40 1031 exchange worksheet excel

The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) In a partial 1031 exchange, "boot" refers to any leftover sale proceeds subject to tax. Boot results from a difference in value between the original property, known as the relinquished property, and the replacement property. When the replacement property has a lower value than the sale price of the relinquished property, that difference is ... Form 8824: Do it correctly | Michael Lantrip Wrote The Book FORM 8824, THE 1031 EXCHANGE FORM The combination of the HUD-1 and the information on our Capital Gains Tax page will be all that you need for the completion of the form. For review, we are dealing with the following scenario. FORM 8824 EXAMPLE Alan Adams bought a Duplex ten years ago for $200,000 cash. He assigned a value of $20,000 to the land.

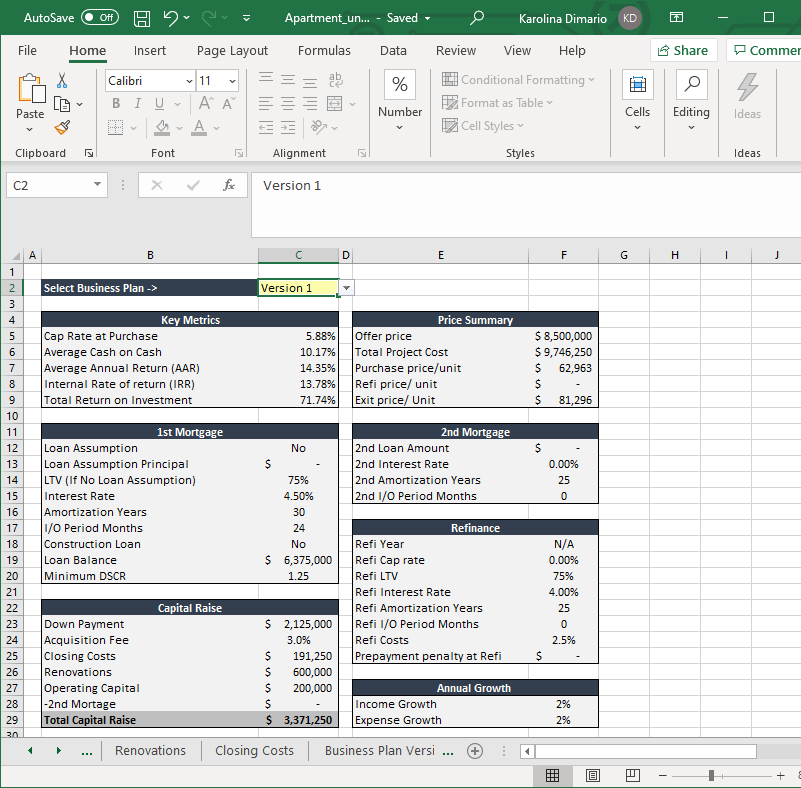

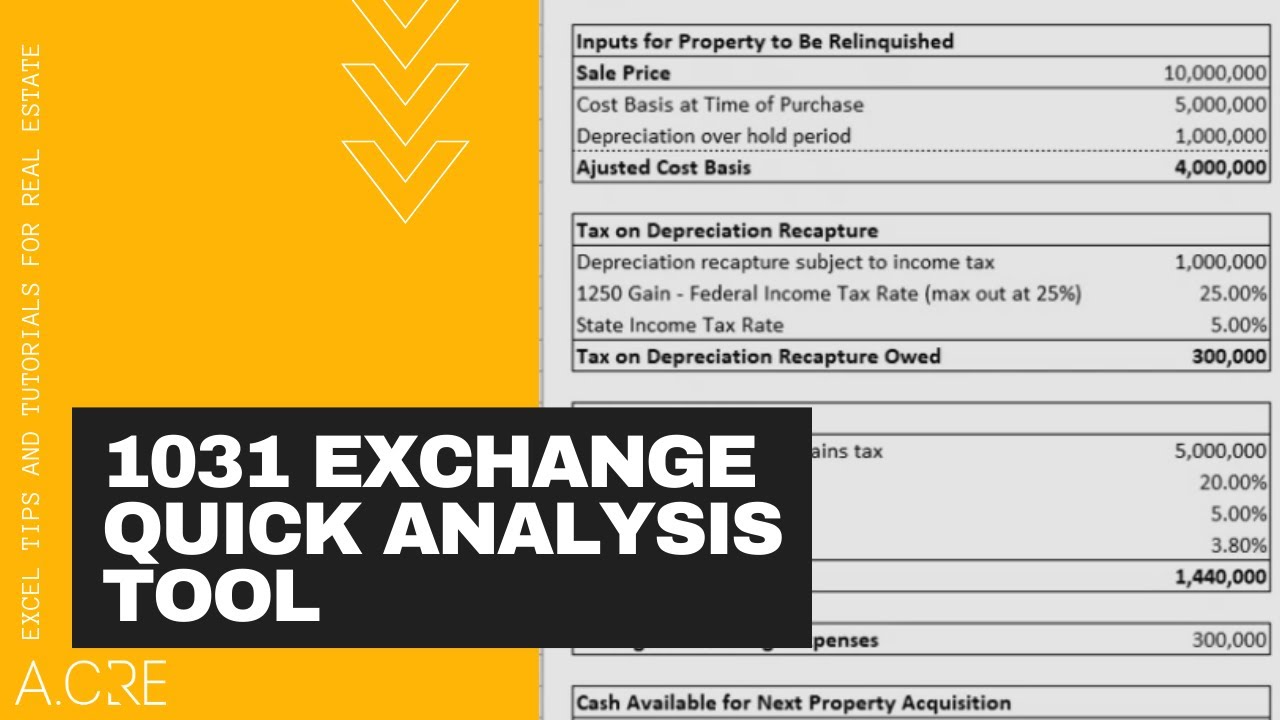

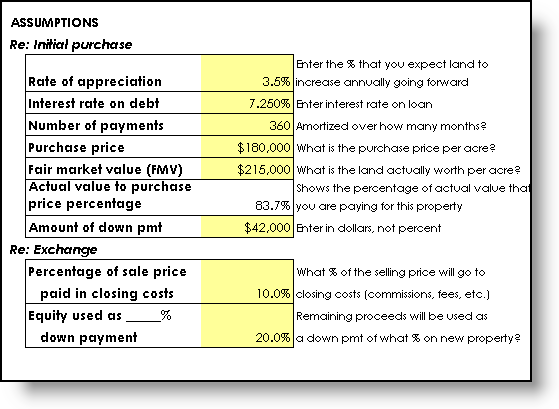

1031 Like Kind Exchange Calculator - Excel Worksheet - Pinterest Nov 27, 2019 - Download the free like kind exchange worksheet. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a property.

1031 exchange worksheet excel

1031 Exchange Experts Equity Advantage - 800.735.1031 Our Team. For three decades, we've been the 1031 Exchange experts. We'll help you with contracts, consult with you on taxation, evaluate investments, and most importantly partner with you. David Moore, CEO, founded Equity Advantage with his brother Tom in 1991, after a successful real estate investment career. PDF 2019 Exchange Reporting Guide - 1031 Corp Excel spreadsheet to help you with the preparation of IRS Form 8824 "LikeKind Exchanges." If - you would like a copy of this copyrighted spreadsheet, please provide us with your email address ... A 1031 exchange must be reported for the tax year in which the exchange was initiated through 1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault.

1031 exchange worksheet excel. PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses A. Exchange expenses from sale of Old Property Commissions $_____ Loan fees for seller _____ Title charges _____ ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 1031 Exchange Examples: Like-Kind Examples to Study & Learn From Example 3. You own a $4,000,000 investment property with a tax basis of $3,500,000 — meaning that you have a $500,000 capital gain. You would like to do a 1031 exchange into a $3,800,000 7-Eleven in Newport News, Virginia. If you exchange your $4,000,000 property for the $3,800,000 7-Eleven. Therefore, a taxable cash boot of $200,000 is realized. Real Estate Investment Software Product Comparison ... - RealData Software View all Excel-based real estate investment and development software products for commercial and residential income property analysis. We've been hiding our bundles under a bushel! Find out more >> 800-899-6060 Sign in Email us Software customers - Download your software, get updates and serial numbers. Sign In ...

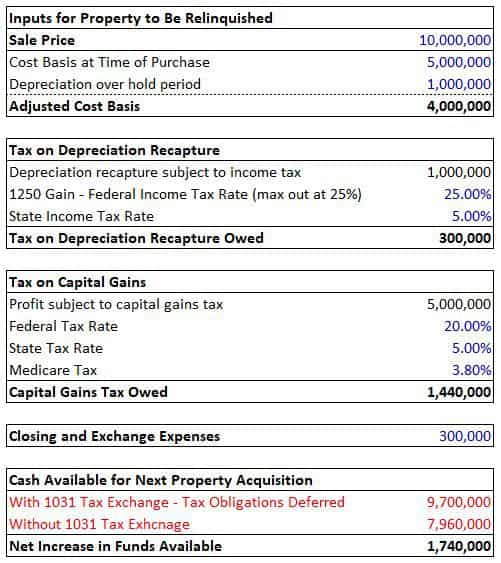

1031 Exchange Worksheet - Pruneyardinn The 1031 Exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet. 1031 Exchange Calculator | Calculate Your Capital Gains Restart & Clear Fields (1) To estimate selling costs use 8 to 10% of selling price consider discounts or allowances given by seller. (2) To estimate residential depreciation taken multiply purchase price of property being sold by 3%, times the number of years the property has been rented. 1031 Exchange - Overview and Analysis Tool (Updated Apr 2022) However, the 1031 Exchange, which has been around since 1921, has survived the recent tax overhaul and appears to be secure in the near term. Compatibility This version of the tool is only compatible with Excel 2013, Excel 2016, and Excel 365. Download the Tool Source File 1031 Exchange Examples | 2022 Like Kind Exchange Example Step 1 Determine Adjusted Basis After several years, Ron and Maggie's adjusted basis in the property may look like this: Step 2 Calculate Realized Gain Ron and Maggie are contemplating selling their property. They believe the property could be sold for $2,850,000. Assuming $50,000 in closing costs, their "realized gain" may look like this:

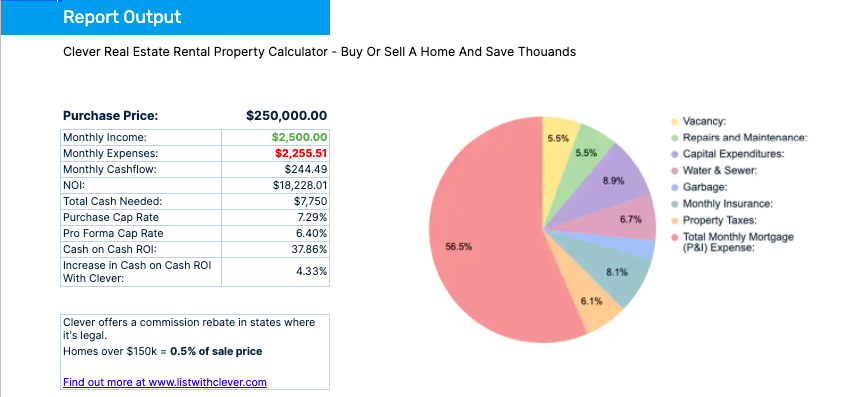

1031 Exchange Calculator - Penn's Grant Realty Corporation We'll be happy to help you with calculating your 1031 Exchange, please give us a call 215-489-3800. Enter the following information and our calculator will provide you an idea of how a 1031 exchange will work in your situation. Note that you can see all of the calculations so you can better understand how the final figures were calculated. ️1031 Exchange Worksheet Free Download| Qstion.co 1031 exchange worksheet (QSTION.CO) - 1031 tax deferred exchange worksheet and 1031 exchange excel spreadsheet. 3) taxpayer/exchangor name* phone* email. In order to aid your youngster much better comprehend and also fix the issues, the 2nd worksheet has the very. If there is no 1031 exchange, it is the difference between the net sales price ... 1031 Tax Deferred Exchange Worksheet And 1031 Exchange Excel Spreadsheet We hope you can find what you need here. We constantly effort to show a picture with high resolution or with perfect images. 1031 Tax Deferred Exchange Worksheet And 1031 Exchange Excel Spreadsheet can be beneficial inspiration for people who seek an image according specific categories, you can find it in this site. 1031 Like Kind Exchange Calculator - Excel Worksheet That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Calculate the taxes you can defer when selling a property Includes state taxes and depreciation recapture Immediately download the 1031 exchange calculator

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

Library of 1031 Exchange Forms Visit our library of important 1031 exchange forms. The pros at Equity Advantage have provided everything you need in easily downloadable PDF files. 800-735-1031 info@1031exchange.com

Get 1031 Exchange Worksheet 2019 2020-2022 - US Legal Forms It takes only a couple of minutes. Follow these simple steps to get 1031 Exchange Worksheet 2019 prepared for sending: Select the form you want in our collection of legal templates. Open the template in the online editing tool. Read the guidelines to determine which details you have to provide. Select the fillable fields and put the required ...

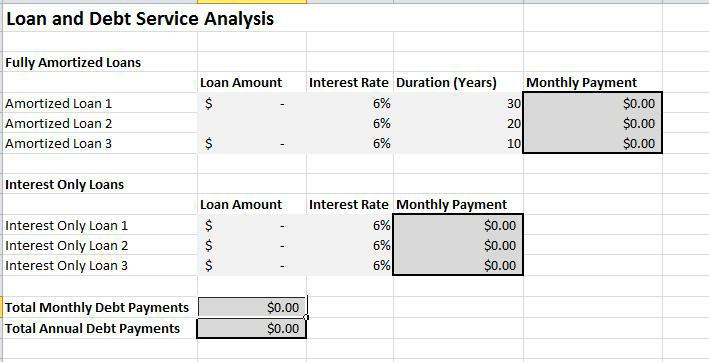

Excel 1031 Property Exchange - Business Spreadsheets 1031 Property Exchange for Excel is designed for investors, real estate brokers and facilitators allowing to: Balance equities. Evaluate boot given and received. Estimate the realized and recognized gains to calculate the transfer basis. Automatically create sample worksheets of IRS Form 8824. Perform "What if" analysis by changing the input ...

1031 Exchange Calculator - The 1031 Investor This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received).

️1031 Exchange Worksheet Excel Free Download| Qstion.co The 1031 exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. 1031 property exchange for excel is designed for investors, real estate brokers and facilitators allowing to: Save Image *Click "Save Image" to View FULL IMAGE Free Download

Instructions for Form 8824 (2022) | Internal Revenue Service The final regulations, which apply to like-kind exchanges beginning after December 2, 2020, provide a definition of real property under section 1031, and address a taxpayer's receipt of personal property that is incidental to real property the taxpayer receives in the exchange. See Regulation sections 1.1031 (a)-1, 1.1031 (a)-3, and 1.1031 (k)-1.

IRC 1031 Like-Kind Exchange Calculator This is known as the exchange period, and there is also an identification period, which is limited to 45 days after closing on the old property. These 45 days of identification are included in the 180-day exchange period. Calculate Your 1031 Deadline Use our 1031 deadline calculator to figure your deadlines. The Improvement Exchange

PDF Home - Realty Exchange Corporation - 1031 Home - Realty Exchange Corporation - 1031

Form 8824 - 1031 Corporation Exchange Professionals We hope that this worksheet will help with these reporting issues that present difficulties in reporting 1031 Exchanges. However, we recognize that almost all Exchanges are different and that this worksheet might or might not work for any given Exchange. It is offered as a possible tool for the use of our clients and their tax professionals.

1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault.

PDF 2019 Exchange Reporting Guide - 1031 Corp Excel spreadsheet to help you with the preparation of IRS Form 8824 "LikeKind Exchanges." If - you would like a copy of this copyrighted spreadsheet, please provide us with your email address ... A 1031 exchange must be reported for the tax year in which the exchange was initiated through

1031 Exchange Experts Equity Advantage - 800.735.1031 Our Team. For three decades, we've been the 1031 Exchange experts. We'll help you with contracts, consult with you on taxation, evaluate investments, and most importantly partner with you. David Moore, CEO, founded Equity Advantage with his brother Tom in 1991, after a successful real estate investment career.

0 Response to "40 1031 exchange worksheet excel"

Post a Comment