41 1031 exchange calculation worksheet

PDF Like-Kind Exchanges Under IRC Section 1031 type of Section 1031 exchange is a simultaneous swap of one property for another. Deferred exchanges are more complex but allow flexibility. They allow you to dispose of property and subsequently acquire one or more other like-kind replacement properties. To qualify as a Section 1031 exchange, a deferred exchange must be distinguished from the case The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) Partial 1031 exchange boot calculator This calculator will use your information, including your 1031 exchange boot tax rate, to tell you how much boot you can anticipate having — and how big of a tax bill you can expect. Partial 1031 exchange boot examples Let's look at two examples to illustrate how cash boot and mortgage boot work.

PDF Reporting the Like-Kind Exchange of Real Estate ... - 1031 The following example is used throughout this workbook, and a completed Worksheet using this example is included. EXAMPLE: To show the use of the Worksheet, we will use the following example of an exchange transaction. In this example, the exchanger will buy down in value and receive excess exchange escrow funds. 1. Basis.

1031 exchange calculation worksheet

1031 Tool Kit Analyze Reinvestment - Exchange: The power of a 1031 Exchange is the ability to use dollars otherwise spent in paying taxes. Over the course of a lifetime the benefits of greater cash flow, appreciation and equity buildup can equal many times the actual taxes paid. The above calculations are meant as an estimate and are not guaranteed for accuracy. IRC 1031 Like-Kind Exchange Calculator This calculator will help you to determine how much tax deferment you can realize by performing a 1031 tax exchange instead of a taxable sale. We also offer a 1031 deadline calculator. For your convenience we list current Redmond mortgage rates to help real estate investors estimate monthly loan payments & find local lenders. Calculator Rates 1031 Exchange with Multiple Properties [Explained A-to-Z ... Alternatives to 1031 Exchange with Multiple Relinquished Properties. Other approaches (with drawbacks specific to each, as well) are available. Completing a separate 1031 exchange for each property you sell may be viable. More 1031 exchanges will provide lower risk of missing identification and exchange deadlines.

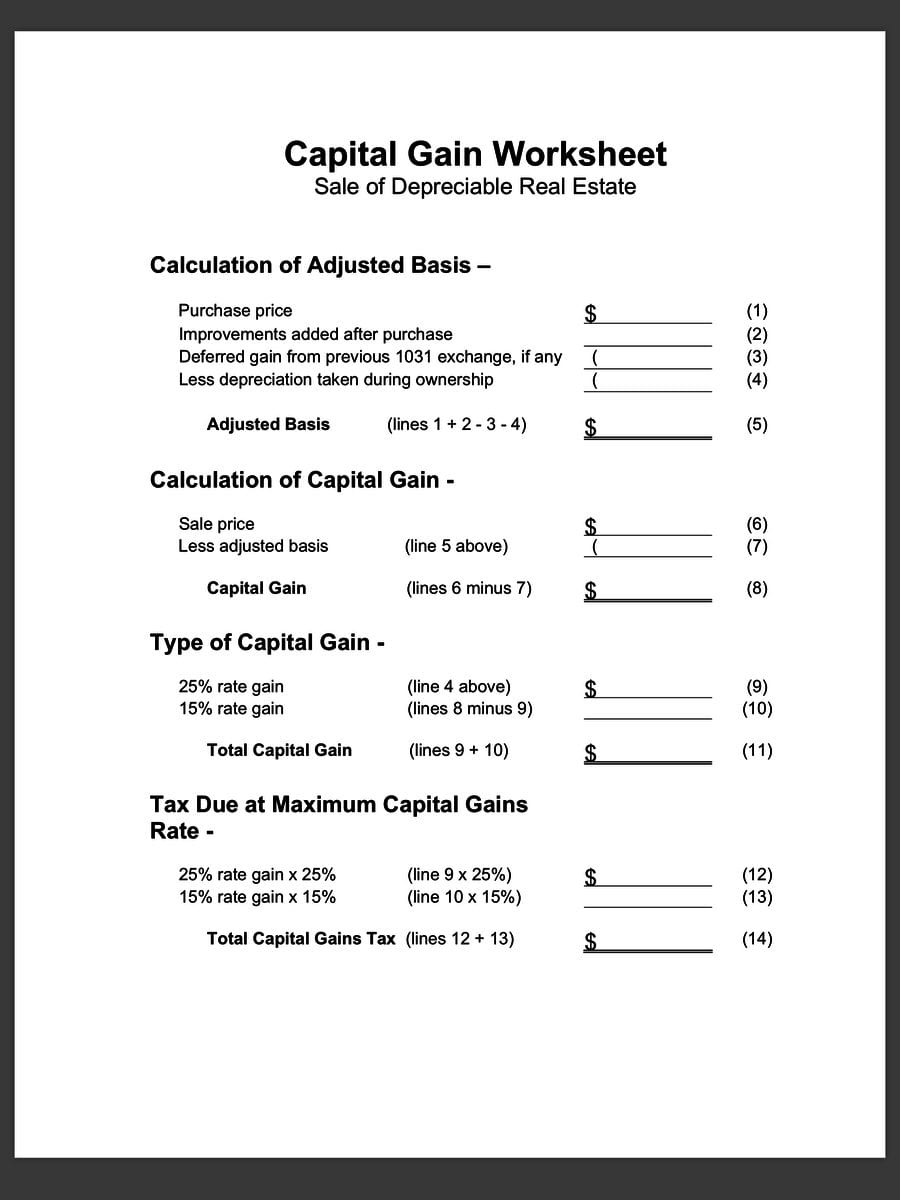

1031 exchange calculation worksheet. 1031 Like Kind Exchange Calculator - Excel Worksheet That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Calculate the taxes you can defer when selling a property Includes state taxes and depreciation recapture Immediately download the 1031 exchange calculator 1031 Exchange Analysis Calculator - Inland Investments This calculator is designed to assist when exchanging into multiple real estate options with potentially different leverage points. PROPERTY DETAILS EXCHANGE OPTIONS SUMMARY Step 1: Enter Relinquished Property Details Enter the relinquished property details for the property that the owner (exchanger) wants to sell (relinquish). Capital Gains Calculator - 1031 Exchange Experts Equity ... Capital Gains Calculator. If the investor does not move forward with an exchange, then the transfer of property is a sale subject to taxation. An investor that holds property longer than 1 year will be taxed at the favorable capital gains tax rate. Otherwise, the sales gain is taxed at the ordinary income rate. PDF §1031 Basis Allocation Worksheet - Irex received in exchange for the property sold ... Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost ... (Supplement to §1031 Recapitulation Worksheet Form 354)

PDF §1031 BASIS ALLOCATION WORKSHEET - firsttuesday received in exchange for the property sold.....$ _____ 4. Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost ... §1031 BASIS ALLOCATION WORKSHEET Replacement Property Depreciation Analysis (Supplement to §1031 Recapitulation Worksheet Form 354) Instructions for Form 8824 (2021) | Internal Revenue Service The final regulations, which apply to like-kind exchanges beginning after December 2, 2020, provide a definition of real property under section 1031, and address a taxpayer's receipt of personal property that is incidental to real property the taxpayer receives in the exchange. See Regulation sections 1.1031 (a)-1, 1.1031 (a)-3, and 1.1031 (k)-1. 1031 Exchange Calculator 1031 Exchange Calculator Definitions. Date of Sale Date the investment real estate will be sold. Date of Purchase Date the purchase of the replacement property(ies) will take place. Exchange must be completed within 180 days from date of sale and meet all other exchange requirements to qualify for tax deferral. PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from WorkSheet #7 (Line J) $_____

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges ... Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) 1031 Exchange Calculator | Calculate Your Capital Gains (1) To estimate selling costs use 8 to 10% of selling price consider discounts or allowances given by seller. (2) To estimate residential depreciation taken multiply purchase price of property being sold by 3%, times the number of years the property has been rented. IRS 1031 Exchange Worksheet And Section 1031 Exchange ... IRS 1031 Exchange Worksheet And Section 1031 Exchange Calculation Worksheet. Worksheet April 17, 2018. We tried to find some amazing references about IRS 1031 Exchange Worksheet And Section 1031 Exchange Calculation Worksheet for you. Here it is. It was coming from reputable online resource which we enjoy it. We hope you can find what you need ... Form 8824 - 1031 Corporation Exchange Professionals We have developed the enclosed worksheets for use in calculating the information used to report 1031 Exchanges on Form 8824 and herein enclose a copy. We hope that this worksheet will help with these reporting issues that present difficulties in reporting 1031 Exchanges.

1031 Exchange Worksheet | Printable Worksheets and Activities for Teachers, Parents, Tutors and ...

1031 Exchange Calculator - cchwebsites.com If there is no 1031 exchange, it is the difference between the net sales price and the adjusted cost basis. If a 1031 exchange is performed, it is any amount purchased less than the net sale OR any amount of cash taken from the net proceeds (often referred to as "boot"). Basis of Property Sold

1031 Exchange Calculator with Answers to 16 FAQs ... We have already published a 1031 exchange article like Accomplish 1031 Exchange in 8 Steps ! and Real Estate Capital Gains Calculator 1. What are the requirements full tax deferral in a 1031 exchange. Well, for complete tax deferral, a person will have to acquire the property of equal or greater value and spending the entire net equity in the acquisition.This is also an answer to a very common ...

1031 Exchange Calculator - Penn's Grant Realty Corporation We'll be happy to help you with calculating your 1031 Exchange, ... In no way should the completion of this worksheet be construed as tax advice or used in ...

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #10 for Buy-Down only . KEEP: or destroy WorkSheet #1 - Calculation of Basis WorkSheet #s 2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheet #s 4, 5 & 6 - Information About Your New Property - Debt Associated with Your Old and New Property - Calculation of Net Cash Received or Paid WorkSheet #s 7 & 8

1031 Exchange Calculator | Estimate Tax Savings & Reinvestment The 1031 Exchange Calculator above provides a simple estimation of potential taxes related to the sale of investment property and net sales proceeds available for reinvestment. These calculations are estimates for the purpose of demonstration. Many factors are involved in calculating taxes, including factors unique to each taxpayer.

1031 Exchange Worksheet - Pruneyardinn Worksheet April 19, 2018 18:23 The 1031 Exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet.

Partial 1031 Exchange | 1031 Exchange for Lesser Value ... IPX1031. The best choice for your 1031. IPX1031 is the largest and one of the oldest Qualified Intermediaries in the United States. As a wholly owned subsidiary of Fidelity National Financial (NYSE:FNF), a Fortune 300 company, IPX1031 provides industry leading security for your exchange funds as well as considerable expertise and experience in facilitating all types of 1031 Exchanges.

1031 Exchange Examples | 2022 Like Kind Exchange Example Purchase Price Step 1 Determine Adjusted Basis After several years, Ron and Maggie's adjusted basis in the property may look like this: Step 2 Calculate Realized Gain Ron and Maggie are contemplating selling their property. They believe the property could be sold for $2,850,000.

1031 Exchange Examples: Like-Kind Examples to Study ... You would like to do a 1031 exchange into a $2,500,000 Starbucks in Clearwater, Oklahoma. You exchange your $3,000,000 property for the $2,500,000 Starbucks. Therefore, a taxable cash boot of $500,000 is realized. Subtract the $400,000 capital gain from the relinquished property from the $500,000 cash boot. The remaining $100,000 can be deferred.

1031 Exchange Calculator - The 1031 ... - The 1031 Investor This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received).

1031 Exchange with Multiple Properties [Explained A-to-Z ... Alternatives to 1031 Exchange with Multiple Relinquished Properties. Other approaches (with drawbacks specific to each, as well) are available. Completing a separate 1031 exchange for each property you sell may be viable. More 1031 exchanges will provide lower risk of missing identification and exchange deadlines.

IRC 1031 Like-Kind Exchange Calculator This calculator will help you to determine how much tax deferment you can realize by performing a 1031 tax exchange instead of a taxable sale. We also offer a 1031 deadline calculator. For your convenience we list current Redmond mortgage rates to help real estate investors estimate monthly loan payments & find local lenders. Calculator Rates

1031 Tool Kit Analyze Reinvestment - Exchange: The power of a 1031 Exchange is the ability to use dollars otherwise spent in paying taxes. Over the course of a lifetime the benefits of greater cash flow, appreciation and equity buildup can equal many times the actual taxes paid. The above calculations are meant as an estimate and are not guaranteed for accuracy.

0 Response to "41 1031 exchange calculation worksheet"

Post a Comment