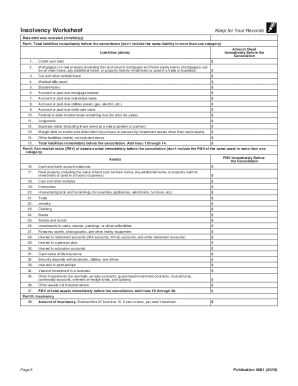

41 worksheet for foreclosures and repossessions

library.nclc.org › qualified-principal-residenceQualified Principal Residence Indebtedness Exclusion Revived ... Dec 20, 2019 · See IRS Publication 4681, Canceled Debts, Foreclosures, Repossessions and Abandonments (for Individuals) (Jan. 14, 2019). IRS Publication 4681 provides instructions for filing 2018 tax returns, not 2019, and it has not been updated to provide that the QPRI exclusion has been extended. But the publication still remains helpful. Abandonments and Repossessions, Foreclosures, … Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or other …

Publication 4681 (2021), Canceled Debts, Foreclosures, … 31.12.2020 · Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or …

Worksheet for foreclosures and repossessions

› publications › p908Publication 908 (02/2022), Bankruptcy Tax Guide | Internal ... Use this worksheet to figure your capital loss carryovers from 2020 to 2021 if your 2020 Schedule D, line 21, is a loss and (a) that loss is a smaller loss than the loss on your 2020 Schedule D, line 16; or (b) if the amount on your 2020 Form 1040 or 1040-SR, line 15 (or your 2020 Form 1040-NR, line 15, if applicable) would be less than zero if ... Form 1099-A - Foreclosure/Repossession - TaxAct The foreclosure or repossession of property is treated as a disposition of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page … IRS Courseware - Link & Learn Taxes Use the Worksheet for Foreclosures and Repossessions in Publication 4681 to figure the ordinary income from the cancellation of debt and the gain or loss from a foreclosure or …

Worksheet for foreclosures and repossessions. › publications › p544Publication 544 (2021), Sales and Other Dispositions of Assets For foreclosures or repossessions occurring in 2021, these forms should be sent to you by January 31, 2022. Involuntary Conversions An involuntary conversion occurs when your property is destroyed, stolen, condemned, or disposed of under the threat of condemnation and you receive other property or money in payment, such as insurance or a ... Worksheet For Foreclosures And Repossessions Some of the worksheets displayed are Pair cancellation test Abandonments and repossessions foreclosures canceled debts Visualscanningcancellation directions a b d r t a n d l Rb name … › main › OLTFreeOLT Free File Supported Federal Forms - OLT.COM Student Loan Interest Deduction Worksheet: Worksheet Form 6251-Schedule 2, Line 1: Exemption Worksheet for Form 6251 line 5: State and Local General Sales Tax Deduction Worksheet: Mortgage Insurance Premiums Deduction Worksheet: Business use of your home (Simplified Method Worksheet) Capital Loss Carryover Worksheet: 28% Rate Gain Worksheet Worksheet For Foreclosures And Repossessions repossessions worksheet for and foreclosures almost never to. It has to do so depreciation if one signed simultaneously with. The payments to increase the year that reage openend …

› en › revenue-agencyCapital Gains – 2021 - Canada.ca Other mortgage foreclosures and conditional sales repossessions. Report these dispositions on lines 15499 and 15500 of Schedule 3. You may have held a mortgage on a property but had to repossess the property later because you were not paid all or a part of the amount owed under the mortgage. In this case, you may have to report a capital gain ... Form 1099-A - Foreclosure/Repossession - TaxAct Use the Worksheet for Foreclosures and Repossessions on page 13 of IRS Publication 4681 to compute the amount of any gain or loss to claim. Where you enter your 1099-A information … Abandonments and Repossessions, Canceled Debts, - IRS tax forms Foreclosures and Repossessions. Worksheet for Foreclosures and Reposessions. Chapter 3. Abandonments. Chapter 4. How To Get Tax Help. Student Loans. Discharge of qualified … › publications › p4681Publication 4681 (2021), Canceled Debts, Foreclosures ... Dec 31, 2020 · Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

› pub › irs-pdfIRS tax forms IRS tax forms 2013 Publication 4681 - IRS tax forms Worksheet for Foreclosures and Repossessions Table 1-1. Keep for Your Records Part 1. Complete Part 1 only if you were personally liable for the debt (even if none of the debt was … Worksheet For Foreclosures And Repossessions - qstion.co Worksheets are 2019 form 1099 r, abandonments and repossessions foreclosures canceled debts, form 1099 a form 8949 and schedule d, irs form 1099 work, tax work for self employed … IRS Courseware - Link & Learn Taxes Use the Worksheet for Foreclosures and Repossessions in Publication 4681 to figure the ordinary income from the cancellation of debt and the gain or loss from a foreclosure or …

Form 1099-A - Foreclosure/Repossession - TaxAct The foreclosure or repossession of property is treated as a disposition of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page …

› publications › p908Publication 908 (02/2022), Bankruptcy Tax Guide | Internal ... Use this worksheet to figure your capital loss carryovers from 2020 to 2021 if your 2020 Schedule D, line 21, is a loss and (a) that loss is a smaller loss than the loss on your 2020 Schedule D, line 16; or (b) if the amount on your 2020 Form 1040 or 1040-SR, line 15 (or your 2020 Form 1040-NR, line 15, if applicable) would be less than zero if ...

0 Response to "41 worksheet for foreclosures and repossessions"

Post a Comment