39 chapter 7 federal income tax worksheet answers

PDF Official Form 122A-2 - United States Courts Official Form 122A-2 Chapter 7 Means Test Calculation page5 Other Necessary Expenses In addition to the expense deductions listed above, you are allowed your monthly expenses for the following IRS categories. 16. Taxes: The total monthly amount that you will actually owe for federal, state and local taxes, such as income taxes, self- Quiz & Worksheet - Taxation Principles & Structures ... About This Quiz & Worksheet. Use this quiz/worksheet combo to gauge your knowledge of different taxation principles. Practice questions assess your understanding of income taxes and federal tax ...

quizlet.com › 128408319 › chapter-7-federal-incomeChapter 7: Federal Income Tax Flashcards | Quizlet Chapter 7: Federal Income Tax STUDY Flashcards Learn Write Spell Test PLAY Match Gravity Created by gerite1025 Terms in this set (35) revenue Money collected by the government from various sources is known as ______. progressive A tax that increases in proportion to increase in income is known as a _____ tax. taxable

Chapter 7 federal income tax worksheet answers

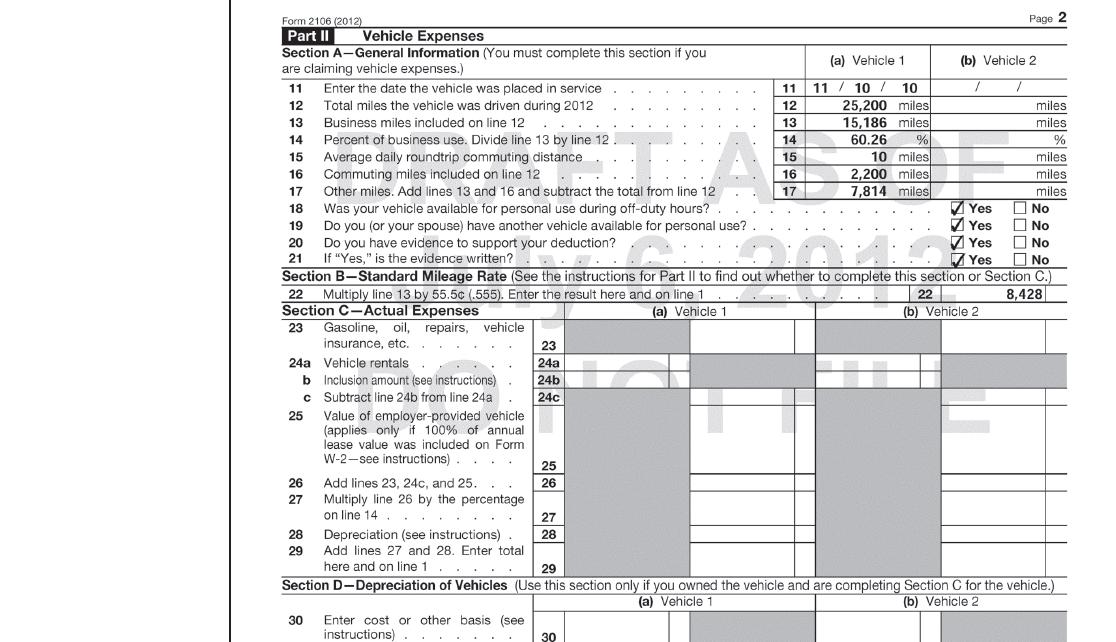

PDF 7-1 Tax Tables, Worksheets, and Schedules Sam's taxable income is $92,300. What percent of his taxable income is his tax? Round to the nearest percent. 12. Manny's taxable income, t, is between $32,550 and $78,850. Write an algebraic expression that represents the amount of his tax. Use the tax computation worksheet for a single taxpayer to answer Exercises 13 - 15. PDF Problems and Solutions for Federal Income Taxation Chapter 2 · Gross Income 7 ... book to assist the student in learning federal tax law. This is because, in addition to a word index and a table of contents, this book contains tables that allow a student ... attempt to solve the problems before looking at our answers. miller maine sup last pages.indb 7 6/14/16 8:41 AM. Chapter 2: Net Income - Mr. Adelmann's Fantastic Math Class Chapter 1: Gross Income. ... Home > Personal Finance > Chapter 2: Net Income. Section 1: Federal Income Tax Class Presentation: Federal Income Tax ... State Income Tax Class Activity: State Income Tax Worksheet. Section 3: Weekly Time Card Class Presentation: Time Cards Class ...

Chapter 7 federal income tax worksheet answers. Quia - Personal Finance Chapter 7 Vocabulary Congress. Money collected bny the government from various sources. revenue. Tax that increases in proportion ito increases in income. progressive. Money earned by individuals that is subject to taxation. taxable. A flat amount allowed taxpayers depending on filing status and subtracted from adjusted gross income. standard deduction. Chapter 7, Income Taxes Video Solutions, Financial Algebra ... A taxpayer has a taxable income of $ 39, 800. What is her tax? b. A taxpayer will owe $ 21, 197. What is his taxable income? c. What is the approximate tax for an income of $ 30, 000? d. What is the approximate tax for an income of $ 99, 000? e. Nick is paid every other week. He has $ 390 taken out of each paycheck for federal taxes. PDF It's Your Paycheck! Lesson 2: 'W' is for Wages, W-4, and W-2 6. Explain that one tax people pay is federal income tax. Income tax is a tax on the amount of income people earn. People pay a percentage of their income in taxes. People who earn more pay a higher percentage of their income in taxes. Display Slide 3 and discuss the following: • How much federal income tax was withheld from John's check ... Chapter 3 ANSWER: F. POINTS: 0 / 1. 7. In the United States, all citizens are ... All forms of income are taxable and must be reported to the IRS for tax purposes.7 pages

Inside the Vault – Income Taxes: Who Pays and How Much? Individual federal income tax affects everyone and the ... Activity 2-A—What-If Worksheet ... Allow students to work with partners to find answers.27 pagesMissing: chapter | Must include: chapter PDF Chapter Answer Key For Income Tax Fundamentals How To Do A Balance Sheet Chapter 6 - Preparing a Worksheet Financial Accounting - Income Statement 12th STD Economic/பொருளியல் (New book) lessons 1,2,3 \u0026 4 book back questions with answer..@GG TNPSC The INCOME STATEMENT Explained (Profit \u0026 Loss / P\u0026L) How to Analyze Transactions and Prepare Income Statement ... SOLVED:Use this tax computation worksheet to answer ... Problem 14 Easy Difficulty. Use this tax computation worksheet to answer Exercises 11-14. table can't copy Calculate the tax using the computation worksheet for a head of household taxpayer with a taxable income of $115,700. › 2019 › 03Chapter 7 Federal Income Tax Worksheet Answers - Worksheet ... Mar 14, 2019 · 21 Gallery of Chapter 7 Federal Income Tax Worksheet AnswersOur Federal Income Tax Plan Worksheet AnswersSection 2 1 Federal Income Tax Worksheet AnswersLesson 2.1 Federal Income Taxes Worksheet AnswersLesson 2.3 Federal Income Taxes Worksheet AnswersChapter 13 Lab From Dna To Protein Synthesis Worksheet AnswersMonthly Retirement Planning ...

quizlet.com › 64142782 › chapter-7-federal-incomeChapter 7 Federal Income Tax - Personal Finance - Quizlet The IRS sends a letter asking the taxpayer to answer specific questions or provide evidence of entries on their tax return Field audit Similar to an office audit, but IRS agent visits taxpayer's house or business to examine records and assets, ask questions, and verify information PDF Chapter Answer Key For Income Tax Fundamentals File Type PDF Chapter Answer Key For Income Tax Fundamentals Chapter 13 Review 24 Terms. mrs_heskamp TEACHER. Accounting Semester 1 Final Vocab Review 59 Terms. mrs_heskamp TEACHER. Ch. 1 Economic Decisions and Systems 28 Terms. Chapter 3 Income Tax Flashcards | Quizlet 21 Gallery of Chapter 7 Federal Income Tax Worksheet Answers. Section 2 1 Federal Income Tax Worksheet Answers And ... We always attempt to show a picture with high resolution or with perfect images. Section 2 1 Federal Income Tax Worksheet Answers And Federal Tax Worksheet 2016 can be valuable inspiration for people who seek an image according specific topic, you will find it in this site. Finally all pictures we have been displayed in this site will inspire ... Lesson-7.3 - 7.3 Income Statements CH. 7 INCOME TAXES ... Everyone pays taxes… An employee's gross pay is their total pay. The amount of money an employee actually takes home is called their net pay. Clearly the net pay is going to be less than the gross pay. Each pay stub (paycheck) gives the employee a list of their wages and deductions.

PDF What You'll Learn Section 2-1 Section 2-2 Section 2-3 ... Find the income range from the table. (It's 420-430.) 2. Find the column for 2 allowances. 3. The amount of income to be withheld is $15. Lance Han's gross pay for this week is $460.00. He is married and claims 1 allowance. What amount will be withheld from Han's pay for FIT? STEPS: 1. Find the income range from the table.

Lesson 2.3 Federal Income Taxes Worksheet Answers ... Chapter 7 Federal Income Tax Worksheet Answers. Our Federal Income Tax Plan Worksheet Answers. Section 2 1 Federal Income Tax Worksheet Answers. ... Chapter 13 Lab From Dna To Protein Synthesis Worksheet Answers. Monthly Retirement Planning Worksheet Chapter 8 Answers. Federal Income Tax Ez Form.

Income Taxes - Henry County Schools 7-1 Tax Tables, Worksheets, and Schedules329 And you are At least If line 43 (taxable income) is Single Married filing jointly * Married filing sepa- rately Head of a house- hold But less than Your tax is — 51,000 51,000 51,0509,100 6,851 9,100 7,819 51,050 51,1009,113 6,859 9,113 7,831 51,100 51,1509,125 6,866 9,125 7,844

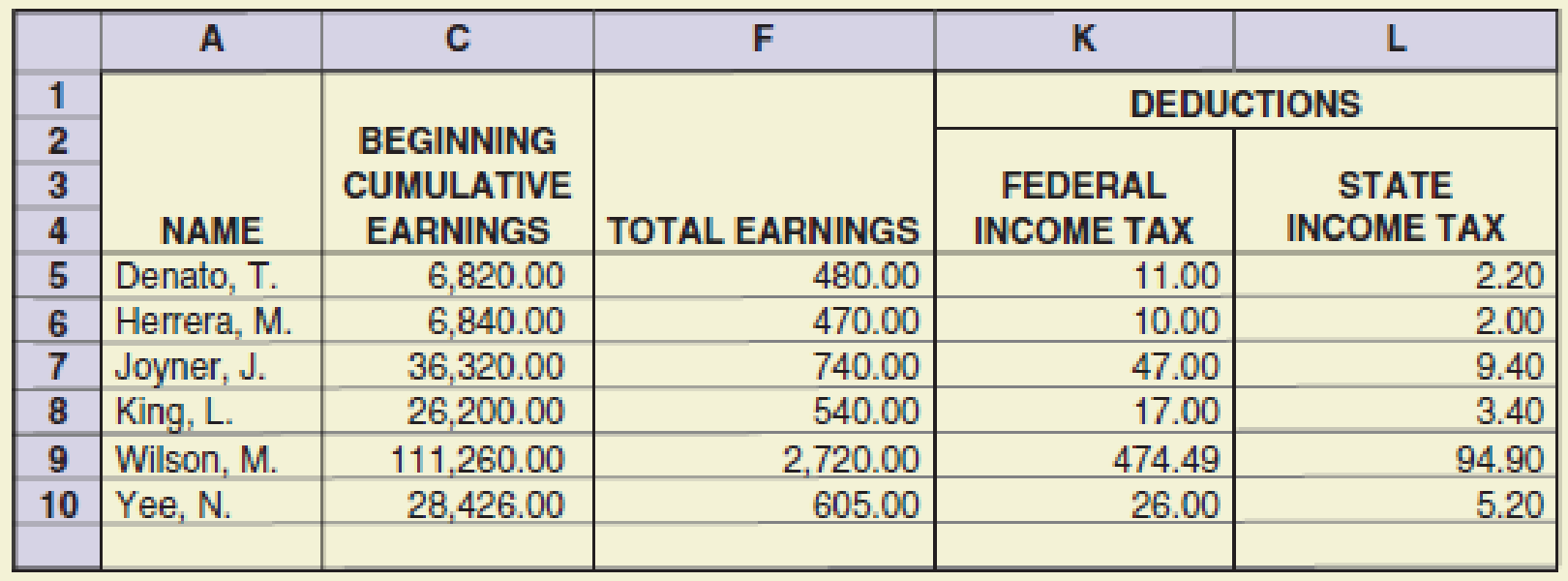

Solved Chapter 7. Problems Saved Help Save & Exit Submit ... For the month of August 2018, the payroll taxes (employee and employer share combined) were as follows points Social Security tax: $3,252.28 Medicare tax: $760.61 Employee Federal income tax: $2,520 eBook Print; Question: Chapter 7. Problems Saved Help Save & Exit Submit Check my work 8 Problem 7-8A KMH Industries is a monthly schedule ...

Quiz & Worksheet - Federal Income Tax Returns | Study.com The Federal Tax System: Filing Taxes & Auditing 5:44 Income Tax: Tax Liability & Deductions 4:42 Alternative Minimum Tax: Definition & Example 3:22

PDF Chapter 2 - Net Income 3. Income Tax = 29800 x 0.035 = $1,043 d. What is his weekly state income tax? 1043 / 52 = $20.06 e. How much does he take home per week after taxes? Federal Tax = $70 State Tax = $20.06 Weekly salary = 615.38 - 70 - 20.06 $525.32 2. Marry is married with 2 children. She claims 4 allowances on her federal income tax. She earns a

quizlet.com › 17450675 › chapter-7-federal-incomeChapter 7: Federal Income Tax Flashcards - Quizlet Terms in this set (17) revenue. Money collected by the government from various sources is known as ______. progressive. A tax that increases in proportion to increase in income is known as a _____ tax. taxable. Money earned by individuals that is subject to taxation is called _____ __income. standard deduction.

Income Taxes 7. It takes a lot of money to run local, city, state, and federal ... Chapter 7. Income ... Use this tax computation worksheet to answer Exercises 11–14.56 pages

federal tax worksheet for answers .pdf - Name _ Tax Tasks ... View federal tax worksheet for answers .pdf from ACCT MISC at Troy University, Troy. Name _ Tax Tasks Important Directions: William is a single teacher working in Boston. ... 477475149-Federal-Income-Tax-1040-Activity-pdf.pdf. Saint Cloud High School. ENGLISH 10014100. ... Mini Practice Set 4 Chapter 8 Problem 62. Troy University, Troy. ACT 307 ...

Solved Refer to your course textbook! Chapter 7 ... Chapter 7 - Cumulative Problem #59 - Jane Smith Requirements You are required to prepare all necessary 2015 forms and schedules using the PDF forms provided at the IRS website. DO NOT USE TAX SOFTWARE Show detailed calculations for partial credit and receipt of useful feedback. Attach your tax return as a PDF file Attach your

› income-tax-worksheetChapter 7 federal income tax worksheet answers and income tax ... Jun 05, 2018 · We tried to find some great references about Chapter 7 federal income tax worksheet answers and income tax computation worksheet for you. Here it is. It was coming from reputable online resource and that we enjoy it. We hope you can find what you need here. We always attempt to show a picture with high resolution or with perfect images.

0 Response to "39 chapter 7 federal income tax worksheet answers"

Post a Comment