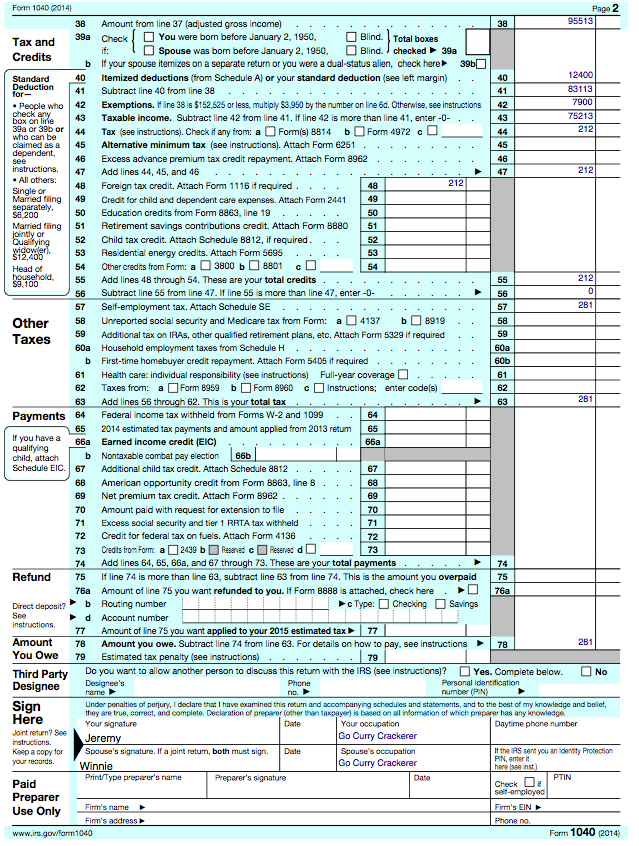

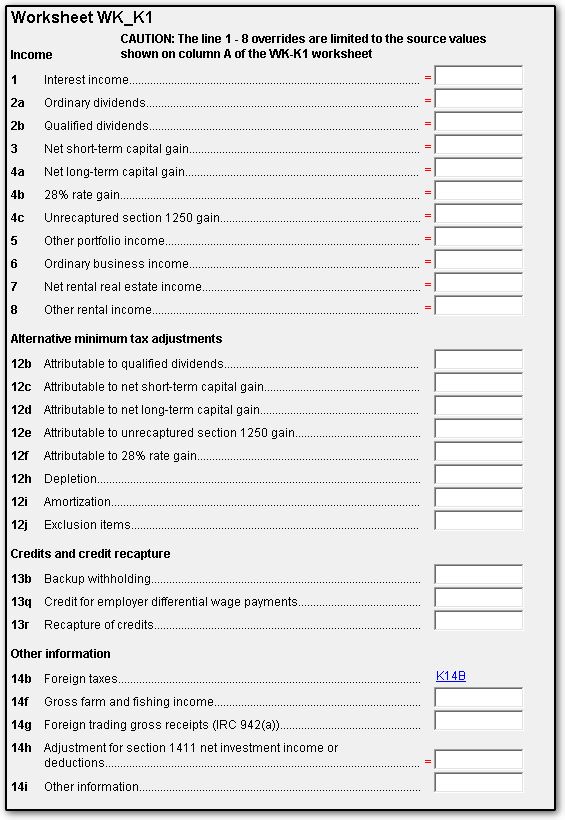

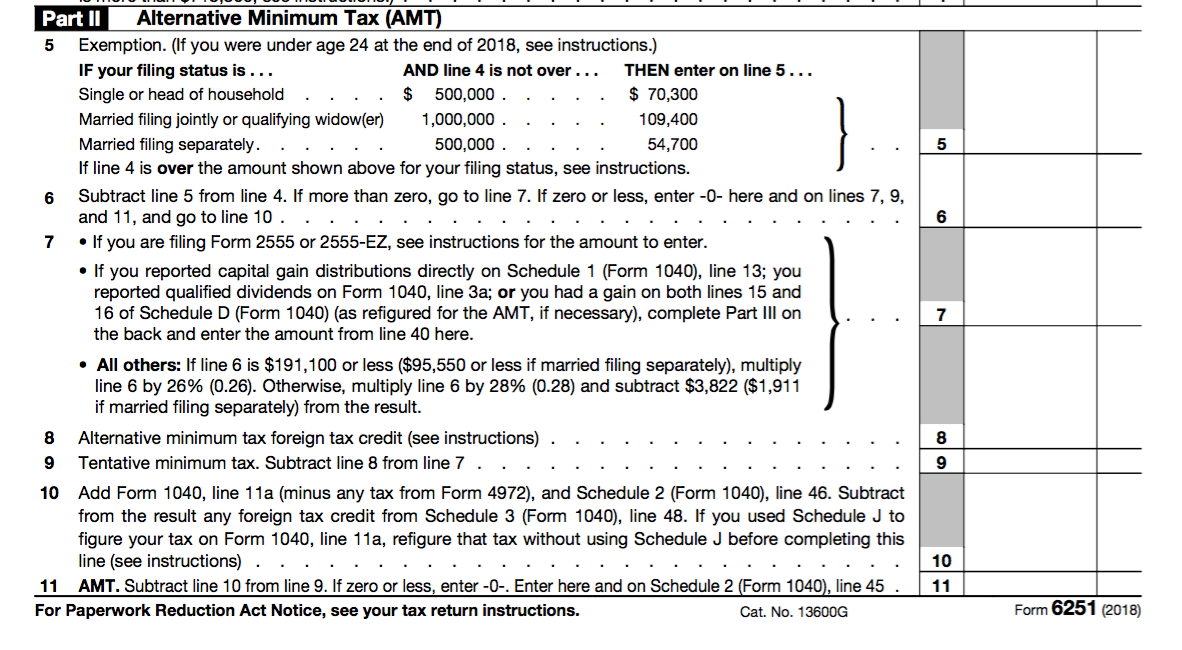

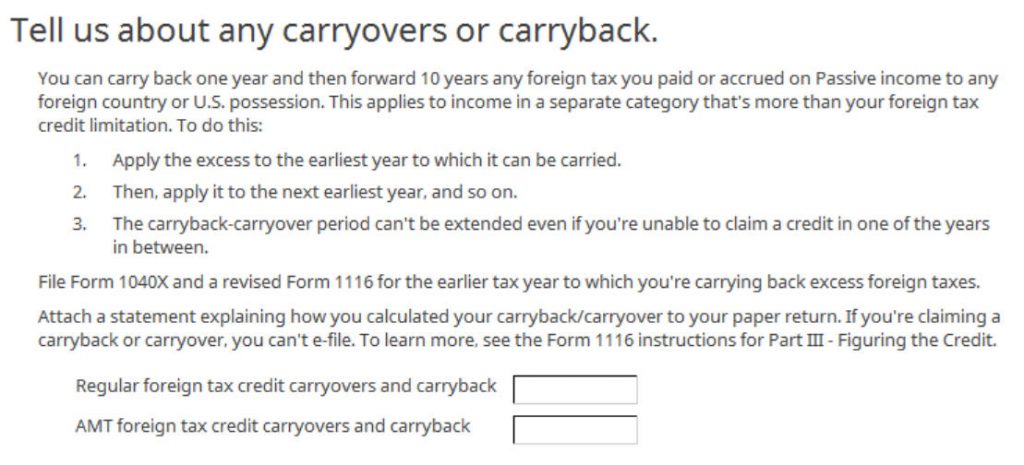

45 amt qualified dividends and capital gains worksheet

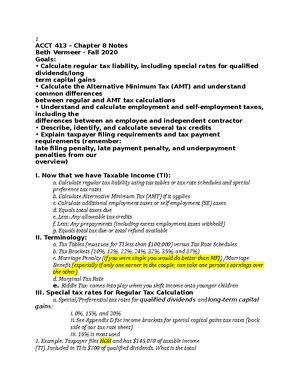

Instructions for Schedule I (Form 1041) (2021) | Internal ... Capital gains and qualified dividends. For tax year 2021, the 20% maximum capital gains rate applies to estates and trusts with income above $13,250. The 0% and 15% rates continue to apply to certain threshold amounts. The 0% rate applies to amounts up to $2,700. The 15% rate applies to amounts over $2,700 and up to $13,250. Alternative minimum tax - Wikipedia Alternative minimum tax calculation. Each year, high-income taxpayers must calculate and then pay the greater of an alternative minimum tax (AMT) or regular tax. The alternative minimum taxable income (AMTI) is calculated by taking the taxpayer's regular income and adding on disallowed credits and deductions such as the bargain element from incentive stock options, state and local tax ...

Publication 525 (2021), Taxable and Nontaxable Income This is true whether you reside inside or outside the United States and whether or not you receive a Form W-2, Wage and Tax Statement, or Form 1099 from the foreign payer. This applies to earned income (such as wages and tips) as well as unearned income (such as interest, dividends, capital gains, pensions, rents, and royalties).

Amt qualified dividends and capital gains worksheet

2020 Instructions for Schedule P 540 | FTB.ca.gov - California References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).. What’s New. Net Operating Loss Suspension – For taxable years beginning on or after January 1, 2020, and before January 1, 2023, California has suspended the net operating loss (NOL) carryover deduction. Publication 505 (2022), Tax Withholding and Estimated Tax Doesn’t include a net capital gain or qualified dividends and you didn’t exclude foreign earned income or exclude or deduct foreign housing in arriving at the amount on line 1, use Worksheet 1-4 to figure the tax to enter here. • Includes a net capital gain or qualified dividends, use Worksheet 2-5 to figure the tax to enter here. • Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Amt qualified dividends and capital gains worksheet. Publication 501 (2021), Dependents, Standard Deduction, and ... Your child had gross income only from interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends). The interest and dividend income was less than $11,000. Your child is required to file a return for 2021 unless you make this election. Your child doesn't file a joint return for 2021. Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Publication 505 (2022), Tax Withholding and Estimated Tax Doesn’t include a net capital gain or qualified dividends and you didn’t exclude foreign earned income or exclude or deduct foreign housing in arriving at the amount on line 1, use Worksheet 1-4 to figure the tax to enter here. • Includes a net capital gain or qualified dividends, use Worksheet 2-5 to figure the tax to enter here. • 2020 Instructions for Schedule P 540 | FTB.ca.gov - California References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).. What’s New. Net Operating Loss Suspension – For taxable years beginning on or after January 1, 2020, and before January 1, 2023, California has suspended the net operating loss (NOL) carryover deduction.

/ScreenShot2021-02-11at1.37.43PM-974cede3b55f40428918bba4eb8d695b.png)

0 Response to "45 amt qualified dividends and capital gains worksheet"

Post a Comment