40 capital gain worksheet 2015

Capital Gain Tax Worksheet - 2015 Form 1040Line 44... - Course Hero 2015 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 through line 43.if you do not have to file schedule d and you received capital gain … Use Excel to File 2015 Form 1040 and Related Schedules The 2015 version of the spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule A: Itemized Deductions; Schedule B: Interest and Ordinary Dividends; Schedule C: Profit or Loss from Business; Schedule D: Capital Gains and Losses (along with its worksheet) Schedule E: Supplemental Income and Loss

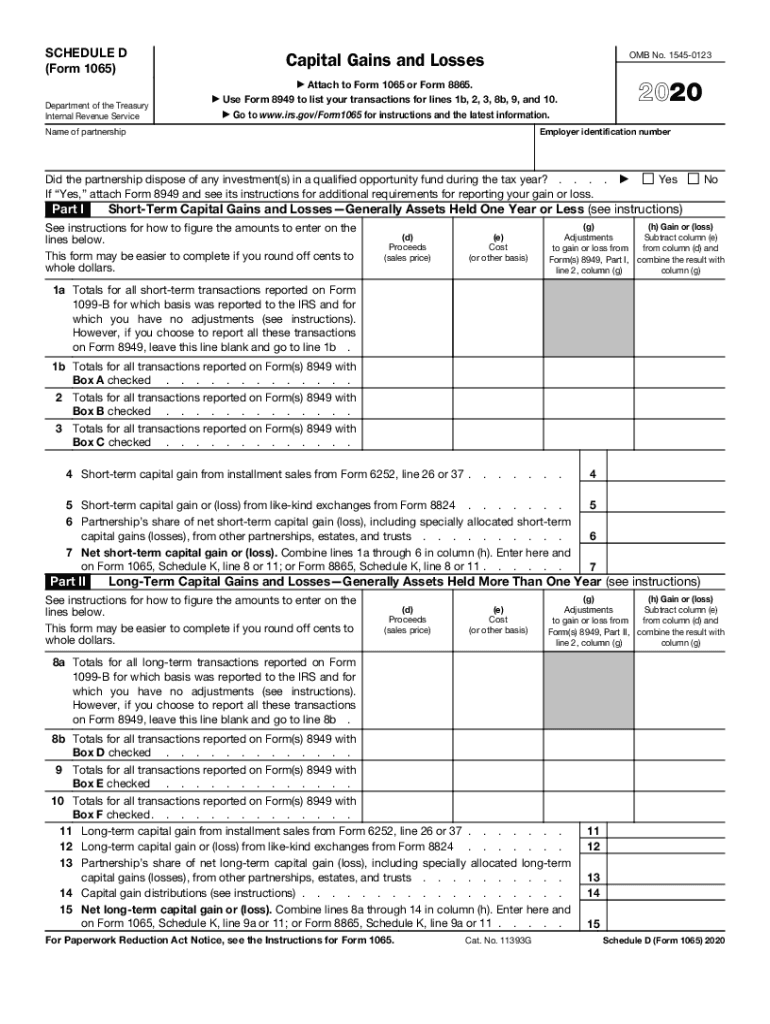

PDF and Losses Capital Gains - IRS tax forms To report capital gain distributions not reported directly on Form 1040, line 13 ... 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information. See Pub. 544 and Pub. 550 for more details. Section references are to the Internal Revenue Code unless otherwise noted. ... Rate Gain Worksheet in these instruc ...

Capital gain worksheet 2015

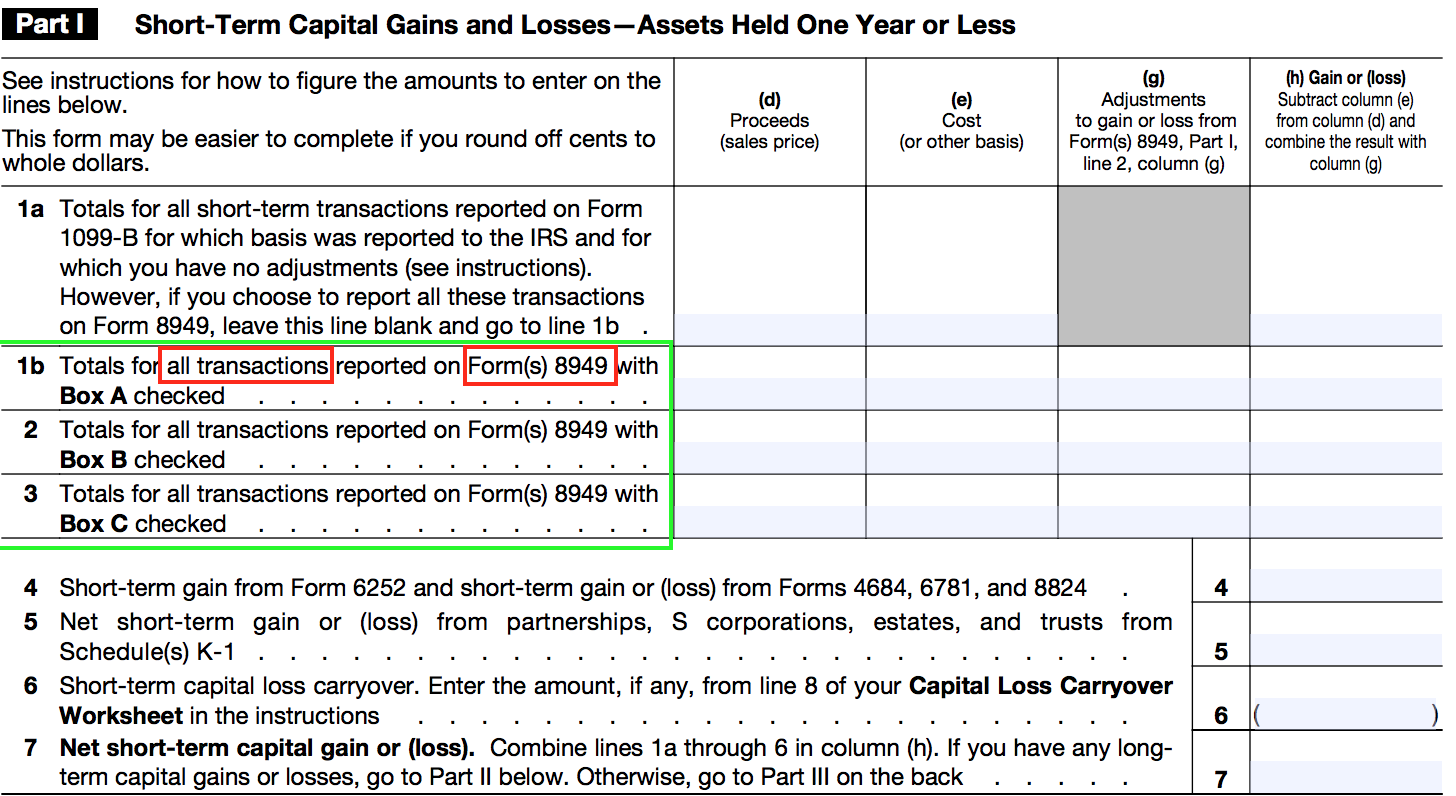

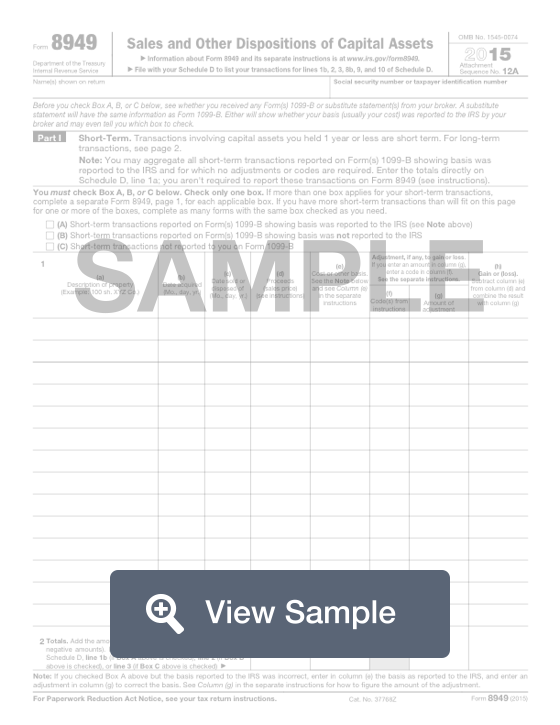

Capital Gains Tax Calculation Worksheet - The Balance Preparing and using a worksheet to calculate your gains and losses can help you identify them at tax time and use them to your best advantage. Worksheet 1: Simple Capital Gains Worksheet Here we have a single transaction where 100 shares of XYZ stock were purchased. A second transaction then sold 100 shares of XYZ stock. 1040 (2021) | Internal Revenue Service - IRS tax forms Standard Deduction Worksheet for Dependents—Line 12a; Line 12b; Line 13. Qualified Business Income Deduction (Section 199A Deduction) Line 16. Tax Yes. No. Tax Table or Tax Computation Worksheet. Form 8615. Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. PDF Capital Gains and Losses - IRS tax forms 2015 Attachment Sequence No. 12 Name(s) shown on return Your social security number Part I Short-Term Capital Gains and Losses—Assets Held One Year or Less See instructions for how to figure the amounts to enter on the lines below. This form may be easier to complete if you round off cents to whole dollars. (d) Proceeds (sales price) (e)

Capital gain worksheet 2015. PDF 2015 Instructions for Form FTB 3514 Worksheet 2 - Investment Income Form 540 and Long Form 540NR Filers Interest and Dividends 1 Add and enter the amounts from Schedule CA (540) or Schedule CA (540NR), line 8(a), column A and line 8(b) 1 2 Enter the amount from form FTB 3803, Parents' Election to Report Child's Interest and Dividends, line 1b. 2 3 As of 2015, there are three rates for long-term capital g... As of 2015, there are three rates for long-term capital gain: Within the range where ordinary income is taxed at 10% or 15%, the rate for long-term capital gain is 0%. ... but you might have a schedule D worksheet instead of a Qualifying Dividends & Capital Gain worksheet. 0 686 Reply. SweetieJean. Level 15 May 31, 2019 4:56 PM. Mark as New ... Worksheet: Calculate Capital Gains | Realtor Magazine Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or exchanged another home during the two years preceding the sale. Publication 550 (2021), Investment Income and Expenses ... Undistributed capital gains (Form 2439, boxes 1a–1d) Schedule D: Gain or loss from sales of stocks or bonds : Line 7; also use Form 8949, Schedule D, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet: Gain or loss from exchanges of like-kind investment property

Publication 523 (2021), Selling Your Home | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. PDF CAPITAL GAIN OR CAPITAL LOSS WORKSHEET - Australian Taxation Office CAPITAL GAIN OR CAPITAL LOSS WORKSHEET This worksheet helps you calculate a capital gain for each CGT asset or any other CGT event1using the indexation method2, the discount method3and the 'other' method. It also helps you calculate a capital loss. CGT asset type or CGT eventShares in companies listed on an Australian securities exchange4 Guide to capital gains tax 2022 Part 1 Total current year capital gains and losses Each group of capital gain or capital loss worksheets you organised at Step 1 corresponds with a column and row in table 1 of the CGT summary worksheet according to the method you used to calculate your capital gain or loss and the type of CGT asset or CGT event that gave rise to it. Self Assessment forms and helpsheets for Capital Gains Tax Find helpsheets, forms and notes to help you fill in the capital gains pages of your Self Assessment tax return. From: HM Revenue & Customs Published 4 July 2014 Log in and file your Self...

Can a Capital Loss Carry Over to the Next Year? - The Balance The remaining $17,000 will carry over to the following year. Next year, if you have $5,000 of capital gains, you can use $5,000 of your remaining $17,000 loss carryover to offset it. You can use another $3,000 to deduct against ordinary income, which would leave you with $9,000. The remaining $9,000 will then carry forward to the next tax year. May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · Occupation code Occupation title (click on the occupation title to view its profile) Level Employment Employment RSE Employment per 1,000 jobs Median hourly wage PDF 2015 Schedule D (540) -- California Capital Gain or Loss Adjustment 2015 C alifornia Capital Gain or Loss Adjustment SCHEDULE Do not complete this schedule if all of your California gains (losses) are the same as your federal gains (losses). ... Use the worksheet on this page to figure your capital loss carryover to 2016. Line 9 - If line 8 is a net capital loss, enter the smaller of the loss on . PDF Capital Loss Carryover Worksheet - IRS tax forms gain from empowerment zone assets had expired. To find out if legisla-tion extended this provision for 2018, go to IRS.gov/ScheduleD . ... Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D, line 21, is a loss and (a) that loss is a ...

2022 Capital Gains Tax Calculator - See What You'll Owe - SmartAsset A good capital gains calculator, like ours, takes both federal and state taxation into account. Capital Gains Taxes on Property. If you own a home, you may be wondering how the government taxes profits from home sales. As with other assets such as stocks, capital gains on a home are equal to the difference between the sale price and the seller ...

Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

PDF Form N-168 Instructions, Rev. 2015 - Hawaii If, for any base year, you had a capital loss that resulted in a capital loss carryover to the next tax year, do not reduce the elected farm income allocated to that base year by any part of the carryover. Line 4 — Figure the tax on the amount on line 3 using the 2015 Tax Table, Tax Rate Schedules, or Capital Gains Tax Worksheet from your ...

Qualified Dividends and Capital Gains Worksheet - StuDocu See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 6. Before you begin: 1.

Publication 525 (2021), Taxable and Nontaxable Income Any excess gain is capital gain. If you have a loss from the sale, it's a capital loss and you don't have any ordinary income. Your employer or former employer should report the ordinary income to you as wages in box 1 of Form W-2, and you must report this ordinary income amount on Form 1040 or 1040-SR, line 1.

2015 Capital Gains Rates - bradfordtaxinstitute.com The table below indicates capital gains rates for 2015. Effective for year 2013 and after, the Health Care Act of 2010 imposed an additional 3.8% net investment income tax (NIIT) on certain individual's investment income. Hence, it is possible that an individual's federal tax on capital gain could be as high as 23.8% (20% + 3.8% NIIT).

PDF Page 40 of 117 - IRS tax forms See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1.

How to Calculate Capital Gains Tax | H&R Block The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your asset or property and how much you sold it for — adjusting for commissions or fees. Depending on your income level, and how long you held the asset, your capital gain will be taxed federally between 0% to 37%.

My 2015 turbotax online does not show "tax calculation worksheet" - Intuit I had qualified dividends and net long capital gains. I wanted to see if TB used worksheet to calculate the tax of capital gains and qualified dividends at the rate of 15%. Browse Discuss. Discover ... My 2015 turbotax online does not show "tax calculation worksheet" ...

Long-Term Capital Gains Tax Rates in 2015 | The Motley Fool If you're in the 25%, 28%, 33%, or 35% tax bracket, then your long-term capital gains rate is 15%. If you're in the 39.6% tax bracket, then your long-term capital gains rate is 20%. Those rates...

Capital Gains Rates and Qualified Dividend Rates 2015 - Loopholelewy.com Start today. Capital Gain Rates and Qualified Dividend Rates: 2015 Securely import transactions from your bank, credit cards, PayPal, Square, and more. Automatically sort transactions into tax categories to maximize your deductions. Instantly see how your business is performing with profit and loss and expenses right on your dashboard.

Qualified Dividends And Capital Gain Tax Worksheet 2021 - signNow Get and Sign Qualified Dividends and Capital Gain Tax Worksheet 2015-2022 Form Use the qualified dividends and capital gain tax worksheet 2021 2015 template to simplify high-volume document management. Show details How it works Upload the capital gains tax worksheet 2021

Qualified Dividend And Capital Gain Tax Worksheet Copy - 50.iucnredlist qualified-dividend-and-capital-gain-tax-worksheet 1/6 Downloaded from 50.iucnredlist.org on October 6, 2022 by guest Qualified Dividend And Capital Gain Tax ... EY Tax Guide 2015 Ernst & Young LLP 2014-11-10 A complete guide to federal taxes and preparing your 2014 tax return provides specific

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. It's Line 11a of Form 1040.

2021 Instructions for Schedule D (2021) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

Capital Gains Tax Worksheet 2022 - tpdevpro.com Capital Gains Tax Calculation Worksheet - The Balance. 1 week ago Feb 23, 2022 · These capital gains bracket thresholds increase to $80,800 and $501,600 for married couples filing jointly. There are some investments, such as collectibles, that are taxed …. Show more View Detail.

FREE 2015 Printable Tax Forms | Income Tax Pro 2015 Form 1040A - Short Form File federal Form 1040A if you met these requirements for 2015: Taxable income less than $100,000. No itemized deductions, mortgage interest, property tax, etc. No capital gain or loss, no other gains or losses. No business income or loss, self-employed, LLC, etc. No farm or fisherman income or loss.

capital_gain_tax_worksheet_1040i - 2015 Form 1040Line 44... 2015 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 through line 43.if you do not have to file schedule d and you received capital gain …

PDF Capital Gains and Losses - IRS tax forms 2015 Attachment Sequence No. 12 Name(s) shown on return Your social security number Part I Short-Term Capital Gains and Losses—Assets Held One Year or Less See instructions for how to figure the amounts to enter on the lines below. This form may be easier to complete if you round off cents to whole dollars. (d) Proceeds (sales price) (e)

1040 (2021) | Internal Revenue Service - IRS tax forms Standard Deduction Worksheet for Dependents—Line 12a; Line 12b; Line 13. Qualified Business Income Deduction (Section 199A Deduction) Line 16. Tax Yes. No. Tax Table or Tax Computation Worksheet. Form 8615. Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet.

Capital Gains Tax Calculation Worksheet - The Balance Preparing and using a worksheet to calculate your gains and losses can help you identify them at tax time and use them to your best advantage. Worksheet 1: Simple Capital Gains Worksheet Here we have a single transaction where 100 shares of XYZ stock were purchased. A second transaction then sold 100 shares of XYZ stock.

0 Response to "40 capital gain worksheet 2015"

Post a Comment