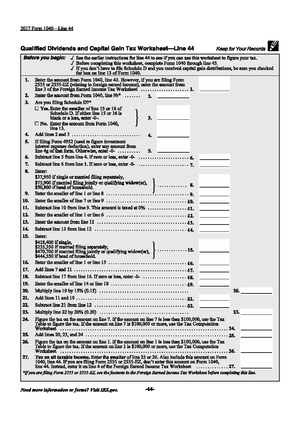

42 qualified dividends and capital gain tax worksheet line 44

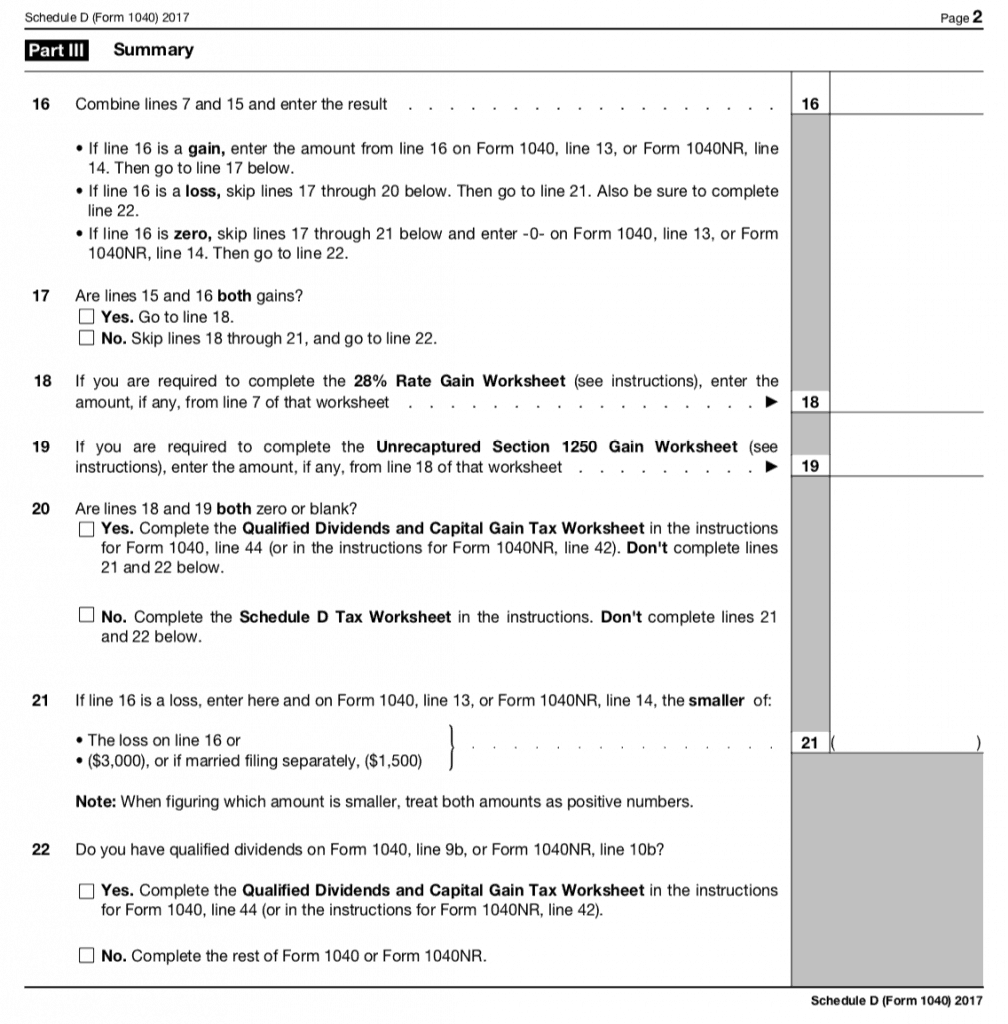

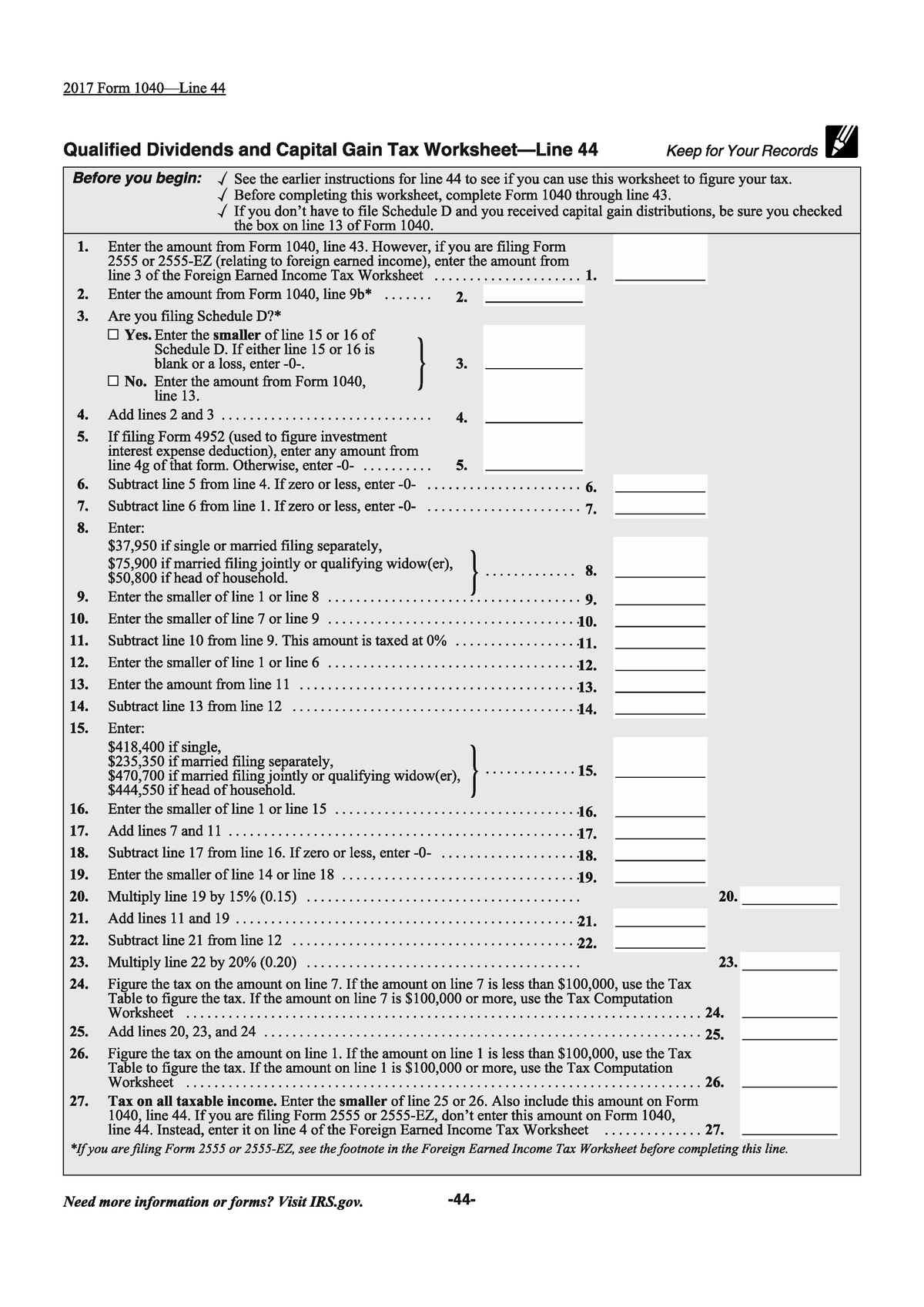

PDF Capital Gains and Losses Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16. Complete the Schedule D Tax Worksheet in the instructions. Don't complete lines 21 and 22 below. 21 If line 16 is a loss, enter here and on Form 1040, 1040-SR, or... Qualified Dividends And Capital Gain Tax Worksheet 1040a Capital Gains Taxation-Michael Littlewood 2017-08-25 Capital gains taxes pose a host of technical and Indexing Capital Gains-Leonard Burman 1990. Qualified Dividends And Capital Gain Tax Combining the authority of firsthand experience, colorful and engaging stories from the front lines...

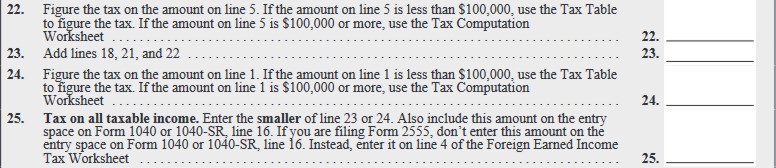

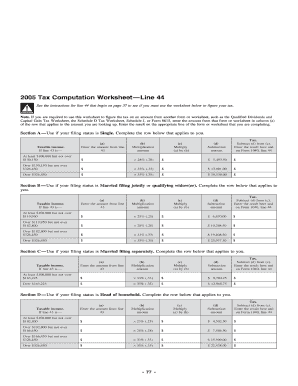

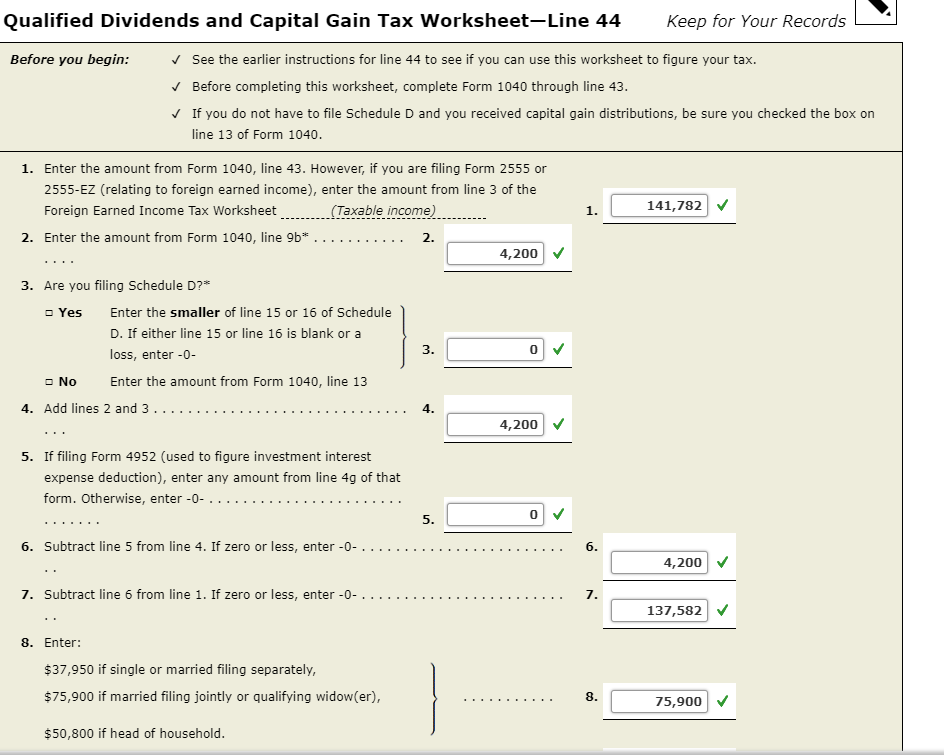

The challenge of maximizing the foreign tax credit on qualified... If the taxpayer has completed the "Qualified Dividends and Capital Gain Tax Worksheet" included in the instructions for Form 1040, U.S. Individual If the taxpayer elects to treat the $100,000 of qualified dividend income as investment income, his regular tax liability on line 44 of Form 1040 is $46,139...

Qualified dividends and capital gain tax worksheet line 44

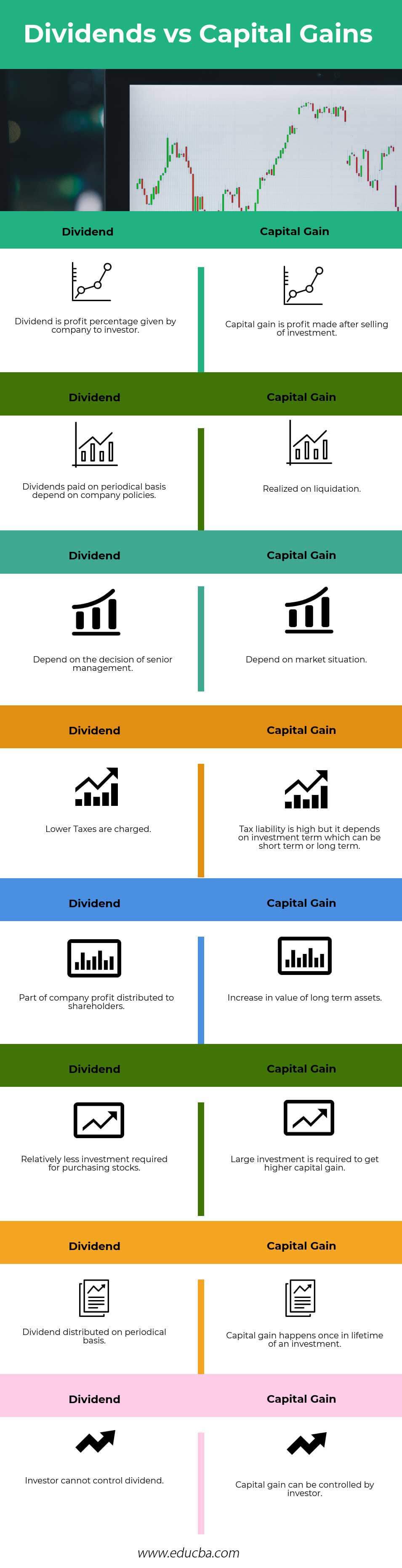

Capital Gains Tax - GOV.UK What Capital Gains Tax (CGT) is, how to work it out, current CGT rates and how to pay. Capital Gains Tax is a tax on the profit when you sell (or 'dispose of') something (an 'asset') that's increased in value. It's the gain you make that's taxed, not the amount of money you receive. Capital Gains Tax: What It Is & How It Works | Seeking Alpha A capital gains tax is a tax on the sale of a profitable investment. Learn more about when a capital gains tax applies and how investors manage capital gains taxes. Qualified Dividends And Capital Gain Tax Worksheet 2017 A worksheet can there will be any subject. Topic generally is a complete lesson in a unit or perhaps a small sub-topic. Worksheet may be used for revising the topic for assessments, recapitulation, helping the scholars to recognize the subject more precisely or even to improve the knowledge throughout the...

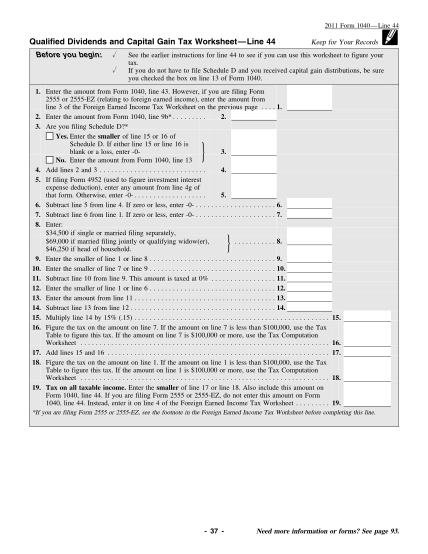

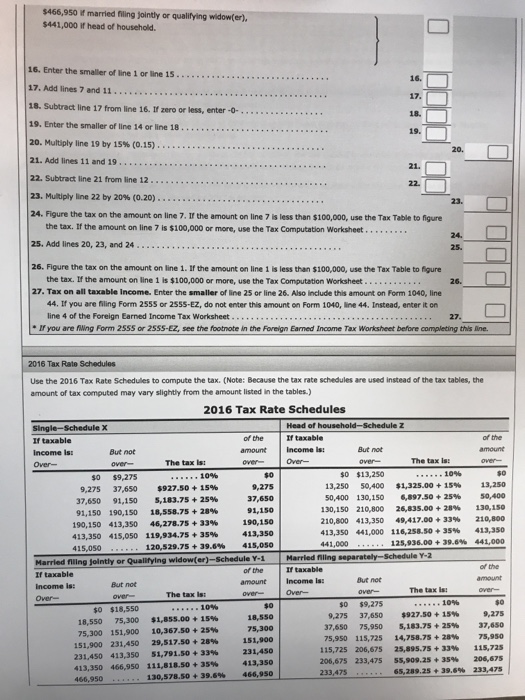

Qualified dividends and capital gain tax worksheet line 44. PDF Tax Forms Guide by HowardSoft®. Tax Forms Guide 2016 Edition. (for preparing tax year 2015 Form 1040 tax returns and tax (printed when tax due, not visible on screen) Schedule A - Itemized Deductions Schedule B - Interest and Dividend Income Schedule C/C-EZ Qualifying Person Worksheet Form 2441, line 2. PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions However, if you are filing Form 2555 or 2555-EZ (relating to foreign earned income), enter the amount from line 3 of the Foreign Earned Income... Capital Gains Tax Brackets For 2022 | What They Are and Rates Learn about what capital gains tax brackets are and the rates associated with them. In general, investment income includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, non-qualified annuities, income from businesses involved in trading of financial instruments... Qualified Dividends and Capital Gains Worksheet.pdf - 2016... 2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions...

Publication 550 (2021), Investment Income ... - IRS tax forms Line 7; also use Schedule D, Form 8824, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet *Report any amounts in excess of your basis in your mutual fund shares on Form 8949. Use Part II if you held the shares more than 1 year. Use Part I if you held your mutual fund shares 1 year or less. For details on Form 8949, see … Tax reform Q&A Thread 1 - Pass-through and 20% deduction | Forum 10 any qualified REIT dividends, qualified cooperative. 11 dividends, or qualified publicly traded partnership. 12 income. IRC Section 199A(b)(1)(B) includes 20% of Qualified REIT Dividends - a defined term, which excludes section 857(b)(3) capital gain dividends and section 1(h)(11) qualified... 2021-22 Capital Gains Tax Rates and Calculator - NerdWallet Short-term capital gains tax is a tax on profits from the sale of an asset held for one year or less. The short-term capital gains tax rate equals your Typically, you'd rebalance by selling securities that are doing well and putting that money into those that are underperforming. But using dividends to invest... Instructions for Form 8801 (2021) - IRS tax forms 13.01.2022 · You qualified for the adjustment exception under Qualified Dividends and Capital Gain Tax ... line 43 of Schedule D is equal to or greater than line 44. You figured your 2020 tax using the Schedule D Tax Worksheet in the Schedule D (Form 1041) instructions and (a) line 17a of that worksheet is zero, (b) line 9 of that worksheet is zero or less, or (c) line 42 of that …

PDF 2014 C3 Capital Gains and Losses The capital gains tax rates and other important issues relating to the disposition of capital assets are included in the chapter. 17. Qualified Dividends and Capital Gain Tax Worksheet — Line 44. [apps.irs.gov/app/vita/content/globalmedia/capital_gain_ tax_worksheet_1040i.pdf] Accessed on Mar. How Capital Gains and Qualified Dividends Are Taxed Qualified Dividends and Capital Gain Tax Worksheet. Examples: Calculating the Capital Gains Tax on Qualified Dividends for Tax Year 2017. Ordinary Income. $44,000. Standard Deduction. $500,000. 4. Net Qualified Gains: Add qualified dividends + capital gains (Line2 + Line 3). Capital Gains Tax Worksheet Capital Gains - Nytaxaide.org • "Capital Gain Worksheet" information automatically transfers to worthless during the tax year, it is treated as though it 2014 Qualified Dividends And Capital Gain Tax Worksheet—Line 44 Tools for Tax Pros TheTaxBook 2014 Qualified Dividends and Capital... Qualified Dividends And Capital Gain Tax Worksheet Line 44 Qualified Dividends And Capital Gains Worksheet Homeschooldressage Com. Also include this amount on form 1040 line 44. Click forms in the upper right upper left for mac and look through the forms in my return list and open the qualified dividends and capital gain tax worksheet.

Qualified dividend - Wikipedia Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual's ordinary income. The rates on qualified dividends range from 0 to 23.8%.

1040 qualified dividends and capital gain tax worksheet 2 Topics Qualified name search rules are actually very simple. First, search for the name on the left side (follow, qualified, unqualified), and then search for the name on the left (at this time only the type name) in the scope (including inline Namespace item) in total?Input format:The input is only one line, contains a s.

Maryland Tax Form 502 Instructions | eSmart Tax Add your Maryland tax from line 28 of Form 502 or line 8 of Form 503 and your local tax from line 33 of Form 502 or line 11 of Form 503. Enter the result on line 34 of Form 502 or line 12 of Form 503. Add to your tax any contribution amounts and enter the total on line 38 of Form 502 or line 16 of Form 503.

UK tax. Tax system. Specialists Finance Business Service Limited Capital Gains Tax. Capital gain is the profit from the sale of capital assets. Capital assets can be both real estate and financial assets (shares, bonds, etc.). Domestic and foreign dividends received by the UK resident companies are generally not taxed, subject to various conditions, depending on...

Question on ordinary and qualified dividends on 1099-DIV The reason I ask is that when I entered line 1a TT showed me an estimated tax owed of $x, but when I put in the qualified amount it showed me an estimated Click Forms in the upper right (upper left for Mac) and look through the list and open the Qualified Dividends and Capital Gain Tax Worksheet.

Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Line 44 the Tax Computation Worksheet on if you are filing. 6 hours ago Line 44 taxable income is $100,000 or more, use amount to enter on Form 1040, line 44. Preview / Show more. Category: Sheet Templates, Worksheet Templates Show details. Qualified Dividends and Capital Gain Tax...

qualified-dividends-tax-worksheet.pdffiller.com qualified-dividends-tax-worksheet.pdffiller.com2015-2022 Form IRS...

2021 Utah TC-40 Individual Income Tax Return 10 Utah tax - multiply line 9 by 4.95% (.0495) (not less than zero) • 10 11 Utah personal exemption (multiply line 2c by $1,750) • 11 12 Federal standard or itemized deductions • 12 13 Add line 11 and line 12 13 14 State income tax included in federal itemized deductions • 14 15 Subtract line 14 from line 13 15 16 Initial credit before phase-out - multiply line 15 by 6% (.06) • …

2022 Capital Gains Tax Calculator - See What You'll Owe - SmartAsset Use SmartAsset's capital gains tax calculator to figure out what you owe. Unearned income comes from interest, dividends and capital gains. It's money that you make from other money. Bottom Line. At SmartAsset we're all about investing in your future.

Form 1040A....line 9B....qualified dividends...is the amount On line 9b the qualified dividends appear. he amount in 9b is part of 9a and is taxed at a lower rate. I'm filling out my 1040 and am stuck on #44 -- how to calculate my tax. Either the tax table (I earned less that $100K) or the qualified dividends and capital gain tax worksheet, which tells me...

Qualified Dividends - Fidelity Since 2003, certain dividends known as qualified dividends have been subject to the same tax rates as long-term capital gains, which are lower than Qualified dividends are generally dividends from shares in domestic corporations and certain qualified foreign corporations which you have held for at...

2021 And 2022 Capital Gains Tax Rates - Forbes Advisor Long-term capital gains are taxed at lower rates than ordinary income, while short-term capital gains are taxed as ordinary income. We've got all the 2021 and 2022 capital gains tax rates in one place.

Qualified Dividends and Capital Gain Tax Worksheet—Line 44 ...Gain Tax Worksheet—Line 44 Before you begin: u u Keep for Your Records See the instructions for line 44 on page 35 to see if you can use this worksheet to figure If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040.

Capital gains tax on shares - Which? Capital gains tax rates on shares How do I calculate my CGT bill? Save tax with a Bed and Isa CGT on employee shares. You may need to pay capital gains tax (CGT) on shares you own if you sell them for a profit. The amount of tax you're charged depends on which income tax band you fall into.

Qualified Dividend Definition A qualified dividend is taxed at the capital gains tax rate, while ordinary dividends are taxed at standard federal income tax rates. Qualified dividends must meet special requirements put in place by the IRS. The maximum tax rate for qualified dividends is 20...

Qualified Dividends And Capital Gain Tax Worksheet 2017 A worksheet can there will be any subject. Topic generally is a complete lesson in a unit or perhaps a small sub-topic. Worksheet may be used for revising the topic for assessments, recapitulation, helping the scholars to recognize the subject more precisely or even to improve the knowledge throughout the...

Capital Gains Tax: What It Is & How It Works | Seeking Alpha A capital gains tax is a tax on the sale of a profitable investment. Learn more about when a capital gains tax applies and how investors manage capital gains taxes.

Capital Gains Tax - GOV.UK What Capital Gains Tax (CGT) is, how to work it out, current CGT rates and how to pay. Capital Gains Tax is a tax on the profit when you sell (or 'dispose of') something (an 'asset') that's increased in value. It's the gain you make that's taxed, not the amount of money you receive.

0 Response to "42 qualified dividends and capital gain tax worksheet line 44"

Post a Comment