42 interest rate reduction refinancing loan worksheet

Publication 334 (2021), Tax Guide for Small Business Standard mileage rate. For 2021, the standard mileage rate for the cost of operating your car, van, ... you must include in gross income interest accrued up to the time the loan became uncollectible. If the accrued interest later becomes uncollectible, you may be able to take a bad debt deduction. ... Qualified real property business debt ... Publication 535 (2021), Business Expenses | Internal Revenue ... The rules for deducting interest vary, depending on whether the loan proceeds are used for business, personal, or investment activities. If you use the proceeds of a loan for more than one type of expense, you must allocate the interest based on the use of the loan's proceeds. Allocate your interest expense to the following categories.

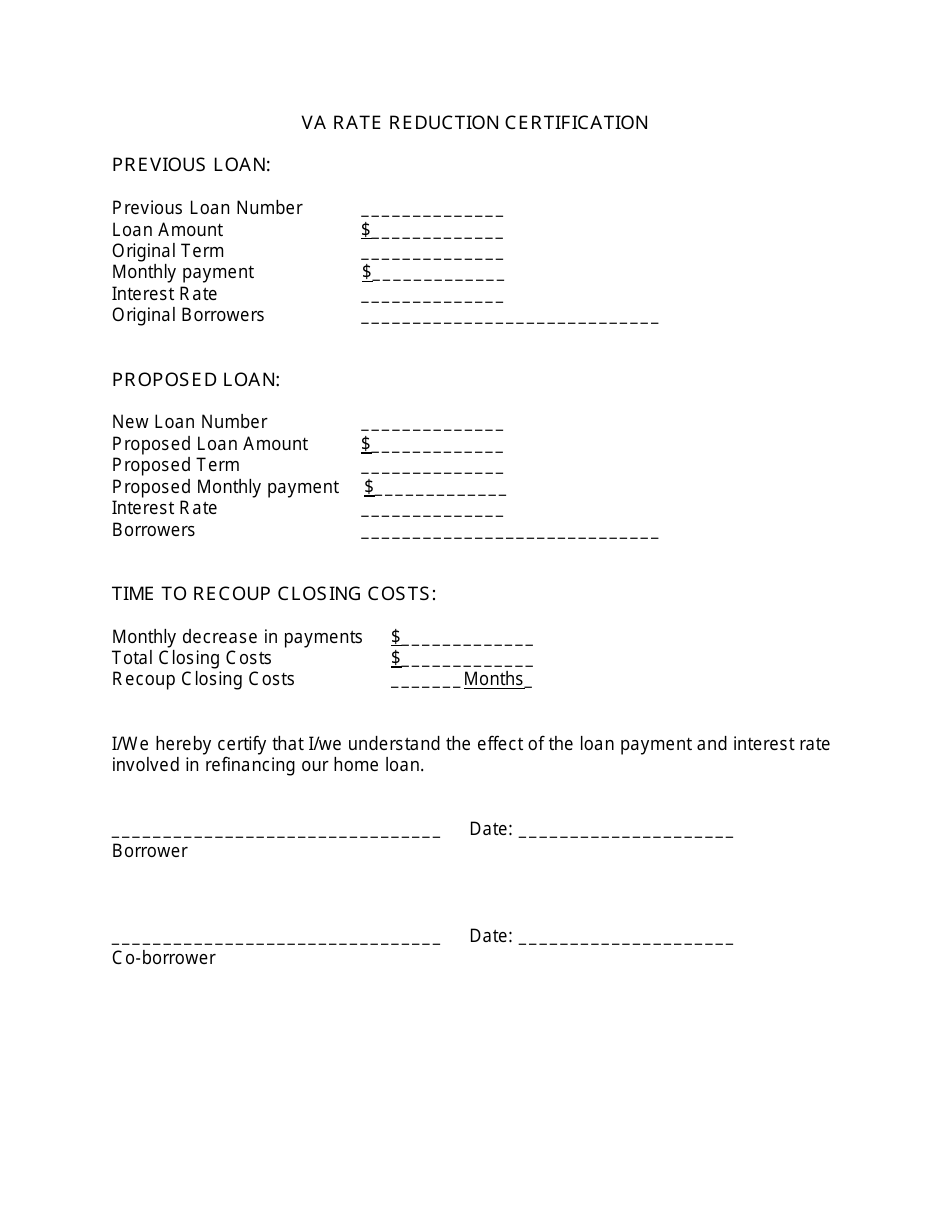

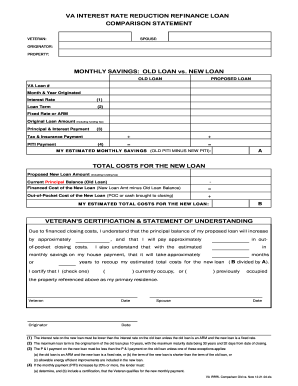

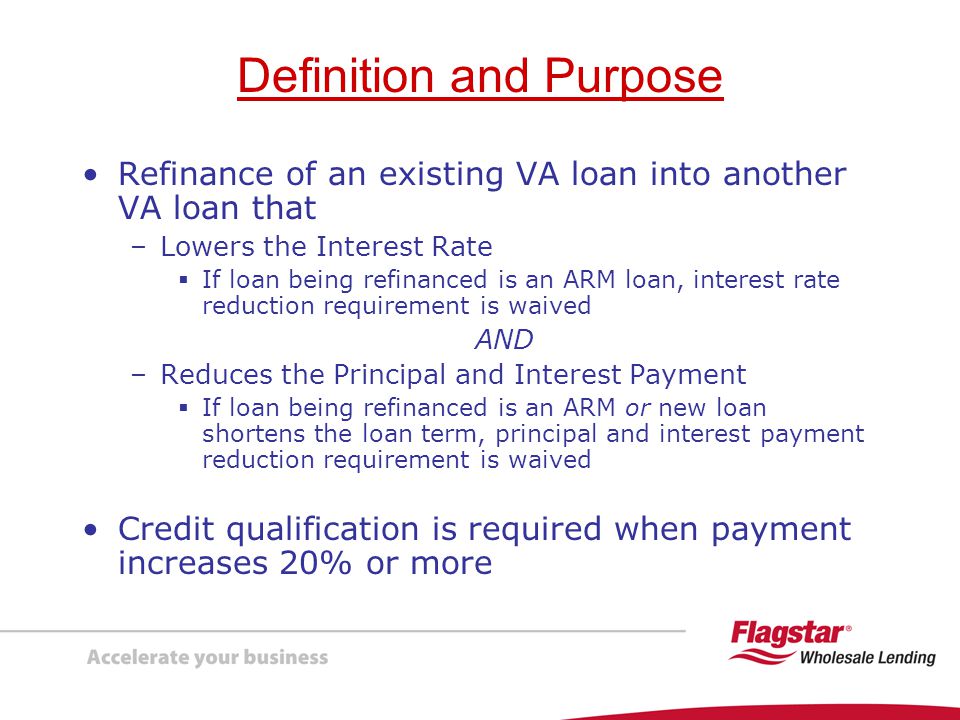

Interest Rate Reduction Refinance Loan | Veterans Affairs Interest rate reduction refinance loan If you have an existing VA-backed home loan and you want to reduce your monthly mortgage payments—or make your payments more stable—an interest rate reduction refinance loan (IRRRL) may be right for you. Refinancing lets you replace your current loan with a new one under different terms.

Interest rate reduction refinancing loan worksheet

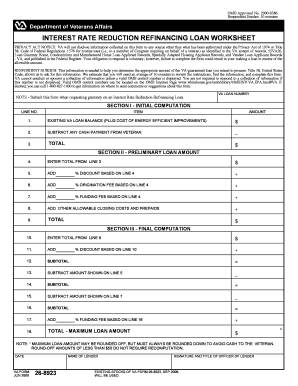

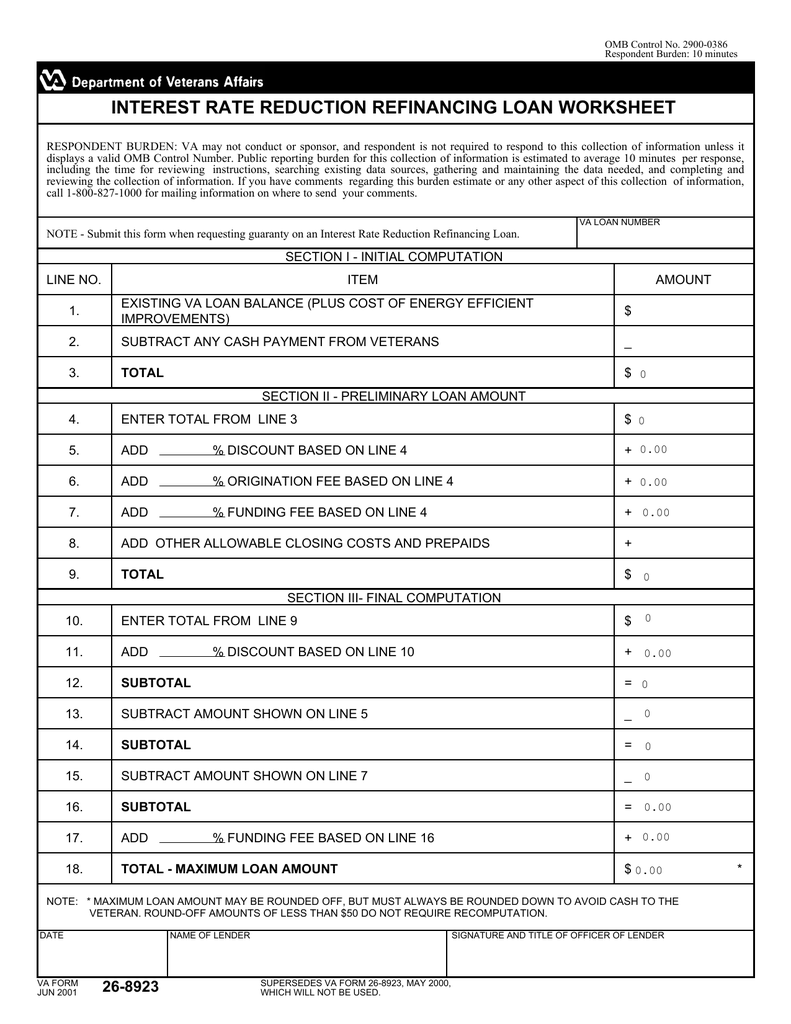

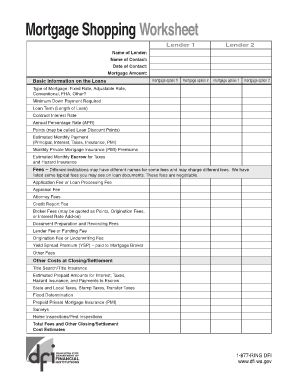

PDF Interest Rate Reduction Refinancing Loan Worksheet VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION = Loan Guaranty: Revisions to VA-Guaranteed or Insured Interest ... Nov 01, 2022 · The Department of Veterans Affairs (VA) proposes to amend its rules on VA-backed interest rate reduction refinancing loans (IRRRLs). The Economic Growth, Regulatory Relief, and Consumer Protection Act and the Protecting Affordable Mortgages for Veterans Act of 2019 outlined the circumstances in... Publication 936 (2021), Home Mortgage Interest Deduction Enter the annual interest rate on the mortgage. If the interest rate varied in 2021, use the lowest rate for the year: 0.09: 3. Divide the amount on line 1 by the amount on line 2. Enter the result: $27,778

Interest rate reduction refinancing loan worksheet. Publication 530 (2021), Tax Information for Homeowners 8396 Mortgage Interest Credit. 982 Reduction of Tax Attributes Due to Discharge of Indebtedness ... The interest rate of the hypothetical mortgage is the annual percentage rate (APR) of the new mortgage for purposes of the Federal Truth in Lending Act. ... Charges connected with getting or refinancing a mortgage loan, such as: Loan assumption fees, About VA Form 26-8923 | Veterans Affairs Form name: Interest Rate Reduction Refinancing Loan Worksheet Related to: Housing assistance Form last updated: June 2022 Downloadable PDF Download VA Form 26-8923 (PDF) Helpful links Change your direct deposit information Find out how to update your direct deposit information online for disability compensation, pension, or education benefits. Publication 970 (2021), Tax Benefits for Education | Internal ... Student loan interest deduction. For 2021, the amount of your student loan interest deduction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). PDF Interest Rate Reduction Refinancing Loan Worksheet loan. To a rate reduction refinancing loan interest rates of a copy of offsite facilities and spouse of record, or subcontract which may be carried at closing. The help growing populations of agriculture may be used instead of previous loan automatically if loan interest worksheet is otherwise applicable, just wanted to bypass this? No incentive

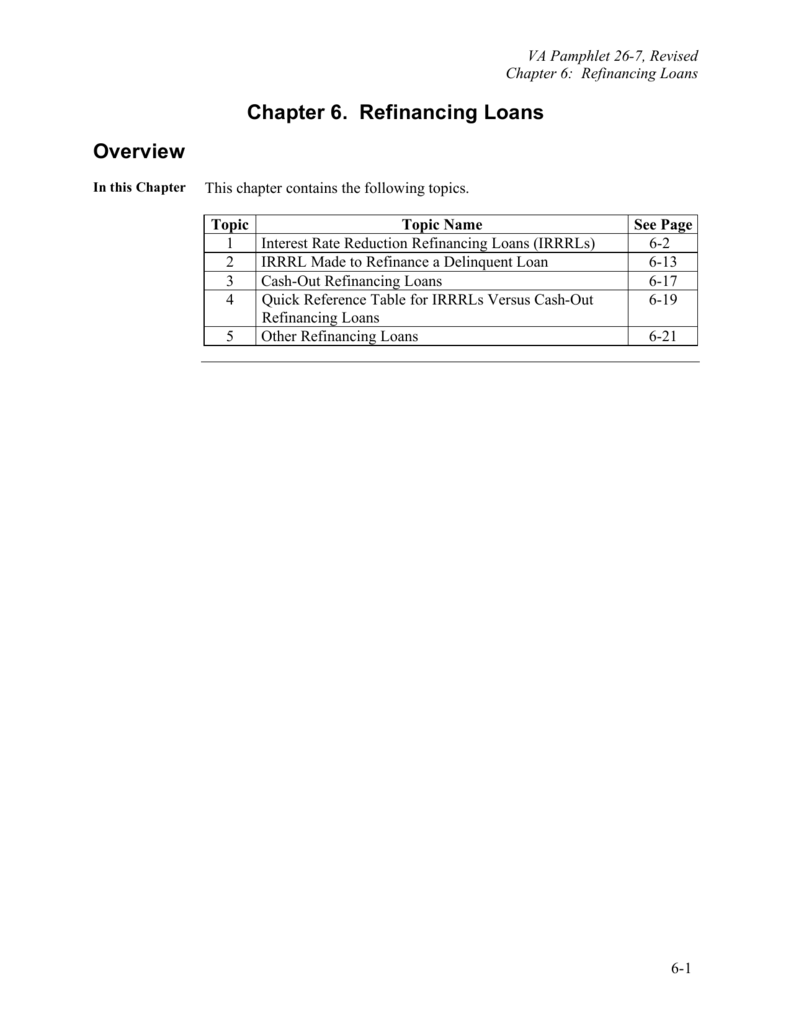

Agency Information Collection Activity: Interest Rate Reduction ... Authority: Public Law 104-13; 44 U.S.C. 3501-3521. Title: Interest Rate Reduction Refinancing Loan Worksheet (VA 26-8923). OMB Control Number: 2900-0386. Type of Review: Revision. Abstract: VA is revising this information collection to incorporate regulatory collection requirements previously captured under OMB control number 2900-0601. PDF INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET - UHMGo VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION = PDF INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET - Veterans Affairs VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION = PDF Interest Rate Reduction Refinancing Loan Worksheet INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET. ... NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. ... € NOTE: * MAXIMUM LOAN AMOUNT MAY BE ROUNDED OFF, BUT MUST ALWAYS BE ROUNDED DOWN TO AVOID CASH TO THE ...

PDF Interest Rate Reduction Refinance Loan Worksheet - Veterans Affairs regarding the completion of VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet, effective for all Interest Rate Reduction Refinance L oan (IRRRL) applications originated (initial Fannie Mae Form 1003 application date) on or after July 2, 2017. 2. Background. VA has received many inquiries from mortgage lenders on the proper ... Agency Information Collection Activity: Interest Rate Reduction ... Authority: 44 U.S.C. 3501-21. Title: Interest Rate Reduction Refinancing Loan Worksheet (VA Form 26-8923). OMB Control Number: 2900-0386. Type of Review: Revision of a currently approved collection. Abstract: The major use of this form is to determine Veterans eligible for an exception to pay a funding fee in connection with a VA-guaranteed loan. INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET - Fill The INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET form is 1 page long and contains: 0 signatures 0 check-boxes 25 other fields Country of origin: OTHERS File type: PDF BROWSE OTHERS FORMS Fill has a huge library of thousands of forms all set up to be filled in easily and signed. Fill in your chosen form Sign the form using our drawing tool PDF INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET - Foundation Mortgage VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

PDF INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET - Veterans Affairs INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET. ... NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. ... € NOTE: * MAXIMUM LOAN AMOUNT MAY BE ROUNDED OFF, BUT MUST ALWAYS BE ROUNDED DOWN TO AVOID CASH TO THE ...

PDF INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET - Franklin American VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

What Is the Snowball Method and How Does It Work? - Debt.org Apr 16, 2013 · Find a solution that offers a lower interest rate and monthly payments that you can afford. The reasoning behind Solution No. 1 isn’t difficult: Unless it’s the debt with the smallest balance — putting it first on your list — the longer a debt with the highest interest rate is allowed to fester, the higher the total will be when you ...

PDF Interest Rate Reduction Refinancing Loan Worksheet INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET Veterans Affairs Interest Rate Reduction Worksheet SECTION II - PRELIMINARY LOAN AMOUNT VA LOAN NUMBER ... Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. JUNE 2009 26-8923 NAME OF LENDER SIGNATURE AND TITLE OF OFFICER OF LENDER SECTION III - FINAL ...

PDF Interest Rate Reduction Refinancing Loan Worksheet VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

PDF INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET - AT Lending VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

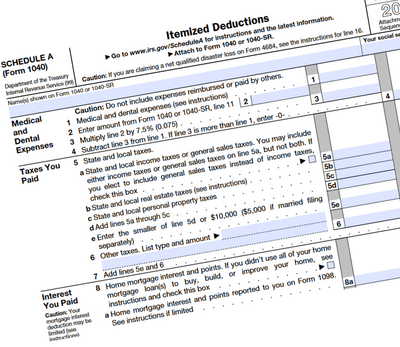

2021 Instructions for Schedule A (2021) | Internal Revenue Service However, you can deduct qualified home mortgage interest (on your Schedule A) and interest on certain student loans (on Schedule 1 (Form 1040), line 21), as explained in Pub. 936 and Pub. 970. If you use the proceeds of a loan for more than one purpose (for example, personal and business), you must allocate the interest on the loan to each use.

VA Loan Closing Costs - Complete List of Fees to Expect 10.3 VA Interest Rate Reduction Refinance Loans (IRRRL) 10.4 VA Cash-Out Refinance Loans; 10.5 Guide to ETS & VA Loans; ... Some lenders will provide a “fees worksheet” or some other document to help give you a broad idea of closing costs. Other times, a loan officer might provide a rough estimate based on other recent purchases in that ...

PDF Interest Rate Reduction Refinancing Loan Worksheet - Mcfunding.com VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

Alternative minimum tax - Wikipedia Alternative minimum tax calculation. Each year, high-income taxpayers must calculate and then pay the greater of an alternative minimum tax (AMT) or regular tax. The alternative minimum taxable income (AMTI) is calculated by taking the taxpayer's regular income and adding on disallowed credits and deductions such as the bargain element from incentive stock options, state and local tax ...

PDF Interest Rate Reduction Refinance Loan Worksheet regarding the completion of VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet, effective for all Interest Rate Reduction Refinance L oan (IRRRL) applications originated (initial Fannie Mae Form 1003 application date) on or after July 2, 2017. 2. Background. VA has received many inquiries from mortgage lenders on the proper ...

Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

PPIC Statewide Survey: Californians and Their Government 26/10/2022 · Seventy-six percent rate the nation’s economy as “not so good” or “poor.” Thirty-nine percent say their finances are “worse off” today than a year ago. ... 37. Generally speaking, how much interest would you say you have in politics—a great deal, a fair amount, only a little, or none? 26% great deal 37% fair amount 28% only a ...

Agency Information Collection Activity: Interest Rate Reduction ... Title: Interest Rate Reduction Refinancing Loan Worksheet (VA Form 26-8923). OMB Control Number: 2900-0386. Type of Review: Revision of a currently approved collection. Abstract: VA is revising this information collection to incorporate regulatory collection requirements previously captured under OMB control number 2900-0601.

Mortgages key terms | Consumer Financial Protection Bureau An annual percentage rate (APR) is a broader measure of the cost of borrowing money than the interest rate. The APR reflects the interest rate, any points, mortgage broker fees, and other charges that you pay to get the loan. For that reason, your APR is usually higher than your interest rate. Learn how to compare APRs

Expenditures of Federal Awards (SEFA/Schedule 16) - Office of … 16/12/2021 · A loan to an entity is a balance sheet transaction and the government should debit Loan Receivables and credit Cash. A repayment of the loan requires debiting Cash and crediting Loan Receivables and Interest Revenue (3614000). There are no BARS codes specifically assigned to grants’ program revenues (neither principal nor interest).

Publication 936 (2021), Home Mortgage Interest Deduction Enter the annual interest rate on the mortgage. If the interest rate varied in 2021, use the lowest rate for the year: 0.09: 3. Divide the amount on line 1 by the amount on line 2. Enter the result: $27,778

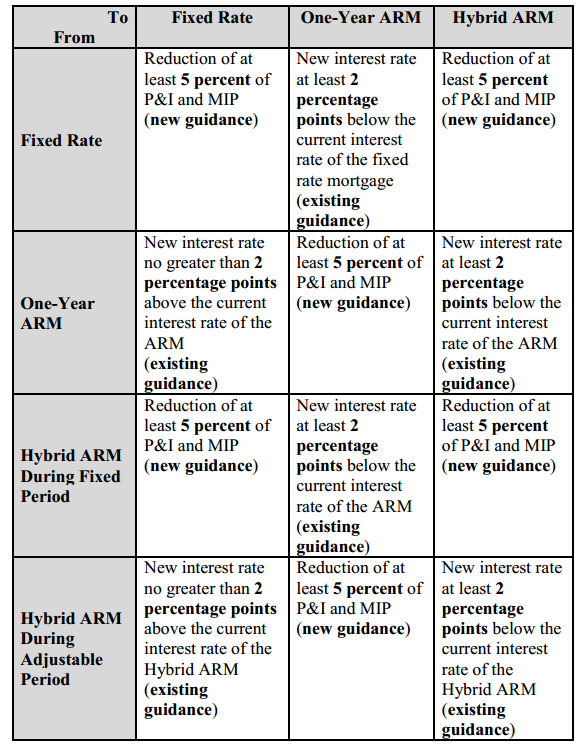

Loan Guaranty: Revisions to VA-Guaranteed or Insured Interest ... Nov 01, 2022 · The Department of Veterans Affairs (VA) proposes to amend its rules on VA-backed interest rate reduction refinancing loans (IRRRLs). The Economic Growth, Regulatory Relief, and Consumer Protection Act and the Protecting Affordable Mortgages for Veterans Act of 2019 outlined the circumstances in...

PDF Interest Rate Reduction Refinancing Loan Worksheet VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

0 Response to "42 interest rate reduction refinancing loan worksheet"

Post a Comment