45 truck driver expenses worksheet

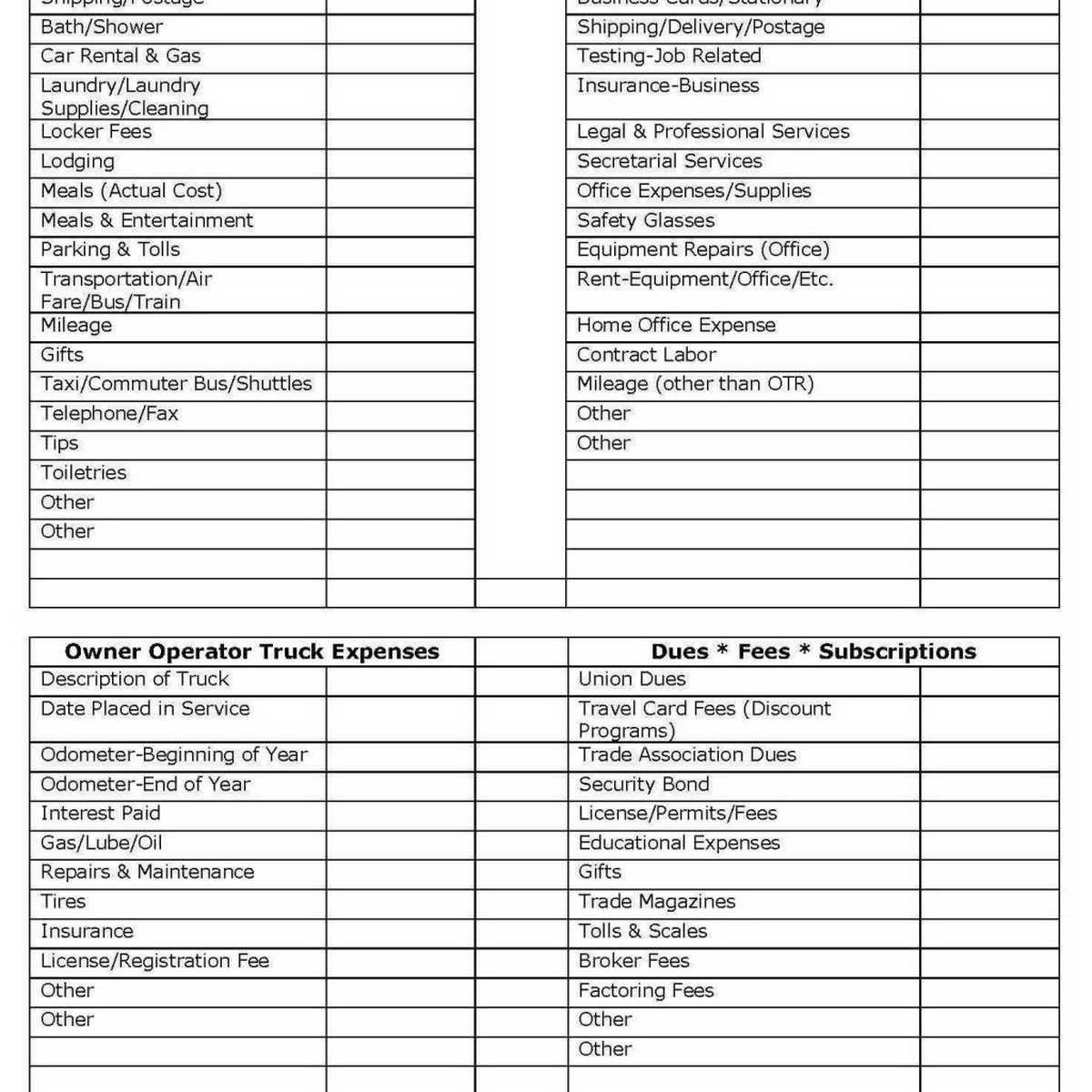

PDF Car and Truck Expense Deduction Reminders Car and Truck Expense Deduction Reminders . FS-2006-26, October 2006 . The Internal Revenue Service reminds taxpayers to become familiar with the tax law before deducting car- and truck-related business expenses. Overstated adjustments, deductions, exemptions and credits of all types account for more than TRUCKER’S INCOME & EXPENSE WORKSHEET Truck loans Equipment loans Business only credit card LEGAL & PROFESSIONAL: Attorney fees for business, accounting fees, bonds, permits, etc. OFFICE EXPENSE: postage, stationery, office supplies, bank charges, pens, faxes, etc. PENSION/PROFIT SHARING: Employees only RENT/LEASE: Truck lease Machinery and equipment Other bus. property, locker fees

Truck Expenses Worksheet | Tax deductions, Printable ... Truck Expenses Worksheet. The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Vehicle Expense Worksheet. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Realtor Tax Deduction Worksheet.

Truck driver expenses worksheet

16_ Truck Driver Worksheet.pdf - California Tax Boutique T CAR and TRUCK EXPENSES (personal vehicle) T VEIDCLEl Year and Make of Vehicle Date Purchased (month, date and year) Ending Odometer Reading (December 31) Beginning Odometer Reading (January 1) - Total Miles Driven (End Odo -Begin Odo) Total Business Miles (do you have another vehicle?) Truck Driver Income Worksheet - CrossLink Tax Tech Truck Driver Expense Worksheet . VEHICLES FOR HIRE MUST USE ACTUAL EXPENSES. Business Miles Driven Other Than While Hauling Loads: _____ Vehicle Expense: (Standard Mileage Rate) Business Miles Only [From . Mileage Log Worksheet] _____ total business miles x 57.5¢ per mile = _____ Do you own the tractor trailer/truck that you use to haul loads? ... 2020 Truck Driver Tax Deductions Worksheet - Fill Out and ... Quick steps to complete and eSign Truck Driver Tax Deductions Worksheet online: Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

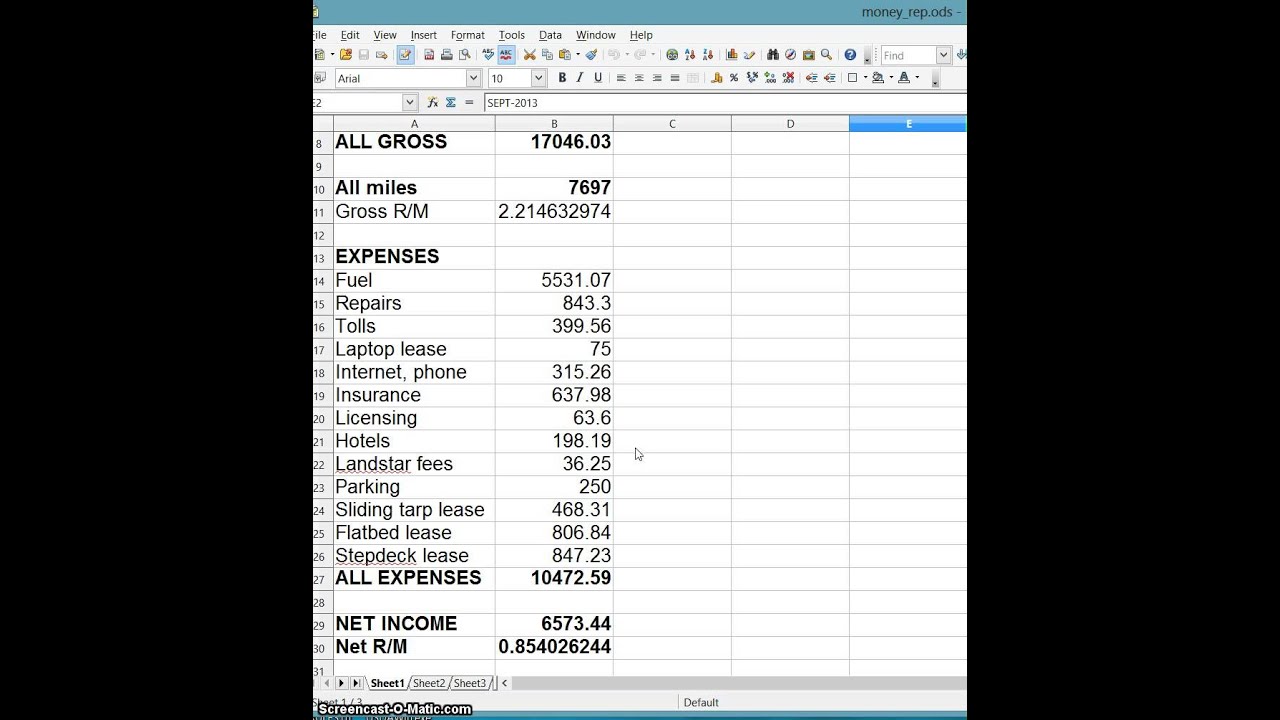

Truck driver expenses worksheet. Truck Driver Expense Spreadsheet | LAOBING KAISUO | Truck ... Mar 27, 2021 - Free Templates Truck Driver Expense Spreadsheet, truck driver expense sheet, tax deduction worksheet for truck drivers, trucking spreadsheet download, owner operator expense spreadsheet, truck driver expense list, truck driver expense report, truck driver expenses irs, owner operator spreadsheet, trucking spreadsheet templates, PDF Name Year TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL ... TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL WORKSHEET FOR OUR CLIENTS CALL IF YOU NEED HELP WITH IT. Total Income (Gross Amount Of All Checks) - Possible Deductions From Checks- Licenses & Permits Bobtail Fees Pager Fees Health Insurance Physical Damage Reserve Withdrawals Truck Washes -Other Deductions- Complete List Of Owner Operator Expenses For Trucking ... 100,000 operating expenses /75,000 miles = 1.33 cents a mile If you want to increase profitability you can lower your costs or raise your miles (although some costs will go up accordingly). Once you get on the road, you may find that your numbers were way off, but it gives you the ability to begin to plan. PDF o n O o õ o o õ o o (.0 o o o o o o o CD õ ... - Emshwiller Created Date: 1/25/2017 2:53:15 PM

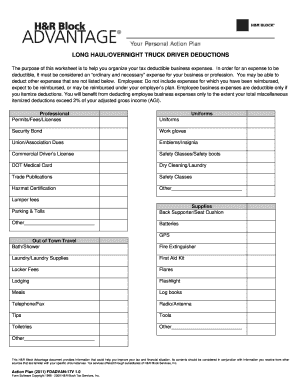

PDF Trucker'S Income & Expense Worksheet!!!!!!!!!!!!!! OFFICE EXPENSE:postage, stationery, office supplies, bank charges, pens, faxes, etc. PENSION/PROFIT SHARING:Employees only "RENT/LEASE:Truck lease Machinery and equipment # Other bus. property, locker fees "REPAIRS & MAINTENANCE:Truck, equipment, etc. SUPPLIES:Maps, safety supplies Small tools Solved: Car & Truck Expenses Worksheet: Cost must be enter... Email to a Friend. Report Inappropriate Content. Car & Truck Expenses Worksheet: Cost must be entered. When the program asks for the cost of the vehicle, it is asking for how much you paid for it when you purchased it. That number would only be known to you. View solution in original post. 1. 1. 2,450. 2020 Truck Driver Tax Deductions Worksheet - Fill Online ... LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS The purpose of this worksheet is to help you organize your tax-deductible business expenses. In order for an expense to be deductible, it must be considered Fill trucking income and expense excel spreadsheet: Try Risk Free Form Popularity owner operator tax deductions worksheet form a spreadsheet for truckdriver expense records. [SOLVED] I'm looking for a speadsheet that i can record my truck expenses on. for example atm fees, tools, clothes, motels, ect. Register To Reply. 08-23-2005, 02:33 PM #2. Excel_Geek. View Profile View Forum Posts Visit Homepage Registered User Join Date 08-18-2005 Posts 59.

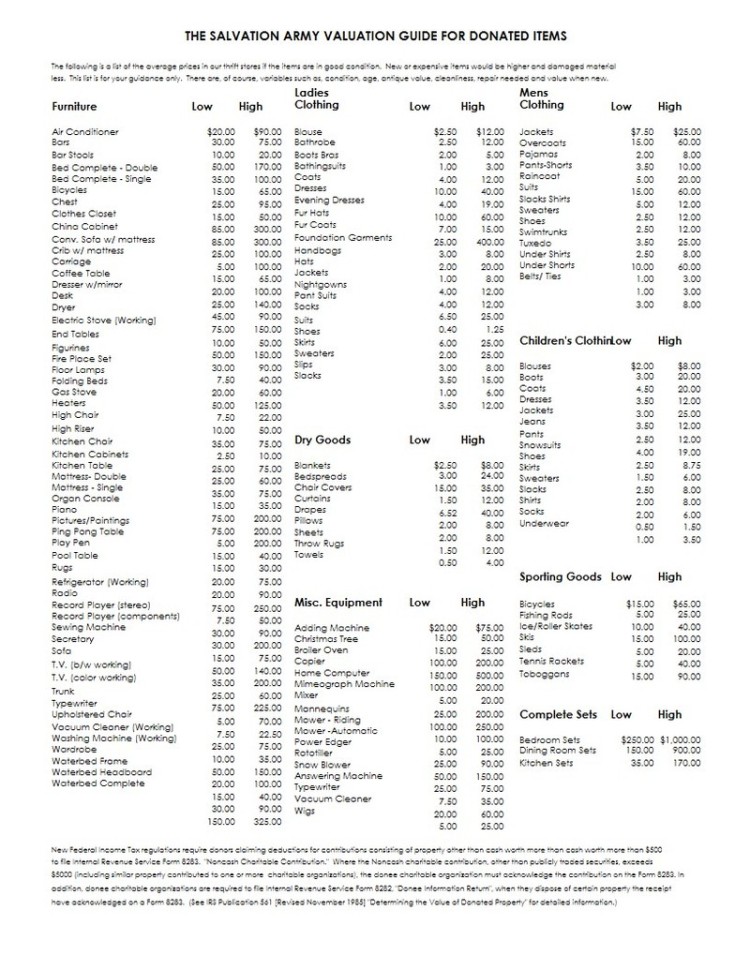

What You Need to Know About Truck Driver Tax Deductions ... If you're a self-employed driver, on the other hand, you can deduct expenses related to your work. As an owner/operator, you should receive a 1099-NEC at year-end from any customer that paid you more than $600 during the year. 1 Fantastic Trucking Expenses Spreadsheet Excel ~ Ginasbakery Free templates trucking expenses spreadsheet spreadsheets cost per mile 972. In this spreadsheet, all expenses including salaries of all driver and owner/members, truck purchases, insurance, office, legal expenses, truck maintenance, devices, and more will be populated automatically from your trucking business report. PDF Tax Deduction checklist for truck drivers -•J'.evnrietTO'peralor Truck Expenses-e ,,J . C itizens Band Rad o . Description of Truck . Compass/GPS . Date Placed in Service . Fire Extinguisher . Odometer-Beginning of Year . First Aid Kit . Odometer-End of Year . Flares . Interest Paid . Flashlight . Gas, Lube and Oil . Glasses- Safety and Sun . Repairs and Maintenance . Gloves . Tires ... 8 Biggest (and Necessary) Owner-Operator Expenses ... In general, you can expect truck maintenance and repair to total approximately 10% of your overall expenses, including $1,000 to $4,000 for tires each year. 3. Fuel expenses and tolls. Fuel is another major owner-operator expense, with the average cost between $50,000 and $70,000 each year. You can estimate your cost per mile by dividing your ...

Truck Driver Tax Deductions - H&R Block As a truck driver, you must claim your actual expenses for vehicles of this type. So, you can't use the standard mileage method. To deduct actual expenses for the truck, your expenses can include (but aren't limited to): Fuel Oil Repairs Tires Washing Insurance Any other legitimate business expense

Truck Driver Expenses Worksheet ≡ Fill Out Printable PDF ... LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS The purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense to be deductible, it must be considered an "ordinary and necessary" expense for your business or profession. You may be able to deduct other expenses that are not listed below.

Owner Operator Expense Spreadsheet intended for Trucking Expenses Spreadsheet Small Business Tax ...

Truck Driver Deductions Spreadsheet - CocoDoc Start on editing, signing and sharing your Truck Driver Deductions Spreadsheet online with the help of these easy steps: Push the Get Form or Get Form Now button on the current page to make access to the PDF editor. Wait for a moment before the Truck Driver Deductions Spreadsheet is loaded

Tax Deductions for Truck Drivers - Jackson Hewitt If you are a driver, such as a bus driver, taxicab driver, or truck driver, you should have received a Form W-2 for your job and none of your job-related expenses are deductible. If you are self-employed you should receive a Form 1099-MISC, Miscellaneous Income and you should report that income, and any expenses, on Schedule C, Profit and Loss from Business.

PDF Tax Organizer--Long Haul Truckers and Overnight Drivers PART 1—Out-of-Town Travel Expenses Baggage and Shipping Bath and Shower Costs Car Rental and Gas Laundry and Laundry Supplies Locker Fees Lodging Meals (Actual Cost) Parking and Tolls Taxi, Commuter Bus and Shuttles Telephone and Fax Tips Toiletries Transportation—Airfare, Bus and Train Other: PART 2—Owner/Operator Truck Expenses

Tax Deductions for Truck Drivers - Support Truck drivers who are independent contractors can claim a variety of tax deductions while on the road. Mileage, daily meal allowances, truck repair (maintenance), overnight hotel expenses, and union dues are some of the tax deductions available. However, local truck drivers typically cannot deduct travel expenses.

Tax Deduction List for Owner Operator Truck Drivers But by May, 2020, the mean annual estimated salary rose to $48,710 and ticked up to $23.42 per hour. Experienced truckers in the 90th salary percentile pulled down $69,480 on average, according to the BLS. Heading into 2022, resources estimate the average trucking salaries exceeded $77,000 annually.

OVER-THE-ROAD TRUCKER EXPENSES LIST - PSTAP When determining passenger vehicle expenses, you cannot use, under current IRS rules and regulations, the standard mileage rate (which is 48.5 cents per mile for 2007 and 50.5 cents per mile for 2008) for vehicles used for hire such as taxicab, bus or tractor (over-the-road trucks).

Get the free truck driver tax deductions worksheet form - pdfFiller Fill Truck Driver Tax Deductions Worksheet, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✓ Instantly. Try Now!

19 Truck Driver Tax Deductions That Will Save You Money ... These expenses include any specialized items you buy to help safely carry your loads. Examples include chains, locks, straps, and even wide-load flags. Tools and equipment If you're like most truckers, you probably carry a tool kit in your truck. Things like hammers, wrenches, pliers, tire irons, and even electrical tape are all deductible.

Owner Operator Truck Driver Tax Deductions Worksheet - Ark ... Feb 22, 2021 · owner operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. Download 2019 per diem tracker.

2020 Truck Driver Tax Deductions Worksheet - Fill Out and ... Quick steps to complete and eSign Truck Driver Tax Deductions Worksheet online: Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

Truck Driver Income Worksheet - CrossLink Tax Tech Truck Driver Expense Worksheet . VEHICLES FOR HIRE MUST USE ACTUAL EXPENSES. Business Miles Driven Other Than While Hauling Loads: _____ Vehicle Expense: (Standard Mileage Rate) Business Miles Only [From . Mileage Log Worksheet] _____ total business miles x 57.5¢ per mile = _____ Do you own the tractor trailer/truck that you use to haul loads? ...

16_ Truck Driver Worksheet.pdf - California Tax Boutique T CAR and TRUCK EXPENSES (personal vehicle) T VEIDCLEl Year and Make of Vehicle Date Purchased (month, date and year) Ending Odometer Reading (December 31) Beginning Odometer Reading (January 1) - Total Miles Driven (End Odo -Begin Odo) Total Business Miles (do you have another vehicle?)

0 Response to "45 truck driver expenses worksheet"

Post a Comment