41 truck driver tax deductions worksheet

Eligible Meal and Lodging Expenses for Truck Drivers ... In most cases, people who travel for work may only claim 50% of their meals and beverage expenses. However, if you are a long-haul truck driver, you can deduct 80% of these expenses. However, if you are claiming meal expenses incurred in the United States, you are entitled to 50% only of the costs. Truck Driver Tax Deductions - H&R Block Truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. Taxes and deductions that may be considered "ordinary and necessary" depends upon: You; Your occupation; What the job is and what the expenses are for; The IRS considers a semi-truck to be a qualified non-personal-use vehicle. As a truck driver, you must claim your actual expenses for vehicles of this type.

What You Need to Know About Truck Driver Tax Deductions ... Common truck driver tax deductions. Here are some common deductions you may be able to claim. Association dues. Many truck drivers are part of a union or other trucking association. You can deduct any required fees to belong to a union or group, as long as they're required for business or help your trucking career.

Truck driver tax deductions worksheet

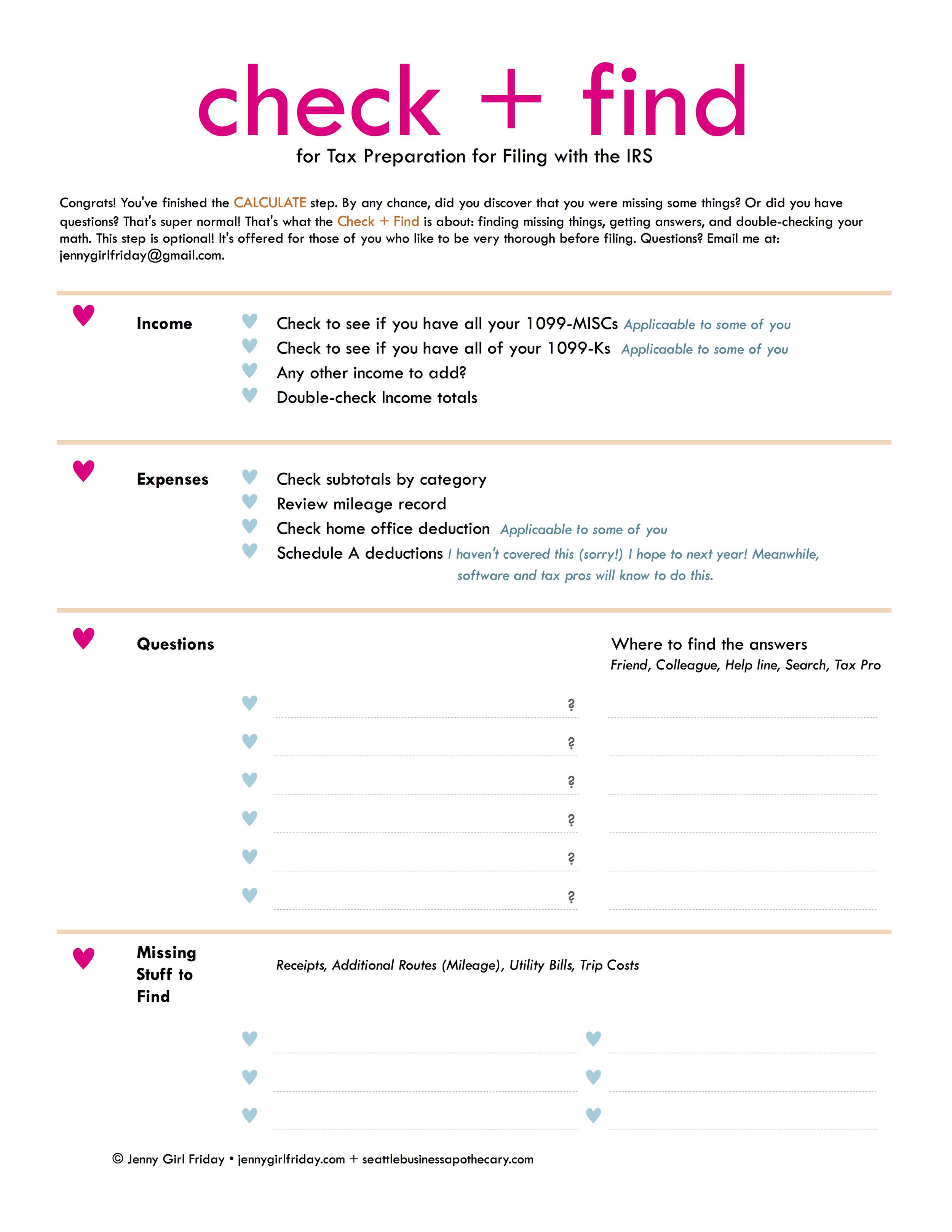

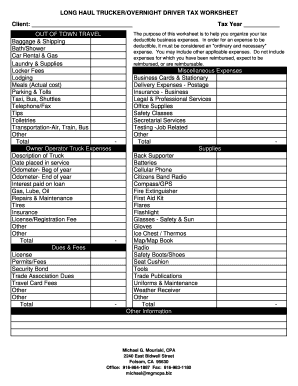

PDF Tax Organizer--Long Haul Truckers and Overnight Drivers 10 Quickfinder® Supplemental Tax Organizers Tax Organizer—Long Haul Truckers and Overnight Drivers Name: Tax Year: Principal Business: Business Name and Address: Date Business Started (if started this year): PART 1—Out-of-Town Travel Expenses ... PDF Trucker'S Income & Expense Worksheet!!!!!!!!!!!!!! Truck Driver Tax Deductions Visit for more CDL Truck Driver Solutions Cleaning Supplies Misc. Supplies Misc. Supplies Air Freshener Alarm Clock Thermos Bottle Armour-All Fly Swatter First Aid Supplies Broom & Dustpan Bedding Clothing Printable Truck Driver Expense Owner Operator Tax ... Owner operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. Trucker's income & expense worksheet. Truck drivers can claim a variety of tax deductions while on the road.

Truck driver tax deductions worksheet. Truck Driver Expense Spreadsheet | LAOBING KAISUO | Truck ... Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Realtor Tax Deduction Worksheet. Owner Operator Expense Spreadsheet PDF Download, federal taxes and truckers deductions list. consultant's income amp expense worksheet mer tax. larrysbass1957. ATBS | Free Owner-Operator Trucker Tools Trucker Tax Deduction Worksheet. Our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Keep track of what deductions you are taking advantage of. DOWNLOAD. 2022 Tax Deadline Calendar. PDF TRUCKER'S INCOME & EXPENSE WORKSHEET - Cameron Tax Services TRUCKER'S EXPENSES (continued) EQUIPMENT PURCHASED Radio, pager, cellular phone, answering machine, other… Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Traded with Related Property Other Information 1099s: Amounts of $600.00 or more paid to individuals (not Truck Expenses Worksheet | Spreadsheet template, Tax ... Owner Operator Expense Spreadsheet PDF Download, federal taxes and truckers deductions list. consultant's income amp expense worksheet mer tax. Nov 4, 2021 - The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Vehicle Expense Worksheet.

2020 Truck Driver Tax Deductions Worksheet - Fill Online ... Get the free 2020 truck driver tax deductions worksheet form. Get Form. Show details. Hide details. LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS The purpose of this worksheet is to help you organize your tax-deductible business expenses. In order for an expense to be deductible, it must be considered. 2020 Truck Driver Tax Deductions Worksheet - Fill Out and ... Quick steps to complete and eSign Truck Driver Tax Deductions Worksheet online: Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. 19 Truck Driver Tax Deductions That Will Save You Money ... If you use it for both business and personal reasons, you can deduct the portion related to work. So if your new laptop cost $1,000 and you use it for work 50% of the time, you can deduct $500. Education If you pay for truck driver school or other training to maintain your CDL license, you can deduct it. PDF 2021 Self-Employed (Sch C) Worksheet If you checked none of these above, please continue by completing the worksheet below for each business. Drivers - be sure you have with you today: • All Forms 1099 ANDthe detail provided by the company (Door Dash, Lyft, Postmates, Uber, etc.) - you need to download and print the detail from each company's web site.

Truck drivers - Deductions | Australian Taxation Office Deductions. You may be able to claim deductions for your work-related expenses. These are expenses you incur to earn your income as a truck driver. For a summary of common claims, see Truck driver deductions (PDF, 826KB) This link will download a file. Or use the list of expenses below to learn more. To claim a deduction for work-related expenses: 5d Planner Full Version For Pc Archives 26.01.2022 · 8/10 (113 votes) - Download Planner 5D - Home & Interior Design Free. To check out what the decoration of your house, office or any other furnished space would look like, just download Planner 5D.Download 500+ free full version games for PC. PDF Trucker'S Income & Expense Worksheet &$/,)251,$ 7$; %287 ... RENT/LEASE: Truck lease WAGES: 9lrin~ourffi~fil' ave en of W-2s/941 s if they 1 e Machinery and equipment Wages to spouse (subjectto Soc.Sec. and Other bus. property, locker fees Medicare tax) REPAIRS & MAINTENANCE: Truck, equipment, Children under 18 (not subjectto etc. Soc.Sec. and Medicare tax) SUPPLIES: Maps, safety supplies Truck Driver Trucking Spreadsheet Templates Truck driver daily timesheet template is an excel book template that is useful for the time records of the driver it has all details about the time records of the drivers. Spreadsheet templates can also be used for instant budgets such as an instant party budget and etc. The automotive market is one of the largest in united states and.

Owner Operator Truck Driver Tax Deductions Worksheet | My Idea Truck driver tax deductions worksheet. Save money with truck driver tax deductions. The money you spend for work on the road might increase the money you get back from taxes. If the trucker cannot itemize then none of the employee business expenses or travel expenses including the per diem deduction may be deducted.

Tax Deductions for Truck Drivers - Jackson Hewitt Self-employed truck drivers may also deduct 80% of the special standard meal allowance rate or their actual expenses. The 2018 special standard meal allowance is $63/full day within the US, $68/full day outside the US, $47.25/partial day within the US, $51/partial day outside the US.

Truck Driver Tax Deductions: 9 Things to Claim - Drive My Way This form allows you to carefully itemize the costs of your work and deduct them from your taxes. That's money back in your wallet! Step 2: Save Money with Truck Driver Tax Deductions. This is the good stuff. Claiming work-related tax deductions is important. It reduces your adjusted gross income, and that means you pay less in taxes.

PDF Over-the-road Trucker Expenses List - Pstap received as a taxicab driver, or bonuses received as a truck driver in cash, are taxable income. And the sale of any of your equipment or work-related purchases also constitute taxable income (i.e.: sales of tires, radios, etc.). If you are self-employed (unincorporated) and your net earnings after all legitimate deductions are taken are $400 or

Tax Deduction List for Owner Operator Truck Drivers Owner Operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. For more trucking industry news, information and high paying trucking jobs, continue to visit CDLjobs.com for up-to-date information and job postings.

114 Overlooked Tax Deductions for Truck Drivers The folks over at CDLLife.com have put together an infographic to illustrate some of the truck driver tax deductions that are often overlooked. While things such as writing off your atlas or duct tape may seem small, these are tools used for the job that can add up when doing an itemized tax deduction. Take a look at over 100 tax deductions you ...

PDF Name Year TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL ... TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL WORKSHEET FOR OUR CLIENTS CALL IF YOU NEED HELP WITH IT. Total Income (Gross Amount Of All Checks) - Possible Deductions From Checks- Licenses & Permits Bobtail Fees Pager Fees Health Insurance Physical Damage Reserve Withdrawals Truck Washes -Other Deductions-

Tax Deductions for Owner Operator Truck Drivers ... Tax Deductions for Owner Operator Truck Drivers June 14, 2018 Bob Holtzman Tax deductions for owner operators reduce the amount of self-employment tax and income tax associated with the income reported to the IRS. Self-employed or statutory employees generally file tax deductible business expenses on Schedule C with reported income.

PDF FEDERAL TAXES and O-T-R & O-O TRUCKERS DEDUCTIONS LIST FEDERAL TAXES and O-T-R & O-O TRUCKERS DEDUCTIONS LIST Advertising/Promotional [ ] Business Cards [ ] Promotional (calendars, pens, brochures) [ ] Signage on Tractor and/or Trailer [ ] Web Site Fees & Charges [ ] Other:_____? Auto Mileage (Business Miles) [ ] Total Miles Driven: _____ [ ] Business-Only Miles: _____

15 Tax Deductions Every Truck Driver Should Consider As stressful as taxes can be, tax time is your chance to claim deductions and get some of that money back. Tax Home Requirement for Truck Drivers Before a truck driver can claim a deduction, the IRS requires that you have a "tax home," or address to list on your tax return. This is usually the address where you receive your mail.

Owner Operator Truck Driver Tax Deductions Worksheet - Ark ... Download 2019 per diem tracker. Feb 22, 2021 · owner operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. Deductions and credits for drivers: Truck driver tax deductions worksheet.

Tax Deductions for Truck Drivers - Support Tax Deductions for Truck Drivers Due to the Tax Cuts and Jobs Act, truck drivers that receive wages reported on a W-2 can no longer deduct items such as mileage and travel on their tax returns. The IRS removed Job-Related Travel Expenses (Form 2106) from the individual income tax return for most taxpayers.

Printable Truck Driver Expense Owner Operator Tax ... Owner operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. Trucker's income & expense worksheet. Truck drivers can claim a variety of tax deductions while on the road.

PDF Trucker'S Income & Expense Worksheet!!!!!!!!!!!!!! Truck Driver Tax Deductions Visit for more CDL Truck Driver Solutions Cleaning Supplies Misc. Supplies Misc. Supplies Air Freshener Alarm Clock Thermos Bottle Armour-All Fly Swatter First Aid Supplies Broom & Dustpan Bedding Clothing

PDF Tax Organizer--Long Haul Truckers and Overnight Drivers 10 Quickfinder® Supplemental Tax Organizers Tax Organizer—Long Haul Truckers and Overnight Drivers Name: Tax Year: Principal Business: Business Name and Address: Date Business Started (if started this year): PART 1—Out-of-Town Travel Expenses ...

0 Response to "41 truck driver tax deductions worksheet"

Post a Comment