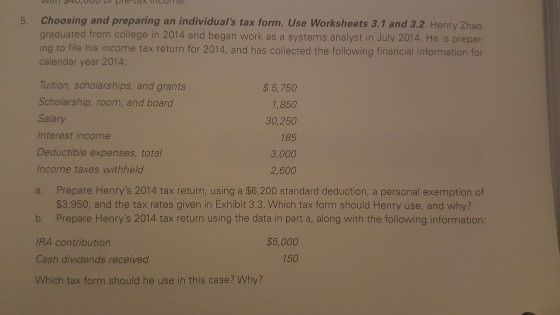

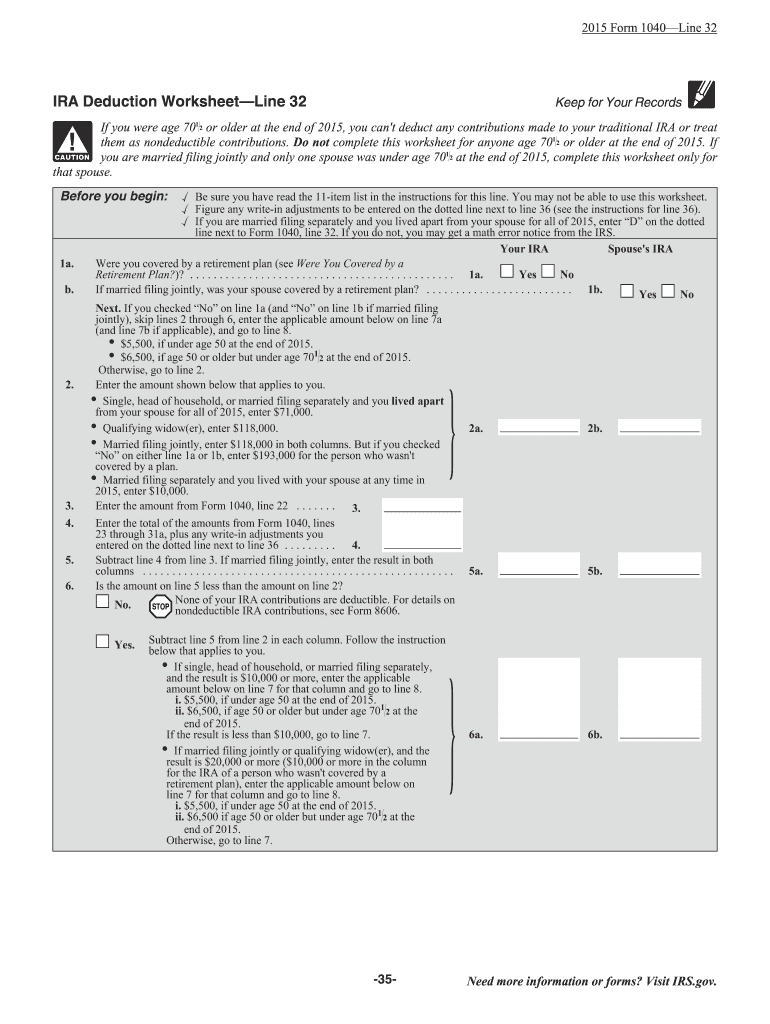

42 ira deduction worksheet 2014

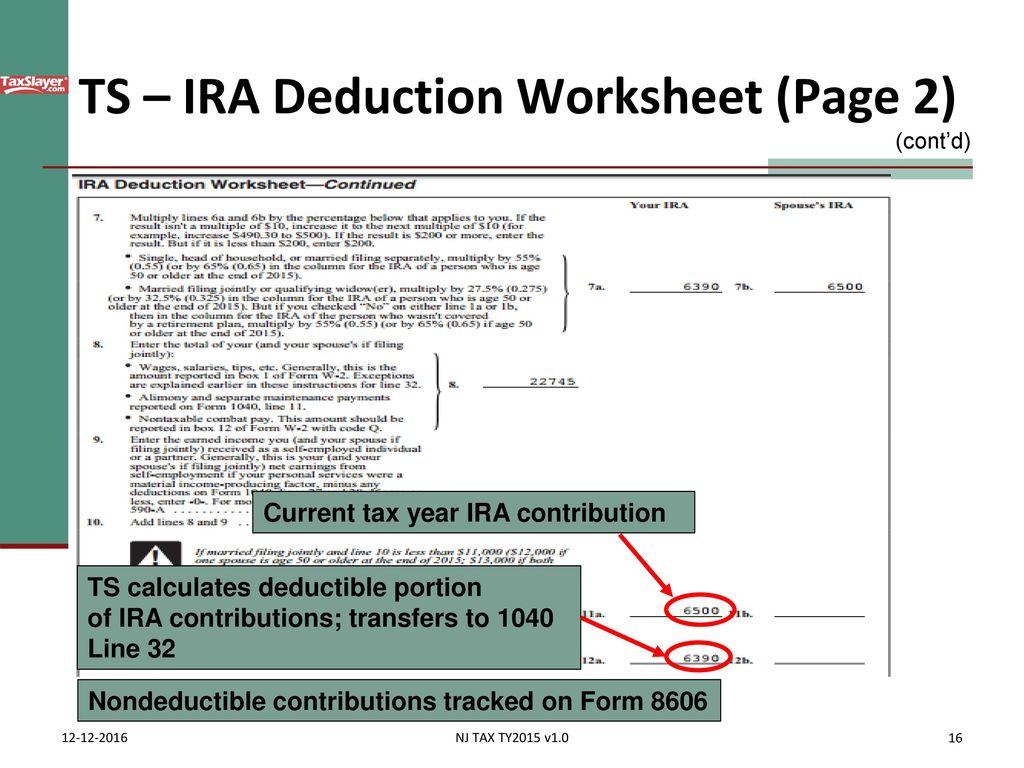

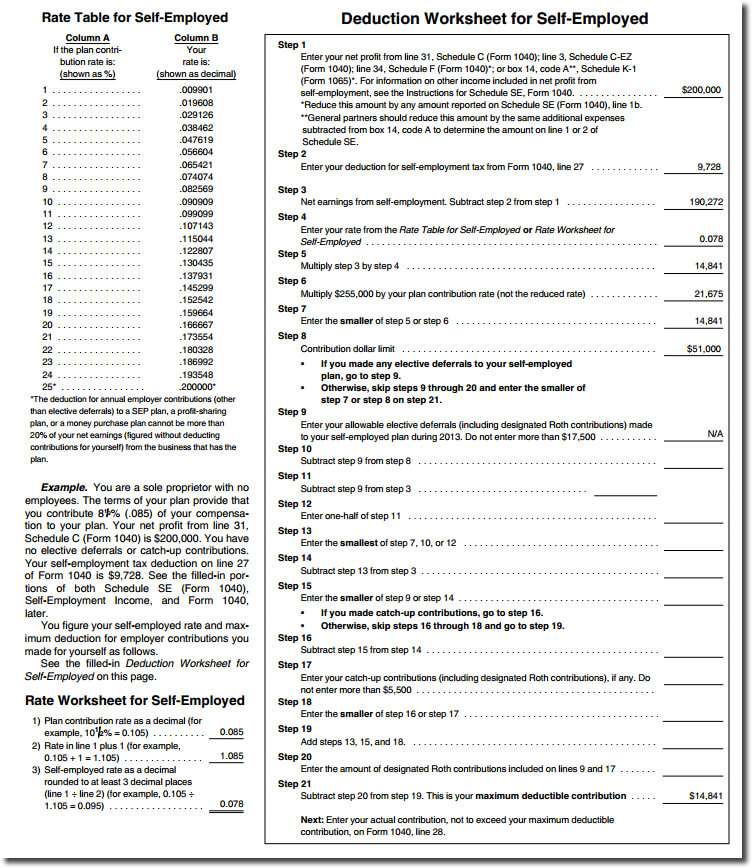

1040 (2021) | Internal Revenue Service - IRS tax forms Self-Employed Health Insurance Deduction Worksheet—Schedule 1, Line 17; Exceptions. Line 18. Penalty on Early Withdrawal of Savings; Lines 19a, 19b, and 19c Alimony Paid. Line 19a; Line 19c; Line 20. IRA Deduction. Were You Covered by a Retirement Plan? Married persons filing separately. IRA Deduction Worksheet—Schedule 1, Line 20 Amount of Roth IRA Contributions That You Can Make For 2023 Oct 26, 2022 · See Publication 590-A, Contributions to Individual Retirement Accounts (IRAs), for a worksheet to figure your reduced contribution. Page Last Reviewed or Updated: 26-Oct-2022 Share

Publication 575 (2021), Pension and Annuity Income Required minimum distributions (RMDs). For tax years beginning after 2019, the age for beginning mandatory distributions is changed for taxpayers reaching age 70½ after December 31, 2019, to age 72. For more information on these benefits and when they are available, see Pub. 590-B, Distributions from Individual

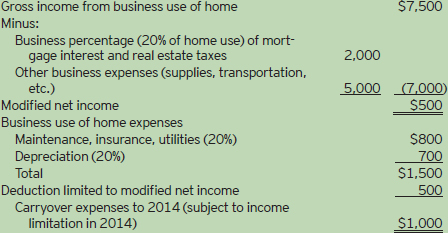

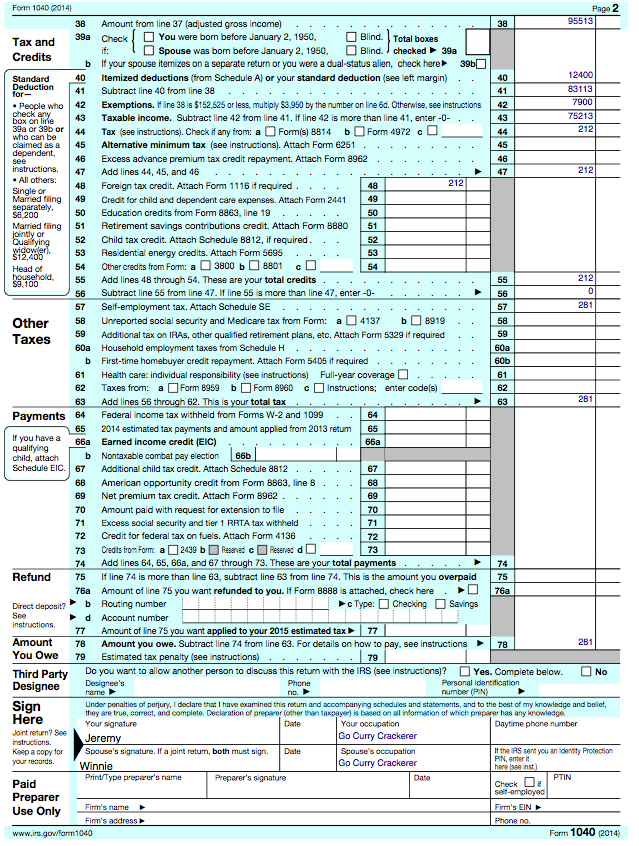

Ira deduction worksheet 2014

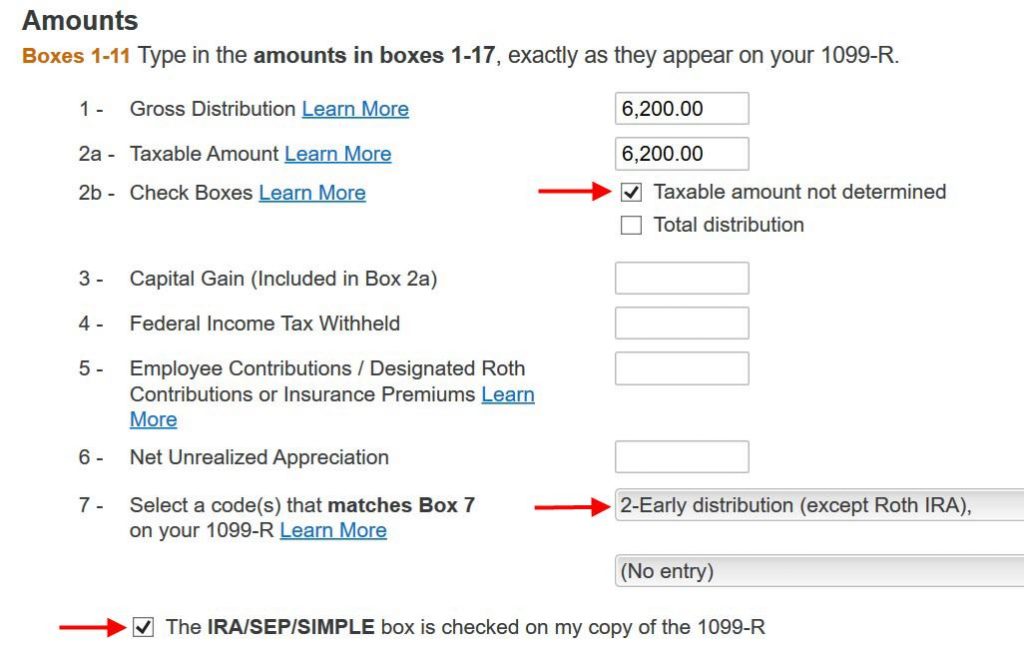

Publication 3 (2021), Armed Forces' Tax Guide | Internal ... Publication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in the District of Columbia. How To Report 2021 Backdoor Roth In TurboTax (Updated) Feb 04, 2022 · So I contributed for 2013 in May 2014 converting from Traditional IRA to Roth IRA the very next day. I received 2013 Form 5498 later in the month, showing the amount 5500 I had contributed. Thereafter I contributed to the Roth IRA for year 2014 itself, and now I have 2014 Form 1099-R, which shows $5500 with all the ticks/marks just like yours. Publication 590-A (2021), Contributions to Individual ... Tom can take a deduction of only $5,850. Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2021, Tom figures his deductible and nondeductible amounts as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2021—Example 1 Illustrated. He can choose to treat the $5,850 as either deductible or nondeductible contributions.

Ira deduction worksheet 2014. Publication 970 (2021), Tax Benefits for Education | Internal ... Business deduction for work-related education. Generally, if you claim a business deduction for work-related education and you drive your car to and from school, the amount you can deduct for miles driven from January 1, 2021, through December 31, 2021, is 56 cents a mile. See chapter 11. Publication 590-A (2021), Contributions to Individual ... Tom can take a deduction of only $5,850. Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2021, Tom figures his deductible and nondeductible amounts as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2021—Example 1 Illustrated. He can choose to treat the $5,850 as either deductible or nondeductible contributions. How To Report 2021 Backdoor Roth In TurboTax (Updated) Feb 04, 2022 · So I contributed for 2013 in May 2014 converting from Traditional IRA to Roth IRA the very next day. I received 2013 Form 5498 later in the month, showing the amount 5500 I had contributed. Thereafter I contributed to the Roth IRA for year 2014 itself, and now I have 2014 Form 1099-R, which shows $5500 with all the ticks/marks just like yours. Publication 3 (2021), Armed Forces' Tax Guide | Internal ... Publication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in the District of Columbia.

0 Response to "42 ira deduction worksheet 2014"

Post a Comment