40 va loan calculation worksheet

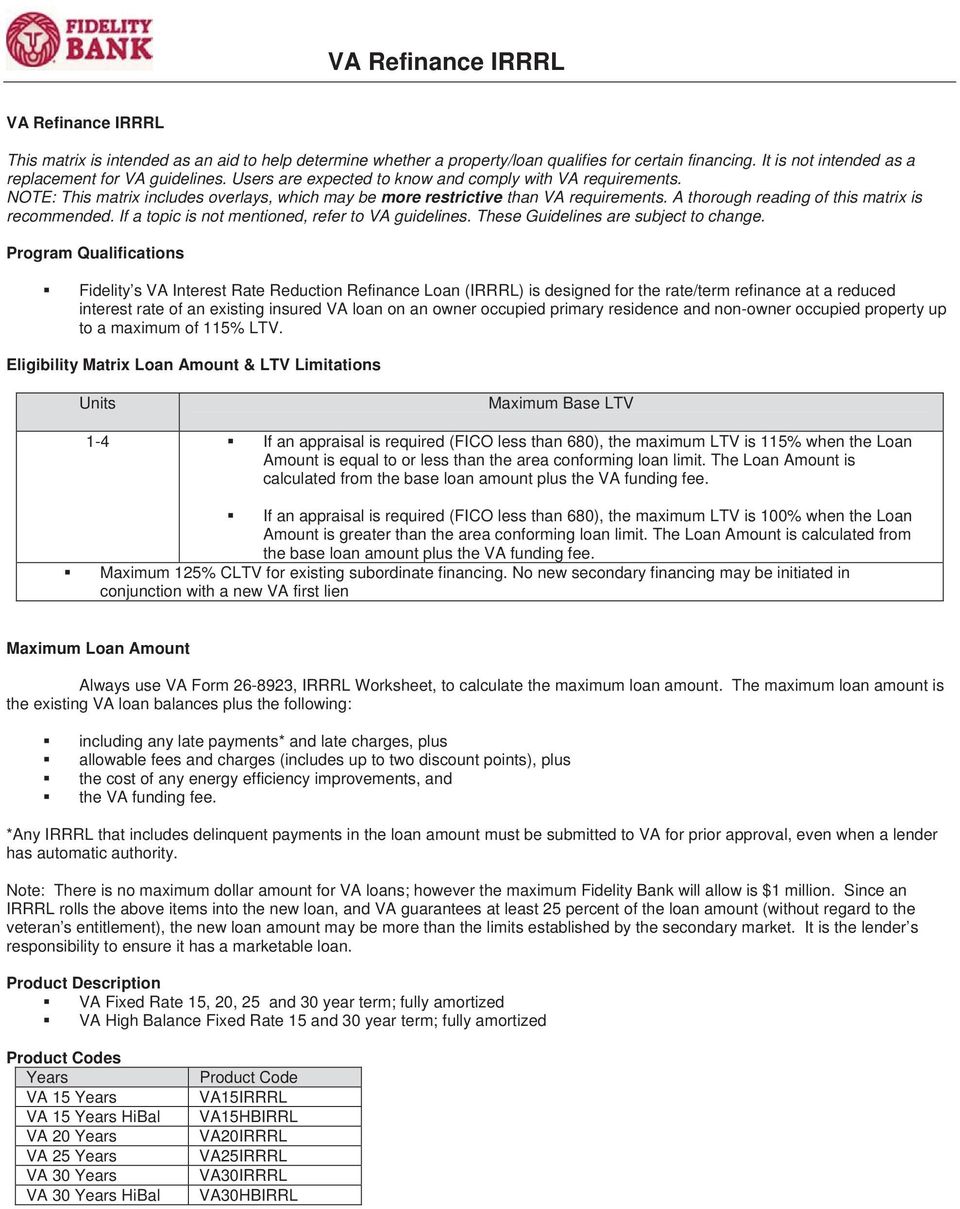

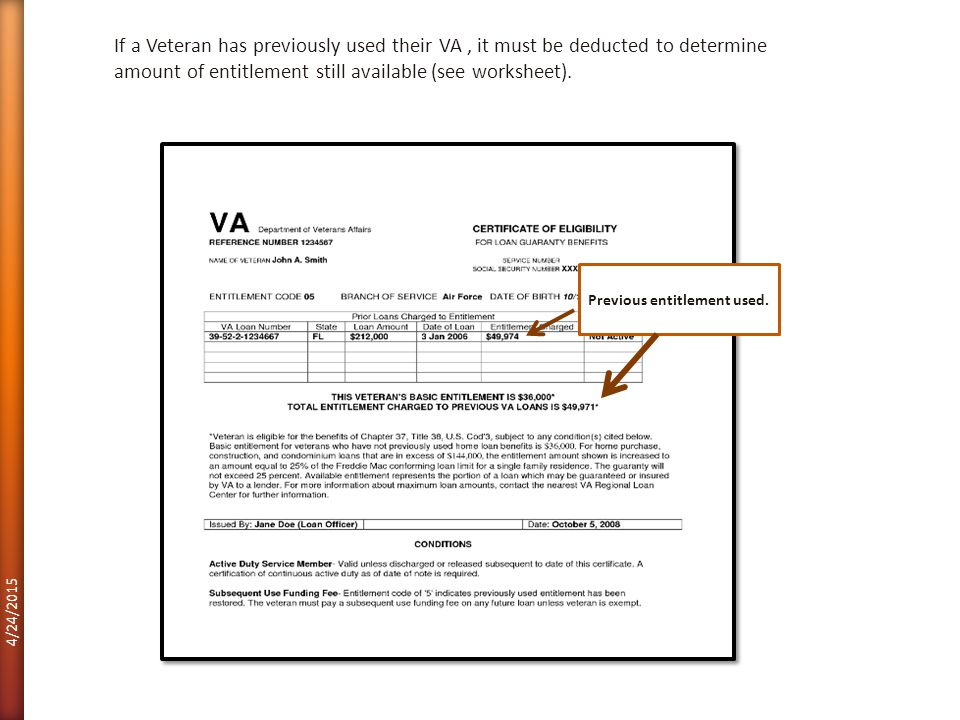

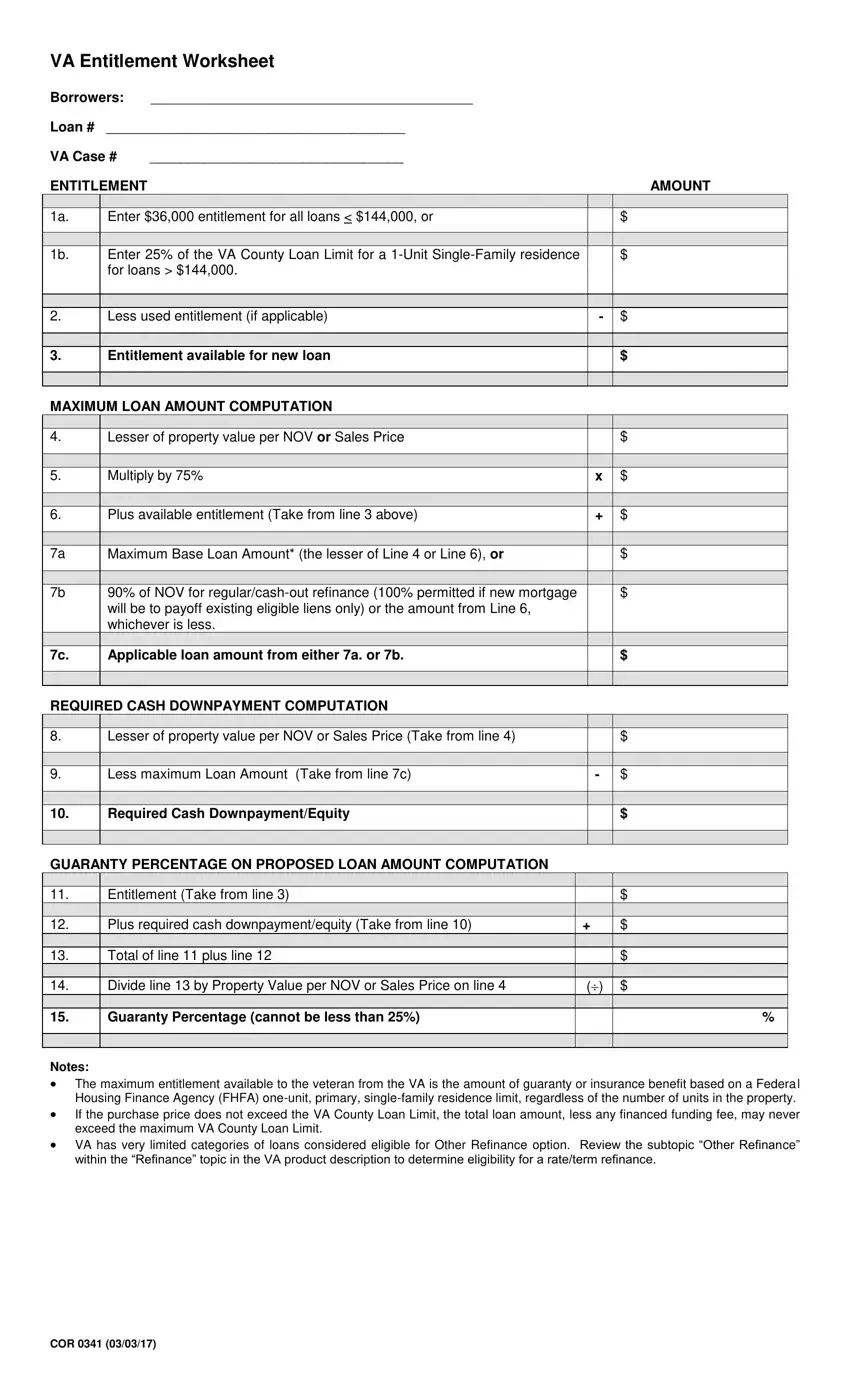

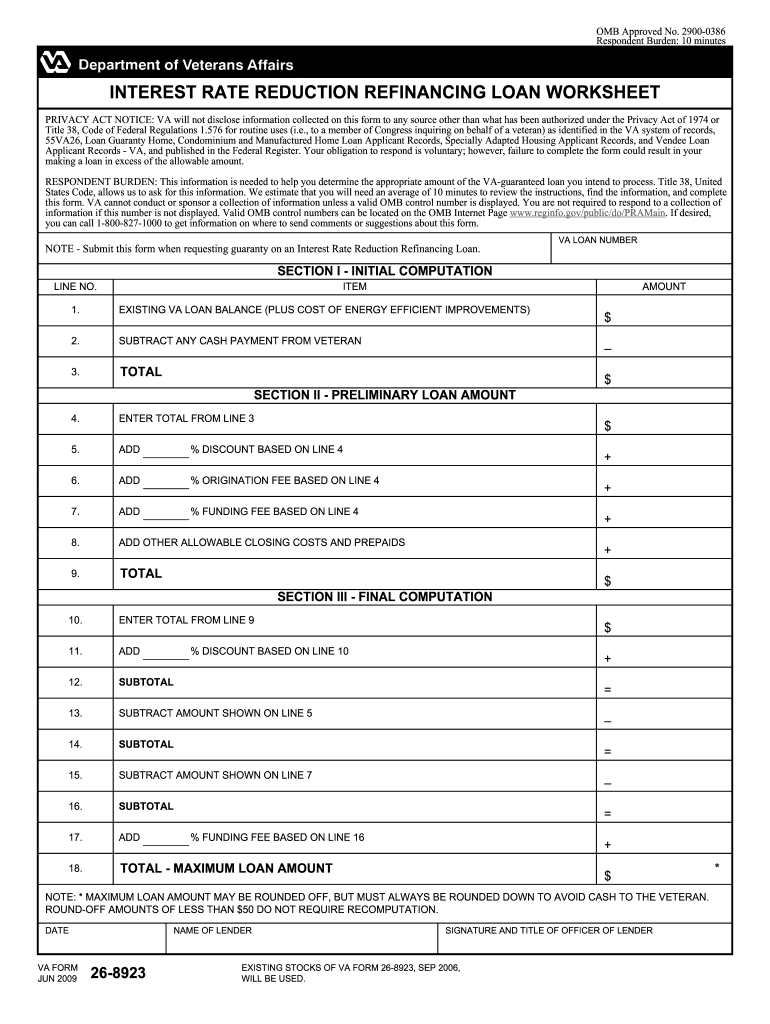

HB-1-3555 CHAPTER 9: INCOME ANALYSIS - USDA Rural … loan closing must be updated or re-verified to support applicant/household eligibility. Lenders must verify the income for each applicant and adult household member (excluding eligible full- time students age 18 and above) through one of the following documentation methods. Refer to Attachment 9-A for documentation and verification options that are acceptable to support … Chapter 3. The VA Loan and Guaranty Overview - Veterans Affairs IRRRLs • Existing VA loan balance, plus • The cost of any energy efficiency improvements up to $6,000, plus • Allowable fees and charges, plus • Up to two discount points, plus • VA funding fee. (Lenders must use VA Form 26-8923, IRRRL Worksheet, for the actual calculation.) Continued on next page

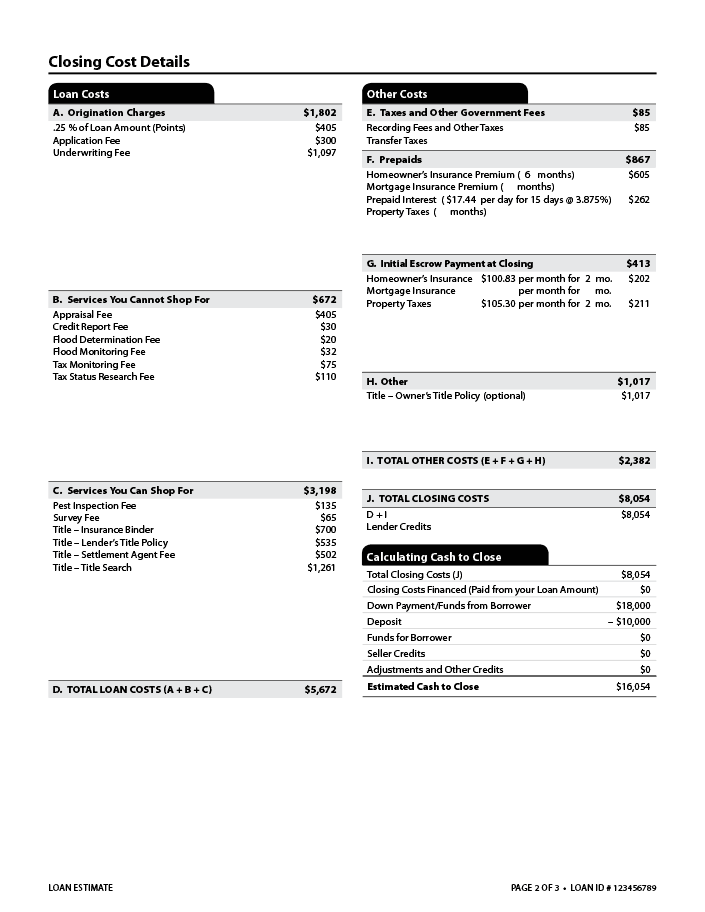

Chapter 8. Borrower Fees and Charges and the VA Funding Fee … veteran a flat charge not to exceed one percent of the loan amount. Calculate the one percent on the principal amount after adding the funding fee to the loan, if the funding fee is paid from loan proceeds (except Interest Rate Reduction Refinancing Loans (IRRRLs). Note: For IRRRLs, use VA Form 26-8923, IRRRL Worksheet, for the calculation.

Va loan calculation worksheet

https www artbreeder com browse - axh.lizetthielemans.nl If your DTI is at 43%, you now must have a residual income of $1,203 to be approved for a VA loan. Understanding your debt-to-income ratio and residual income balance can be difficult.. If the hours are consistent, and the VA lender will verify this by reviewing paycheck stubs covering at least a 30 day period, the gross monthly income used for qualifying is $2,000 X 26 (weeks. Va … Publication 590-A (2021), Contributions to Individual Retirement ... The Instructions for Form 1040 include a similar worksheet that you can use instead of the worksheet in this publication. ... Plan loan offset. A plan loan offset is the amount your employer plan account balance is reduced, or offset, to repay a loan from the plan. How long you have to complete the rollover of a plan loan offset depends on what kind of plan loan offset you have. … What Are Mortgage Points and How Do They Work? - Better … * Maximum income and loan amount limits apply. Fixed-rate mortgages (no cash out refinances), primary residences only. Certain property types are ineligible. Maximum loan-to-value (“LTV”) is 97%, and maximum combined LTV is 105%. For LTV >95%, any secondary financing must be from an approved Community Second Program. Homebuyer education may ...

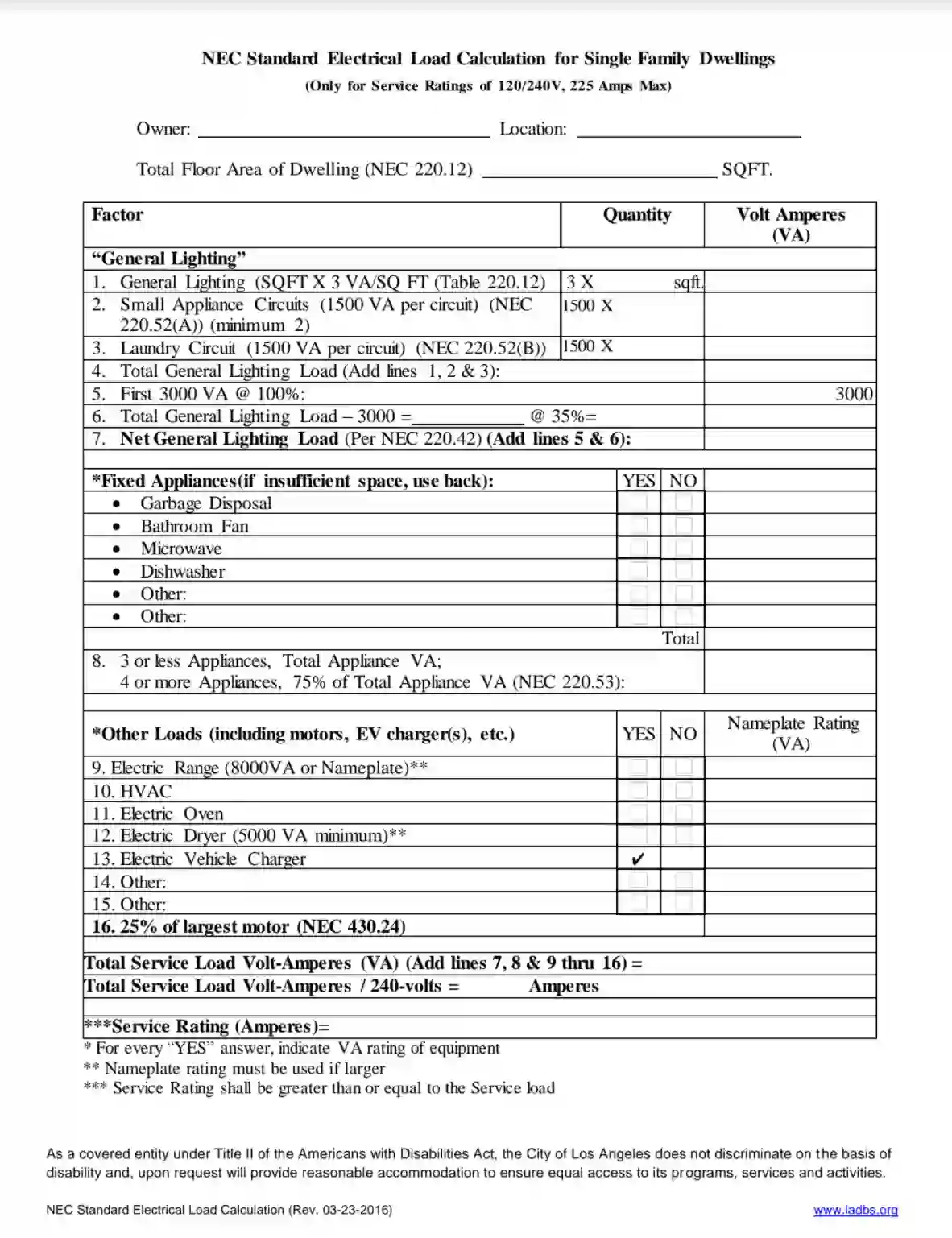

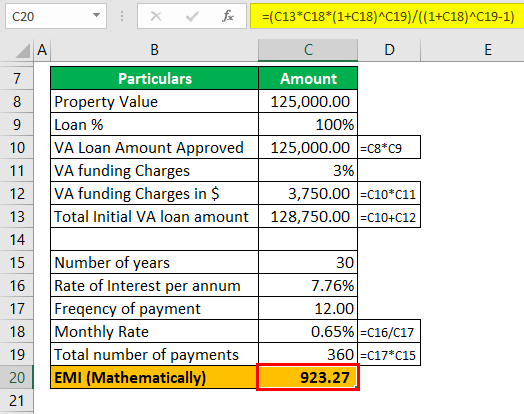

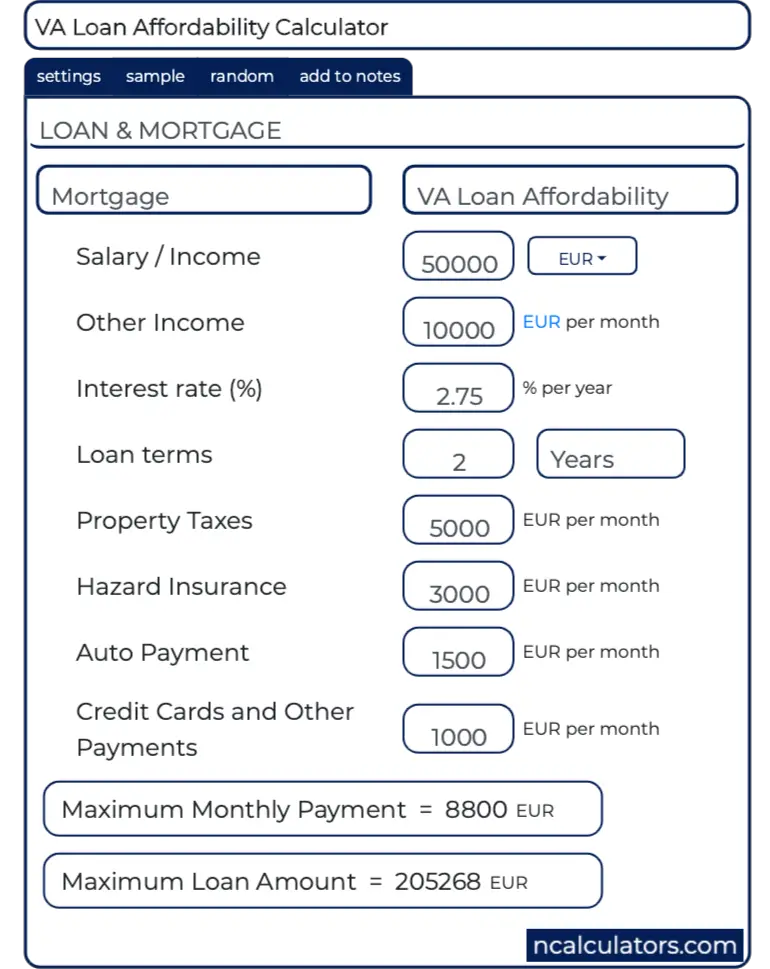

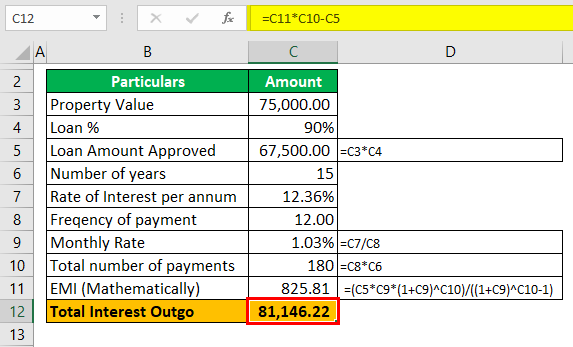

Va loan calculation worksheet. LADBS NEC Standard Electrical Load Calculation - FormsPal If the number of units is four or more, you are to multiply the total VA by 0.75 and enter the product in line 8. Indicate the Load of Other Equipment. Like in the preceding section, you are to select either the ‘Yes ‘ or ‘No’ box. If you check the ‘Yes’’ box, include the VA rating (or installed capacity). If you have the ... Publication 970 (2021), Tax Benefits for Education | Internal … Student loan interest deduction. For 2021, the amount of your student loan interest deduction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). You can’t claim the deduction if your MAGI is $85,000 or more ($170,000 or more if you file a joint return). You can’t deduct as interest on a student loan any … Microsoft Excel Mortgage Calculator with Amortization Schedule By default this calculator is selected for monthly payments and a 30-year loan term. A person could use the same spreadsheet to calculate weekly, biweekly or monthly payments on a shorter duration personal or auto loan. Some of Our Software Innovation Awards! Since its founding in 2007, our website has been recognized by 10,000's of other websites. VA Loan Affordability Calculator - How Much Can I Borrow? The VA loan affordability calculator is set to the top end of the VA's recommended DTI ratio of 41 percent. Learn more about how we calculate affordability below. Annual Income. Income that may count towards a VA loan must be stable and reliable. Stable and reliable generally includes sources such as your salary, spouse's salary, pension/retirement, part-time income and …

What Are Mortgage Points and How Do They Work? - Better … * Maximum income and loan amount limits apply. Fixed-rate mortgages (no cash out refinances), primary residences only. Certain property types are ineligible. Maximum loan-to-value (“LTV”) is 97%, and maximum combined LTV is 105%. For LTV >95%, any secondary financing must be from an approved Community Second Program. Homebuyer education may ... Publication 590-A (2021), Contributions to Individual Retirement ... The Instructions for Form 1040 include a similar worksheet that you can use instead of the worksheet in this publication. ... Plan loan offset. A plan loan offset is the amount your employer plan account balance is reduced, or offset, to repay a loan from the plan. How long you have to complete the rollover of a plan loan offset depends on what kind of plan loan offset you have. … https www artbreeder com browse - axh.lizetthielemans.nl If your DTI is at 43%, you now must have a residual income of $1,203 to be approved for a VA loan. Understanding your debt-to-income ratio and residual income balance can be difficult.. If the hours are consistent, and the VA lender will verify this by reviewing paycheck stubs covering at least a 30 day period, the gross monthly income used for qualifying is $2,000 X 26 (weeks. Va …

0 Response to "40 va loan calculation worksheet"

Post a Comment