43 1031 like kind exchange worksheet

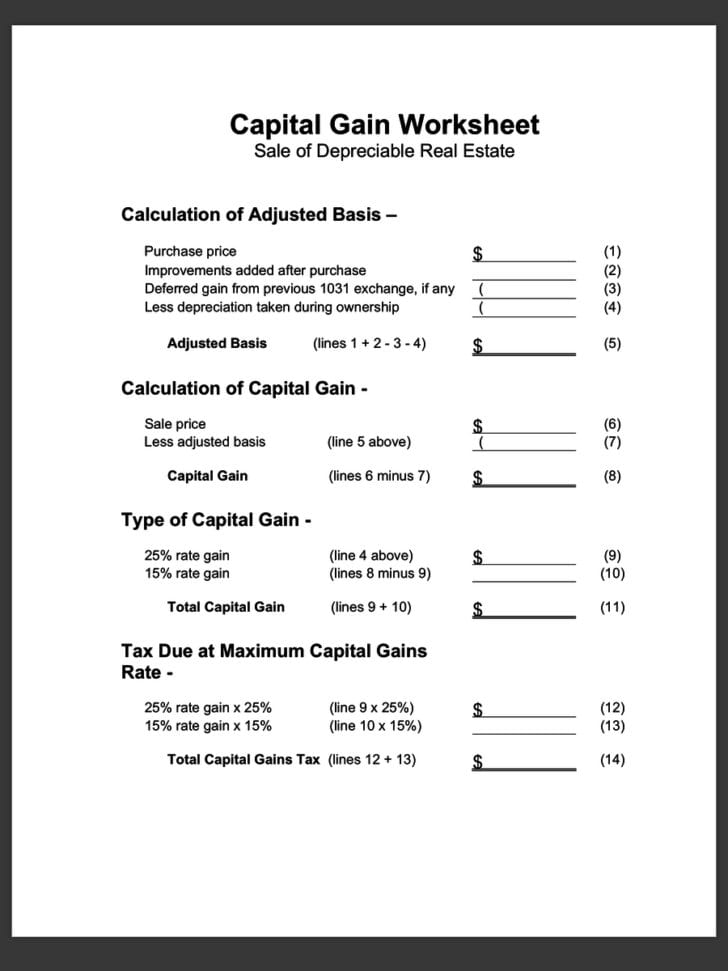

1031worksheet - Learn more about 1031 Worksheet 1031worksheet - Learn more about 1031 Worksheet 1031 Exchange Rules In all cases of a 1031 exchange, the owner must close on the identified replacement property (s) within 180 days from the sale date of the original property. The "three-property" 1031 exchange rule: the owner may identify up to three properties, regardless of their value. PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from ...

Do You Have to Pay Capital Gains Tax on a Home Sale? Mar 02, 2022 · Deferrals of capital gains tax are allowed for investment properties under the 1031 exchange if the proceeds from the sale are used to purchase a like-kind investment.

1031 like kind exchange worksheet

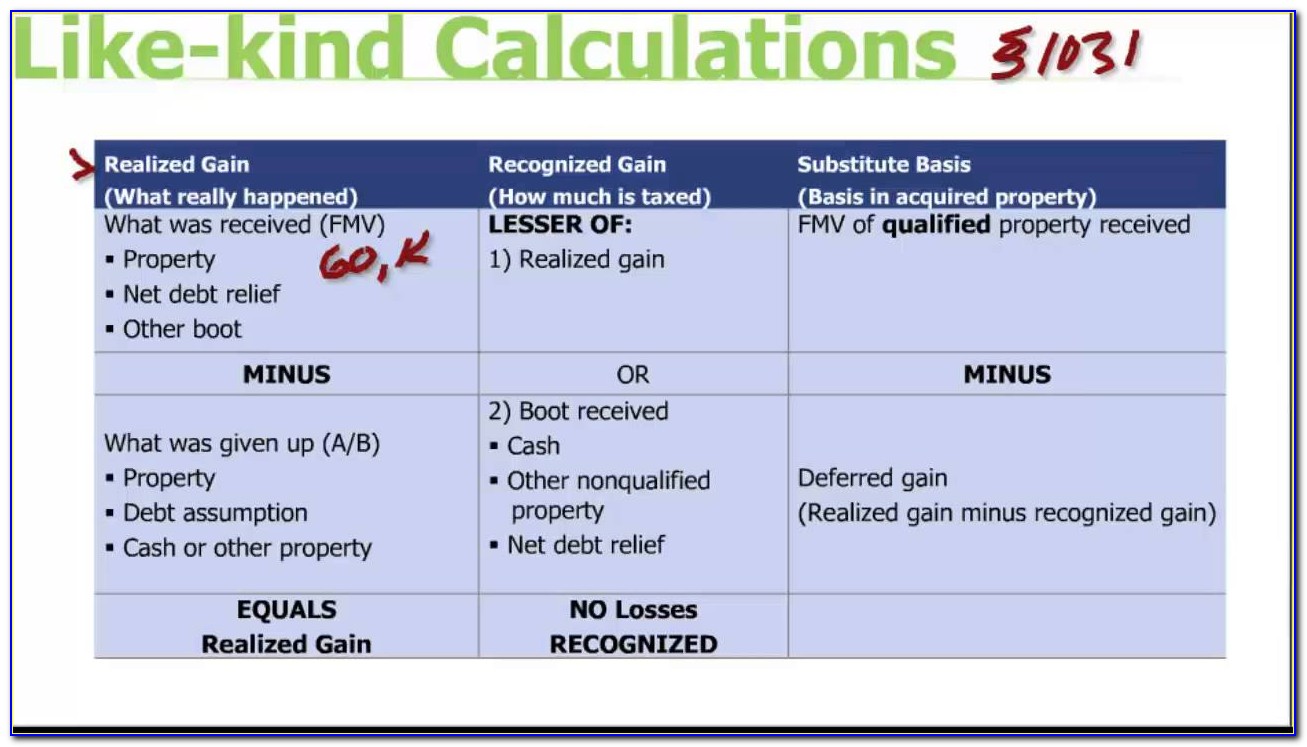

Instructions for Form 8824 (2021) | Internal Revenue Service The final regulations, which apply to like-kind exchanges beginning after December 2, 2020, provide a definition of real property under section 1031, and address a taxpayer's receipt of personal property that is incidental to real property the taxpayer receives in the exchange. See Regulation sections 1.1031 (a)-1, 1.1031 (a)-3, and 1.1031 (k)-1. PDF Reporting the Like-Kind Exchange of Real Estate ... - 1031 Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 7400 Heritage Village Plaza, Suite 102 Gainesville, VA 20155 800-795-0769 703-754-9411 Fax 703-754-0754 Compliments of Realty Exchange Corporation Your Nationwide Qualified Intermediary for the Tax Deferred Exchange of Real Estate PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or

1031 like kind exchange worksheet. Solved: 1031 exchange - Intuit Accountants Community A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. Publication 537 (2021), Installment Sales | Internal ... Like-kind exchanges. Beginning after December 31, 2017, section 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or for investment, other than real property held primarily for sale. See Like-Kind Exchange, later. Photographs of missing children. Publication 544 (2021), Sales and Other Dispositions of ... If the like-kind exchange involves the receipt of money or unlike property or the assumption of your liabilities, see Partially Nontaxable Exchanges, later. If the like-kind exchange involves a portion of a MACRS asset and gain is not recognized in whole or in part, the partial disposition rules in Treasury Regulations section 1.168(i)-8 apply. The 6 Best 1031 Exchange Companies of 2022 - The Balance A 1031 like-kind exchange is a tax strategy to delay paying capital gains taxes when selling investment properties. These taxes can be up to 20% of the sale price. The name 1031 comes from Section 1031 of the U.S. Internal Revenue Code. This section of the tax code lets taxpayers sell a qualified property. Then, they can reinvest the proceeds ...

Use Event1644Reader.ps1 to analyze LDAP query performance ... 23.03.2022 · Event1644Reader.ps1 is a PowerShell script that extracts 1644 events from saved Directory Service event logs and imports them into predefined views in an Excel spreadsheet for analysis. Event1644Reader.ps1 can be used on event logs generated by Windows Server 2012 R2 domain controllers or Windows Server 2008 R2 and Windows Server 2012 domain … Form 8824: Do it correctly | Michael Lantrip Wrote The Book FORM 8824, THE 1031 EXCHANGE FORM The combination of the HUD-1 and the information on our Capital Gains Tax page will be all that you need for the completion of the form. For review, we are dealing with the following scenario. FORM 8824 EXAMPLE Alan Adams bought a Duplex ten years ago for $200,000 cash. He assigned a value of $20,000 to the land. Like-Kind Exchange (Meaning, Rules)| How Does 1031 Works? A like-kind exchange is a transaction to defer the capital gain tax arising in the transaction of sale of an asset when it can be shown that the proceeds are being used to acquire another asset in the place of the first-mentioned asset. It is called the 1031 exchange because Section 1031 of the Internal Revenue Code exempts the seller of an ... Avoiding a Big Tax Bill on Real Estate Gains 05.04.2022 · A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset. more Understanding Section 1250

Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. 2019 Limited Liability Company Tax Booklet | California ... 01.01.2015 · Like-Kind Exchanges – The TCJA amended IRC Section 1031 limiting the nonrecognition of gain or loss on like-kind exchanges to real property held for productive use or investment. California conforms to this change under the TCJA for exchanges initiated after January 10, 2019. Technical Termination of a Partnership – For taxable years beginning on or … 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet ... We always effort to show a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be beneficial inspiration for those who seek a picture according specific categories, you can find it in this website. Finally all pictures we've been displayed in this website will inspire you all. Net Gains (Losses) from the Sale, Exchange, or Disposition ... A like-kind exchange refers to property that has been exchanged for similar property. For example: a taxpayer exchanged land in Pennsylvania for land in Florida. Under the Internal Revenue Code (IRC) a gain (loss) is not recognized and is deferred until the like-kind property is sold. Pennsylvania tax law contains no such provision, the difference between the basis of the …

1031 Tool Kit - TM 1031 Exchange Click here for your 1031 Exchange Tool Kit including at 1031 checklist, qualified intermediary locator, close date form, 1031 identification form and more. Click here to schedule your free 1031 exchange and investment consultation.

1031 Like Kind Exchange Calculator - Excel Worksheet 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet.

Like Kind Exchange Calculator - cchwebsites.com Description of Like Kind Property Brief description of the property involved in this exchange. Sales Price or Fair Market Value The sales price or Fair Market Value (FMV) of the property sold. Purchase Price or Fair Market Value The purchase price or Fair Market Value (FMV) of the property received. Less Liabilities/Mortgages

Asset Worksheet for Like-Kind Exchange Asset Worksheet for Like-Kind Exchange. Asset IDs bundle your assets for sale. So any associated assets (improvements to a rental property and the rental property itself) would use the same ID in order to link them. You should cut all of the depreciation on the relinquished assets in two and apply the 50% to each of the new properties. 0. 2. 117.

Understanding Depreciation Recapture Taxes on Rental ... 03.04.2020 · We sold the MA condo in Dec 2017 in a 1031 exchange, for 417k , and purchased the replacement rental property in FL fir 502.5 in Jan of 2018, which has been rented for two years. We have our primary residence in FL, but now, due to health and other circumstances, we are going move in to the rental, and convert it to our primary, understanding that we nerd to …

XLS Welcome - Hutchins, Canning & Company | CPA Services for ... 1031 Worksheet 5 GAIN OR LOSS REALIZED (Line 7 less line 13 Date of Sale of Property Traded Date of Settlement of New Property Received Description of New Property Received Description of Old Property Traded Date New Property to be Received was Identified Fair Market Value of the new property received List any cash you received in the transaction 1

Solved: Like-Kind Exchange - Intuit Like-Kind Exchange. I believe that an asset is characterized as 'given away' by entering a zero sales price. But this will generate a loss, and will conflict with the entries on Form 8824. I filled out 8824 manually with my own adjusted basis calculations which included asset depreciation through the date of sale.

IRC 1031 Like-Kind Exchange Calculator Everything You Need to Know About 1031 Exchanges. 1031 tax-deferred swaps allow real estate investors to defer paying capital gains taxes when they sell a property that is used "for productive use in a trade or business," or for investment.This is due to IRC Section 1031, and when structured correctly, it lets you sell a property and reinvest the proceeds in a new property - while deferring ...

What is IRS Form 8824: Like-Kind Exchange - TurboTax Tax ... Like-kind exchanges don't have to be exact replacements—a warehouse for a warehouse, for example—but they do have to be of the same "nature, character or class," the IRS says. Swapping a warehouse that includes land for vacant property or a factory with land would be a like-kind exchange, since all involve real property.

Partial 1031 Exchange | 1031 Exchange for Lesser Value ... IPX1031. The best choice for your 1031. IPX1031 is the largest and one of the oldest Qualified Intermediaries in the United States. As a wholly owned subsidiary of Fidelity National Financial (NYSE:FNF), a Fortune 300 company, IPX1031 provides industry leading security for your exchange funds as well as considerable expertise and experience in facilitating all types of 1031 Exchanges.

1031 Relinquished Property Worksheet. Read more. 1031 Replacement Property Worksheet. Read more. 1031 "Like-Kind" Exchange Best Practices. Raising the Bar for Secure, Transparent, and Compliant Exchanges. Read more. How to do a 1031 Exchange. The 1031 Forward Exchange Process.

2016 Form 568 Limited Liability Company Tax Booklet Like-Kind Exchanges – For taxable years beginning on or after January 1, 2014, California requires taxpayers who exchange property located in California for like-kind property located outside of California, and meet all of the requirements of the IRC Section 1031, to ile an annual information return with the Franchise Tax Board (FTB). For ...

Replacement Property Basis Worksheet Replacement Property Basis Worksheet. The following is a worksheet to calculate basis in Replacement Property. Like-Kind Exchange Replacement Property Analysis of Tax Basis for Depreciation (pdf).

Like Kind Exchange Worksheet Excel And Irs 1031 Exchange Worksheet - Form : Resume Examples # ...

PDF 2019 - 1031 Corp We realize the form used to report your 1031 exchange is not the easiest form to complete so we have included line by line instructions to assist you. Additionally, we have developed a Microsoft Excel spreadsheet to help you with the preparation of IRS Form 8824 "LikeKind Exchanges."

IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange ... Worksheet April 17, 2018 We tried to find some amazing references about IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example for you. Here it is. It was coming from reputable online resource which we like it. We hope you can find what you need here. We always attempt to show a picture with high resolution or with perfect images.

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges ... Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

0 Response to "43 1031 like kind exchange worksheet"

Post a Comment