42 fannie mae rental income worksheet

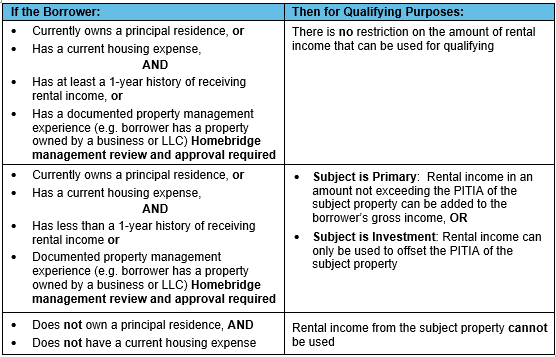

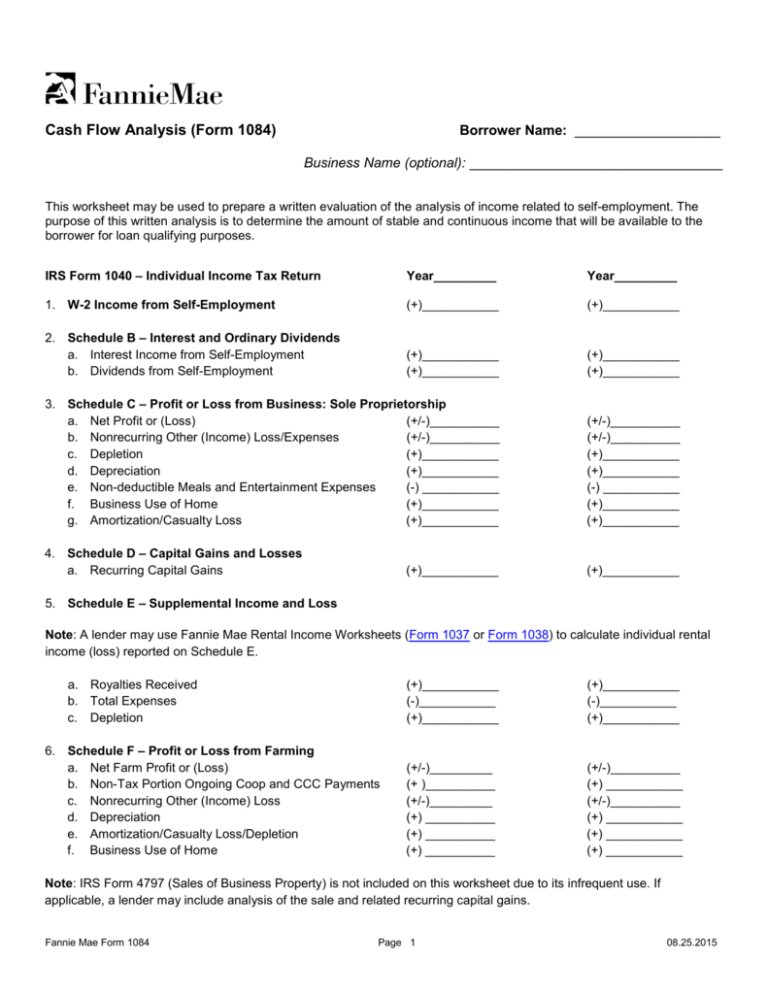

Free Customizable Fannie Mae Rental Income Worksheet - PDF ... To Fill In Fannie Mae Rental Income Worksheet, Follow the Steps Below: Draw Up your Fannie Mae Rental Income Worksheet online is easy and straightforward by using CocoSign . You can simply get the form here and then put down the details in the fillable fields. Follow the guides given below to complete the document. Fill out the editable areas PDF Fannie Mae Cash Flow Analysis Calculator Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a.

PDF Rental Income Calculator - Genworth Financial Please use the following calculator and quick reference guide to assist in calculating rental income from IRS Form 1040 Schedule E. It provides suggested guidance only and does not replace Fannie Mae or Freddie Mac instructions or applicable guidelines.

Fannie mae rental income worksheet

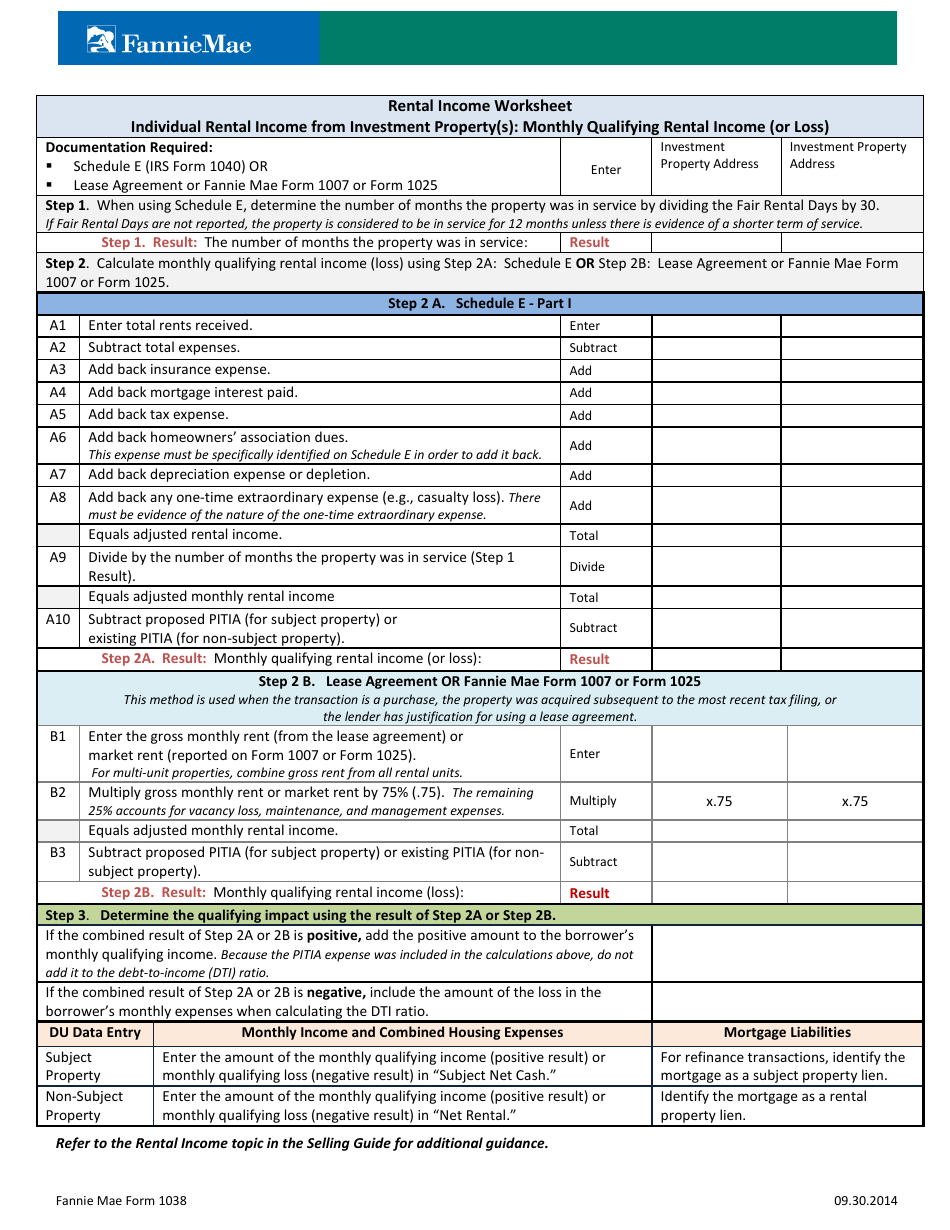

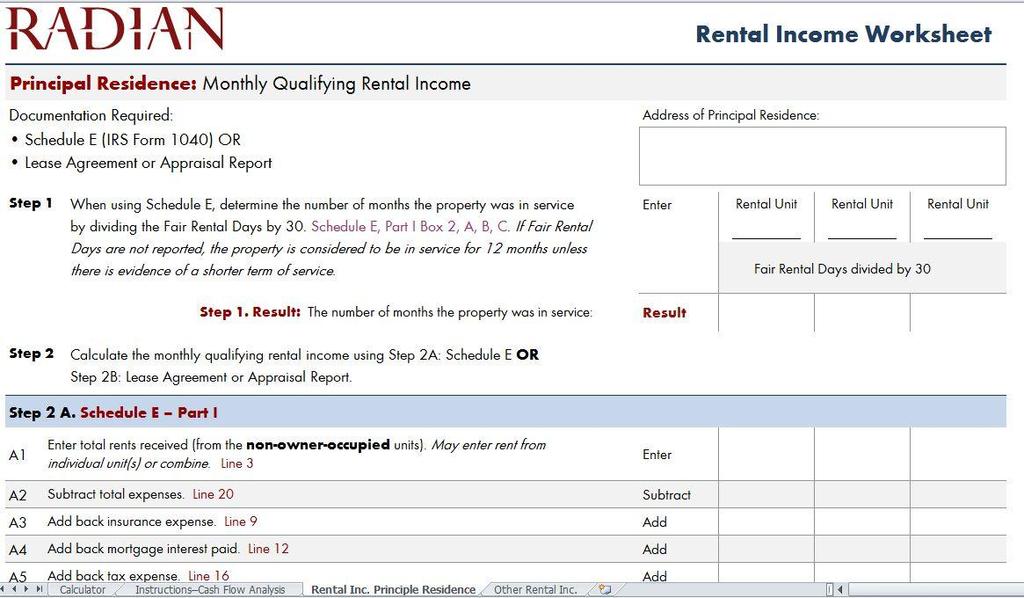

Fannie Mae Income Worksheet - Arithmetic Problems Worksheets Use fannie mae rental income worksheet s Form 1037 or Form 1038 to evaluate individual rental income loss reported on Schedule E. All you need is smooth internet connection and a device to work on. Schedule e irs form 1040 or lease agreement or fannie mae form 1007 or form 1025 enter investment property address step 1. Self-Employed Borrower Tools by Enact MI Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1037 (Principal Residence, 2- to 4-unit Property) Fannie Mae Rental Guide (Calculator 1039) Calculate qualifying rental income for Fannie Mae Form 1039 (Business Rental Income from Investment Property) Fannie Mae Form 1088 Cheat Sheet XLSX House Loan Enter Step 1 When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service. Step 1. Result:

Fannie mae rental income worksheet. Fannie mae rental income worksheet: Easy to Customize and ... How to Edit Your Fannie mae rental income worksheet Online On the Fly. Follow the step-by-step guide to get your Fannie mae rental income worksheet edited for the perfect workflow: Hit the Get Form button on this page. You will go to our PDF editor. Make some changes to your document, like adding checkmark, erasing, and other tools in the top ... Fannie Mae Liquidity Worksheet and Similar Products and ... Cash Flow Analysis (Form 1084) - Fannie Mae great singlefamily.fanniemae.com. CASH FLOW ANALYSIS (Fannie Mae Form 1084) Instructions. Guidance for documenting access to income and business liquidity If the Schedule K-1 reflects a documented, stable history of receiving cash distributions of income from the business Single-Family Homepage | Fannie Mae Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: § Schedule E (IRS Form 1040) OR § Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Step 1. When using Schedule E, determine the number of months the property was ... B3-6-06, Qualifying Impact of Other Real Estate ... - Fannie Mae Feb 02, 2022 · an existing investment property or a current principal residence converting to investment use, the borrower must be qualified in accordance with, but not limited to, the policies in topics B3-3.1-08, Rental Income, B3-4.1-01, Minimum Reserve Requirements, and, if applicable B2-2-03, Multiple Financed Properties for the Same Borrower;

Single-Family Homepage | Fannie Mae Net Rental Income - The total monthly amount of net rental income on all properties owned by the Borrower and Co-Borrower, other than the subject property. This amount is the Gross Rental Income X 75% on all rental properties less mortgage payments, insurance, maintenance, taxes and miscellaneous expenses. XLSX Genworth Financial A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a. Royalties Received (Line 4) b. Total Expenses (Line 20) c. Depletion (Line 18) Subtotal Schedule E Schedule F - Profit or Loss from Farming a. Net Farm Profit or Loss (Line ... What is required for foreign income? - Fannie Mae Foreign income is income that is earned by a borrower who is employed by a foreign corporation or a foreign government and is paid in foreign currency. Borrowers may use foreign income to qualify if the following requirements are met. . Verification of Foreign Income. Copies of his or her signed federal income tax returns for the most recent ... Mgic Income Calculation Worksheet 2021 and Similar Products ... Mgic Rental Income Calculator Worksheet » Semanario . Income Semanarioangolense.net Show details . 4 hours ago Here are two simple questions to ask self-employed borrowers so you can save 10. Income Rental MGIC 2017pdf 1 MB Was this article helpful.Mgic Income Worksheet 2019 Jobs Ecityworks Our editable auto-calculating worksheet s help you ...

Single-Family Homepage | Fannie Mae Rental Income Worksheet Documentation Required: Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1 When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. Fannie Mae Rental Income Worksheet - Fill Online ... Rental Income Worksheet Principal Residence 2- to 4-unit Property Monthly Qualifying Rental Income Documentation Required Schedule E IRS Form 1040 OR Lease Agreement or Fannie Mae Form 1025 Address of Principal Residence Enter Rental Unit Rental Unit Rental Unit Step 1 When using Schedule E determine the number of months the property was in service by dividing the Fair Rental Days by 30. B3-3.1-08, Rental Income (06/03/2020) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ), Form 1038: Rental Income Worksheet - Genworth Financial Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Investment Property Address Step 1.

Rental Income Property Analysis Excel Spreadsheet The spreadsheet can account for multiple unit types such as apartment buildings, duplexes, etc. Rental income assumptions are also entered here. This sheet calculates Gross Scheduled Income, Gross Operating Income, and provides assumptions for rent increase and property price appreciation.

Rental Income Worksheet Fannie Mae Fannie Mae Rental Income Worksheet - Fill Out and Sign . Rentals Details: Step 1.Result The number of months the property was in service Result Step 2. Calculate monthly qualifying rental income loss using Step 2A Schedule E OR Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 2 A. Schedule E - Part I A1 Enter total rents received* A2 Subtract total expenses.

Fannie Mae Rental Income Worksheet - Fill Out and Sign ... Follow the step-by-step instructions below to eSign your genworth rental income worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

PDF Rental Income Worksheet Individual Rental Income from ... Fannie Mae Form 1038 09.30.2014 Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter ...

Fannie Mae Income Calculation Worksheet - Summarized by ... Step 1. Result number of months property was in Result Step 2. Calculate monthly qualifying rental income loss using 2A Schedule E or Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 2. Schedule E-Part I A1 total rents receive * A2 Subtract total expenses. Subtract A3 back insurance expense.

Single-Family Homepage | Fannie Mae Equals adjusted rental income. Total A9 Divide Equals adjusted monthly rental income A10 existing PITIA (for non-subject property). B1 Enter the gross monthly rent (from the lease agreement) or market rent (reported on Form 1007 or Form 1025). B2 Multiply x.75 Equals adjusted monthly rental income. B3 Subtract DU Data Entry

Fannie Mae Rental Income Worksheet - Fill Out and Sign ... Follow the step-by-step instructions below to eSign your fannie mae self employed worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

PDF For full functionality, download PDF first before entering ... Fannie Mae Form 1037 09.30.2014 Refer to the Rental Income topic in the Selling Guide for additional guidance. Rental Income Worksheet Principal Residence, 2- to 4-unit Property: Monthly Qualifying Rental Income . Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1025 Address of Principal Residence:

XLSX Cornerstone Home Lending, Inc. Lease Agreement or Fannie Mae Form 1025 Step 1 When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service. Step 1. Result:

Fannie Mae Rental Income Worksheet and Similar Products ... Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ), More ›

42 rental income calculation worksheet - Worksheet Information PDF Form 1038: Rental Income Worksheet - Genworth Financial Step 2. Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 2 A. Schedule E - Part I A1 Enter total rents received. Enter A2 Subtract total expenses.

Fannie Mae Rental Worksheet - Rental Services 2021 ... Fannie Mae. Posted: (4 days ago) Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: § Schedule E (IRS Form 1040) OR § Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Step 1. When using Schedule E, determine the number of months the property was ...

Tpo Go Fannie Mae Homestyle Buy and renovate a home with a low down payment No upfront mortgage insurance No minimum FICO with AUS approval Monthly Mortgage insurance removable at 22% home equity Purchase and limited cash out refinance Ability to renovate in luxury items 1-4 Units Second Homes Investor 1 Unit Ready, Set, Go… Become a Partner First Name*

Cash Flow Analysis (Form 1084) - Fannie Mae Schedule E - Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

Fannie Mae Rental Income Worksheet Documentation Required: Enter If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service. Result A1 A2 Subtract A3 Add A4 A5 A6 A7 A8 Equals adjusted rental income. Total A9 Divide Equals adjusted monthly rental income A10 B1 B2

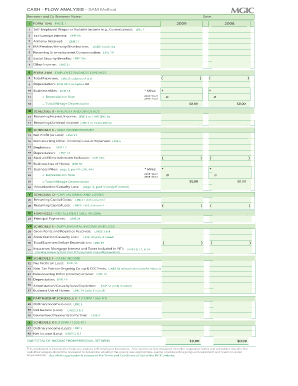

Cash Flow Analysis Who have 25% or greater Who are employed by Who are paid Who own rental property interest in a business family members commissions Who receive variable income, have earnings reported on IRS Form 1099, or income that cannot otherwise be verified by an independent and knowable source. Form 1040 - Individual Income Tax Return Yr. Yr. 1.

XLSX House Loan Enter Step 1 When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service. Step 1. Result:

Self-Employed Borrower Tools by Enact MI Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1037 (Principal Residence, 2- to 4-unit Property) Fannie Mae Rental Guide (Calculator 1039) Calculate qualifying rental income for Fannie Mae Form 1039 (Business Rental Income from Investment Property) Fannie Mae Form 1088 Cheat Sheet

Fannie Mae Income Worksheet - Arithmetic Problems Worksheets Use fannie mae rental income worksheet s Form 1037 or Form 1038 to evaluate individual rental income loss reported on Schedule E. All you need is smooth internet connection and a device to work on. Schedule e irs form 1040 or lease agreement or fannie mae form 1007 or form 1025 enter investment property address step 1.

0 Response to "42 fannie mae rental income worksheet"

Post a Comment