40 qualified dividends and capital gain tax worksheet fillable

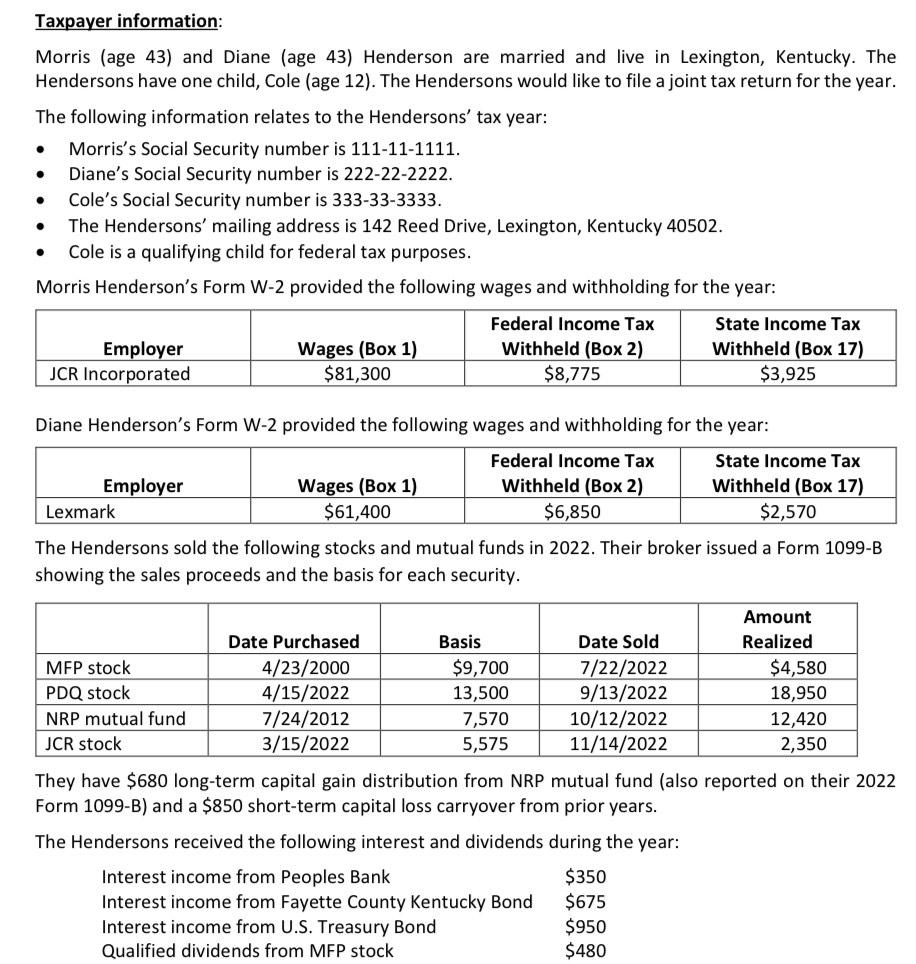

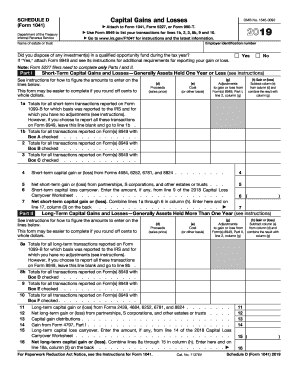

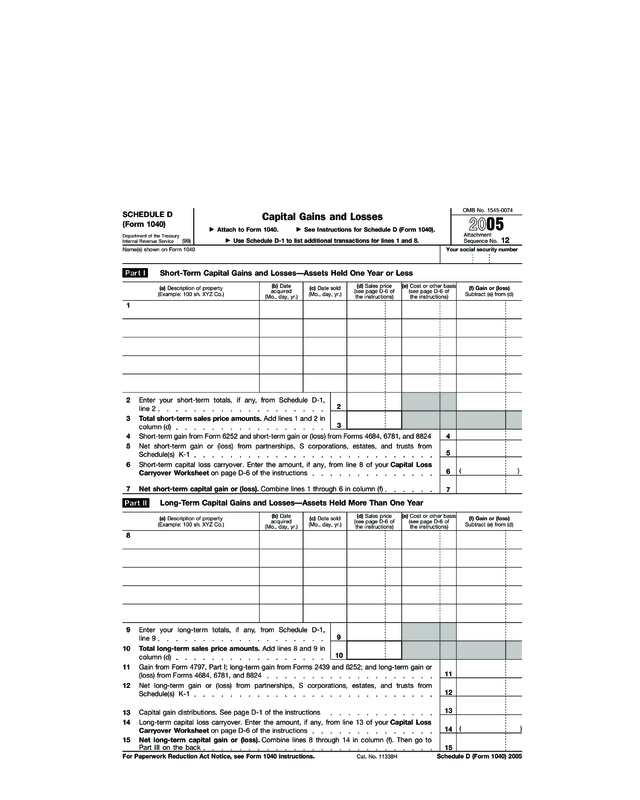

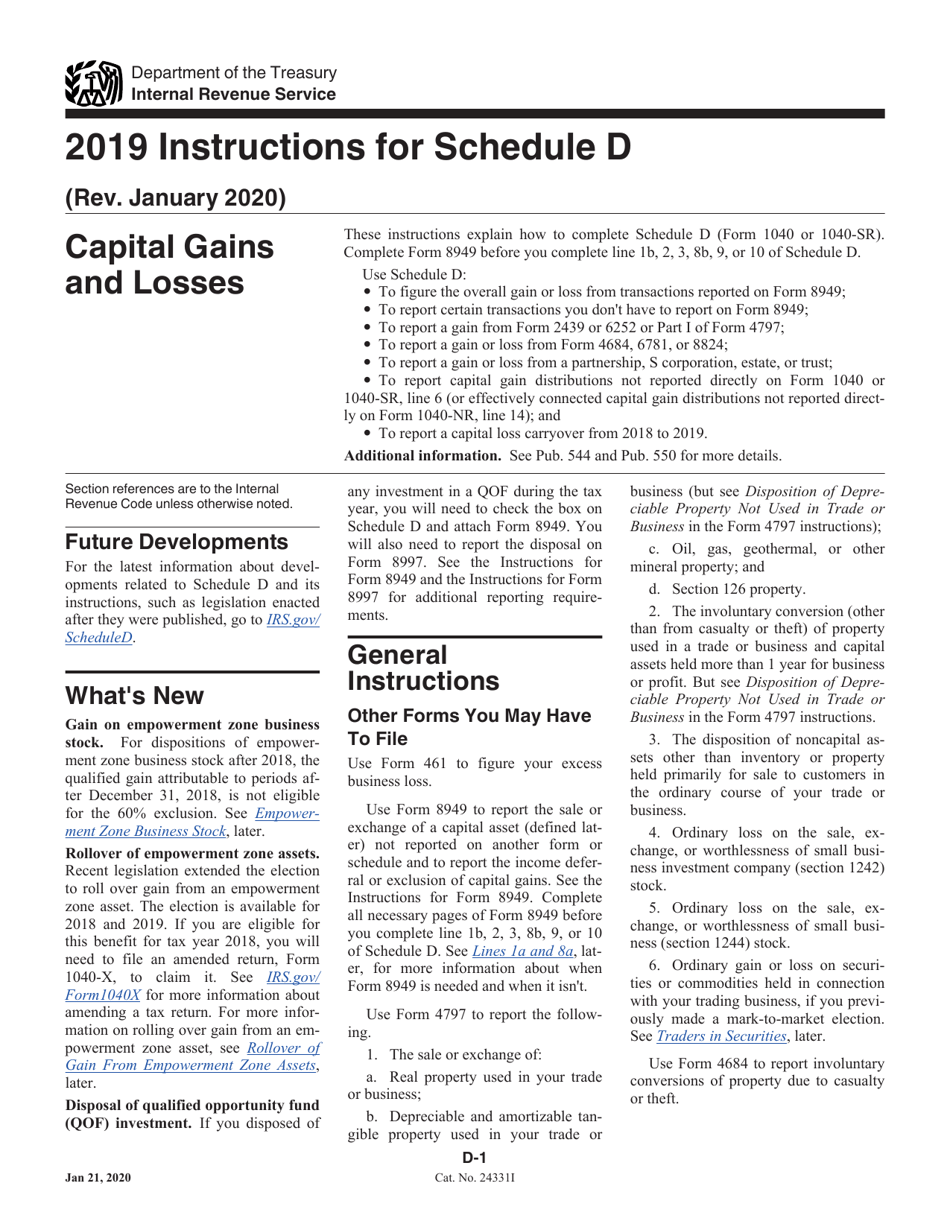

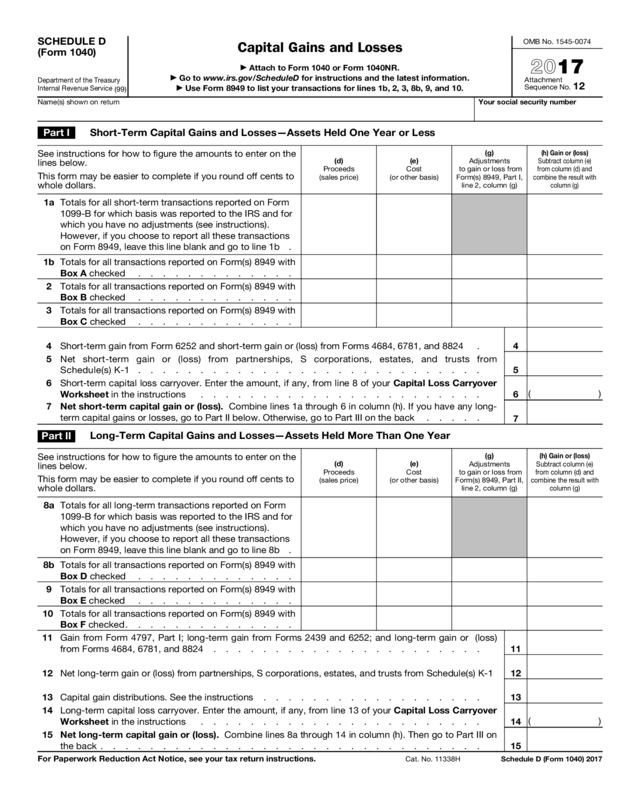

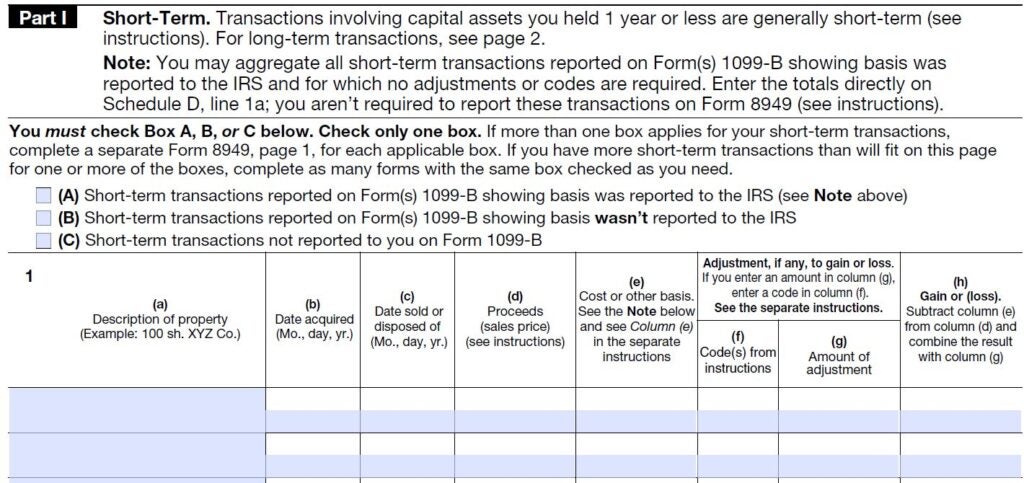

Qualified Dividends and Capital Gain Tax - taxact.com Qualified Dividends and Capital Gain Tax. Information reported to you on Form 1099-DIV and Form 1099-B can be entered in the TaxAct program in the Investment Income section of the Federal Q&A, or directly on the forms where applicable. The Tax Summary screen will indicate if the tax has been computed on the Schedule D Worksheet or the Qualified ... 2022 Instructions for Schedule D (2022) - IRS tax forms Use Form 8997 to report each QOF investment you held at the beginning and end of the tax year and the deferred gains associated with each investment. Also, use Form 8997 to report any capital gains you are deferring by investing in a QOF during the tax year and any QOF investment you disposed of during the tax year. Capital Asset

1040 capital gains worksheet 33 Qualified Dividends And Capital Gain Tax Worksheet Line 44 dontyou79534.blogspot.com. dividends. Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Page worksheet.middleworld.net. irs fillable gains losses gain templateroller dividends. 1040 28 Rate Gain Worksheet - Worksheet Template Design cheaperpetsafeinvisiblefence ...

Qualified dividends and capital gain tax worksheet fillable

› publications › p523Publication 523 (2021), Selling Your Home | Internal Revenue ... Using the information on Form 8949, report on Schedule D (Form 1040) the gain or loss on your home as a capital gain or loss. Follow the Instructions for Schedule D when completing the form. If you have any taxable gain from the sale of your home, you may have to increase your withholding or make estimated tax payments. › publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a full-time student under age 24 at the end of 2021, and certain other conditions are met, a parent can elect to include the child's income on the parent's return. The 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) form is 1 page long and contains: Use our library of forms to quickly fill and sign your H&Rblock forms online. Fill has a huge library of thousands of forms all set up to be filled in easily and signed. Send to someone else to fill in and sign.

Qualified dividends and capital gain tax worksheet fillable. Qualified Dividends And Capital Gain Tax Worksheet Calculator Showing top 8 worksheets in the category 2019 qualified dividends and capital gains. Have done so for years. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. Source: db-excel.com. He did all of his. A qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax ... Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields ... › fill-and-sign-pdf-form › 3873Qualified Dividends And Capital Gain Tax Worksheet 2021 ... How to fill out the Qualified dividends tax worksheetsignNowcom 2015-2019 form on the internet: To start the form, use the Fill & Sign Online button or tick the preview image of the document. The advanced tools of the editor will lead you through the editable PDF template. Enter your official identification and contact details. Qualified Dividends And Capital Gain Tax Worksheet Qualified dividends and capital gain tax worksheet. Showing top 8 worksheets in the category 2019 qualified dividends and capital gains. Enter the tax amount on line 7. Before completing this worksheet complete form 1040 through line 10. Use fill to complete blank online irs pdf forms for free. Qualified dividends and capital gain tax ...

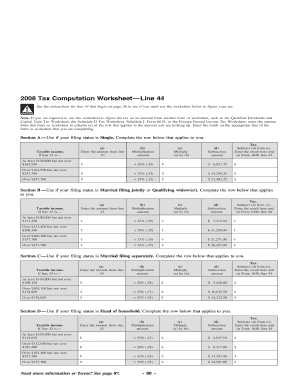

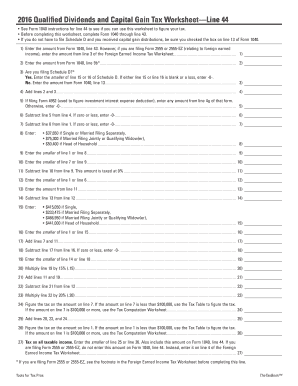

10++ Qualified Dividends And Capital Gain Tax Worksheet 2019 Worksheets are 2019 form 1041 es, 44 of 107, qualified dividends and capital gain tax work 2018, 2018 form 1041 es, 2018 estimated tax work keep for your records 1 2a, 2018 form 1040. Showing top 8 worksheets in the category 2019 qualified dividends and capital gain tax. If you are required to use this worksheet to figure the tax on an amount ... How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet. The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. capital gaines work sheet: Fill out & sign online | DocHub Edit qualified dividends and capital gain tax worksheet 2021. Quickly add and underline text, insert images, checkmarks, and symbols, drop new fillable fields, and rearrange or delete pages from your paperwork. Get the qualified dividends and capital gain tax worksheet 2021 accomplished. Download your adjusted document, export it to the cloud ... How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet For this reason, the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out. Lines 1-5: Qualified Income & Ordinary Income Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates.

› instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200. Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Fill Online, Printable, Fillable, Blank Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 Form Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 'Qualified Dividends And Capital Gain Tax Worksheet' - A Basic, Simple ... 'Qualified Dividends And Capital Gain Tax Worksheet' — A Basic, Simple Excel Spreadsheet For The Math. 8 Replies by Anura Guruge on February 24, 2022 Click to ENLARGE. Link to download Excel spreadsheet BELOW. Click image to download clean, very simple Excel. This is NOT sophisticated or fancy. It is very SIMPLE & BASIC. I do my taxes by hand. Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records Before you begin: See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 11b. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 ...

› publications › p590aPublication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

› story › moneyUnbanked American households hit record low numbers in 2021 Oct 25, 2022 · Those who have a checking or savings account, but also use financial alternatives like check cashing services are considered underbanked. The underbanked represented 14% of U.S. households, or 18. ...

PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1. Enter the amount from Form 1040, line 10. However, if you are filing Form 2555 or 2555-EZ (relating to foreign earned income), enter the amount from line 3 of the Foreign Earned Income Tax Worksheet .....1. 2. Enter the amount from Form 1040, line 3a*..... 2. 3.

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2020 Use Fill To Complete Blank Online Irs Pdf Forms For Free. Qualified Dividends And Capital Gain Tax. However, If Filing Form 2555 (Relating To Foreign Earned Income), Enter The. The Worksheet Has 27 Lines, And All Fields Must Be Filled According To Relevant Information. Related posts: See also Liberty Tax Office Houston Texas

Fillable Qualified Dividends and Capital Gain Tax Worksheet (2018 ... Qualified Dividends and Capital Gain Tax Worksheet 2018 Easily fill out and sign forms Download blank or editable online. Current Version: Fillable Qualified Dividends and Capital Gain Tax Worksheet

Qualified dividends and capital gain tax worksheet 2019 pdf: Fill out ... Get the up-to-date 2021 qualified dividends and capital gains worksheet-2022 now Get Form 4.1 out of 5 44 votes 44 reviews 23 ratings 15,005 10,000,000+ 303 100,000+ users Here's how it works 02. Sign it in a few clicks Draw your signature, type it, upload its image, or use your mobile device as a signature pad. 03. Share your form with others

Qualified Dividends And Capital Gain Tax Worksheet Fillable ? - 50 ... Just invest little times to get into this on-line proclamation Qualified Dividends And Capital Gain Tax Worksheet Fillable as capably as evaluation them wherever you are now. 1040 Quickfinder Handbook Practitioners Publishing Co. Staff 2005-12-01 Contains extensive coverage of the tax issues faced by all types of contractors, including

Get Qualified Dividends And Capital Gain Tax Worksheet 2019 Follow our easy steps to have your Qualified Dividends And Capital Gain Tax Worksheet 2019 prepared rapidly: Pick the web sample from the catalogue. Type all necessary information in the necessary fillable fields. The easy-to-use drag&drop graphical user interface makes it easy to add or relocate fields. Make sure everything is filled out ...

Qualified Dividends and Capital Gain Tax - prd.taxact.com The Tax Summary screen will indicate if the tax has been computed on the Schedule D Worksheet or the Qualified Dividends and Capital Gain Tax Worksheet. To review the Tax Summary in the TaxAct program, go to our Summary of Return - Tax Summary FAQ. If the tax was calculated on either of these worksheets, you should see "Tax computed on ...

Qualified Dividends Tax Worksheet PDF Form - FormsPal Step 2: You can now edit the qualified dividends and capital gains worksheet fillable 2020. You may use our multifunctional toolbar to include, erase, and adjust the text of the form. The following sections will create the PDF document that you will be filling out: Type in the requested details in the space . Step 3: Select the "Done" button.

Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gains Worksheet one of the forms due with the final project University Southern New Hampshire University Course Federal Taxation I (ACC330) Academic year2021/2022 Helpful? 85 Comments Please sign inor registerto post comments. Tim5 months ago 2019 - Correct Year Related Studylists ACC 330 Preview text

Qualified Dividend and Capital Gains Tax Worksheet? - YouTube Qualified Dividend and Capital Gains Tax Worksheet? 4,129 views Feb 16, 2022 The tax rate computed on your Form 1040 must consider any tax-favored items, such as qualified...

Qualified Dividends And Capital Gain Tax Worksheet: Fillable, Printable ... Qualified Dividends And Capital Gain Tax Worksheet: Fillable, Printable & Blank PDF Form for Free | CocoDoc Qualified Dividends And Capital Gain Tax Worksheet: Fill & Download for Free GET FORM Download the form How to Edit Your Qualified Dividends And Capital Gain Tax Worksheet Online Free of Hassle Click the Get Form button on this page.

› pub › irs-pdfAttach to Form 1041, Form 5227, or Form 990-T ... - IRS tax forms attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. Yes. NoNote: Form 5227 filers need to complete. only. Parts I and II. Part I Short-Term Capital Gains and Losses—Generally Assets Held 1 Year or Less (see instructions) See instructions for how to figure the amounts to enter on the lines below.

PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) - IA Rugby.com • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions, be sure the box on line 7, Form 1040, is checked.

The 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) form is 1 page long and contains: Use our library of forms to quickly fill and sign your H&Rblock forms online. Fill has a huge library of thousands of forms all set up to be filled in easily and signed. Send to someone else to fill in and sign.

› publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2021 or was a full-time student under age 24 at the end of 2021, and certain other conditions are met, a parent can elect to include the child's income on the parent's return.

› publications › p523Publication 523 (2021), Selling Your Home | Internal Revenue ... Using the information on Form 8949, report on Schedule D (Form 1040) the gain or loss on your home as a capital gain or loss. Follow the Instructions for Schedule D when completing the form. If you have any taxable gain from the sale of your home, you may have to increase your withholding or make estimated tax payments.

0 Response to "40 qualified dividends and capital gain tax worksheet fillable"

Post a Comment