PDF NC-4 - iCIMS NC-4 Allowance Certificate 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 17 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars) .00 Social Security Number Filing Status

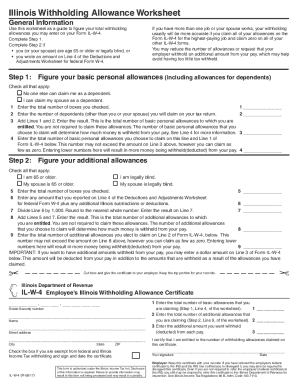

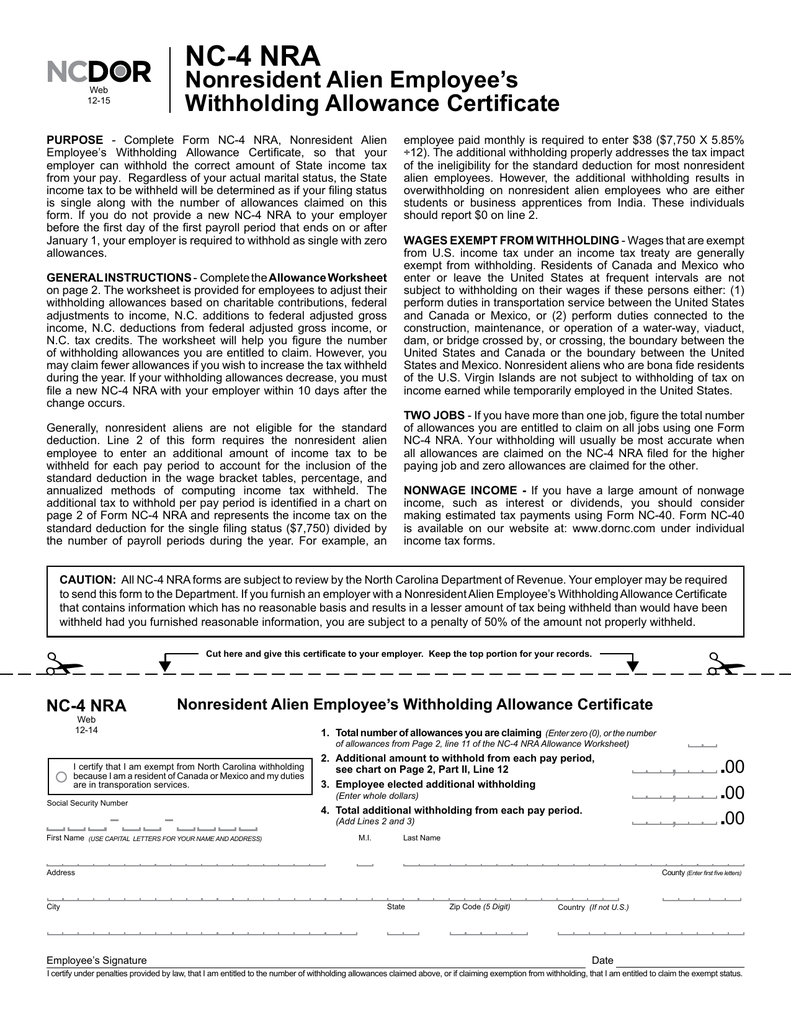

Nc 4 allowance worksheet. PDF NC-4 NRA Nonresident Alien Employee's Withholding ... NC-4 NRA Allowance Worksheet Answer all of the following questions: 1. Will your charitable contributions exceed $2,499? Yes o No o 2. Will you have adjustments or deductions from income, see Page 3, Schedule 1? Yes o No o 3. Will you be able to claim any N.C. tax credits or tax credit carryovers from Page 4, Schedule 3? PDF Nc-4 FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits. Withholding Tax Forms and Instructions - NCDOR Business Registration Application for Income Tax Withholding,Sales and Use Tax, and Machinery and Equipment Tax. Register Online. NC-3. Annual Withholding Reconciliation ( Instructions) eNC3. NC-3X. Amended Annual Withholding Reconciliation. eNC3 eNC3. NC-5501. What is Food Stamp Fraud? - Investigation ... - Study.com 13.01.2022 · He sells his $150 food stamp allowance to a friend for $75 cash. Another way that the food stamp system is defrauded is by a store selling ineligible items. When an individual receives food stamps ...

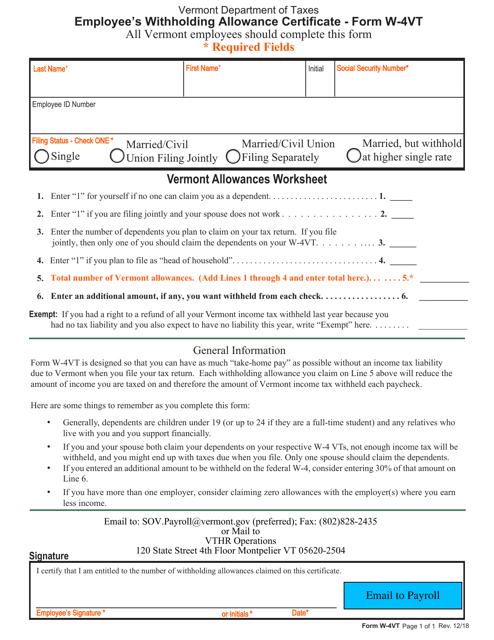

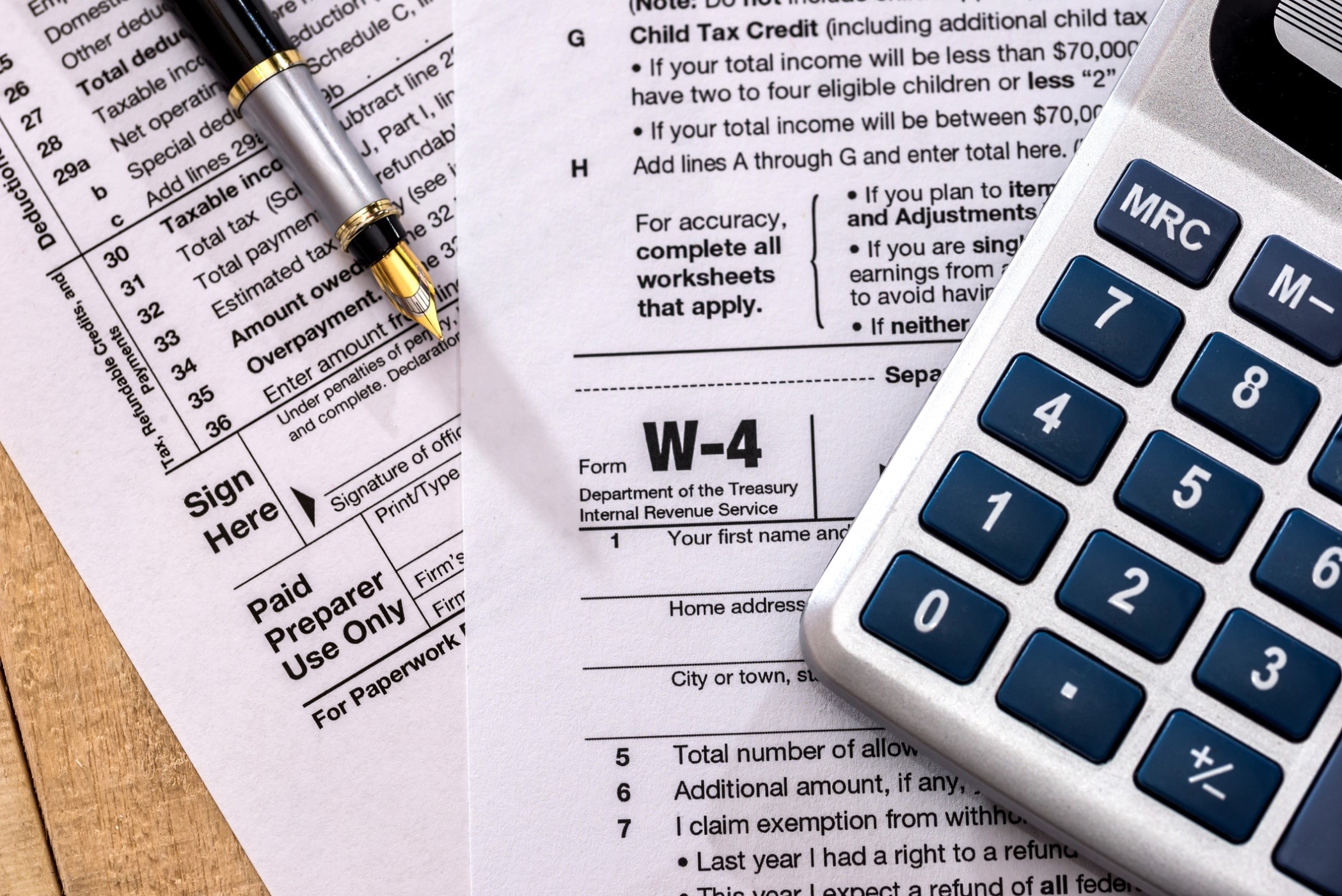

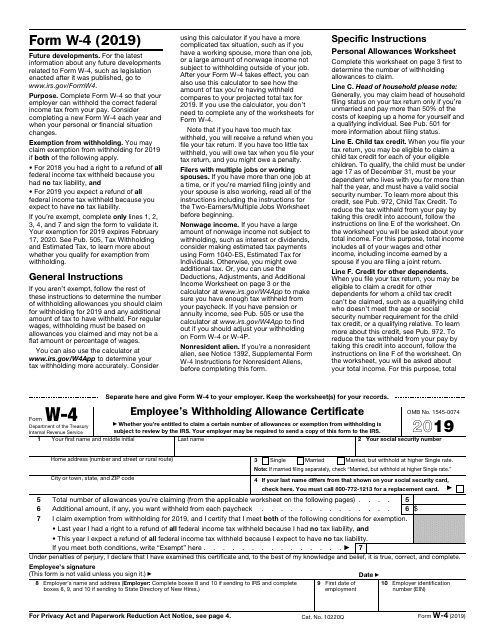

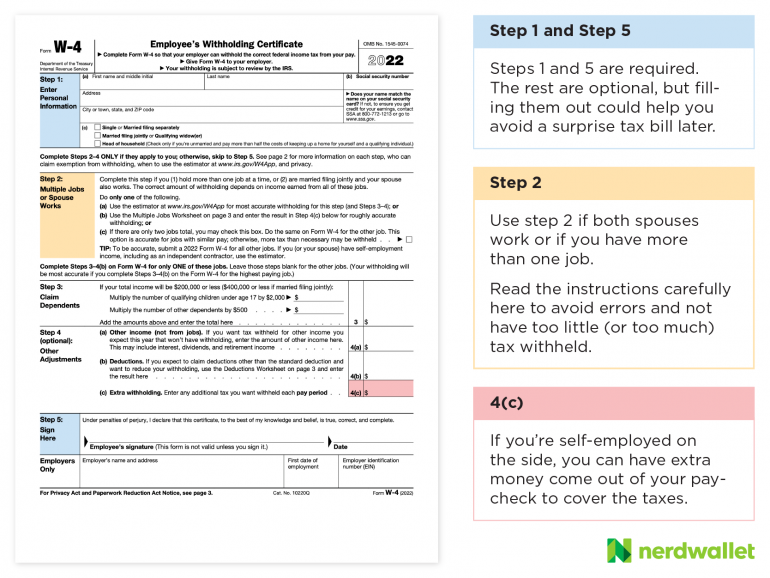

2022 Form W-4 - IRS tax forms If you choose the option in Step 2(b) on Form W-4, complete this worksheet (which calculates the total extra tax for all jobs) on only ONE Form W-4. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. Note: If more than one job has annual wages of more than $120,000 or there are more than three jobs, … How to fill out the NC-4 - One Source Payroll Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 . Line 1 of NC-4 You are no longer allowed to claim a N.C. withholding allowance for yourself, your spouse, your children, or any other dependents. Please enter 0 if you plan to claim a N.C. standard deduction and do not … 3 Ways to Fill Out a W4 As a Married Couple - wikiHow 18.04.2020 · For example, suppose you claimed 2 personal allowances. Your lowest paying job pays $35,000 a year, which corresponds to the number "4" on the table. Since 2 is smaller than 4, enter "-0-" on your W-4. Then continue the worksheet to calculate any additional withholding. Employee's Withholding Allowance Certificate NC-4 | NCDOR Employee's Withholding Allowance Certificate NC-4. Form NC-4 Employee's Withholding Allowance Certificate. Files. NC-4_Final.pdf. PDF • 488.48 KB - December 17, 2021 Taxes & Forms. Individual Income Tax; Sales and Use Tax; Withholding Tax. Withholding Tax Forms and Instructions; eNC3 - Web File Upload;

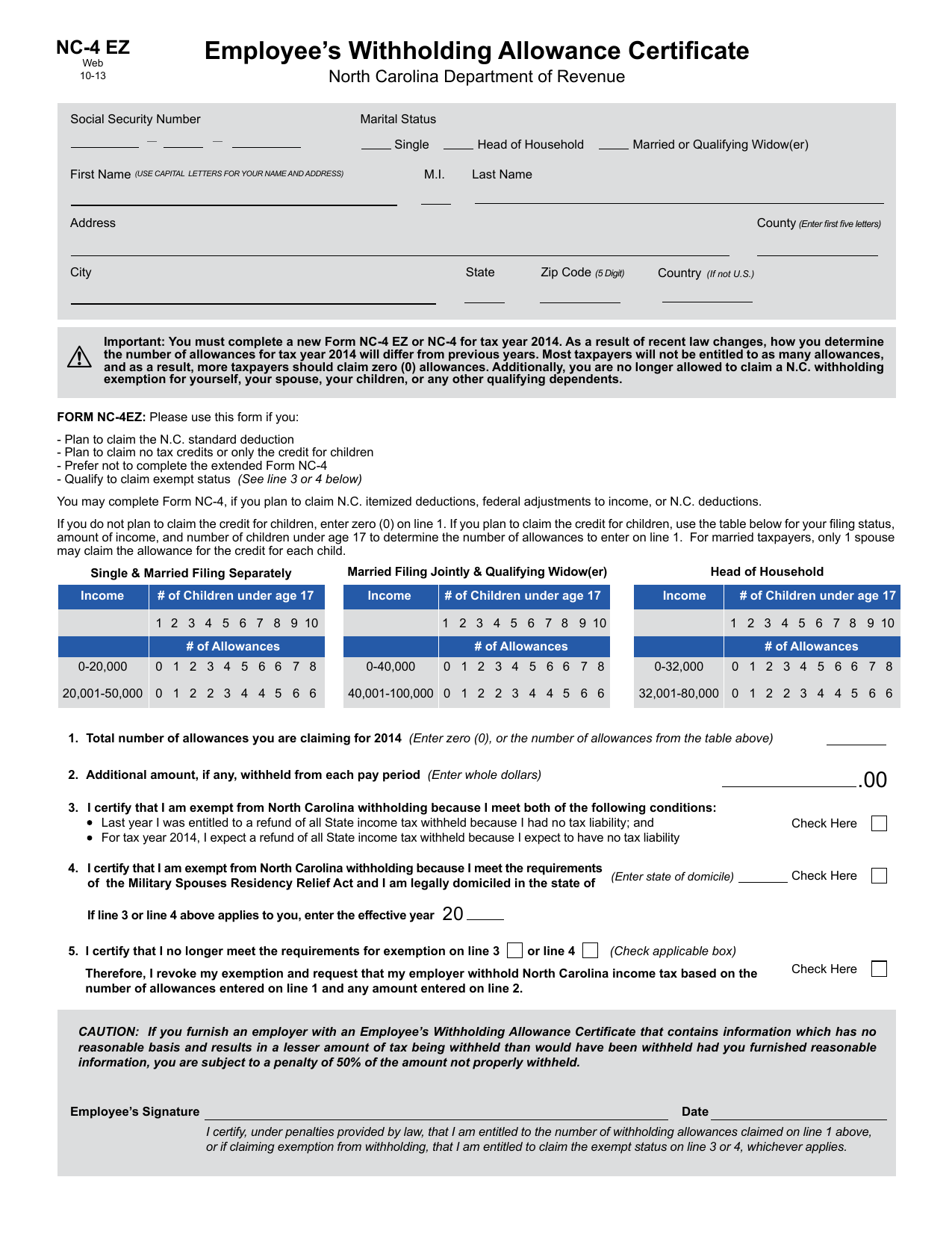

How to Fill Out The Personal Allowances Worksheet (W-4 ... Here is more information about the W-4 Worksheet, including how to fill out the W-4 allowance worksheet, line by line. Although it is late in the year, if you were disappointed in the size of your refund or you had an unexpected balance due when you filed your 2018 tax return, it is not too late to make changes for 2019. ... PDF NC-4 Employee's Withholding Allowance Certificate 1. Total number of allowances you are claiming for 2014 (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars),. 00 Single Head of Household Married or Qualifying Widow(er) Marital Status 5+ Popular Nc 4 Allowance Worksheet - Weavingaweb Nc 4 allowance worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. Itemized Total after limits Schedule 2 Estimated Child Deduction Amount. Tax credits or tax credit carryovers from Page 4 Schedule 3. Employee's Withholding Allowance Certificate NC-4EZ - NCDOR Form NC-4EZ Web Employee's Withholding Allowance Certificate. Files. NC-4EZ_Final.pdf. PDF • 453.31 KB - December 17, 2021 Taxes & Forms. Individual Income Tax; Sales and Use Tax; Withholding Tax. Withholding Tax Forms and Instructions; eNC3 - Web File Upload; eNC3; eNC3 Waiver Information;

NC-4 - form.jotform.com Employee's Withholding Allowance Certificate North Carolina Department of Revenue. 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars)

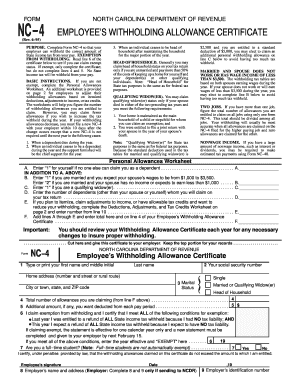

NC-4 Employee's Withholding FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits. However, you may claim fewer allowances than

PDF How to fill out the NC-4 EZ - One Source Payroll Form NC-4 EZ Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Please fill out header Be sure to fill in Marital Status Header 3 Line 1 of NC-4 EZ Enter zero (0) or the number of allowances from the table on the next slide. 4

› doc › north-carolina-w-4pdfNC-4 Employee’s Withholding - University of Colorado NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

Federal and North Carolina Paycheck Withholding Calculator NC-4 Allowance Worksheet Part II; Schedule 1 Estimated N.C. Itemized Deductions Qualifying Mortgage Interest: Real estate property taxes: Charitable Contributions (Same as allowed for federal): Medical and Dental Expenses (Same as allowed for federal): Itemized Total (after limits) Schedule 2 Estimated Child Deduction Amount

PDF NC-4 Employee's Withholding - Rowan-Salisbury School System (From Line F of the Personal Allowances Worksheet on Page 2) Additional amount, if any, you want withheld from each pay period (Enter whole dollars) 2. ... (See Form NC-4 Instructions before completing this form) (Enter state of domicile) NC-4 Web 10-12 Social Security Number

NC-4 NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

PDF NC-4 NRA Web Nonresident Alien Employee's Withholding ... NC-4 NRA Allowance Worksheet Answer all of the following questions: 1. Will your charitable contributions exceed $2,499? Yes o Noo 2. Will you have adjustments or deductions from income, see Page 3, Schedule 1? Yes o Noo 3. Will you be able to claim any N.C. tax credits or tax credit carryovers from Page 4, Schedule 3?

PDF NC-4 NRA Part II GENERAL INSTRUCTIONS- Complete the NC-4 NRAAllowance Worksheet on page 2. The worksheet will help you determine the number of withholding allowances you are entitled to claim based on federal and State adjustments to gross income, including the N.C. Child Deduction Amount, N.C. itemized deduction for charitable contributions, and N.C. tax credits.

› human_resources_nc4_faqFrequently Asked Questions Re: Employee’s Withholding ... completing the NC-4 Allowance worksheet? A15. No. Pre-tax items are not included in taxable income and similarly should not be included when completing the NC-4 Allowance worksheet. Q16. When do we send a NC-4EZ or NC-4 to the Department? A16. If an employee claims more than 10 allowances, you should forward this document to

PDF Fayetteville State University | Fayetteville, NC NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 5).

NC-4 Employee’s Withholding Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet). NONWAGE INCOME - If you …

PDF NC-4 Employee's Withholding 10-17 Allowance Certicate Allowance Certicate NC-4 Web 10-17 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 17 of the NC-4 Allowance Worksheet) 2.Additional amount, if any, withheld from each pay period (Enter whole dollars),. 00 First Name (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS) M.I. Last Name

PDF Form NC-4 Instructions for Completing Form NC-4 Employee's ... BASIC INSTRUCTIONS- Complete the Personal Allowances Worksheeton Page 2 of Form NC-4. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income, or tax credits.

Home Page [myidp.sciencecareers.org] You have put a lot of time and effort into pursuing your PhD degree. Now it’s time to focus on how to leverage your expertise into a satisfying and productive career.

Diy Nc 4 Allowance Worksheet - Goal keeping intelligence FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheets will help you figure the number of withholding allowances you are entitled to claim. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 See Allowance Worksheet.

Surviving Spouse - Nc FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits. However, you may claim fewer allowances than

PDF NC-4 - iCIMS NC-4 Allowance Certificate 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 17 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars) .00 Social Security Number Filing Status

39 nc-4 allowance worksheet - Worksheet Resource Nc 4 Allowance Worksheet - Addition Worksheets Pictures 2020 Allowance worksheet part i. It may send you back with a number to enter on line 1 or send you to complete part ii of the allowance worksheet. Instructions on completing new nc 4. Franchise tax corporate income tax and insurance premium tax rules and bulletins reflecting changes made ...

c; sides of paper. NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/XDQFMUVP4NFPXECEUEKYBL5SIE.jpg)

0 Response to "40 nc 4 allowance worksheet"

Post a Comment