38 usda income calculation worksheet

Usda Income Calculation Worksheet - Fill Online, Printable, Fillable ... Instructions and Help about fillable usda income worksheet form. Hi and welcome to loan officer school this is your how to calculate income training session once again I'm Sherman Lane please call me Star because the toilet paper jokes got old by the third grade and done you can always reach me at Charmin out loan officer school comm, and you ... eligibility.sc.egov.usda.gov eligibility.sc.egov.usda.gov

usda income calculation worksheet: Fill out & sign online | DocHub Get the up-to-date usda income calculation worksheet 2022 now Get Form 4.9 out of 5 401 votes 44 reviews 23 ratings 15,005 10,000,000+ 303 100,000+ users Here's how it works 02. Sign it in a few clicks Draw your signature, type it, upload its image, or use your mobile device as a signature pad. 03. Share your form with others

Usda income calculation worksheet

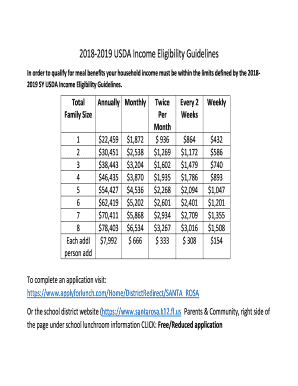

PDF Worksheet for Documenting Eligible Household and Repayment Income Calculate and record how the calculation of each income source/type was determined in the space below. 4. Additional Adult Household Member (s) who are not a Party to the Note (Primary Employment from Wages, Salary, Self-Employed, Additional income to Primary Employment, Other Income). Calculate and record how the calculation of each income PDF Single Family Housing Direct Programs Determining Annual, Adjusted, and ... For the Section 502 program,the Worksheet for Computing Income and Maximum Loan Amount Calculator (commonly known as the automated 4‐A) can be found on the program's Forms & Resources site; a link to the site is provided on the slide. USDA Loan Payment Calculator: Calculate Loan ... - Mortgage Calculator That means you can qualify for a USDA loan with an annual income of $89,930 or less. 15% of $78,200 is equivalent to $11,730, which we added to $78,200 to obtain the $89,930 income limit. What if I can pay 20% down? Generally, if you can afford to make a 20% down payment on top of your mortgage, you won't qualify for a USDA loan.

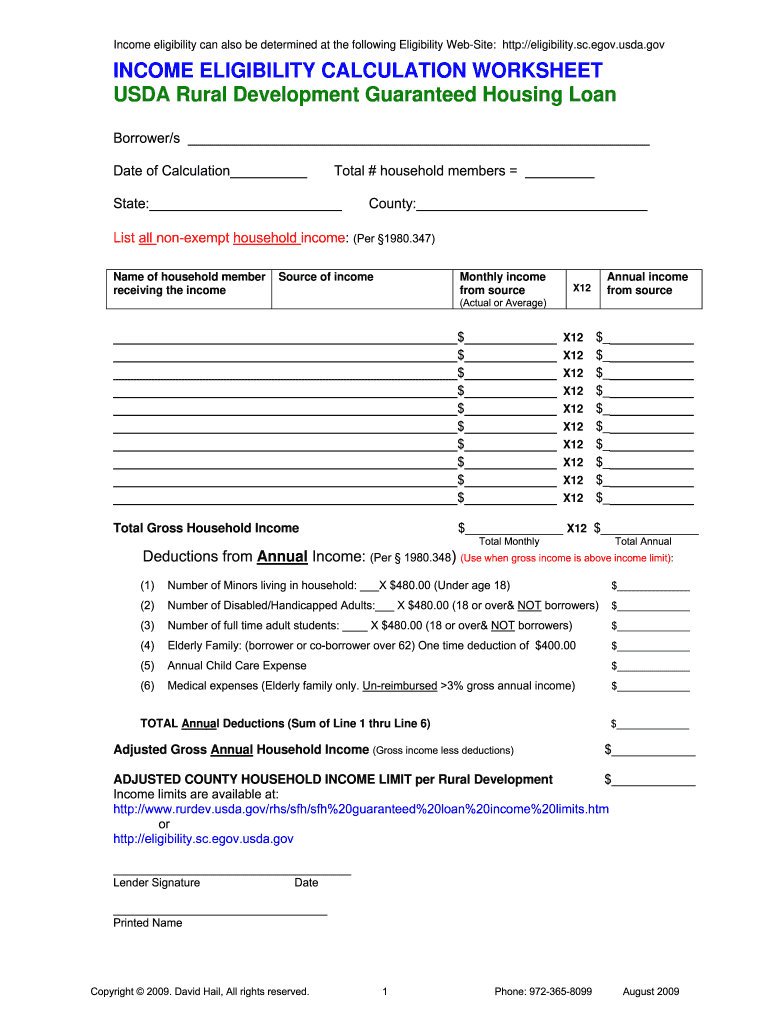

Usda income calculation worksheet. USDA Annual Income Calculation. The worksheet provides space to identify the anticipated income for all adult members of the household. 1. Applicant. Calculate and record how the calculation of each income source/types was determined in the space provided. In the column adjacent insert the annual total income. 2. Co-Applicant SFH Section 502 GLP Eligibility Check Worksheet - USDA Historical data based on the past 12 months or previous fiscal year may be used if a determination cannot be logically made. Example: Current hourly income is $10/hour, and applicant works 40 hours/week. Monthly income would be $10*40*52=$20,800/year. The yearly income of $20,800 divided by 12 months=$1,733/month. Overtime Income. PDF Worksheet for Documenting Eligible Household and Repayment Income - Usda Attachment A Page 2 of 3 Rev 1/2013 Applicant(s): ADJUSTED INCOME CALCULATION (Consider qualifying deductions as described in §1980.348 of RD Instruction 1980-D) 7. Dependent Deduction ($480 for each child under age 18, or full-time student attendi ng school or disabled family member over the age of 18) - #_____ x $480 8. Annual Child Care Expenses (Reasonable expenses for children 12 and under). PDF CHAPTER 9: INCOME ANALYSIS - USDA Rural Development verifications. Documentation of income calculations should be provided on Attachment 9-B, or the Uniform Transmittal Summary, (FNMA FORM 1008/FREDDIE MAC FORM 1077), or equivalent. Attachment 9-C provides a case study to illustrate how to properly complete the income worksheet. A public website is available to assist in the

SFH Section 502 GLP Eligibility Check Worksheet - USDA If you are an applicant or an individual interested in learning more about the Single Family Housing Guaranteed Loan Program, please visit our guaranteed housing webpage for further program information and guidance. If you are interested in applying for a guaranteed loan, or have more specific questions not answered by the website, please reach out to any of the program's approved lenders ... XLSX USDA Rural Development USDA Rural Development Certification of Compliance Worksheets: 5-Day Schedule - USDA Lunch Worksheets. Grades K-5. Grades K-8. Grades 6-8. Grades 9-12. 05/06/2022. PDF Annual Income - USDA Rural Development 9) Is the Income calculation sheet still required or does it just need to be in the lender loan file? You can utilize either the RD Attachment 9B, GRH Income Worksheet, a lender income calculation sheet or show your calculations on the 1008. Income calculations are required to be shown on all files to show how the Annual Household, Adjusted Annual

Get Usda Income Calculation Worksheet - US Legal Forms Be sure the info you fill in Usda Income Calculation Worksheet is updated and accurate. Indicate the date to the template using the Date tool. Click on the Sign tool and make an e-signature. You can use three available options; typing, drawing, or capturing one. Make sure that each and every field has been filled in correctly. PDF HB-1-3555 CHAPTER 9: INCOME ANALYSIS - USDA Rural Development month timeframe. Form RD 3555-21 Income Calculation Worksheet must state: the income source, the number of months receipt remaining for the ensuing 12- month timeframe, and the total amount to be received. The calculation of annual income should be logical based on the history of income and documentation provided. Eligibility To determine if a property is located in an eligible rural area, click on one of the USDA Loan program links above and then select the Property Eligibility Program link. When you select a Rural Development program, you will be directed to the appropriate property eligibility screen for the Rural Development loan program you selected. To assess ... USDA Loan Calculator USDA Loan Calculator with amortization schedule is used to calculate your monthly mortgage payment for your USDA loan. The USDA mortgage calculator has everything you need to learn about your monthly mortgage and payments.

PDF Income Limits Worksheet to Figure Your Adjusted Family Income Applicant's gross income per year (Current gross weekly income x 52) include annual overtime . Co-applicant's gross income per year (Current gross weekly income x 52) include annual overtime Other Applicant Household income (Annual Amounts) (i.e. Social Security, Pension Income, VA Benefits, Child Support, Annual Bonuses etc.)

USDA Loan Payment Calculator: Calculate Loan ... - Mortgage Calculator That means you can qualify for a USDA loan with an annual income of $89,930 or less. 15% of $78,200 is equivalent to $11,730, which we added to $78,200 to obtain the $89,930 income limit. What if I can pay 20% down? Generally, if you can afford to make a 20% down payment on top of your mortgage, you won't qualify for a USDA loan.

PDF Single Family Housing Direct Programs Determining Annual, Adjusted, and ... For the Section 502 program,the Worksheet for Computing Income and Maximum Loan Amount Calculator (commonly known as the automated 4‐A) can be found on the program's Forms & Resources site; a link to the site is provided on the slide.

PDF Worksheet for Documenting Eligible Household and Repayment Income Calculate and record how the calculation of each income source/type was determined in the space below. 4. Additional Adult Household Member (s) who are not a Party to the Note (Primary Employment from Wages, Salary, Self-Employed, Additional income to Primary Employment, Other Income). Calculate and record how the calculation of each income

31fdb44192cc435ab27bf26eabcb56fb.jpg?sfvrsn=5131f7e0_0&MaxWidth=450&MaxHeight=450&ScaleUp=false&Quality=High&Method=ResizeFitToAreaArguments&Signature=655078AF5533337B6D49CDE418FFFE04718CB9A5)

0 Response to "38 usda income calculation worksheet"

Post a Comment