40 fnma rental income worksheet

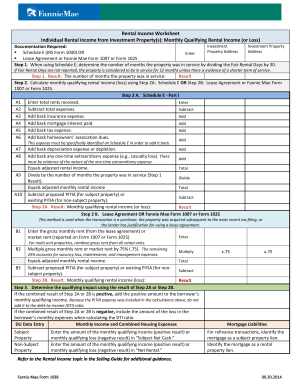

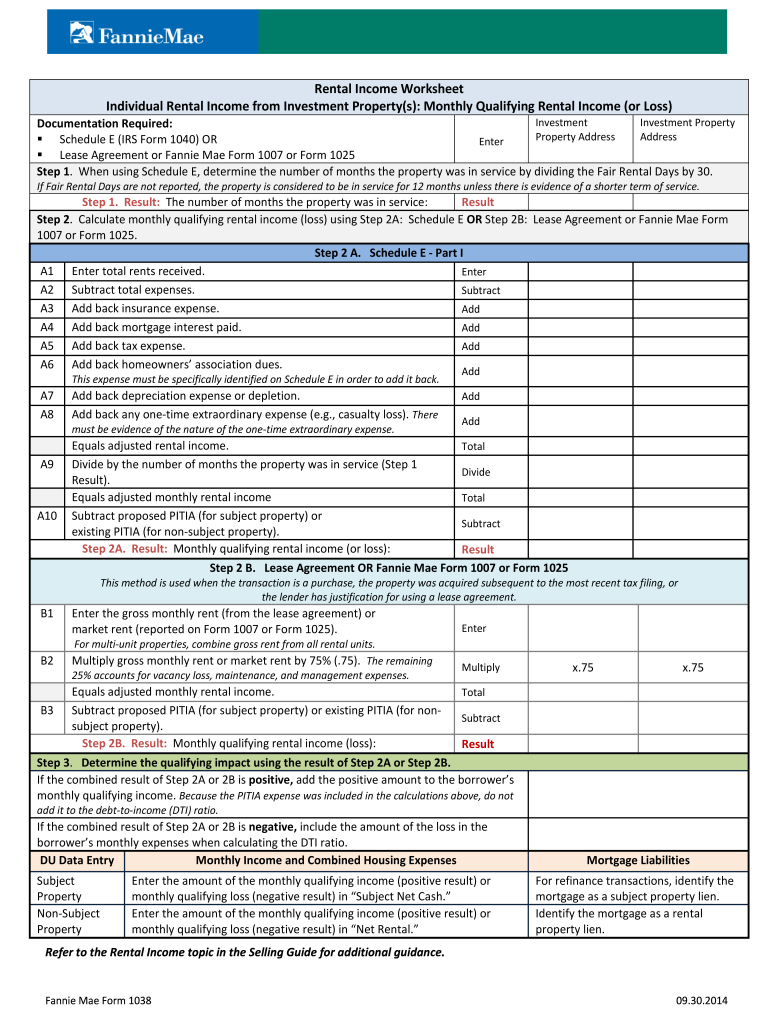

PDF Form 1038: Rental Income Worksheet - Genworth Financial Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Investment Property Address Step 1. XLSX Genworth Financial A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a. Royalties Received (Line 4) b. Total Expenses (Line 20) c. Depletion (Line 18) Subtotal Schedule E Schedule F - Profit or Loss from Farming a. Net Farm Profit or Loss

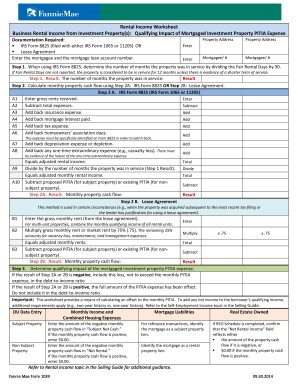

Single-Family Homepage | Fannie Mae Equals adjusted rental income. Total A9 Divide Equals adjusted monthly rental income A10 existing PITIA (for non-subject property). B1 Enter the gross monthly rent (from the lease agreement) or market rent (reported on Form 1007 or Form 1025). B2 Multiply x.75 Equals adjusted monthly rental income. B3 Subtract DU Data Entry

Fnma rental income worksheet

Self-Employed Borrower Tools by Enact MI Fannie Mae Rental Guide (Calculator 1037) Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1037 (Principal Residence, 2- to 4-unit Property) Fannie Mae Rental Guide (Calculator 1038) XLSX House Loan Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair ... Fannie Mae 1037 2014-2022 - Fill and Sign Printable ... FNMA Rental Income on a Departing Residence Buyers who qualify for a conventional loan have two options: Fannie Mae and Freddie Mac. ... No matter the type of loan is on the prior residence, Fannie Mae allows a buyer to qualify with 75% of the new rent.

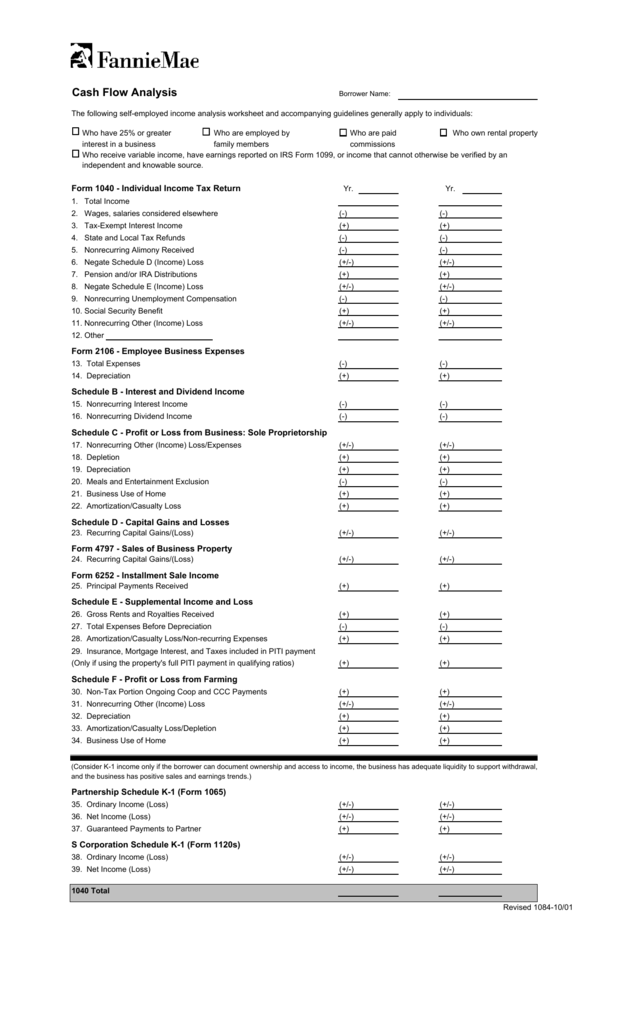

Fnma rental income worksheet. PDF For full functionality, download PDF first before entering ... Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Investment Property Address Step 1. Fannie Mae Rental Income Worksheet - Fill Out and Sign ... Follow the step-by-step instructions below to design your Fannie make income worksheet form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done. Cash Flow Analysis (Form 1084) - Fannie Mae : A lender may use Fannie Mae Rental Income Worksheets ( Form 1037 or Form 1038) to calculate individual rental income (loss) reported on Schedule E. a. Royalties Received (+)___________ (+)___________ b. Total Expenses (-)___________ (-)___________ c. Depletion (+)___________ (+)___________ 6. Schedule F - Profit or Loss from Farming a. B3-3.5-02, Income from Rental Property in DU (12/16/2020) If Net Rental Income is not entered in VI R, DU will calculate it using the following formula: Gross rental income — 75% = net rental income The lender should override DU's calculation, if it is different from the lender's calculation, by entering the Net Rental Income in VI R.

Fannie Mae Rental Income Worksheet Form 2014-2022 - Fill ... Get and Sign Fannie Mae Rental Income Worksheet 2014-2022 Form Create a custom fannie mae rental income worksheet 2014 that meets your industry's specifications. Show details How it works Upload the fannie mae self employed worksheet Edit & sign fannie mae income calculation worksheet 2021 from anywhere Free Customizable Fannie Mae Rental Income Worksheet - PDF ... Draw Up your Fannie Mae Rental Income Worksheet online is easy and straightforward by using CocoSign . You can simply get the form here and then put down the details in the fillable fields. Follow the guides given below to complete the document. Fill out the editable areas Revise the form using our tool Email the completed form What is required for foreign income? - Fannie Mae Share this answer Foreign Income Foreign income is income that is earned by a borrower who is employed by a foreign corporation or a foreign government and is paid in foreign currency. Borrowers may use foreign income to qualify if the following requirements are met. For additional information, see B3-3.1-09, Other Sources of Income. PDF For full functionality, download PDF first before entering ... Fannie Mae Form 1039 09.30.2014 Refer to Rental Income topic in the Selling Guide for additional guidance. Rental Income Worksheet Business Rental Income from Investment Property(s) : Qualifying Impact of Mortgaged Investment Property PITIA Expense . Documentation Required: IRS Form 8825 (filed with either IRS Form 1065 or 1120S) OR

USMI - Calculators - Arch Mortgage Rental Income Fannie Mae Form 1037 Principal Residence, 2- to 4-unit Property Download XLXS Fannie Mae Form 1038A Individual Rental Income from Investment Property (s) (up to 10 properties) Download XLXS Freddie Mac Form 92 Schedule E - Net Rental Income Calculations Download PDF Fannie Mae Form 1038 PDF Net Rental Income Calculations - Schedule E Result: Net Rental Income(calculated to a monthly amount) 4 (Sum of subtotal(s) divided by number of applicable months = Net Rental Income) $_____ / _____ = $_____ 1. Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2. This expense, if added back, must be included in the monthly payment amount being used to ... Single-Family Homepage | Fannie Mae Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: § Schedule E (IRS Form 1040) OR § Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Step 1. When using Schedule E, determine the number of months the property was ... Fannie Mae Income Worksheet: Fillable, Printable & Blank ... A Complete Guide to Editing The Fannie Mae Income Worksheet. Below you can get an idea about how to edit and complete a Fannie Mae Income Worksheet step by step. Get started now. Push the"Get Form" Button below . Here you would be taken into a splashboard allowing you to make edits on the document.

Single-Family Homepage | Fannie Mae Fannie Mae Form 1037 02/23/16 Rental Income Worksheet Documentation Required: Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1 When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30.

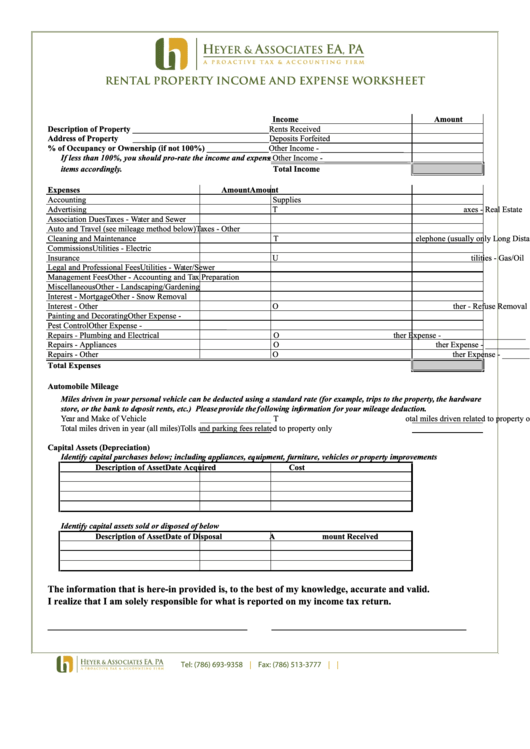

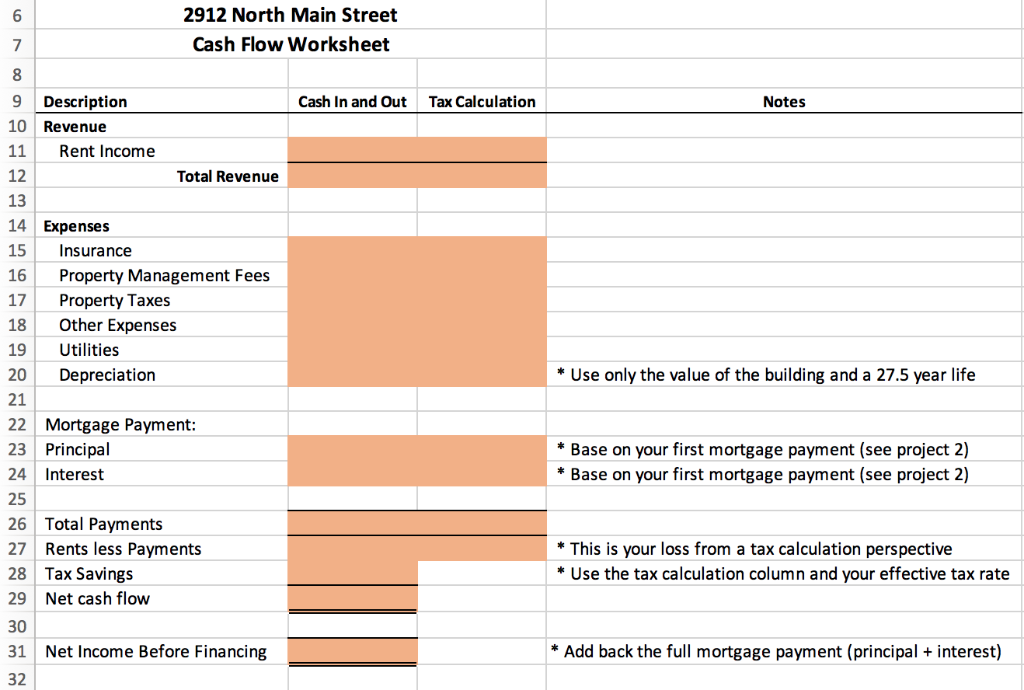

Income Analysis Worksheet | Essent Guaranty Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Rental Property - Investment (Schedule E) Determine the average monthly income/loss for a non-owner occupied investment property. Download Worksheet (PDF)

B3-3.1-08, Rental Income (06/03/2020) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ),

Tpo Go Fannie Mae HomeReady; Ready, Set, Go… FHA. Low down payment, higher debt to income ratios and flexible credit requirements makes FHA a great option for first time homebuyers and those who may not qualify for a conventional product. Pair this with our TPO GO 100 Chenoa product and make sure every borrower can get a loan.

Single-Family Homepage | Fannie Mae 0 0 0 0. 0 0 0 0. 0 0 0 0. 0 0 0 0. 0 0 0 0. 0 0 0 0. Fannie Mae Form 1039 02/23/16. Rental Income Worksheet Documentation Required: Enter If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service.

PDF Fannie Mae Cash Flow Analysis Calculator Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a.

Fannie Mae 1037 2014-2022 - Fill and Sign Printable ... FNMA Rental Income on a Departing Residence Buyers who qualify for a conventional loan have two options: Fannie Mae and Freddie Mac. ... No matter the type of loan is on the prior residence, Fannie Mae allows a buyer to qualify with 75% of the new rent.

XLSX House Loan Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair ...

Self-Employed Borrower Tools by Enact MI Fannie Mae Rental Guide (Calculator 1037) Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1037 (Principal Residence, 2- to 4-unit Property) Fannie Mae Rental Guide (Calculator 1038)

0 Response to "40 fnma rental income worksheet"

Post a Comment