38 realtor tax deduction worksheet

› rental-manager › resourcesFree Rental Income and Expense Worksheet | Zillow Rental Manager Jan 01, 2021 · To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or HOA dues, gardening service and utilities in the “monthly expense” category. 115 Popular Tax Deductions For Real Estate Agents For 2022 You have two choices when claiming a vehicle tax deduction. Simple Method (Standard Mileage Deduction) The simple method where you take a cost per mileage driven for business. For 2019, the standard mileage rate is $.58 per mile. Simply put if you drove 10,000 miles, you could deduct $5,800 from your

Real Estate Professional Expense Worksheet - atmTheBottomLine TAX BASICS About Your Business. TYPE OF BUSINESS Business or Hobby? SOLE PROPRIETORSHIPS; DEDUCTIONS What you need to know; EXPENSE FORMS Keep Track of Your Expenses. Clergy Expense Worksheet; Daycare Expense Worksheet; Outside Sales Expense Worksheet; Real Estate Professional Expense Worksheet; ABOUT US and Contact Info. ABOUT US; STAFF ...

Realtor tax deduction worksheet

Fill & Sign Real Estate Agent Tax Deductions Worksheet Form To Fill In Real Estate Agent Tax Deductions Worksheet Form, Follow the Steps Below: Write your Real Estate Agent Tax Deductions Worksheet Form online is easy and straightforward by using CocoSign . You can simply get the form here and then fill in the details in the fillable fields. Follow the tips given below to complete the document. prontointervento.roma.itNames Vegan Catchy Search: Catchy Vegan Names. You are free to choose and use them as your blog’s name, your blog’s website address and/or domain name if it’s available to be registered @name_catchy Now that's what I call will Okay, so I had a couple of posts lamenting the lack of good vegan slogans and decided to come up with a few more, but I think a separate page is in order This comprehensive guide of ... Realtor Tax Deductions Worksheet Form - signNow Follow the step-by-step instructions below to design your tax deductions for a rEvaltor form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

Realtor tax deduction worksheet. Understanding Depreciation Recapture Taxes on Rental Property 03.04.2020 · Turbotax and IRS sort of “fill-in” that $43,846, i.e., $77,200 – 33,354 = $43,846 which goes on Schedule D worksheet and is taxed at an ordinary income tax rate of 12%. I don’t see any logic to that calculation, but I like the tax rate so great so far. But we still have $22,652 of depreciation recapture yet to be taxed ($66,507 of depreciation recapture less $43,846 taxed … Cyataxes Realtors Tax Deductions Worksheet - US Legal Forms Get the Cyataxes Realtors Tax Deductions Worksheet you need. Open it using the cloud-based editor and begin adjusting. Fill in the empty areas; concerned parties names, places of residence and phone numbers etc. Customize the template with smart fillable fields. Include the particular date and place your electronic signature. Do You Have to Pay Capital Gains Tax on a Home Sale? 02.03.2022 · How the Capital Gains Tax Works With Homes . Suppose you purchase a new condo for $300,000. You live in it for the first year, rent the home for the next three years, and when the tenants move out ... Names Vegan Catchy You are free to choose and use them as your blog’s name, your blog’s website address and/or domain name if it’s available to be registered @name_catchy Now that's what I call will Okay, so I had a couple of posts lamenting the lack of good vegan slogans and decided to come up with a few more, but I think a separate page is in order This comprehensive guide of the best English …

Real Estate Agent Tax Deductions - Fill Out and Use Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; include them as business miles. Brit A Z | PDF | Nature - Scribd aardvark aardvarks aardvark's aardwolf ab abaca aback abacus abacuses abaft abalone abalones abalone's abandon abandoned abandonee. abandoner abandoning abandonment abandons abase abased abasement abasements abases abash abashed abashes abashing abashment abasing abate abated abatement abatements abates abating abattoir abbacy … Real Estate Agent Tax Deduction Wordsheet - Google Sheets Real Estate Agent Tax Deduction Wordsheet - Google Sheets. To enable screen reader support, press Ctrl+Alt+Z To learn about keyboard shortcuts, press Ctrl+slash. Quotes are not sourced from all markets and may be delayed up to 20 minutes. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. University of South Carolina on Instagram: “Do you know a future ... 13.10.2020 · Do you know a future Gamecock thinking about #GoingGarnet? 🎉 ••• Tag them to make sure they apply by Oct. 15 and have a completed application file by Nov. 2 to get an answer from @uofscadmissions by mid-December. 👀 // #UofSC

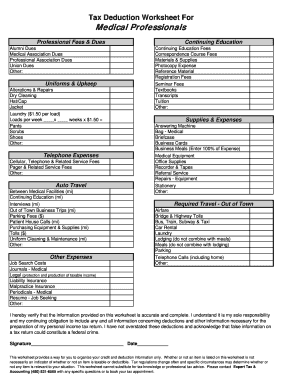

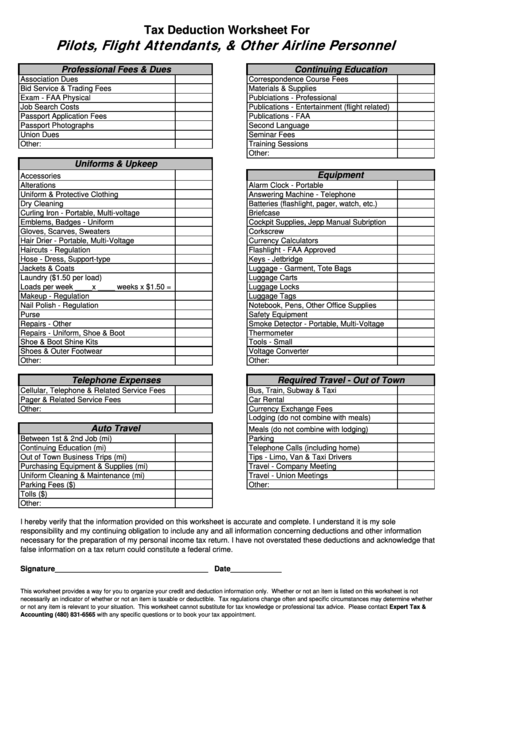

fountainessays.comFountain Essays - Your grades could look better! 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong. PDF Realtor - Tax Deduction Worksheet This worksheet cannot substitute for tax knowledge or professional tax advice. Please contact Expert Tax & Accounting (480) 831-6565 with any specific questions or to book your tax appointment. Other: Other: Rent Repairs to Sell Listed Property Shipping Stationery FAX Machine. Title: Realtor - Tax Deduction Worksheet.xls Fountain Essays - Your grades could look better! All our academic papers are written from scratch. All our clients are privileged to have all their academic papers written from scratch. These papers are also written according to your lecturer’s instructions and thus minimizing any chances of plagiarism. PDF Object Moved This document may be found here

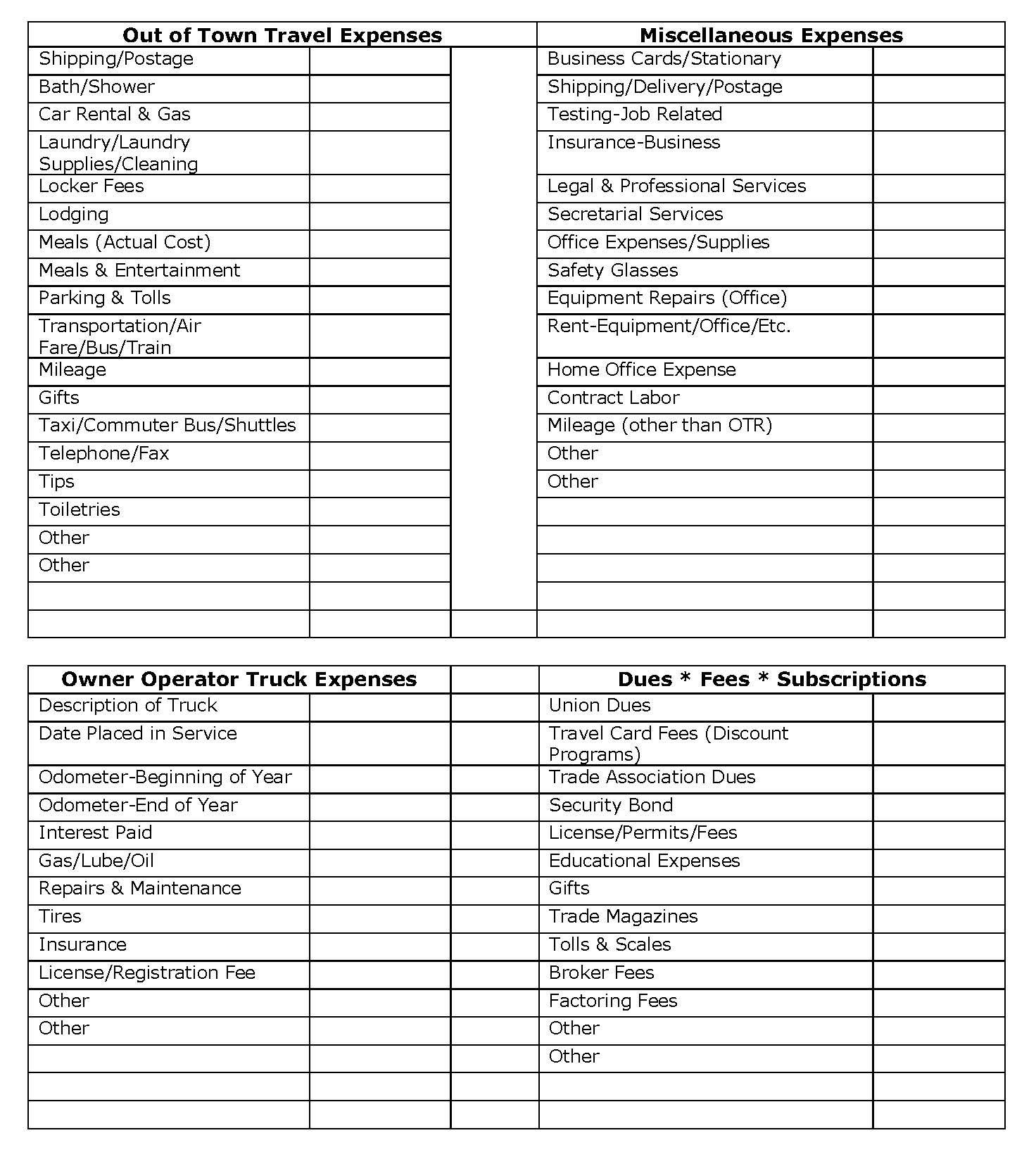

DOC Income Tax Deduction Checklist --- REALTORS Generally, to be deductible, items must be ordinary and necessary to your profession and not reimbursable by your employer. Record separately, in the Equipment Purchases Section, items costing over $100 and having a useful life of more than one year.

› sale-of-your-home-3193496Home Sale Exclusion From Capital Gains Tax - The Balance Mar 10, 2022 · William Perez is a tax expert with 20+ years of experience advising on individual and small business tax. He has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income. He previously worked for the IRS and holds an enrolled agent certification.

Tax Deductions for Real Estate Agents 2022: Ultimate Guide 6 Real Estate Agent Car Tax Deduction 6.1 Simple Method (Standard Mileage Deduction) 6.2 Actual Method 7 Business Travel & Meals 8 Home Office Deduction 8.1 Simplified Method for Realtors 8.2 Detailed Method for Realtors 9 Office Rent And Utilities 10 Business Gifts ($25 Deduction Limit) 11 Expenses Paid on Clients Behalf

How Much Can I Contribute To My Self-Employed 401k Plan? 22.03.2022 · 3) Not deducting from operating income the 1/2 SE tax deduction, which also leads to over contributing. Excess Self-Employed 401k Contribution Withdrawn by April 15. If you over-contribute to your 401k, you have until April 15 of the next year to withdraw the excess amount. Your employer must amend your W-2 to show the returned amount as wages ...

16 Real Estate Tax Deductions for 2022 | 2022 Checklist Hurdlr Real estate agents can deduct legal and professional fees to the extent they are an ordinary part of and necessary to operations. Deduction #4 Show Detail Advertising Expense The IRS allows you to deduct reasonable advertising expenses that are directly related to your business activities. Deduction #5 Show Detail Home Office Deduction

Realtor Tax Deductions And Tips You Must Know - Easy Agent PRO Want our Realtor tax deduction worksheet? Check it out right here: Little-Known Realtor Tax Deductions One of the key strategies in getting better tax returns is starting New Years Day. Your tax strategy starts from day #1. Keep is simple and keep every single receipt for transactions starting today!

The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage.

PDF Realtors Tax Deduction Worksheet - FormsPal Realtors Tax Deduction Worksheet Due to the overwhelming response to last month's Realtor "tax tip" article, Daszkal Bolton LLP has created this Realtors' Tax Deduction Worksheet to assist our clients in becoming more organized for taking advantage of tax deductible business expenses.

› understanding-depreciationUnderstanding Depreciation Recapture Taxes on Rental Property Apr 03, 2020 · On our 2017 tax return, that $80,000 showed up as income on our tax return, pushing us from the 15% tax bracket to the 25% tax bracket. So when we calculated the depreciation recapture, we paid $20,000 in depreciation recapture taxes. As you can see, $20,000 tax payment for a $12,000 tax savings isn’t exactly “a wash.”

Daszkal Bolton Realtors Tax Deduction Worksheet - US Legal Forms Realtors Tax Deduction Worksheet Due to the overwhelming response to last month s Realtor tax tip article Daszkal Bolton LLP has created this Realtors Tax Deduction Worksheet to assist our clients in becoming more organized for taking advantage of tax deductible business expenses.

Free Rental Income and Expense Worksheet | Zillow Rental … 01.01.2021 · This worksheet, designed for property owners with one to five properties, has a section for each category of income and spending associated with managing a rental property. Appropriate sections are broken down by month and by property. Each section automatically calculates the totals to provide your gross income, net income and total expenses for the year. …

Top 20 Real Estate Agent Tax Deductions in 2021 - Bonsai If you use a company car, don't worry - the mileage will already be tracked for you. Standard mileage deduction involves you taking a cost per mileage driven for business purposes. For the tax year 2021, the standard mileage rate for use of a car (also vans, pickups, or panel trucks) is 56 cents per mile driven.

Tax Worksheets - CPA for Real Estate Agents Realtor Deductions Common deductions available for real estate agents as self employment expenses Rental Property Worksheet Record rental income and expenses by property for preparation of the schedule E. Self Employed Income and Expenses Document income and deductions available for Schedule C filers.

PDF Real Estate Agent/Broker - Finesse Tax Reduce your taxes by tracking your tax deductions ... Finesse Tax Accounting, LLC Real Estate Agent/Broker Do Your Taxes With Finesse 2035 2nd St. NW Suite G-102 Washington, DC 20001 Office: 240.417.7234 Mobile: 202.664.2490 Fax: 240.559.0990 Email: finessetax@gmail.com

Real Estate Agent Tax Deductions Worksheet 2021 Form - signNow Follow the step-by-step instructions below to design your rEvaltor tax deduction worksheet form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

› how-much-can-iHow Much Can I Contribute To My Self-Employed 401k Plan? Mar 22, 2022 · A self-employed 401k plan is a great way to save for retirement if you are an entrepreneur or solopreneur. A self-employed 401k plan is also know as a Solo 401k plan. This article will discuss how much you can contribute to your self-employed 401k plan. For 2021, the IRS says you can contribute up to $61,000 in your self-employed 401k plan. The amount should go up by $500 - $1,000 every one or ...

Home Sale Exclusion From Capital Gains Tax - The Balance 10.03.2022 · Keeping accurate records is key. Make sure your realtor knows that you qualify for the exclusion if you do, and provide proof if necessary. Otherwise, your realtor must issue you a Form 1099-S recording your profit and must send a copy to the IRS as well. This won't prevent you from claiming the exclusion, but it could complicate things, and ...

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

0 Response to "38 realtor tax deduction worksheet"

Post a Comment