43 1040 qualified dividends and capital gains worksheet

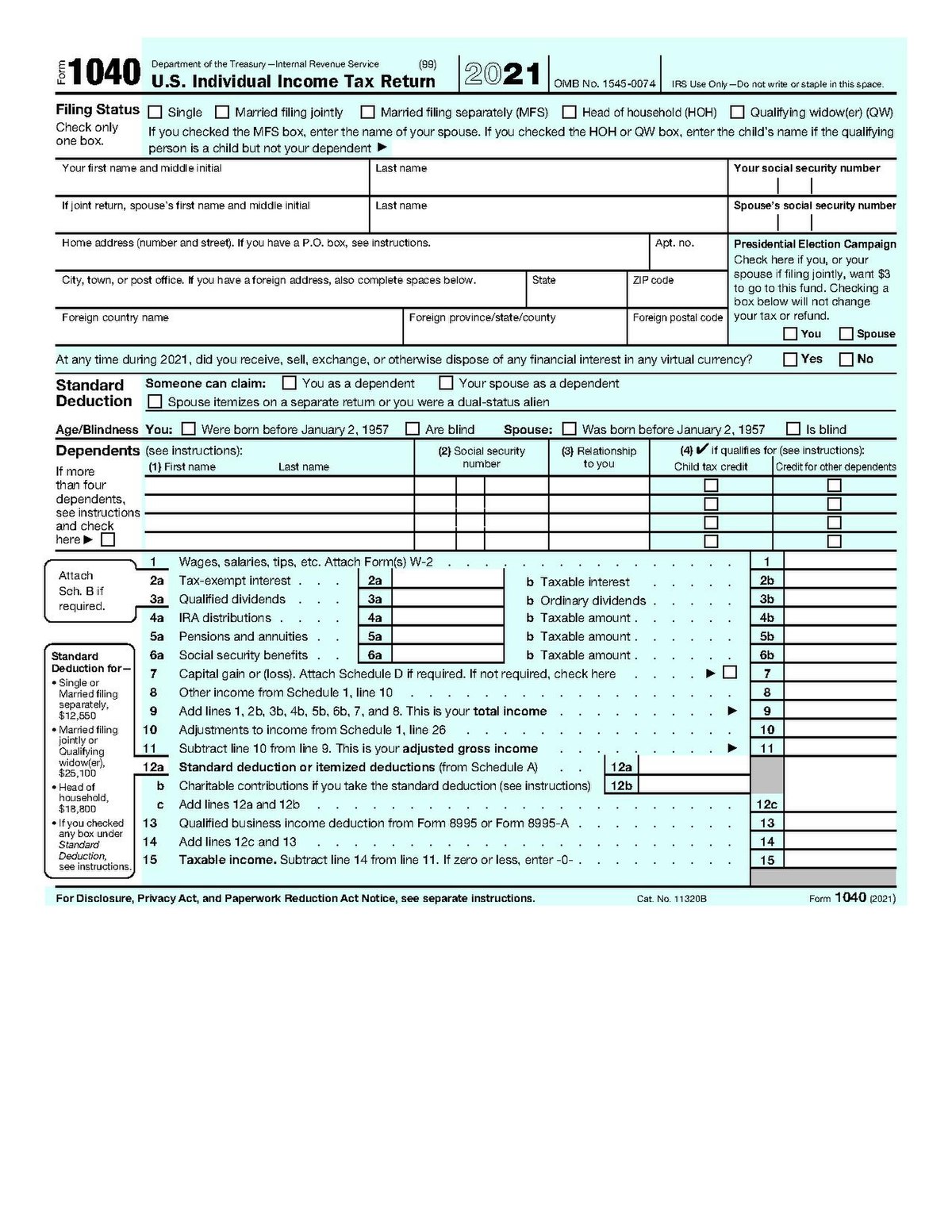

How Your Tax Is Calculated: Understanding the Qualified Dividends and ... Instead, 1040 Line 44 "Tax" asks you to "see instructions." In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. Qualified Dividends and Capital Gains Worksheet - StuDocu See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 6.

Qualified Dividends And Capital Gain Tax Worksheet 2021 - signNow All you need is smooth internet connection and a device to work on. Follow the step-by-step instructions below to eSign your capital gains tax worksheet 2021: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature.

1040 qualified dividends and capital gains worksheet

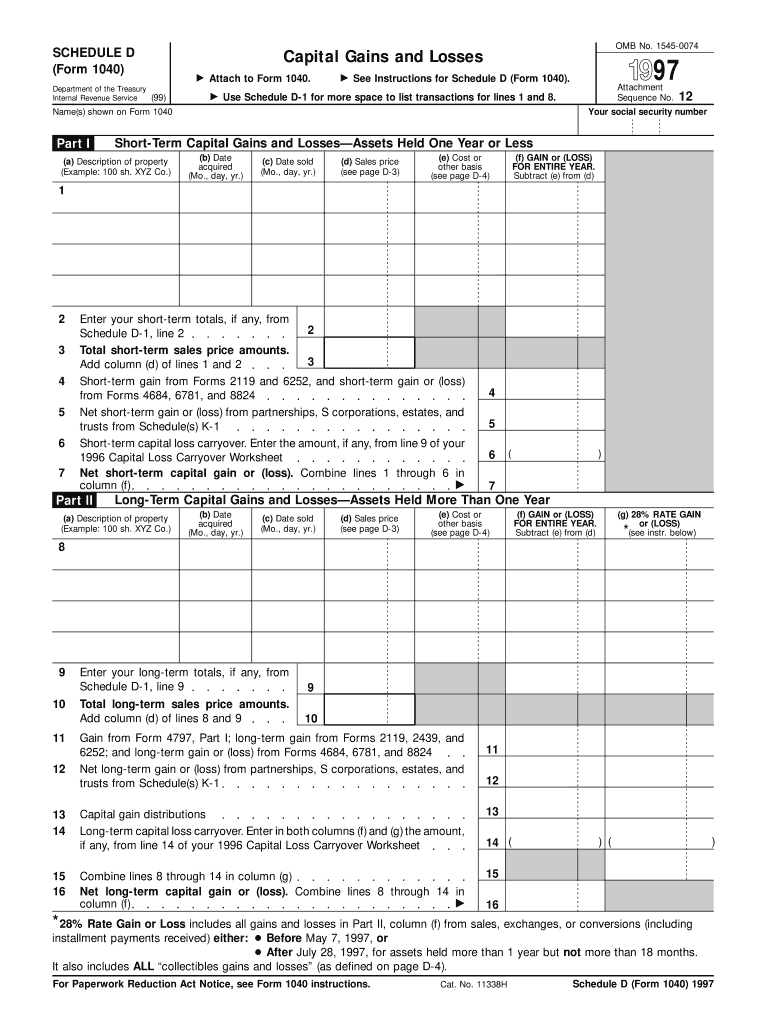

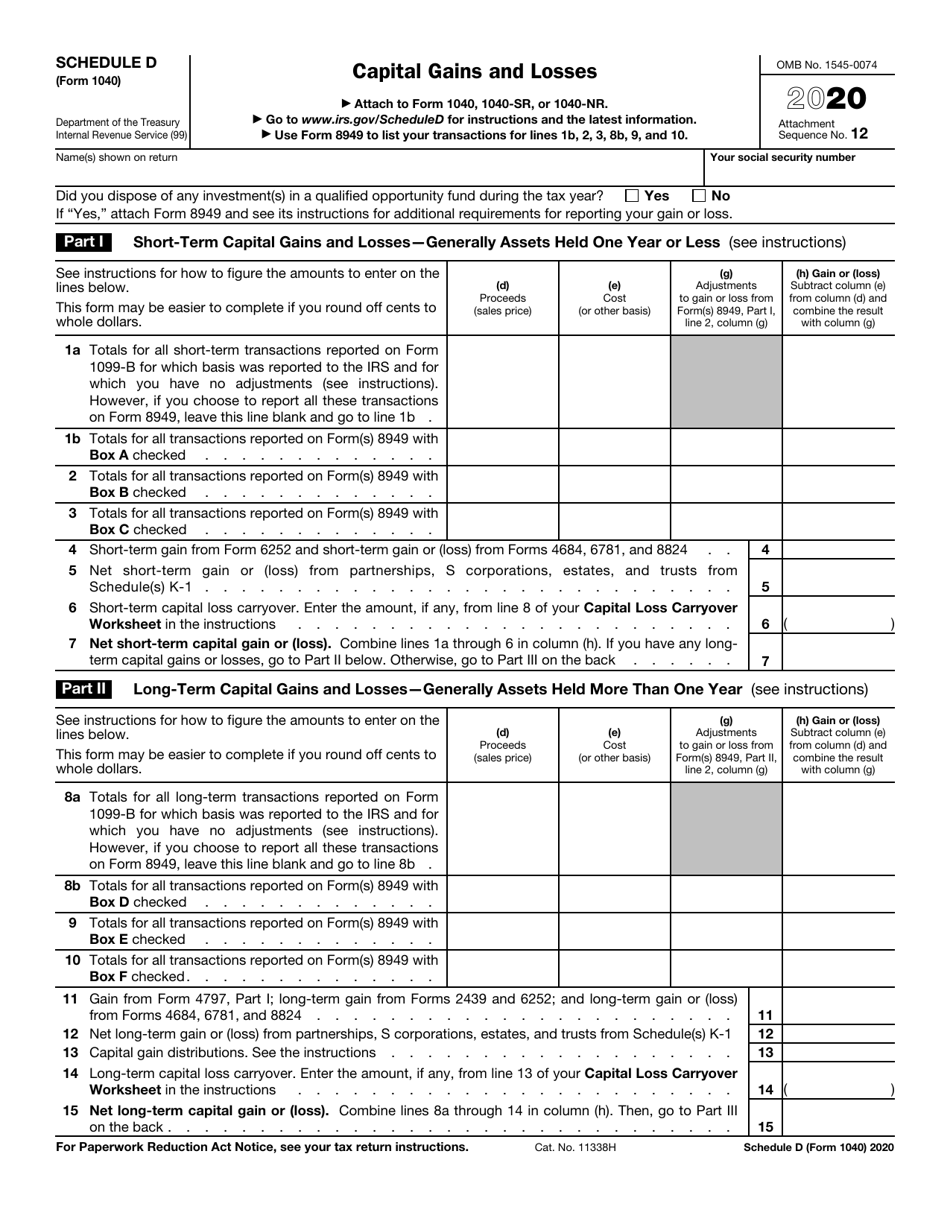

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow). How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Sep 24, 2021 · In this way, the size of your ordinary income can change in which qualified bracket your qualified dividends and capital gains are taxed. Lines 6-9: Non-Taxable Qualified Income. The first qualified tax bracket is the 0% bracket. Lines 6-9 of the worksheet are figuring if any gains are taxed at the 0% rate (line 9). SCHEDULE D Capital Gains and Losses - IRS tax forms SCHEDULE D (Form 1040 or 1040-SR) Department of the Treasury Internal Revenue Service (99) Capital Gains and Losses Attach to Form 1040, 1040-SR, or 1040-NR.

1040 qualified dividends and capital gains worksheet. Publication 3 (2021), Armed Forces' Tax Guide | Internal ... Certain investment income must be $10,000 or less during the year. For most people, this investment income is taxable interest and dividends, tax-exempt interest, and capital gain net income. See Worksheet 1 in Pub. 596 for more information on the investment income includible in the amount that must meet the $10,000 limit. Qualified Dividends And Capital Gain Worksheet - Martin Lindelof Web use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax worksheet and if any of the following. Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you. Source: db-excel.com Instructions for Form 1116 (2021) | Internal Revenue Service If you aren't required to complete the Worksheet for Line 18 or you qualify for the adjustment exception and elect not to adjust your qualified dividends and capital gains, enter on line 18 of Form 1116 your taxable income without the deduction for your exemption (for example, the amount from Form 1040, 1040-SR, or 1040-NR, line 15). Qualified Dividends and Capital Gain Tax Worksheet - Course Hero Qualified Dividends and Capital Gain Tax Worksheet - Line 16 1. Enter the amount from Form 1040 or 1040-SR, line 15. 118,915 2. Enter the amount from Form 1040 or 1040-SR, line 3a* 2,000 3. Are you filing Schedule D? ☐ Yes. Enter the smaller of line 15 or 16 of Schedule D.

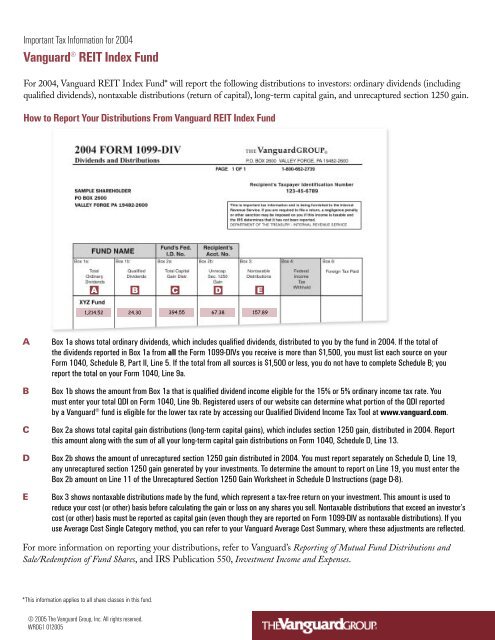

PDF Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to ... rates to qualified dividends received after 2002 and before 2009. The IRS added several lines to Schedule D, Capital Gains and Losses, to capture the different rates that apply during 2003 and to include the dividend tax break. Schedule D will be much shorter for 2004, when one set of rates will apply for the whole year. Worksheet Alternative How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. Multiple worksheet Template for Assignment 3 Fall 2022 (1).xlsx Line 16 Worksheet Line 1: Form 1040, Line 15 (Taxable Income) Line 2: Form 1040, Line 3a (Qualified divdends) Line 3: Line 7 Capital gains Line 4: Add Lines 2 and 3 Line 5: Line 1 - Line 4 Line 6: Statutory cutoff: 41,675/83,350/55,800 (Single, MFJ, HH) Line 7: Smaller of Line 1 or Line 6 Line 8: Smaller of Line 5 or Line 7 Line 9: Line 7 - Line 8: Amount taxed at 0% Line 10: Smaller of Line 1 ... How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7.

Page 40 of 117 - IRS tax forms Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1. Enter the amount from Form 1040, line 10. However, if you are filing Form How Capital Gains and Dividends Are Taxed Differently Dec 25, 2021 · In the case of qualified dividends, these are taxed the same as long-term capital gains. For 2021 and 2022, individuals in the 10% to 12% tax bracket are still exempt from any tax. Publication 519 (2021), U.S. Tax Guide for Aliens | Internal … Redesigned Form 1040-NR. Beginning with tax year 2020, nonresident alien taxpayers will file a redesigned Form 1040-NR, which is similar to the Form 1040. Attach Form 1040-NR Schedules OI, A, and NEC to Form 1040-NR as necessary. Filers may also be required to attach Form 1040 Schedules 1, 2, or 3 to Form 1040-NR. Publication 929 (2021), Tax Rules for Children and Dependents If line 8 includes any net capital gain or qualified dividends, use the Qualified Dividends and Capital Gain Tax Worksheet to figure this tax. For details, see the instructions for Form 8615, line 9. However, if the child, the parent, or any other child has 28% rate gain or unrecaptured section 1250 gain, use the Schedule D Tax Worksheet.

Qualified Dividend and Capital Gains Tax Worksheet? - YouTube The tax rate computed on your Form 1040 must consider any tax-favored items, such as qualified dividends and long-term capital gains, which are generally sub...

PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) - IA Rugby.com Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain ...

1040 (2021) | Internal Revenue Service - IRS tax forms ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200.

'Qualified Dividends And Capital Gain Tax Worksheet' - A Basic, Simple ... This entry was posted in Musings and tagged Anura Guruge, check the math, Excel, Excel1040, math, Qualified Dividends And Capital Gain Tax Worksheet, spreadsheet, TurboTax on February 24, 2022 by admin. Post navigation ← Ukraine (2022) vs Poland (1939): The HUGE Difference — Where Is OUR 'Churchill'?

BCHEDULE D (Form 1040) Capltal Gains and Losses If | Chegg.com Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 16. Don't complete lines 21 and 22 below. ... Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 16. Np. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Form if: Sales and Other ...

PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... See the instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43 (Form ...

What is a Qualified Dividend Worksheet? - Money Inc If you have never come across a qualified dividend worksheet, IRS shows how one looks like; its complete name is "Qualified Dividend and Capital Gain Tax Worksheet-Line 11a." In short, it is referred to as Form 1040-Line 11a, and even before you try filing out the many blank spaces, you are supposed to have filled out Form 1040 through line 10.

PDF and Losses Capital Gains - IRS tax forms ly on Form 1040-NR, line 7); and •To report a capital loss carryover from 2021 to 2022. Additional information. See Pub. 544 and Pub. 550 for more details. ... Unrecaptured Section 1250 Gain Worksheet. Exclusion of Gain on Qualified Small Business \(QSB\) Stock. Exclusion of Gain on Qualified Small Business \(QSB\) Stock.

Forms and Instructions (PDF) - IRS tax forms Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains. 2021. 01/07/2022. Form 2438. Undistributed Capital Gains Tax Return. 1220. 11/30/2020. Form 2439. Notice to Shareholder of Undistributed Long-Term Capital Gains.

2022 Instructions for Schedule D (2022) | Internal Revenue Service Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 16, (or in the instructions for Form …

Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 On average this form takes 7 minutes to complete The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: 0 signatures 2 check-boxes 29 other fields Country of origin: US File type: PDF

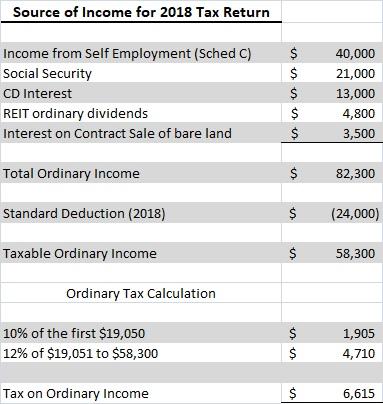

Solved Instructions Form 1040 Schedule 1 Schedule 5 Schedule | Chegg.com Expert Answer. As per given details please refer below answer :- In 2018 line 11a on form 1040 total tax liability is reported. Standard deductio …. View the full answer. Transcribed image text: Instructions Form 1040 Schedule 1 Schedule 5 Schedule B Qualified Dividends and Capital Gain Tax Worksheet Form 1040 X 7,000 6 173,182 4,453.50 + 22% ...

Instructions for Form 1040-NR (2021) | Internal Revenue Service Simplified Method Worksheet—Lines 5a and 5b Exception 1. Exception 2. Line 6—Reserved for Future Use Exception. Line 7—Capital Gain or (Loss) Exception. Lines 10a, 10b, 10c, and 10d—Adjustments to Income Line 10b—Reserved for Future Use Line 10c Lines 12a, 12b, and 12c Line 12a—Itemized Deductions or Standard Deduction

Fillable Qualified Dividends and Capital Gain Tax Worksheet This printable PDF blank is a part of the 1040 guide-you-on-your-way brochure's 'Tax and Credits' section. It is used only if you have dividend income or long-term capital gains (LTCG). What I need the fillable Qualified Dividends Worksheet for? You'll need the Qualified Dividend and Capital Gain Worksheet for the following major purposes:

Qualified Business Income Deduction | Internal Revenue Service REIT/PTP Component. This component of the deduction equals 20 percent of qualified REIT dividends and qualified PTP income. This component is not limited by W-2 wages or the UBIA of qualified property. Depending on the taxpayer’s taxable income, the amount of PTP income that qualifies may be limited depending on the PTP’s trade or business.

Qualified Dividends and Capital Gains Worksheet.pdf qualified dividends and capital gain tax worksheet—line 12a keep for your records see the earlier instructions for line 12a to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 or 1040-sr through line 11b.if you don't have to file schedule d and you received capital gain distributions, be …

Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain ...

Instructions for Form 8615 (2022) | Internal Revenue Service If line 8 includes any net capital gain or qualified dividends, use the Qualified Dividends and Capital Gain Tax Worksheet to figure this tax. For details, see the instructions for Form 8615, line 9. However, if the child, the parent, or any other child has 28% rate gain or unrecaptured section 1250 gain, use the Schedule D Tax Worksheet.

ACC 330 Final Project Two Qualified Dividends and Capital Gains Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 6. Enter the amount from Form 1040 or 1040-SR, line 11b.

SCHEDULE D Capital Gains and Losses - IRS tax forms SCHEDULE D (Form 1040 or 1040-SR) Department of the Treasury Internal Revenue Service (99) Capital Gains and Losses Attach to Form 1040, 1040-SR, or 1040-NR.

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Sep 24, 2021 · In this way, the size of your ordinary income can change in which qualified bracket your qualified dividends and capital gains are taxed. Lines 6-9: Non-Taxable Qualified Income. The first qualified tax bracket is the 0% bracket. Lines 6-9 of the worksheet are figuring if any gains are taxed at the 0% rate (line 9).

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow).

0 Response to "43 1040 qualified dividends and capital gains worksheet"

Post a Comment