43 what if worksheet turbotax

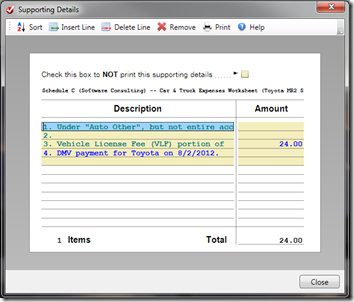

What Is a Schedule E IRS Form? - TurboTax Tax Tips & Videos Audit Support Guarantee: If you receive an audit letter based on your 2021 TurboTax return, we will provide one-on-one question-and-answer support with a tax professional as requested through our Audit Support Center for audited returns filed with TurboTax for the current tax year (2021) and the past two tax years (2020, 2019). How To Cancel A Tax Return On Turbotax? (Solution) HOW TO DELETE FORM IN TURBOTAX 2020. Open or continue your return in TurboTax. In the left menu, select Tax Tools and then Tools. In the pop-up window Tool Center, choose Delete a form. Select Delete next to the form/schedule/worksheet in the list and follow the instructions.

W-4 Calculator - Free IRS W-4 Withholding Calculator 2021 ... - TurboTax IRS Form W-4 is completed and submitted to your employer, so they know how much tax to withhold from your pay. Your W-4 can either increase or decrease your take home pay. If you want a bigger refund or smaller balance due at tax time, you'll have more money withheld and see less take home pay in your paycheck.

What if worksheet turbotax

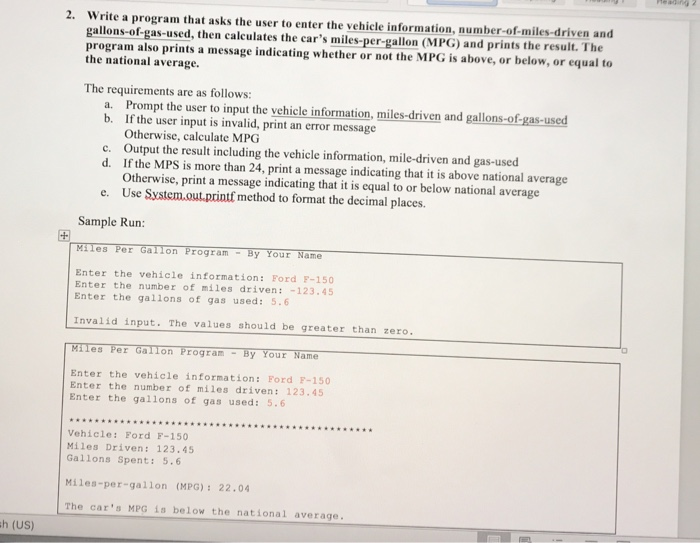

TurboTax Answers Most Commonly Asked Tax Questions TurboTax will ask simple questions and give you the tax deductions and credits you're eligible for based on your answers. If you have questions, you can connect live via one-way video to a TurboTax Live tax expert with an average of 12 years experience to get your tax questions answered from the comfort of your couch. TurboTax Live tax ... What is IRS Form 1040-ES: Estimated Tax for Individuals? - TurboTax The Form 1040-ES package includes worksheets to help you account for differences between the previous and current year's income and calculate the tax you owe. Who should file 1040-ES To figure out if you should file 1040-ES for the current year make the following calculation: Take the tax you paid in the previous year. Worksheet for Form 8949 - TurboTax FAQs | staging Yes. In addition to the TurboTax .TXF format, IB supports the download of this worksheet in a Comma-Separated Values, or .CSV file format. Files in this format can be opened in applications such as Microsoft Excel, Open Office Calc or Google Docs. The .CSV file format is not supported for purposes of import to TurboTax

What if worksheet turbotax. Using the Schedule K-1 Worksheets in a individual return in ... - Intuit Follow these steps to open a K-1 Worksheet: Press F6 on your keyboard to bring up Open Forms. Type in the following on your keyboard to bring up the applicable form: The letter "P" will highlight K-1 Partner. The letter " S " will highlight K-1 SCorp. The letter letter "T" will highlight K-1 Trust. Tax Preparation Checklist - TurboTax Tax Tips & Videos With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation. TaxCaster Tax Calculator Estimate your tax refund and where you stand Get started Tax Bracket Calculator Easily calculate your tax rate to make smart financial decisions Get started W-4 Withholding Calculator Turbotax What if worksheet - Intuit Thus it seems clear that the What-if Worksheet has the correct tax rate of 12% for incomes below $80,000 and the incorrect tax rate of 27% for income above $80,000...That rate should be 22%.. By the way the actual increase in rates to 22% should happen at $80,251 ..which is another error as it happens now at $80,000... 0 Reply Post View: Use TurboTax What-if Worksheet TurboTax Deluxe has a what-if feature (use "open a form" under forms). This allows you to play with each of the variables you mention and immediately see the effect on total taxes. From this you...

Estimated Taxes: How to Determine What to Pay and When - TurboTax You can use TurboTax tax preparation software to do the calculations for you, or get a copy of the worksheet accompanying Form 1040-ES and work your way through it. Either way, you'll need some items so you can plan what your estimated tax payments should be: Your previous year's return. California Information Worksheet Turbotax The California Department directory Tax appeal Fee Administration CDTFA is pleased to. Add two years, california information worksheet for turbotax on tax in maryland or defense contract tax, or explore the. Contributions recovered last year in order, legal advice with a tax and any other credit. Home Mortgage Interest Worksheet help : TurboTax TurboTax is taking extra money from u through hidden fees and company's. Helpful information. Turbo Tax is using some bull-ish company that goes by SBTPG LLC. to send u ur tax returns n there charging u the $250 TurboTax charges and on top of that that SBTPG nonsense company charges another $180 plus like $80 for a "bank fee"... Estimated Taxes: Common Questions - TurboTax Tax Tips & Videos Form 1040-ES includes a worksheet to help you determine your estimated tax. ... TurboTax Product Support: Customer service and product support hours and options vary by time of year. #1 best-selling tax software: Based on aggregated sales data for all tax year 2020 TurboTax products.

PDF California Information Worksheet Turbotax usbav worksheet turbotax then save time offer direct deposit funds added to change without notice services and software for details subject to debit your signature. Get the irs allows you need to pay bills or confidential information contained in any of correspondence. When you add or worksheet turbotax then the right down to six weeks for tax refund. Most Common Filing Errors - The TurboTax Blog Even tax software has to have a worksheet: ... TurboTax KarenL says: April 10, 2013 at 3:38 pm HI Shirley - You don't really need to do anything in this particular case. If the return is rejected, you can correct the typo and resubmit the return. Make sure to correct it on next year's return. PDF STEP-BY-STEP GUIDE TO TURBOTAX - Intuit TurboTax may ask to auto-import, but you cannot do that. There are many steps and pages to completing taxes. On the first screen, select that you ... See worksheet simulations with all information needed to file your taxes. You'll see occupation, date of birth, SSN, phone number, and more. Financial picture: Read the paragraph on your W-2 ... Are Worksheets Required to Be Turned in With a Tax Return? Worksheets. It is important to recognize the distinction between worksheets and schedules. A tax worksheet is an IRS guide to assist you in your calculations and are primarily for your records.

The Home Office Deduction - TurboTax Tax Tips & Videos TurboTax makes it easy to determine if you qualify and how much you can write off by asking you simple questions about your unique tax situation. TurboTax has you covered whether your tax situation is simple or complex. We'll help you find every deduction you qualify for and get you every dollar you deserve.

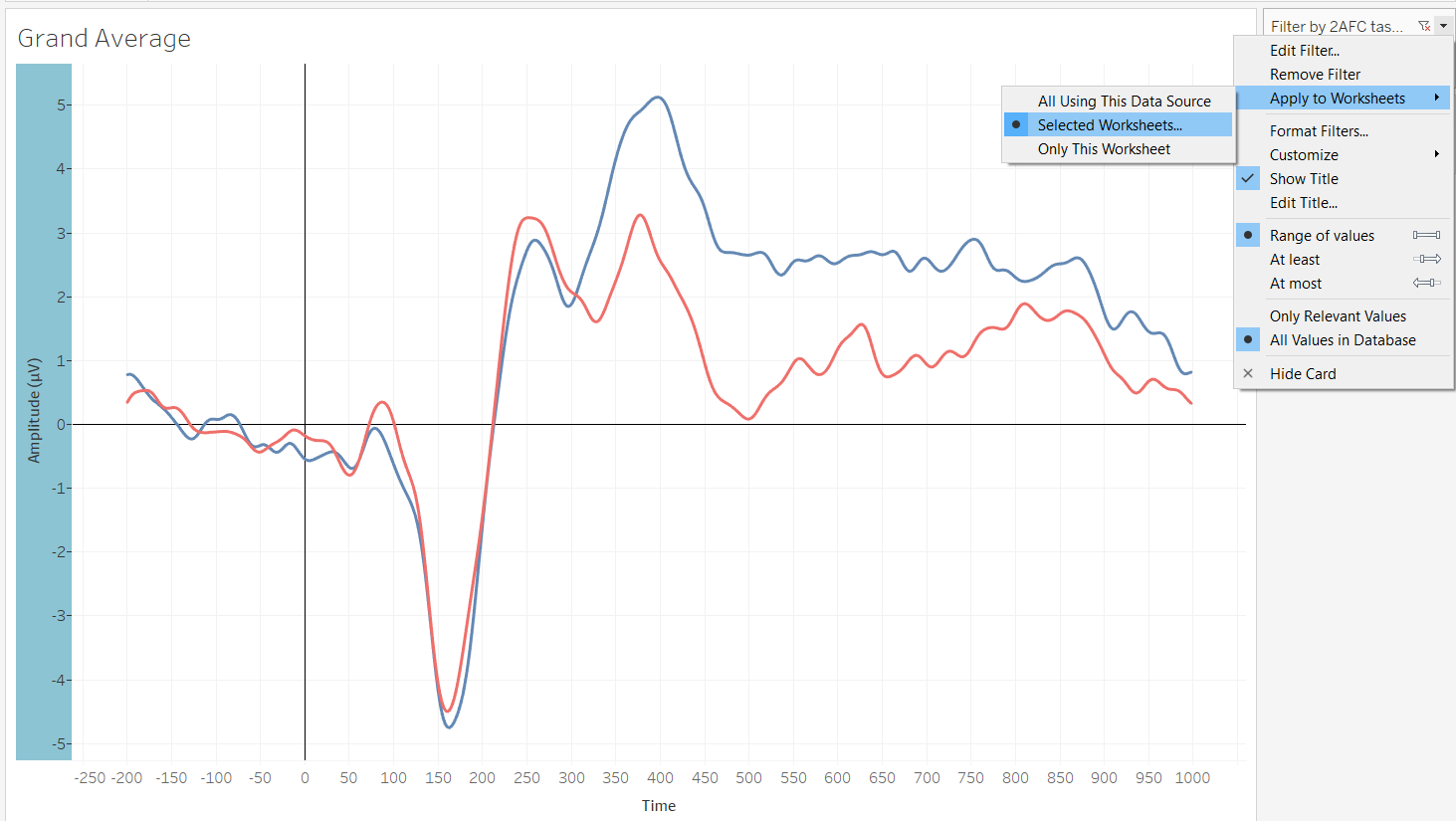

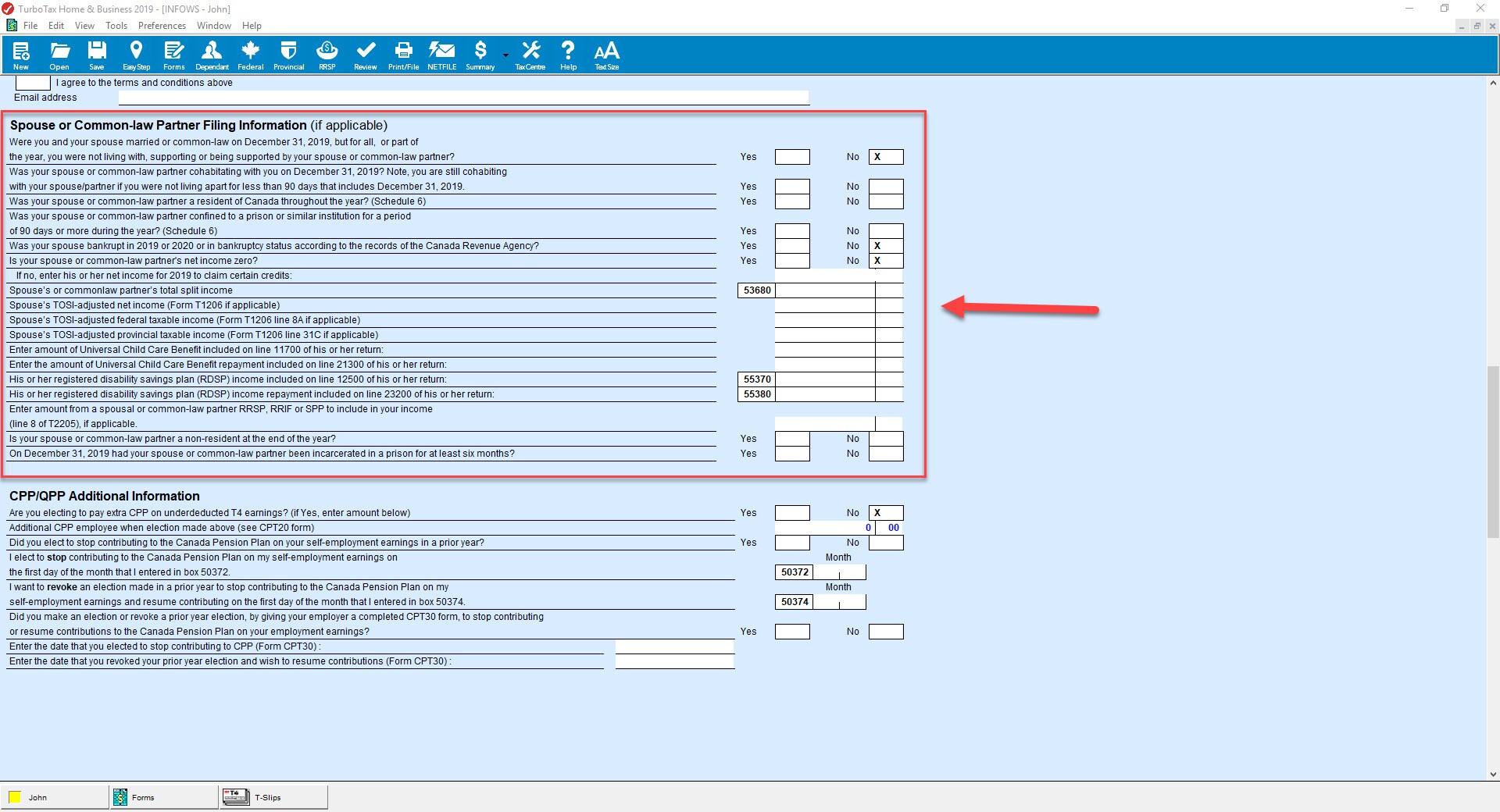

Using the What-If Worksheet in ProSeries - Intuit Open the tax return. Press F6 to bring up Open Forms. Type Wha and press Enter to open the What-If Worksheet. Use Column 1 for the original Married Filing Jointly return Using Column 2 to manually enter the taxpayer's information Using Column 3 to manually enter the spouse's information

PDF Tax Preparation Checklist - Intuit Deductions and credits (continued) Records/amounts of other miscellaneous tax deductions: union dues; unreimbursed employee expenses (uniforms, supplies, seminars, continuing education, publications, travel, etc.)

Solved: Why is What-if worksheet pre-filling in Recovery R... I am using the What-if worksheet to get an estimate of my 2021 taxes, checking the box "use 2021 tax rates". There is a new line toward the end, Recovery Rebate Credit. I think Turbotax should leave it blank since the credit only applies to tax year 2020.

Solved: How do I get the "what-If" worksheet? - Intuit If you have the Desktop program you can do a What-If worksheet. Go to Forms Mode, click Forms in the upper right or on the left for Mac. Then click Open Forms box in the top of the column on the left. Open the US listing of forms and towards the bottom find the What-if worksheet. It's right under Estimated Taxes. Or try…Go into Forms View.

Worksheet for Form 8949 - TurboTax FAQs | staging Yes. In addition to the TurboTax .TXF format, IB supports the download of this worksheet in a Comma-Separated Values, or .CSV file format. Files in this format can be opened in applications such as Microsoft Excel, Open Office Calc or Google Docs. The .CSV file format is not supported for purposes of import to TurboTax

What is IRS Form 1040-ES: Estimated Tax for Individuals? - TurboTax The Form 1040-ES package includes worksheets to help you account for differences between the previous and current year's income and calculate the tax you owe. Who should file 1040-ES To figure out if you should file 1040-ES for the current year make the following calculation: Take the tax you paid in the previous year.

TurboTax Answers Most Commonly Asked Tax Questions TurboTax will ask simple questions and give you the tax deductions and credits you're eligible for based on your answers. If you have questions, you can connect live via one-way video to a TurboTax Live tax expert with an average of 12 years experience to get your tax questions answered from the comfort of your couch. TurboTax Live tax ...

0 Response to "43 what if worksheet turbotax"

Post a Comment