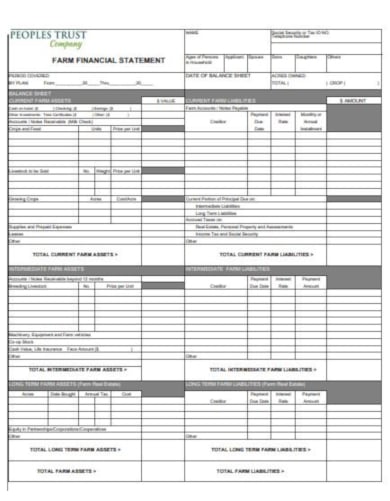

42 farm income and expense worksheet

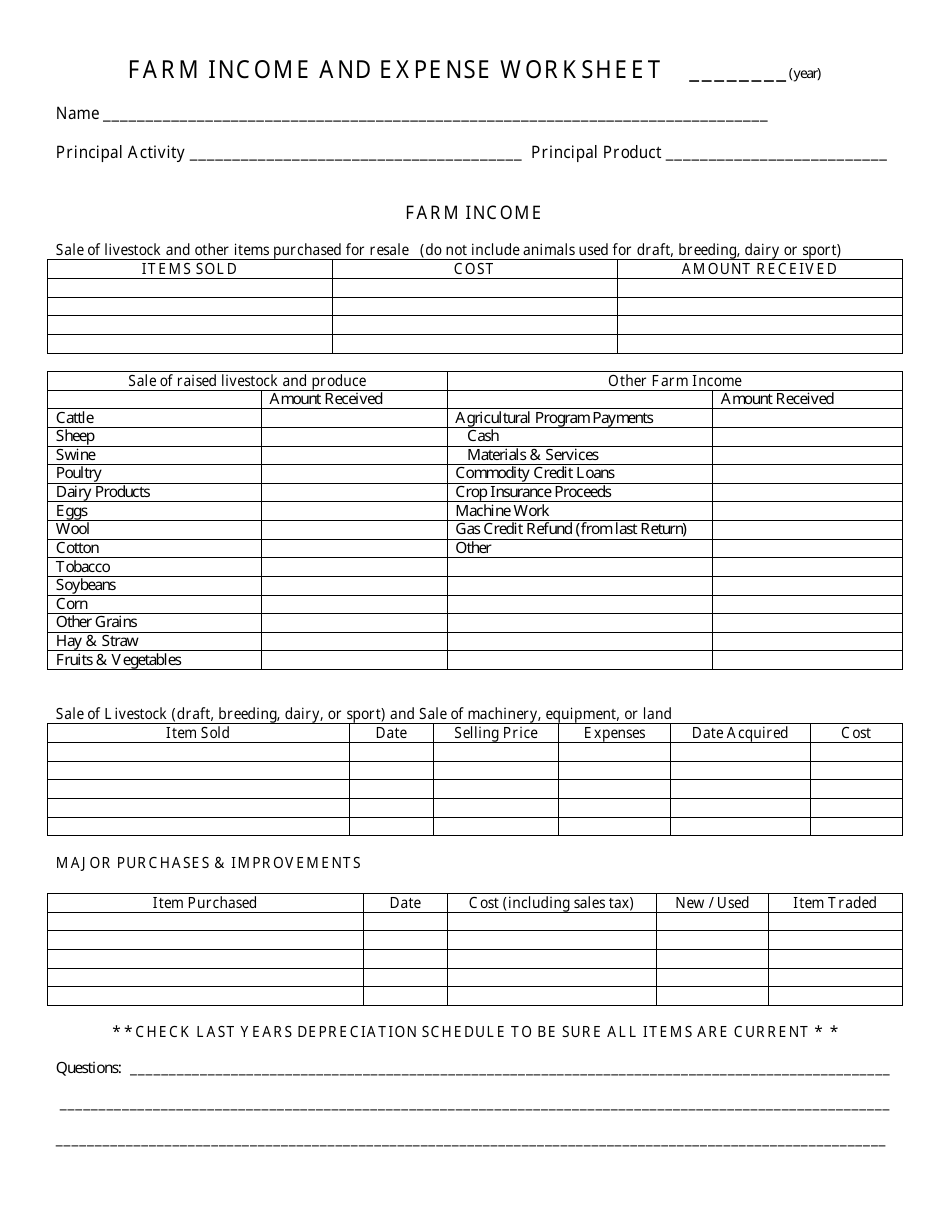

Farm Income Worksheet | Flightax Expense. Banking Fees. $. Rent/Lease – Vehicles, Machinery. $. Breeding Fees. $. Rent – Other Business Property. $. Chemicals. 2014 FARM INCOME & EXPENSE WORKSHEET //////////////////// 2014 FARM INCOME & EXPENSE WORKSHEET ... Did you defer Disaster income, Crop Insurance Proceeds or Forced Sales due to Disaster in Prior tax year?

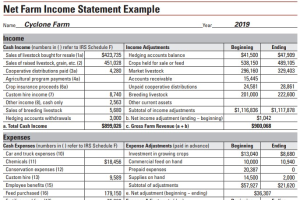

farm worksheet Hedging Income (Loss). SALE OF LIVESTOCK (dairy, draft, breeding), MACHINERY, EQUIPMENT & LAND: Kind of Property. Date Sold. Gross Sale. Sales Expense.

Farm income and expense worksheet

Incorporation (business) - Wikipedia Along with that growth there was a growth in the profits this industry experienced as well. As the disposable income of banks and other financial institutions rose, they sought a way to use it to influence politics and policy. In response, Massachusetts passed a law limiting corporate donations strictly to issues related to their industry. Supplemental Income and Loss (From rental real estate, royalties ... WebPart I Income or Loss From Rental Real Estate and Royalties . Note: If you are in the business of renting personal property, use. Schedule C. See instructions. If you are an individual, report farm rental income or loss from . Form 4835 . on page 2, line 40. A. Did you make any payments in 2022 that would require you to file Form(s) 1099? See ... Farm Income And Expense Worksheet: Farm Record Log Buy Farm Income And Expense Worksheet: Farm Record Log on Amazon.com ✓ FREE SHIPPING on qualified orders.

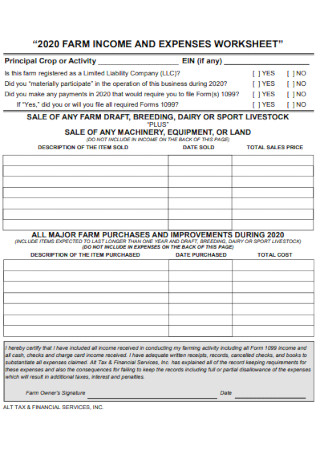

Farm income and expense worksheet. Publication 225 (2022), Farmer's Tax Guide | Internal Revenue … WebMembers of the National Farm Income Tax Extension Committee are contributors to the website, and the website is hosted by Utah State University Cooperative Extension. You can visit the website at ruraltax.org. Future Developments . The IRS has created a page on IRS.gov for information about Pub. 225 at IRS.gov/Pub225. Information about recent … Publication 535 (2021), Business Expenses | Internal Revenue … WebFile Form 1099-MISC, Miscellaneous Income, for each person to whom you have paid during the year in the course of your trade or business at least $600 in rents, prizes and awards, other income payments, medical and health care payments, and crop insurance proceeds. See the Instructions for Forms 1099-MISC and 1099-NEC for more information … FARM INCOME AND EXPENSE WORKSHEET - Marquis Tax Services FARM INCOME AND EXPENSE WORKSHEET. Did you materially participate in the operation or management of the farm on a regular, continuous, and. FARM WORKSHEET FARM INCOME 2022 - RFSW Dec 31, 2022 ... INCOME. EXPENSE. Applied for Forgiveness: YES_____ NO_____. PPP Loan, EIDL Grant, & Other Grants. Other Grants: EIDL Advance/Grant Amount:.

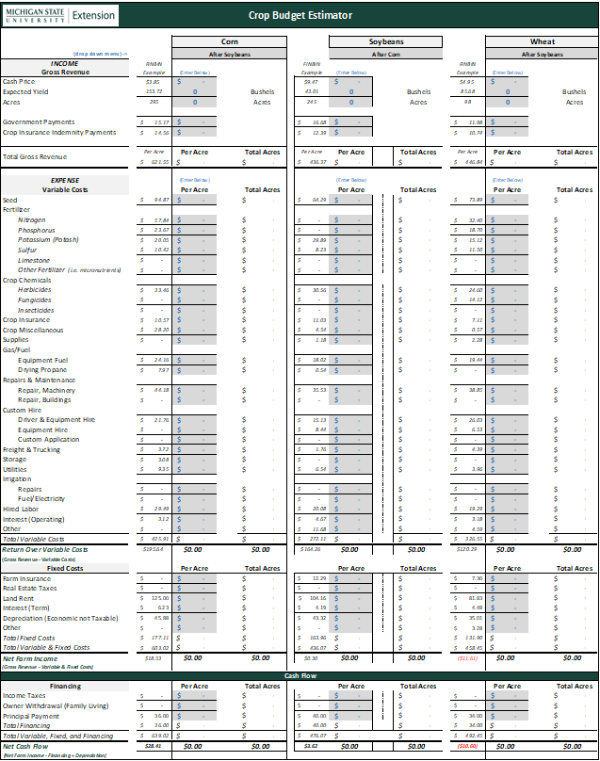

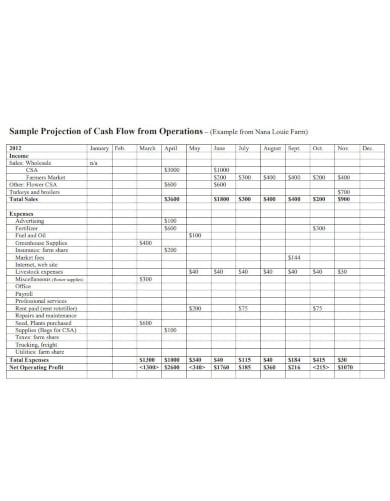

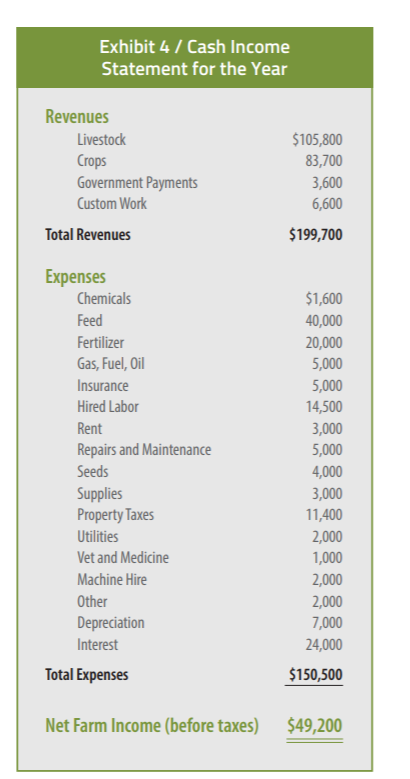

12+ Farm Budget Templates - PDF, DOC Put Together a Farm Budget That Details the Income and Expense, Cash Flow, ... Each Doc and Spreadsheet Example Is Applicable to Any Farming No Matter How ... Publication 970 (2021), Tax Benefits for Education | Internal … WebExample 3—Scholarship partially included in income. The facts are the same as in Example 2—Scholarship excluded from income. If, unlike Example 2, Bill includes $4,000 of the scholarship in income, he will be deemed to have applied that amount to pay for room and board. The remaining $1,600 of the $5,600 scholarship would reduce his ... Cash Flow Analysis (Form 1084) - Fannie Mae these income types provided these sources of income are likely to continue and do not represent a one-time occurrence. Line 6c - Nonrecurring Other (Income) Loss: Other income reported on Schedule F represents income received by a farmer that was not obtained through farm operations. Deduct other income unless the income is determined to be ... Publication 970 (2021), Tax Benefits for Education | Internal ... Example 3—Scholarship partially included in income. The facts are the same as in Example 2—Scholarship excluded from income. If, unlike Example 2, Bill includes $4,000 of the scholarship in income, he will be deemed to have applied that amount to pay for room and board. The remaining $1,600 of the $5,600 scholarship would reduce his ...

Publication 334 (2021), Tax Guide for Small Business WebThere are special methods of accounting for certain items of income or expense. These include the following. Amortization, discussed in chapter 8 of Pub. 535. Bad debts, discussed in chapter 10 of Pub. 535. Depletion, discussed in chapter 9 of Pub. 535. Depreciation, discussed in Pub. 946, How To Depreciate Property. Installment sales, … Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Monthly Farm Expenses Form Template - Pinterest This simple monthly farm expense form includes spaces for the date, the expense, the ... Income and Expense Tracking Worksheet Household Budget Worksheet, ... “2021 FARM INCOME AND EXPENSES WORKSHEET” “2021 FARM INCOME AND EXPENSES WORKSHEET”. Principal Crop or Activity. EIN (if any). Is this farm registered as a Limited Liability Company (LLC)?.

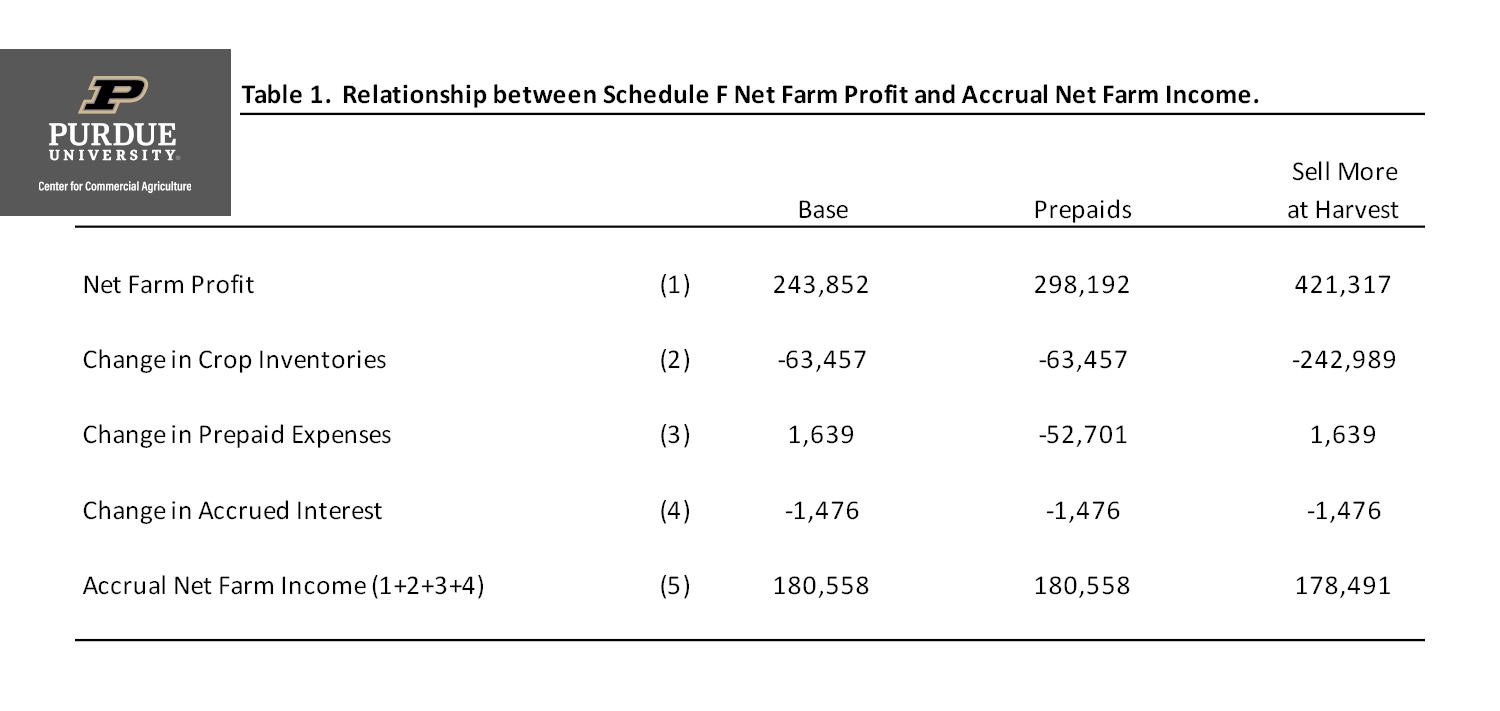

Cash Flow Analysis (Form 1084) - Fannie Mae WebOther income reported on Schedule F represents income received by a farmer that was not obtained through farm operations. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is determined that the loss will not continue.

Publication 17 (2021), Your Federal Income Tax - IRS tax forms WebQualified business income deduction. The simplified worksheet for figuring your qualified business income deduction is now Form 8995, Qualified Business Income Deduction Simplified Computation. If you don't meet the requirements to file Form 8995, use Form 8995-A, Qualified Business Income Deduction. For more information, see each form's …

Incorporation (business) - Wikipedia WebIn 1816, the New Hampshire state legislature passed a bill intended to turn privately owned Dartmouth College into a publicly owned university with a Board of Trustees appointed by the governor. The board filed a suit challenging the constitutionality of the legislation. The suit alleged that the college enjoyed the right to contract and the government changing …

Tables Created by BLS - Bureau of Labor Statistics Web19/07/2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

Tax Support: Answers to Tax Questions | TurboTax® US Support The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics.

Supplemental Income and Loss (From rental real estate ... Part I Income or Loss From Rental Real Estate and Royalties . Note: If you are in the business of renting personal property, use. Schedule C. See instructions. If you are an individual, report farm rental income or loss from . Form 4835 . on page 2, line 40. A. Did you make any payments in 2022 that would require you to file Form(s) 1099?

Unbanked American households hit record low numbers in 2021 Web25/10/2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ...

FARM INCOME AND EXPENSE WORKSHEET ______(year) FARM INCOME AND EXPENSE WORKSHEET ______(year) ... Agricultural Program Payments ... Expenses. Date Acquired. Cost. MAJOR PURCHASES & IMPROVEMENTS.

Farm Income And Expense Worksheet: Farm Record Log Buy Farm Income And Expense Worksheet: Farm Record Log on Amazon.com ✓ FREE SHIPPING on qualified orders.

Supplemental Income and Loss (From rental real estate, royalties ... WebPart I Income or Loss From Rental Real Estate and Royalties . Note: If you are in the business of renting personal property, use. Schedule C. See instructions. If you are an individual, report farm rental income or loss from . Form 4835 . on page 2, line 40. A. Did you make any payments in 2022 that would require you to file Form(s) 1099? See ...

Incorporation (business) - Wikipedia Along with that growth there was a growth in the profits this industry experienced as well. As the disposable income of banks and other financial institutions rose, they sought a way to use it to influence politics and policy. In response, Massachusetts passed a law limiting corporate donations strictly to issues related to their industry.

Farm Expenses and Income Tracker / Printable PDF Expense and Income Tracker / Minimalist Tracker / PDF

:max_bytes(150000):strip_icc()/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

0 Response to "42 farm income and expense worksheet"

Post a Comment