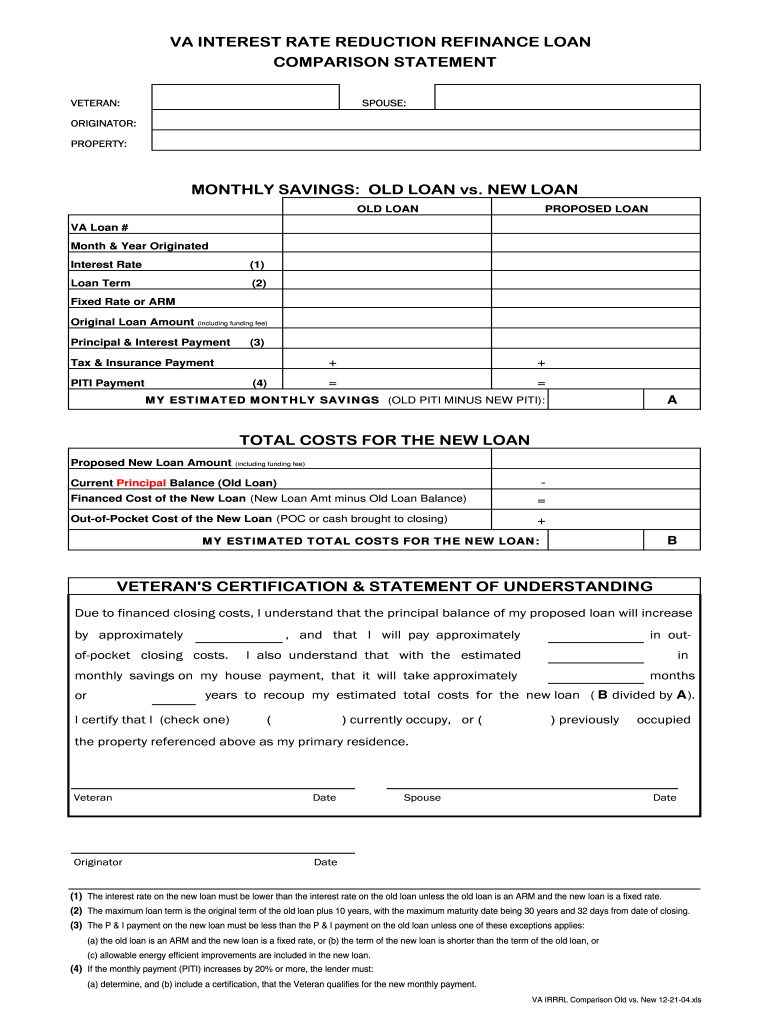

38 interest rate reduction refinance loan worksheet

Simple loan calculator and amortization table Just enter the loan amount, interest rate, loan duration, and start date into the Excel loan calculator. It will calculate each monthly principal and interest cost through the final payment. Great for both short-term and long-term loans, the loan repayment calculator in Excel can be a good reference when considering payoff or refinancing. Agency Information Collection Activity: Interest Rate Reduction ... May 17, 2021 ... In compliance with the Paperwork Reduction Act (PRA) of 1995, ... Title: Interest Rate Reduction Refinancing Loan Worksheet (VA Form ...

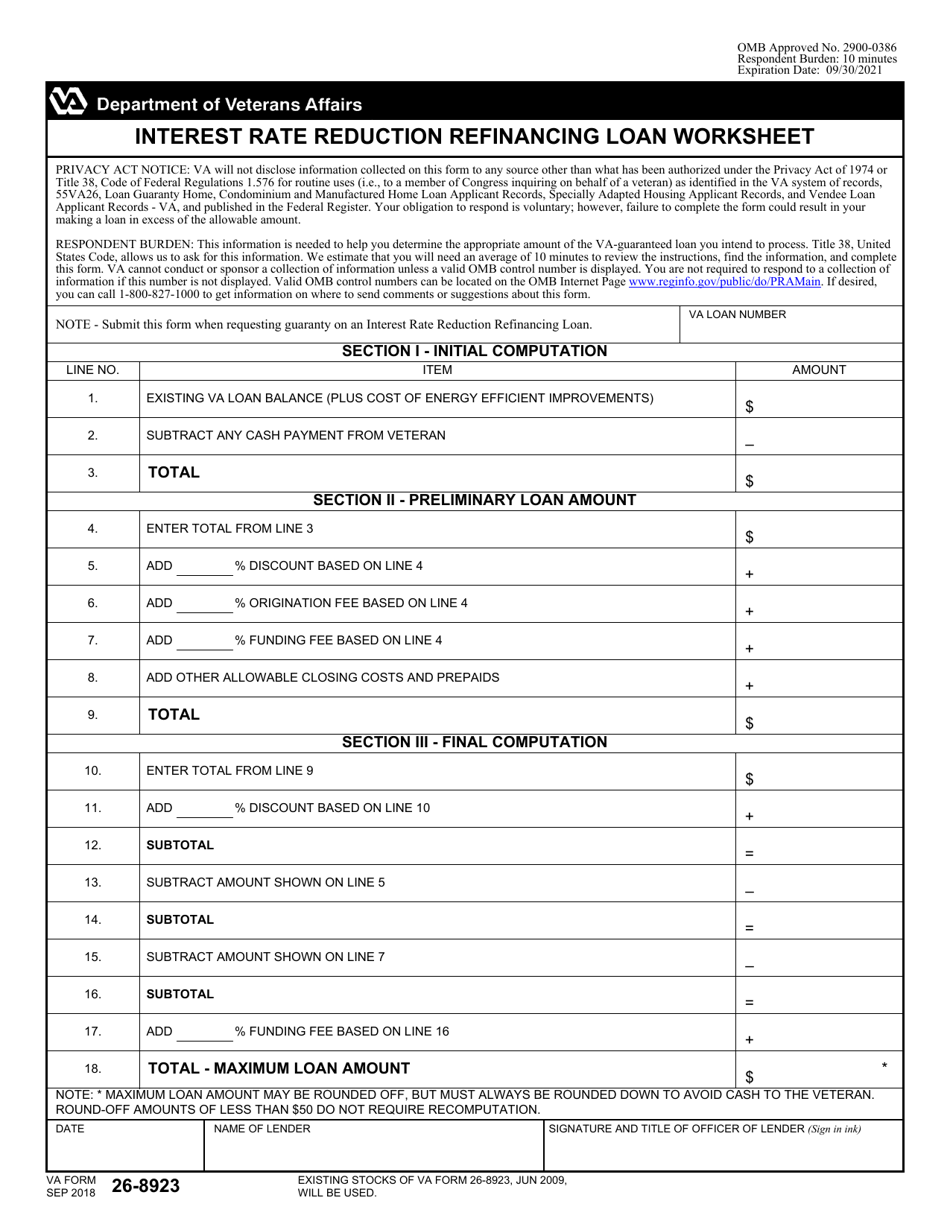

Interest Rate Reduction Refinancing Loan Worksheet (VA Form 26 ... VA Form 22-8923 is used by lenders for completing the funding fee and maximum permissible loan amounts for interest rate reduction refinancing loans to ...

Interest rate reduction refinance loan worksheet

Publication 936 (2021), Home Mortgage Interest Deduction Home mortgage interest. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($500,000 if married filing separately)) apply if you are deducting mortgage interest from indebtedness incurred before December 16, 2017. Future developments. › publications › p537Publication 537 (2021), Installment Sales | Internal Revenue ... The test rate of interest for a contract is the 3-month rate. The 3-month rate is the lower of the following applicable federal rates (AFRs). The lowest AFR (based on the appropriate compounding period) in effect during the 3-month period ending with the first month in which there’s a binding written contract that substantially provides the ... Interest Rate Reduction Refinance Loan | Veterans Affairs Interest rate reduction refinance loan If you have an existing VA-backed home loan and you want to reduce your monthly mortgage payments—or make your payments more stable—an interest rate reduction refinance loan (IRRRL) may be right for you. Refinancing lets you replace your current loan with a new one under different terms.

Interest rate reduction refinance loan worksheet. The Best Free Debt-Reduction Spreadsheets - The Balance The author of the spreadsheet and the Squawkfox blog, Kerry Taylor, paid off $17,000 in student loans over six months using this downloadable Debt Reduction Spreadsheet. 1 Start by entering your creditors, current balance, interest rates, and monthly payments to see your current total debt, average interest rate, and average monthly interest paid. VA Clarifies and Establishes Requirements with respect to ... - TENA existing loan balance allowable, Interest Rate Reduction Refinancing Loan Worksheet, maximum allowable closing costs, maximum loan amount, principal reduction from veteran VA issued Circular 26-17-12, clarifying and establishing requirements with respect to completion of VA Form 26-8923 (Interest Rate Reduction Refinancing Loan Worksheet). Agency Information Collection Activity: Interest Rate Reduction ... The purpose is to consolidate information collection requirements applicable only for interest rate reduction refinance loans (IRRRLs) under one information collection package. An agency may not conduct or sponsor, and a person is not required to respond to a collection of information unless it displays a currently valid OMB control number. What Is A Tangible Net Benefit? | Rocket Mortgage 22/08/2022 · An FHA Streamline refinance allows those who have an existing Federal Housing Administration (FHA) loan to do a rate/term refinance into another FHA loan for the purposes of a lower interest rate, modified mortgage term and/or a lower mortgage insurance rate.. FHA Streamline refinances come with lower mortgage insurance rates. When you do an FHA …

Publication 537 (2021), Installment Sales | Internal Revenue Service The consideration remaining after this reduction must be allocated among the various business assets in a certain order. For asset acquisitions occurring after March 15, 2001, make the allocation among the following assets in proportion to (but not more than) their FMVs on the purchase date in the following order. Certificates of deposit, U.S. Government securities, … › learn › tangible-net-benefitsWhat Is A Tangible Net Benefit? | Rocket Mortgage Aug 22, 2022 · VA Streamlines (also referred to as the Interest Rate Reduction Refinance Loans, or IRRRLs) are refinances of existing Department of Veterans Affairs (VA) loans to help lower the interest rate or change your term. As with an FHA Streamline, in a VA Streamline, you’re paying off your existing VA loan and taking on a new one under different terms. INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET. RESPONDENT BURDEN: VA may not conduct or sponsor, and respondent is not required to respond to this ... About VA Form 26-8923 | Veterans Affairs About VA Form 26-8923. Form name: Interest Rate Reduction Refinancing Loan Worksheet. Related to: Housing assistance. Form last updated: June 2022.

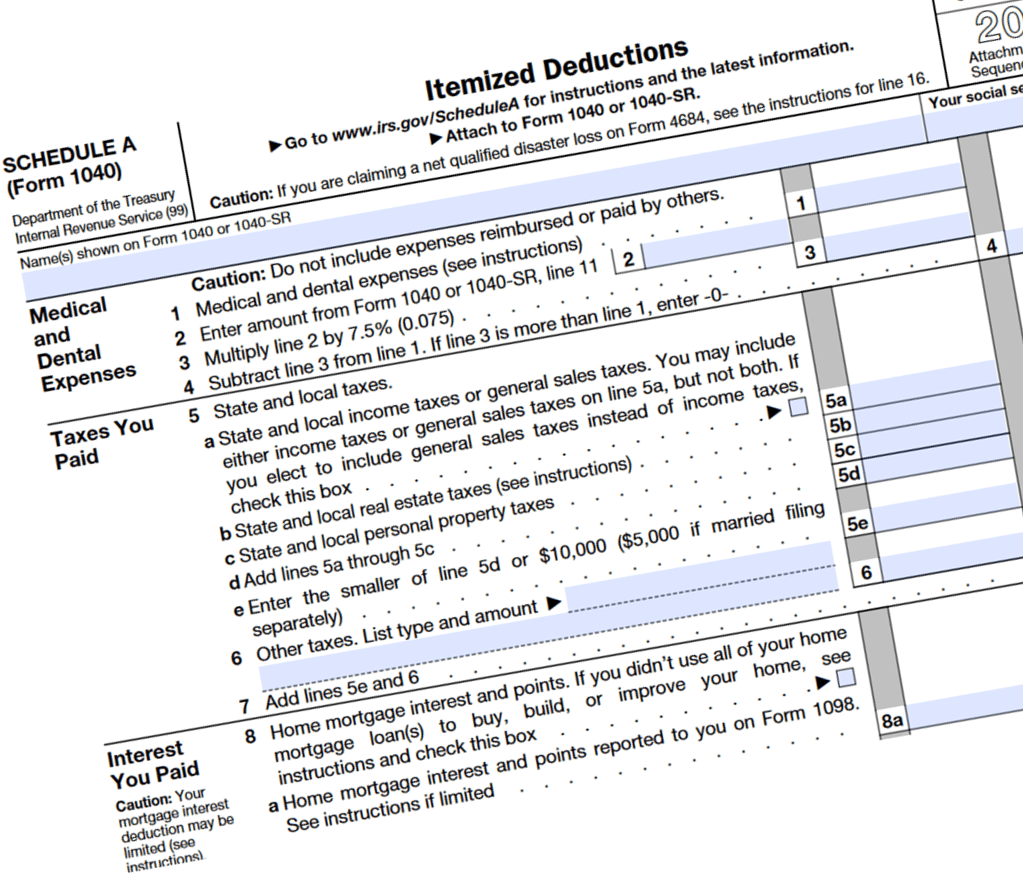

8396 Mortgage Interest Credit - IRS tax forms Worksheet B in the Instructions for Schedule 8812 (Form 1040), include the amount from line 14 of Credit Limit Worksheet B instead of the amount from Form 1040, 1040-SR, or 1040-NR, line 19. Part II—Mortgage Interest Credit Carryforward to 2022 If the amount on line 9 is less than the amount on line 7, you may PDF Interest Rate Reduction Refinance Loan - Federal Deposit Insurance ... Rate Reduction Refinance Loan (IRRRL) generally lowers the interest rate by refinancing an existing VA home loan. By obtaining a lower interest rate, the monthly mortgage payment should decrease. Eligible borrowers can also refinance an adjustable-rate mort - gage (ARM) into a fixed-rate mortgage. PDF Policy Guidance for VA Interest Rate Reduction Refinance Loans (IRRRL) in their best interest. 3. Action. Starting with loans closed on and after April 1, 2018, lenders should: a. Provide the Veteran's Statement and Lender Certification (note: lender certification only ... Interest Rate Reduction Refinancing Loan Worksheet, at the point of requesting the LGC. Again, more information about system enhancements ... Reducing Balance Method of Loan Calculation: Online ... - GETMONEYRICH The loan calculations will be as below: Things to note in the above calculation: Interest Payable: The total interest payable calculation is simple. But on downside, this simplicity makes the 'fixed interest loans' expensive for the borrowers. Calculation: Rs.1,00,000 x 8.5% x 1 year = Rs.8,500.

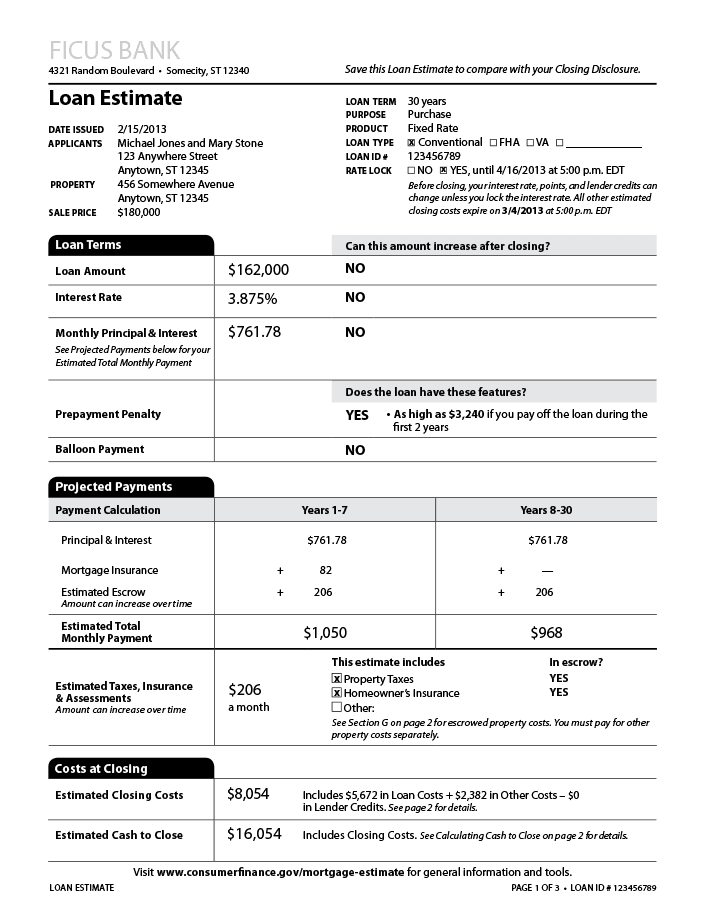

What Are Mortgage Points and How Do They Work? - Better … Mortgage points, also known as discount points, are fees a homebuyer pays directly to the lender (usually a bank) in exchange for a reduced interest rate. This is also called “buying down the rate.” Essentially, you pay some interest up front in exchange for a lower interest rate over the life of your loan. Each point you buy costs 1 ...

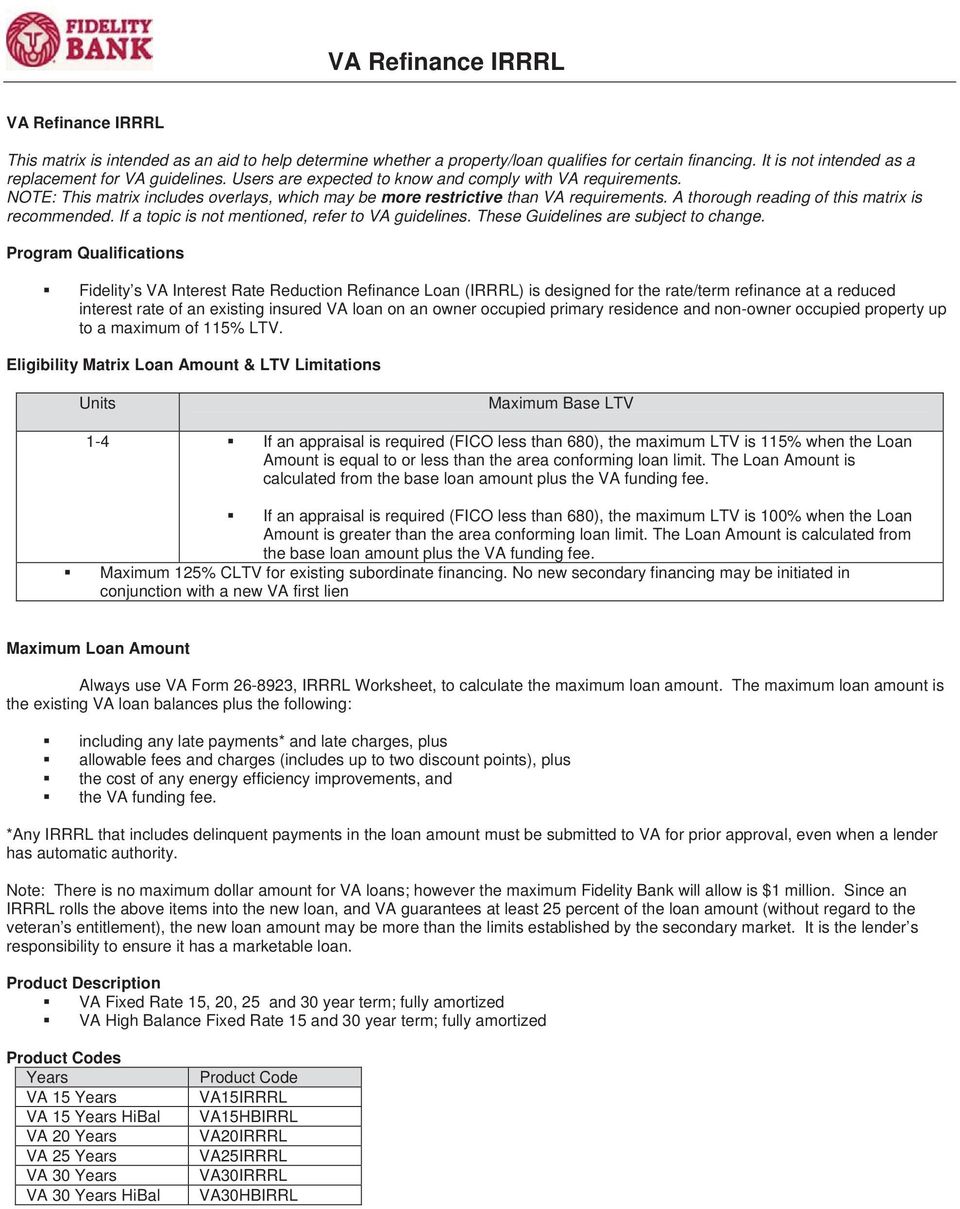

The interest rate reduction refinance loan (IRRRL) for VA mortgages ... The VA-guaranteed Interest Rate Reduction Refinance Loan (IRRRL) ... VA Form 26-8923, the IRRRL Worksheet, is used to calculate the maximum mortgage amount available on an IRRRL. The maximum mortgage amount is the existing VA mortgage balance, plus: late fees and late charges, if the mortgage is past due; ...

PDF INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET - Veterans Affairs section ii - preliminary loan amount $ add other allowable closing costs and prepaids. 9. 10. + add % funding fee based on line 4. 11. total € note: * maximum loan amount may be rounded off, but must always be rounded down to avoid cash to the€ veteran. round-off amounts of less than $50 do not require recomputation. _ date. name of lender

SUPPORTING DTATEMENT FOR VA FORM 26-8923 - RegInfo.gov ... Loan (IRRRL) Worksheet, on all interest rate reduction refinancing loans and submit the form in the loan file when selected by VA for quality review.

Agency Information Collection Activity: Interest Rate Reduction ... Title: Interest Rate Reduction Refinancing Loan Worksheet (VA 26-8923). OMB Control Number: 2900-0386. Type of Review: Revision. Abstract: VA is revising this information collection to incorporate regulatory collection requirements previously captured under OMB control number 2900-0601. The purpose is to consolidate information collection ...

Originate & Underwrite - Freddie Mac .pdf Interest Rate Cap Options for Floating-Rate Cash Loans 02/19/2016 .pdf Supplemental Loans: Top 10 Tips 02/09/2016 .pdf Defeasance: An Attractive Alternative to Yield Maintenance 05/20/2015 .pdf Comparison of Fixed-Rate Note (Defeasance) to Floating-Rate Note 05/08/2014 .pdf Comparing our Securitization and Portfolio Executions - TAH 03/19/2014 .pdf Loan …

What Is the Snowball Method and How Does It Work? - Debt.org 09/01/2018 · Find a solution that offers a lower interest rate and monthly payments that you can afford. The reasoning behind Solution No. 1 isn’t difficult: Unless it’s the debt with the smallest balance — putting it first on your list — the longer a debt with the highest interest rate is allowed to fester, the higher the total will be when you finally get around to it.

PDF Interest Rate Reduction Refinance Loan Worksheet - Veterans Affairs regarding the completion of VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet, effective for all Interest Rate Reduction Refinance L oan (IRRRL) applications originated (initial Fannie Mae Form 1003 application date) on or after July 2, 2017. 2. Background. VA has received many inquiries from mortgage lenders on the proper ...

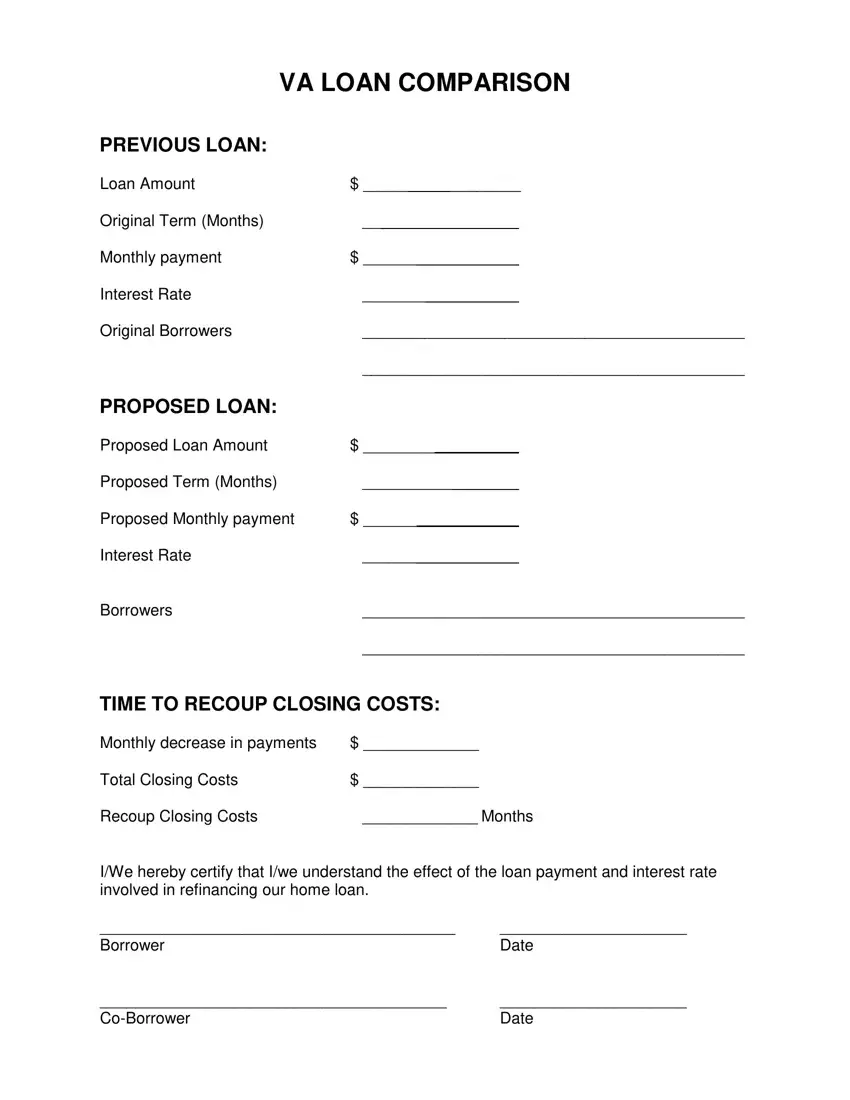

VA Interest Rate Reduction Refinance Loans (IRRRL) For example, if the costs and fees to close on an IRRRL come out to $4,000 and the new loan saves the homeowner $125 per month, the time to recoup those upfront expenses would be 32 months (4,000 / 125 = 32). At Veterans United, the time to recoup costs and fees must be 36 months or less. This calculation does not include escrow funds.

PDF A Quick Guide to Interest Rate Reduction *The loan origination fee is limited to 1% . of the loan amount. The lender may charge . this flat fee or itemize the following fees . not to exceed 1%: - Application and Processing Fees - Document Preparation Fee - Loan Closing or Settlement Fee - Notary Fees - Interest Rate Lock-In Fee - Tax Service Fee - Reconveyance Fees

benefits.va.gov › WARMS › docsChapter 3. The VA Loan and Guaranty Overview - Veterans Affairs • To refinance an existing VA-guaranteed or direct loan for the purpose of a lower interest rate. • To refinance an existing mortgage loan or other indebtedness secured by a lien of record on a residence owned and occupied by the veteran as a home. • To repair, alter, or improve a residence owned by the veteran and occupied as a home.

VA Rate Reduction Form Changes - Summit Help Knowledge Base - Confluence VA Circular 26-17-12 clarifies the VA requirements regarding the completion of VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet, effective for all Interest Rate Reduction Refinance Loan (IRRRL) applications originated (initial Fannie Mae Form 1003 application date) on or after July 2, 2017. This Circular clarifies that the ...

Chapter 3. The VA Loan and Guaranty Overview - Veterans Affairs • Points may not be financed in the loan except with Interest Rate Reduction Refinancing Loans (IRRRLs). 6 and 7 of this chapter Purpose of Guaranty To encourage lenders to make VA loans by protecting lenders/loan holders against loss, up to the amount of guaranty, in the event of foreclosure. 11 of this chapter Underwriting Flexible standards. The veteran must have: • …

VA IRRRL Worksheet - What is it and How Do I Use It? In order to get VA approval and a VA guarantee for your Interest Rate Reduction Refinance Loan, your lender must fill out and accurately complete a VA IRRRL worksheet. The worksheet is quite simple and shouldn't take more than a few minutes for an experienced VA expert, like those at Low VA Rates, to fill out.

Mortgage refinancing drops to a 22-year low - cnbc.com The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 6.52% from 6.25% Applications to refinance a home loan dropped 11% ...

Microsoft Excel Mortgage Calculator with Amortization Schedule loan term in years - most fixed-rate home loans across the United States are scheduled to amortize over 30 years. Other common domestic loan periods include 10, 15 & 20 years. Some foreign countries like Canada or the United Kingdom have loans which amortize over 25, 35 or even 40 years.

Supporting Dtatement for Va Form 26-8923 - Reginfo.gov 2. Lenders are required to complete VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet, on all interest rate reduction refinancing loans and submit the form in the loan file when selected by VA for quality review.

VA IRRRL Cost Recoupment Worksheet VA IRRRL Cost Recoupment Worksheet This worksheet is REQUIRED for all VA Interest Rate Reduction Refinance loans. File Name: Loan Number: MONTHS TO RECOUP The following calculates the total number of months to recoup all fees and charges financed as part of ... If the IRRRL reduces the loan term or converts an existing ARM to a fixed rate ...

VA Provides Instructions for Completion of VA Form 26-8923, Interest ... VA Provides Instructions for Completion of VA Form 26-8923, Interest Rate Reduction Refinance Loan Worksheet 19 Apr 2017 In their Circular 26-17-12 dated April 12, 2017, the Department of Veterans Affairs (VA) clarified the requirements regarding completing VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet (worksheet).

refinance comparison worksheet Heloc: Heloc Vs Personal Loan. 9 Images about Heloc: Heloc Vs Personal Loan : Va Irrrl Loan Comparison Worksheet, 23 Printable Worksheet Template Forms - Fillable Samples in PDF, Word and also Va Interest Rate Reduction Refinancing Loan Worksheet | TUTORE.ORG.

› pub › irs-pdf8396 Mortgage Interest Credit - IRS tax forms Worksheet B in the Instructions for Schedule 8812 (Form 1040), include the amount from line 14 of Credit Limit Worksheet B instead of the amount from Form 1040, 1040-SR, or 1040-NR, line 19. Part II—Mortgage Interest Credit Carryforward to 2022 If the amount on line 9 is less than the amount on line 7, you may

mf.freddiemac.com › lenders › uwOriginate & Underwrite - Freddie Mac .pdf SBL Update 03/25/2020 temporary authorization, cash equity, .10x increase in dcr, 5% reduction in ltv, commercial space underwritten as vacant, forbearance, inspection guidance, covid-19.pdf SBL Update 03/13/2020 lender call, timing pmt applications, refi of freddie mac loan section

PDF INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET - Veterans Affairs INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET. VA will not disclose information collected on this form to any source other than what has been ...

Chapter 6 Interest Rate Reduction Refinance Loans IRRRL does not increase PB on existing loan except for EEMs and allowable fees and charges ... VA Form 26-8923, IRRRL Worksheet. 6. Recoup Statement ...

Interest Rate Reduction Refinancing Loan Tips | Military.com An Interest Rate Reduction Refinancing Loan (IRRRL) can be done only when the veteran already has his or her entitlement used for a VA loan on the property to be refinanced. In other words, it must...

A Consumer's Guide to Mortgage Refinancings - Federal Reserve 30-year loan @ 6.0%. $1,199. $231,640. 15-year loan @ 5.5%. $1,634. $ 94,120. Tip: Refinancing is not the only way to decrease the term of your mortgage. By paying a little extra on principal each month, you will pay off the loan sooner and reduce the term of your loan.

› advice › debt-snowball-method-how-itWhat Is the Snowball Method and How Does It Work? - Debt.org Jan 09, 2018 · Find a solution that offers a lower interest rate and monthly payments that you can afford. The reasoning behind Solution No. 1 isn’t difficult: Unless it’s the debt with the smallest balance — putting it first on your list — the longer a debt with the highest interest rate is allowed to fester, the higher the total will be when you ...

bettermoneyhabits.bankofamerica.com › en › homeWhat Are Mortgage Points and How Do They Work? Essentially, you pay some interest up front in exchange for a lower interest rate over the life of your loan. Each point you buy costs 1 percent of your total loan amount. Buying points to lower your monthly mortgage payments may make sense if you select a fixed-rate mortgage and plan on owning the home after reaching the break-even period.

PDF Refinances - USDA Rural Development • Mortgage must have closed 12 months prior to loan application • Mortgage must be paid as agreed for 12 months prior to loan application • Interest rate must be at or below current rate • $50 net tangible benefit must be achieved • Borrowers may be added, but not deleted 15

Interest Rate Reduction Refinance Loan | Veterans Affairs Interest rate reduction refinance loan If you have an existing VA-backed home loan and you want to reduce your monthly mortgage payments—or make your payments more stable—an interest rate reduction refinance loan (IRRRL) may be right for you. Refinancing lets you replace your current loan with a new one under different terms.

› publications › p537Publication 537 (2021), Installment Sales | Internal Revenue ... The test rate of interest for a contract is the 3-month rate. The 3-month rate is the lower of the following applicable federal rates (AFRs). The lowest AFR (based on the appropriate compounding period) in effect during the 3-month period ending with the first month in which there’s a binding written contract that substantially provides the ...

Publication 936 (2021), Home Mortgage Interest Deduction Home mortgage interest. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($500,000 if married filing separately)) apply if you are deducting mortgage interest from indebtedness incurred before December 16, 2017. Future developments.

0 Response to "38 interest rate reduction refinance loan worksheet"

Post a Comment