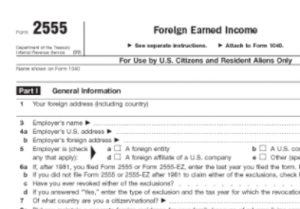

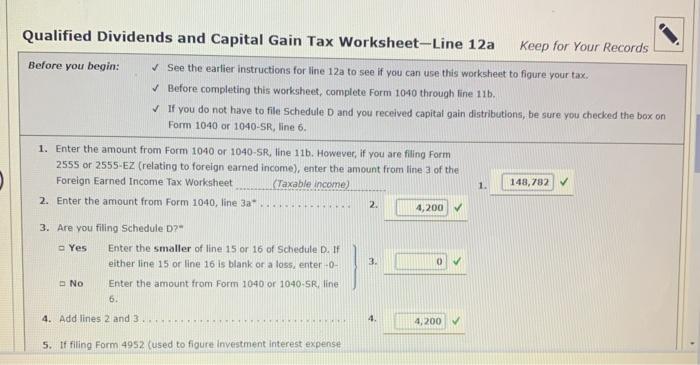

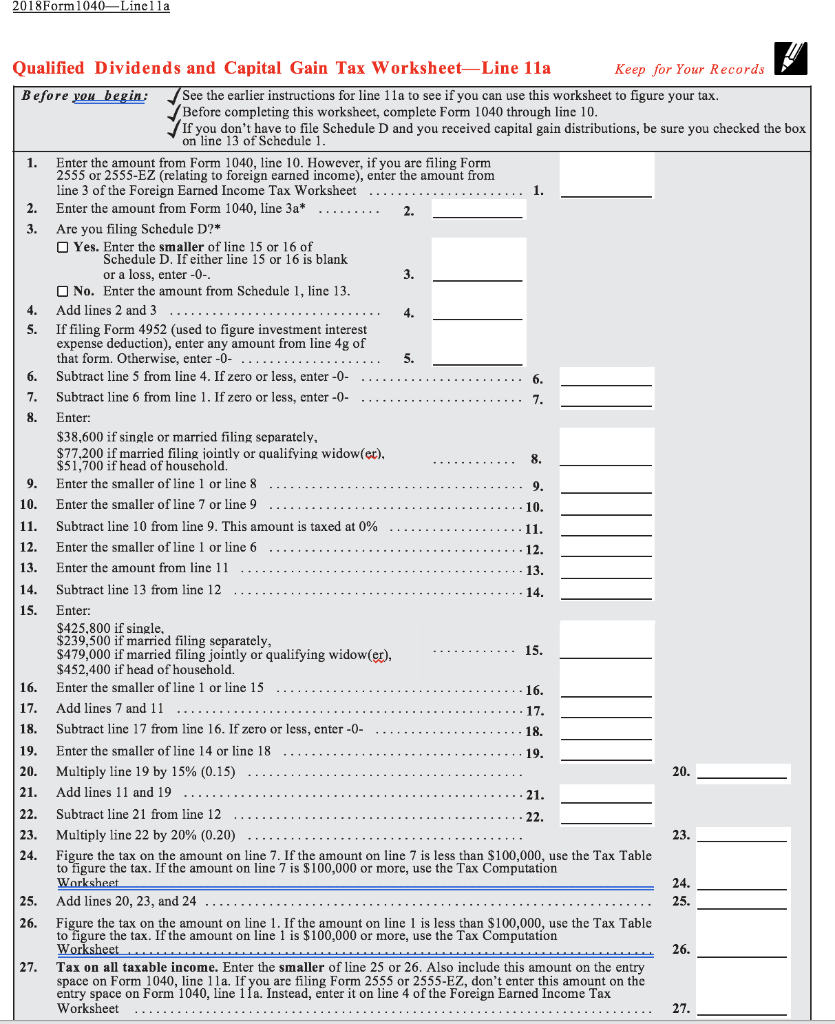

41 foreign earned income tax worksheet

Earned Income Tax Credit for 2020 - Check Your Eligibility - e-File Web23.11.2022 · Use this simple EITC worksheet to get an easy overview if you qualify or not. If your 2019 or 2020 income (W-2 income wages and/or net earnings from self-employment, etc.) was less than $56,844, you might qualify for the Earned Income Tax Credit. Remember, on your 2020 Return, you can use the 2019 or 2020 income to determine … Publication 554 (2021), Tax Guide for Seniors - IRS tax forms WebGross income means all income you receive in the form of money, goods, property, and services that isn't exempt from tax, including any income from sources outside the United States or from the sale of your main home (even if you can exclude part or all of it). It also includes gains, but not losses, reported on Form 8949 or Schedule D. Gross income …

Publication 590-A (2021), Contributions to Individual Retirement ... WebYou can make a contribution to your IRA by having your income tax refund (or a portion of your refund), if any, paid directly to your traditional IRA, Roth IRA, or SEP IRA. For details, see the instructions for your income tax return or Form 8888, Allocation of Refund. . Contributions can be made to your traditional IRA for each year that you receive …

Foreign earned income tax worksheet

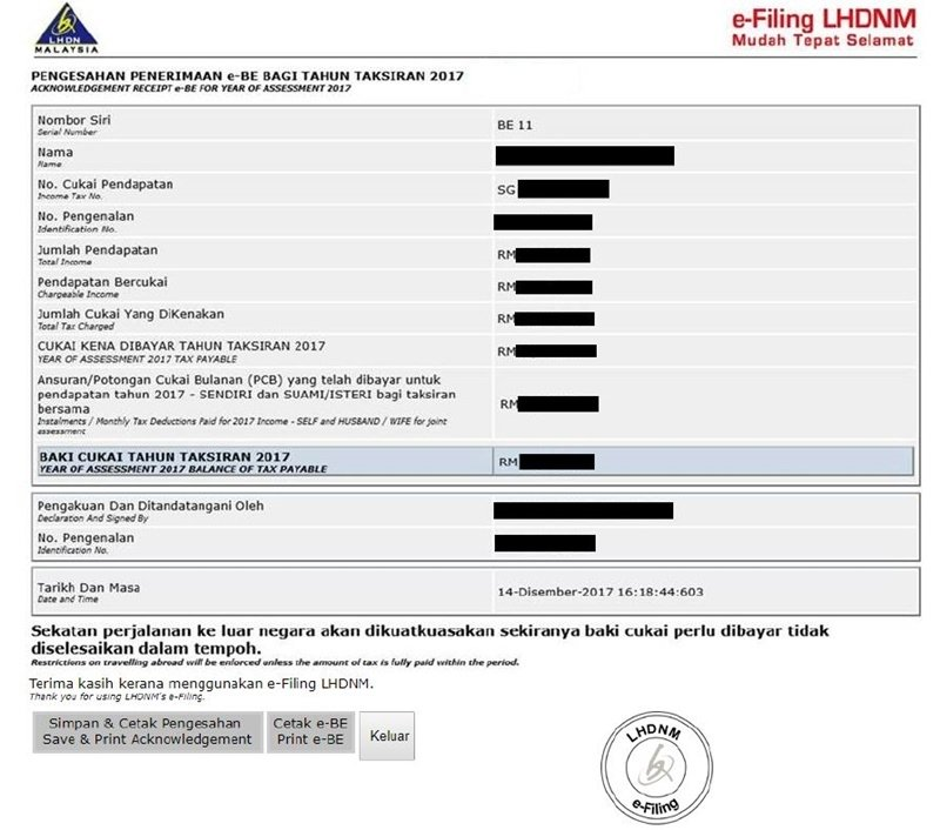

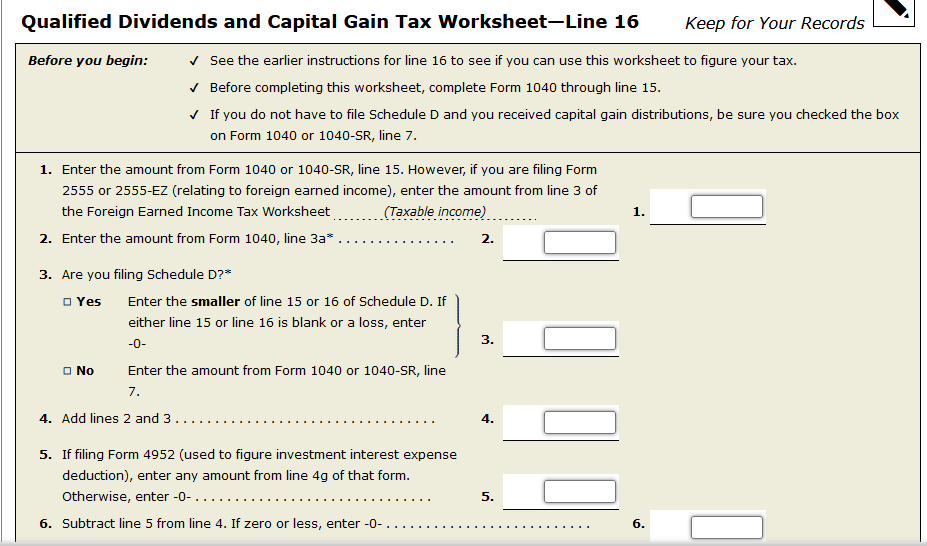

Foreign Earned Income Exclusion | Internal Revenue Service - IRS tax … Nov 14, 2022 · Figuring the tax: If you qualify for and claim the foreign earned income exclusion, the foreign housing exclusion, or both, must figure the tax on your remaining non-excluded income using the tax rates that would have applied had you not claimed the exclusion(s). Use the Foreign Earned Income Tax Worksheet in the Form 1040 Instructions. Claiming the Foreign Tax Credit with Form 1116 - TurboTax Web17.11.2022 · Use Form 2555 to claim the Foreign Earned-Income Exclusion (FEIE), which allows those who qualify to exclude some or all of their foreign-earned income from their U.S. taxes. In most cases, choosing the FTC will reduce your U.S. tax liability the most. Foreign tax credit eligibility. Taxes paid to other countries qualify for the FTC when: Do I Have To Report Income From Foreign Sources? - Investopedia Dec 25, 2021 · If you are a U.S. citizen or resident alien, your income–unless exempt–is subject to U.S. income tax, including income that is earned outside the U.S.

Foreign earned income tax worksheet. Publication 17 (2021), Your Federal Income Tax - IRS tax forms WebIf you live outside the United States, you may be able to exclude part or all of your foreign earned income. For details, see Pub. 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad. Foreign financial assets. If you had foreign financial assets in 2021, you may have to file Form 8938 with your return. See Form 8938 and its instructions or visit … Foreign Electronic Payments | Internal Revenue Service - IRS tax … Web10.11.2022 · Your foreign bank must have a banking relationship with a U.S. bank, although the U.S. bank does not have to be an affiliate or otherwise related to the foreign bank. Small local banks may not be able to affect an international wire transfer but most large banks can. If your bank is able to transfer money to the U.S., it will ask you to complete an … Earned Income Credit (EITC): Definition, Who Qualifies - NerdWallet Web22.11.2022 · For the 2022 tax year, the earned income credit ranges from $560 to $6,935 depending on tax-filing status, income and number of children. In 2023, the credit will be worth $600 to $7,430. People ... 2022 Form 2555 - IRS tax forms WebIf any of the foreign earned income received this tax year was earned in a prior tax year, or will be earned in a later tax year (such as a bonus), see the instructions. Don’t ; include income from line 14, column (d), or line 18, column (f). Report amounts in U.S. dollars, using the exchange rates in effect when you actually or constructively received the income. If …

Foreign Housing Exclusion or Deduction - IRS tax forms Web27.07.2022 · In addition to the foreign earned income exclusion, you can also claim an exclusion or a deduction from gross income for your foreign housing amount if your tax home is in a foreign country and you qualify under either the bona fide residence test or the physical presence test.. The foreign housing exclusion applies only to amounts … Ohio Ohio Individual Income Tax Return Bundle - TaxFormFinder Like the Federal Form 1040, states each provide a core tax return form on which most high-level income and tax calculations are performed. While some taxpayers with simple returns can complete their entire tax return on this single form, in most cases various other additional schedules and forms must be completed, depending on the taxpayer's ... Demystifying IRS Form 1116- Calculating Foreign Tax Credits Similarly, an overall foreign loss reduces taxable U.S. source income in the year generated and thus the U.S. tax on U.S. source income earned in that year. Section 904(f) recaptures the loss, however, by re-sourcing foreign source income earned in a later year as domestic source. Frequently Asked Questions About International Individual Tax ... However, if you take the foreign earned income exclusion your foreign tax credit or deduction will be reduced. If eligible, you can claim a foreign tax credit on foreign income taxes owed and paid by filing Form 1116 with your U.S. income tax return. Visit Publication 514, Foreign Tax Credit for Individuals, for more details.

Do I Have To Report Income From Foreign Sources? - Investopedia Dec 25, 2021 · If you are a U.S. citizen or resident alien, your income–unless exempt–is subject to U.S. income tax, including income that is earned outside the U.S. Claiming the Foreign Tax Credit with Form 1116 - TurboTax Web17.11.2022 · Use Form 2555 to claim the Foreign Earned-Income Exclusion (FEIE), which allows those who qualify to exclude some or all of their foreign-earned income from their U.S. taxes. In most cases, choosing the FTC will reduce your U.S. tax liability the most. Foreign tax credit eligibility. Taxes paid to other countries qualify for the FTC when: Foreign Earned Income Exclusion | Internal Revenue Service - IRS tax … Nov 14, 2022 · Figuring the tax: If you qualify for and claim the foreign earned income exclusion, the foreign housing exclusion, or both, must figure the tax on your remaining non-excluded income using the tax rates that would have applied had you not claimed the exclusion(s). Use the Foreign Earned Income Tax Worksheet in the Form 1040 Instructions.

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/2B6VZ5VJPFFBNCPYGKPTR677NE.JPG)

0 Response to "41 foreign earned income tax worksheet"

Post a Comment