39 income tax deduction worksheet

What is this tax and interest deduction worksheet - Intuit February 6, 2020 12:38 PM. The tax and interest deduction worksheet shows the itemized deductions claimed for state and local taxes, including real estate taxes, and mortgage interest. You would only itemize if your total deductions were greater than the standard deduction for your filing status. However, these deductions can still be listed on ... list of itemized deductions worksheet - eparchy.org Gifts to charity. list-of-itemized-deductions-worksheet 2/6 Downloaded from brickyardatmutianyu.com on May 15, 2022 by guest INCOME TAX FUNDAMENTALS 2018. Stuff you'll need if … Georgia State Income Tax Forms for Tax Year 2021 (Jan. 1 - Dec. 31, 2021) can be …

PDF 2022 Form W-4 - IRS tax forms Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. OMB No. 1545-0074 2022 Step 1: Enter Personal Information (a) First name and middle initial Last name Address City or town, state, and ZIP code

Income tax deduction worksheet

Federal Income Tax Deduction Worksheet - signNow Follow the step-by-step instructions below to eSign your federal income tax deduction worksheet: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done. Publication 501 (2021), Dependents, Standard Deduction ... - IRS tax forms Worksheet 2. Worksheet for Determining Support Qualifying Child of More Than One Person Tiebreaker rules. Applying the tiebreaker rules to divorced or separated parents (or parents who live apart). Qualifying Relative Age. Kidnapped child. Not a Qualifying Child Test Child of person not required to file a return. PDF 19 2021 Itemized Deduction (Sch A) Worksheet 19 - 2021 Itemized Deduction (Sch A) Worksheet (type-in fillable) I donated a vehicle worth more than $500 I made more than $5,000 of noncash donations I paid interest on borrowings for investments I repaid income (taxed in prior year) over $3,000 If you checked any of the above, please stop here and speak with one of our Counselors.

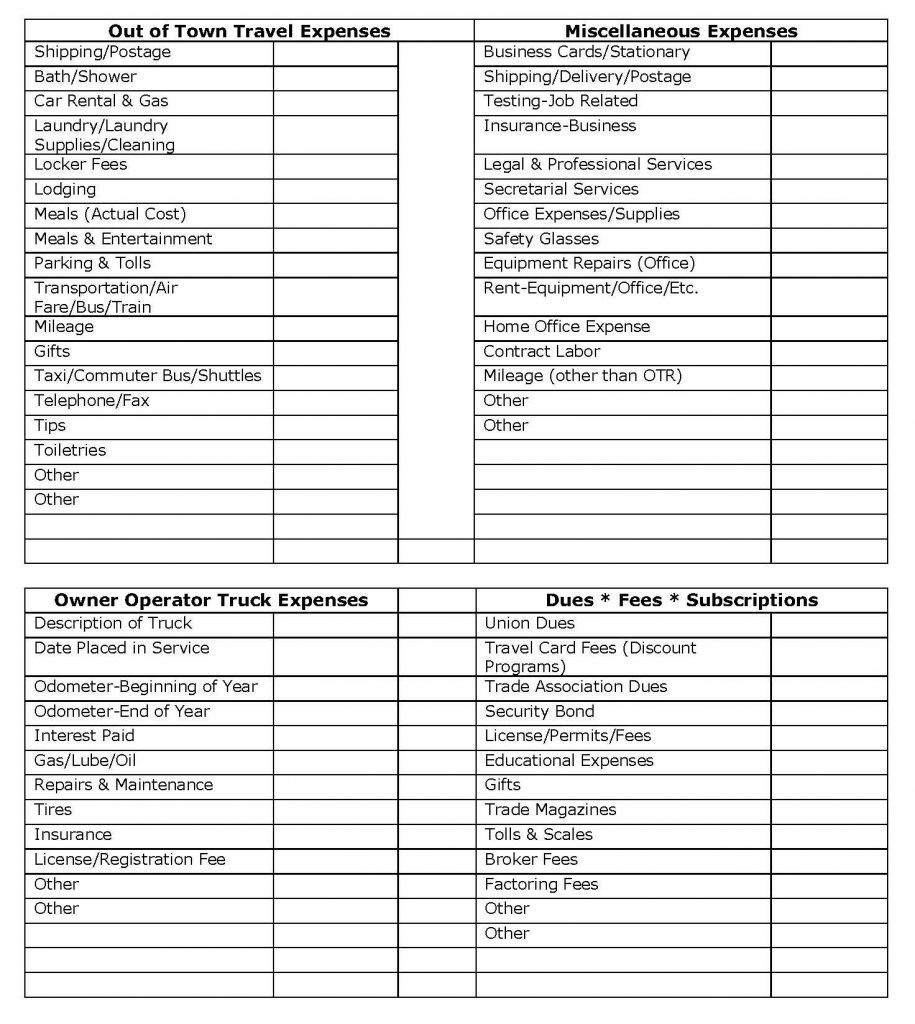

Income tax deduction worksheet. › publications › p970Publication 970 (2021), Tax Benefits for Education | Internal ... Refunds received after 2021 but before your income tax return is filed. If anyone receives a refund after 2021 of qualified education expenses paid on behalf of a student in 2021 and the refund is paid before you file an income tax return for 2021, the amount of qualified education expenses for 2021 is reduced by the amount of the refund. About Schedule A (Form 1040), Itemized Deductions About Schedule A (Form 1040), Itemized Deductions. Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. PDF Contractor's Deduction Worksheet - MB Tax Pro Self-Employed Worksheet Client: _____ Tax Year: _____ Did you make any payments that would require you to file Form 1099? YES_____ NO_____ Income: Office Expense Office Supplies Outside Services Parking & Tolls Expenses: Postage Accounting Printing Advertising Rent, Business Equipment Business Cards Rent, Office Rent ... Downloadable tax organizer worksheets Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. The source information that is required for each tax return is unique. Therefore we also have specialized worksheets to meet your specific needs. All the documents on this page are in PDF format.

PDF Federal Income Tax Deduction Worksheet - Alabama Federal Income Tax Deduction Worksheet Line 2 Penalty on Early Withdrawal of Savings The Form 1099-INTgiven to you by your bank or savings and loan association will show the amount of any penalty you were charged for withdrawing funds from your time savings deposit before its ma- turity. Enter this amount on line 2, Column B only. Alabama Tax Law Changes - Federal Income Tax Deduction Worksheet The increased federal income tax deduction will reduce the amount of tax due on an Alabama individual income tax return. Tax returns that have already been electronically filed do not need to be amended. The Alabama Department of Revenue will adjust returns that have already been e-filed. Tax returns that were paper filed will need to be amended. › individual-income-tax-2019Individual Income Tax Forms - 2019 | Maine Revenue Services 2019 Additional Worksheet to Report Certain "Other" Modifications to Maine Income Related to Federal Tax Law Changes Enacted After December 31, 2019: Included: Worksheet for "Other" Income Modifications - Additions (PDF) Worksheet for Form 1040ME, Schedule 1, Line 1h: Included: Worksheet for "Other" Income Modifications - Subtractions (PDF) PDF Federal Income Tax Deduction Worksheet - Alabama Alabama Use Tax Worksheet Report 2020 purchases for use in Alabama from out-of-state sellers on which tax was not collected by the seller. Standard Deduction ... Federal Income Tax Deduction Worksheet. Title: 40 Booklet TY 2020.qxp Created Date: 1/25/2021 4:02:53 PM ...

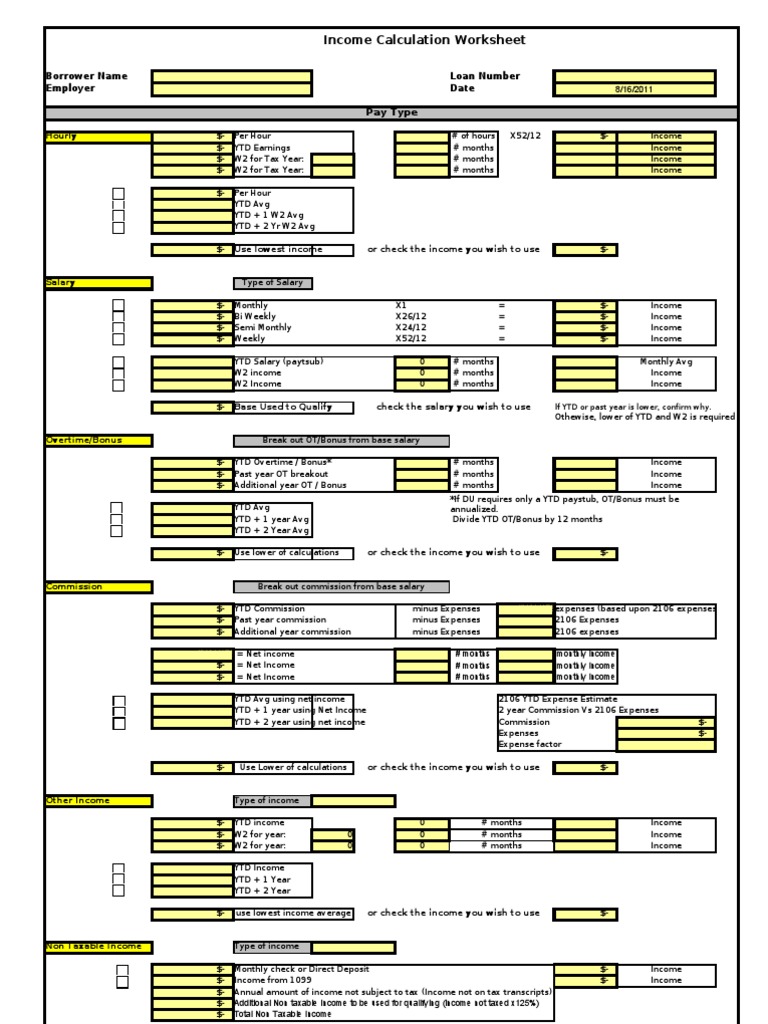

Income Tax Worksheet Download this income tax worksheet AKA income tax organizer to maximize your deductions and minimize errors and omissions. FileTax site offers FREE information to HELP YOU PLAN AND MANAGE YOUR STATE AND FEDERAL INCOME TAXES. Pension Protection Act of 2006 highlights. Key changes of tax law brought on by the act, including those related to IRA's ... Alabama Federal Income Tax Deduction Worksheet Federal Income Tax Deduction Worksheet requires you to list multiple forms of income, such as wages, interest, or alimony . We last updated the Federal Income Tax Deduction Worksheet in January 2022, so this is the latest version of Federal Income Tax Deduction Worksheet, fully updated for tax year 2021. 1040 (2021) | Internal Revenue Service - IRS tax forms Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax. See the instructions for line 16 for details.. Line 3b. ... You should receive a Form 1099-R showing the total amount of any distribution from your IRA before income tax or other deductions were withheld. This ... › are-you-eligible-for-the-iraThe IRA Tax Deduction Rules: Income Limits Apply. May 08, 2022 · You're entitled to less of a deduction if you earn $68,000 or more, and you're not allowed a deduction at all if your MAGI is over $78,000 in 2022. The IRA deduction is phased out between $109,000 and $129,000 in 2022 if you're married and filing jointly, or if you're a qualifying widow(er). Those with MAGIs over $129,000 aren't allowed a ...

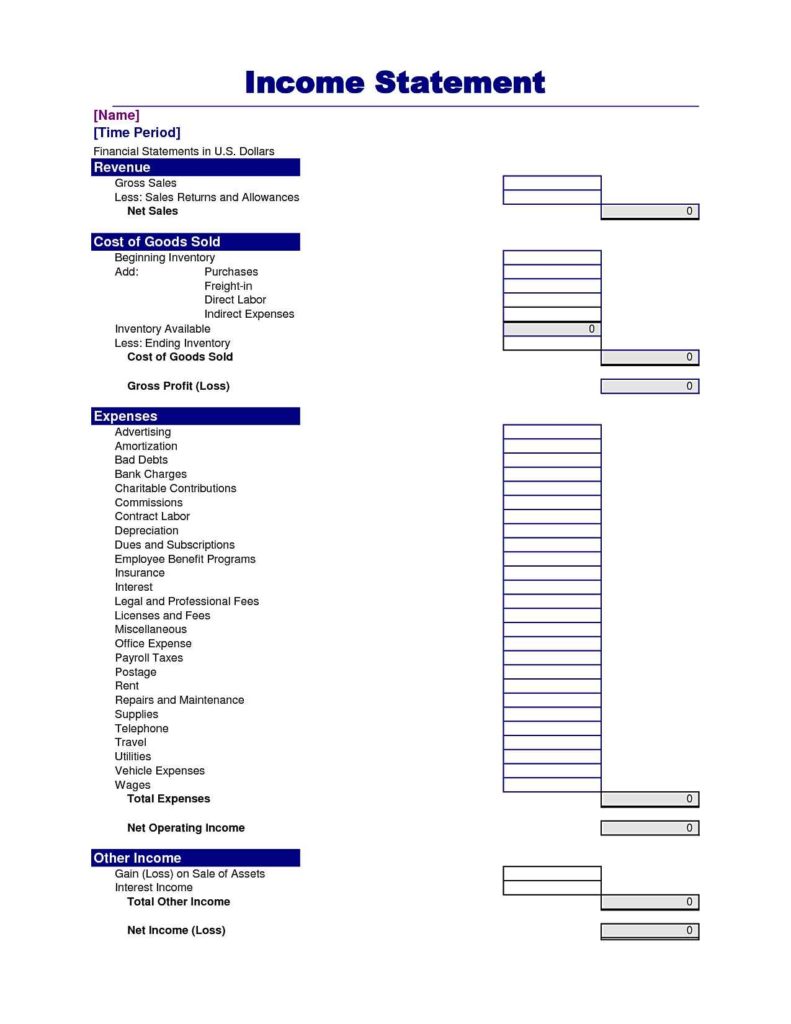

The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage.

Worksheets | Australian Taxation Office Worksheet 1: Reconciliation statement. The Reconciliation statement worksheet (PDF, 93KB) This link will download a file is available to download.. Worksheet 1A: Net small business income. The Net small business income worksheet (PDF, 75KB) This link will download a file is available to download.. Worksheet 2: Distribution of income from other partnerships and share of net income from trusts

Federal Worksheet - Canada.ca You may also have to complete the Federal Worksheet (for all provinces and territories) to calculate the amount for the following lines: Lines 12000 and 12010 - Taxable amount of dividends from taxable Canadian corporations Line 12100 - Interest and other investment income Line 22100 - Carrying charges, interest expenses, and other expenses

Tax Deduction | Excel Templates Included in this excel tax deduction template you will receive an itemized deductions calculator that comes with two sections known as the header section and the calculation section. These areas are where you will fill out your personal financial details that correspond to each category. Optional Tips 1.

How to Calculate Deductions & Adjustments in a W-4 Worksheet The standard deduction amount is currently set to $12,950 for single individuals or married individuals filing separately, $19,400 for the head of household, and $25,900 for a qualifying widower or a married couple filing jointly in 2022. You can only claim either the standard deduction or itemized deductions.

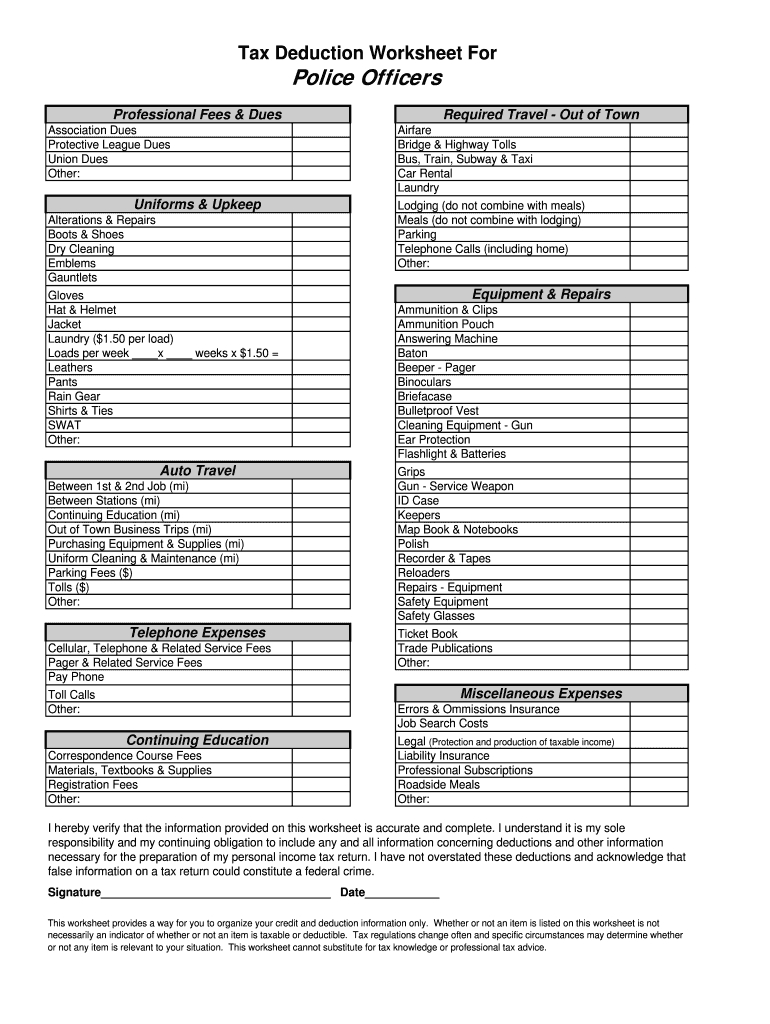

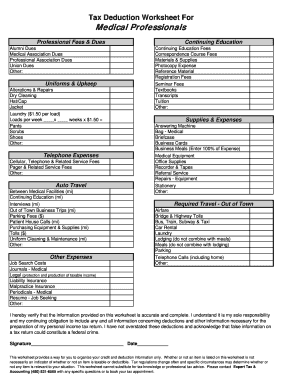

PDF Tax Deduction Worksheet - Oxford University Press Tax Deduction Worksheet This worksheet allows you to itemize your tax deductions for a given year. Tax deductions for calendar year 2 0 ___ ___ HIRED$___________HELP $___________$___________ $___________$___________$___________ $___________AccountantAdministrativeAgent/manager expensesContractedOther costslessons, classes,expenses or camps)

Worksheet 2 (Tier 3 Michigan Standard Deduction) Estimator Individual Income Tax. Worksheet 2 (Tier 3 Michigan Standard Deduction) Estimator. If the older of you or your spouse (if married filing jointly) was born during the period January 1, 1953 through January 1, 1954, and reached the age of 67 on or before December 31, 2020, you may deduct the personal exemption amount and taxable Social Security ...

PDF Itemized Deductions Detail Worksheet (PDF) - IRS tax forms If MFS and spouse itemizes, taxpayer must also itemize. Standard deduction can't be used. It doesn't matter which spouse files first. Select "Use Standard or Itemized De-duction" then select the option "Must itemize because spouse itemized." Select to enter taxes not entered elsewhere in the software. F-5

› credits-deductions › individualsUse the Sales Tax Deduction Calculator | Internal Revenue Service Oct 01, 2021 · The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately).

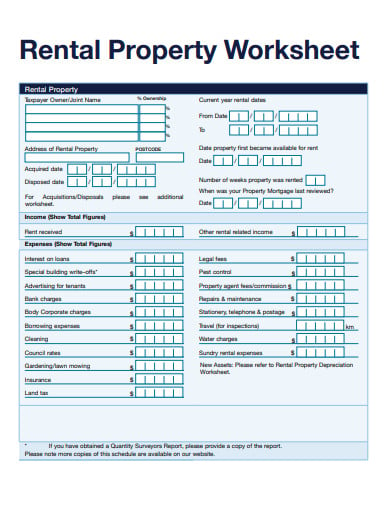

Free Rental Income and Expense Worksheet | Zillow Rental Manager To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

Tax Withholding Estimator | Internal Revenue Service If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. It's a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. Why Use the Estimator When Should You Use the Estimator

› illinois › income-taxIllinois Income Tax Rates for 2022 Illinois' maximum marginal income tax rate is the 1st highest in the United States, ranking directly below Illinois' %. You can learn more about how the Illinois income tax compares to other states' income taxes by visiting our map of income taxes by state. The Illinois income tax was lowered from 5% to 3.75% in 2015.

Federal Income Tax Deduction Worksheet Alabama Department of ... - signNow Easily find the app in the Play Market and install it for eSigning your federal income tax deduction worksheet alabama department of revenue alabama. In order to add an electronic signature to a federal income tax deduction worksheet alabama department of revenue alabama, follow the step-by-step instructions below: Log in to your signNow account.

Deductions | FTB.ca.gov Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction ... The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California ...

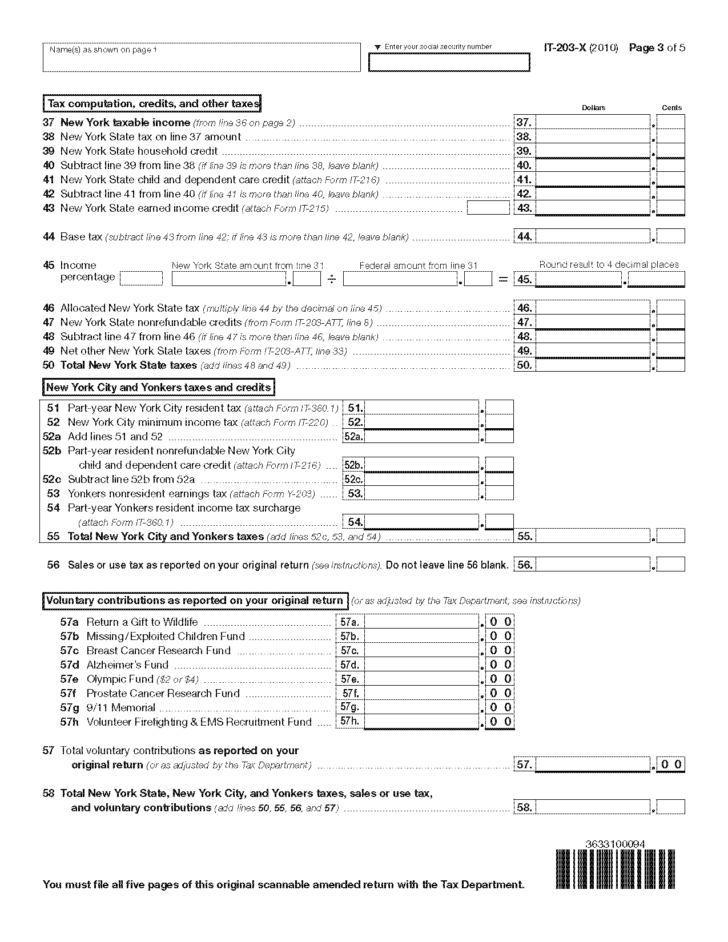

AL - Federal Income Tax Deduction Worksheet Changes (Drake21) The amount of the credits based on 2020 federal law will automatically be calculated on lines 3, 4, 8b, and 9e of AL INC WK, Federal Income Tax Deduction Worksheet. The corresponding federal worksheets for each credit will also be printed. If necessary, overrides to these amounts may be made on AL screen ITDW.

PDF 19 2021 Itemized Deduction (Sch A) Worksheet 19 - 2021 Itemized Deduction (Sch A) Worksheet (type-in fillable) I donated a vehicle worth more than $500 I made more than $5,000 of noncash donations I paid interest on borrowings for investments I repaid income (taxed in prior year) over $3,000 If you checked any of the above, please stop here and speak with one of our Counselors.

0 Response to "39 income tax deduction worksheet"

Post a Comment